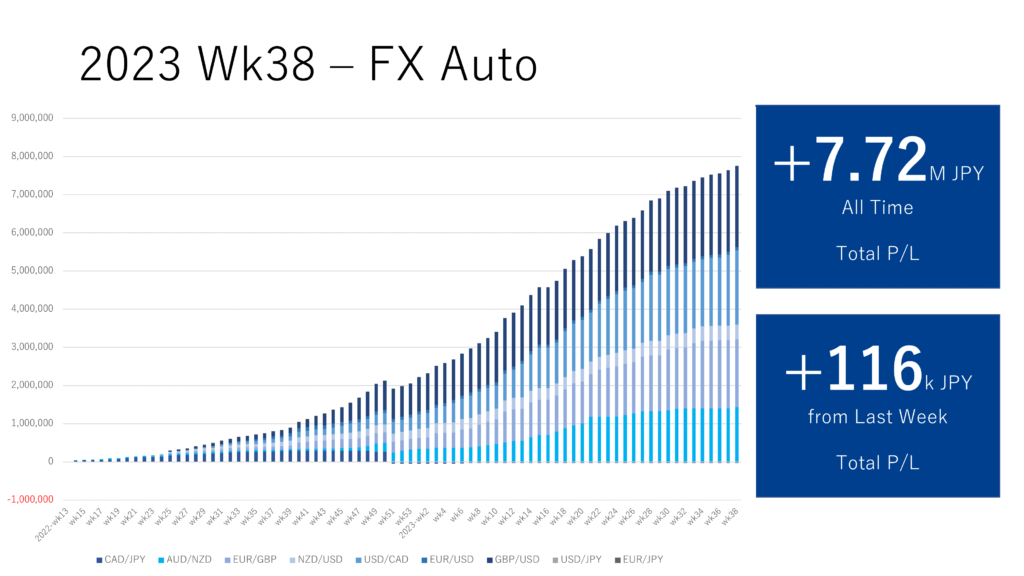

The reports are for Toraripi now. (The previous results include Triauto as well as Toraripi.)

Contents

Status of This Week

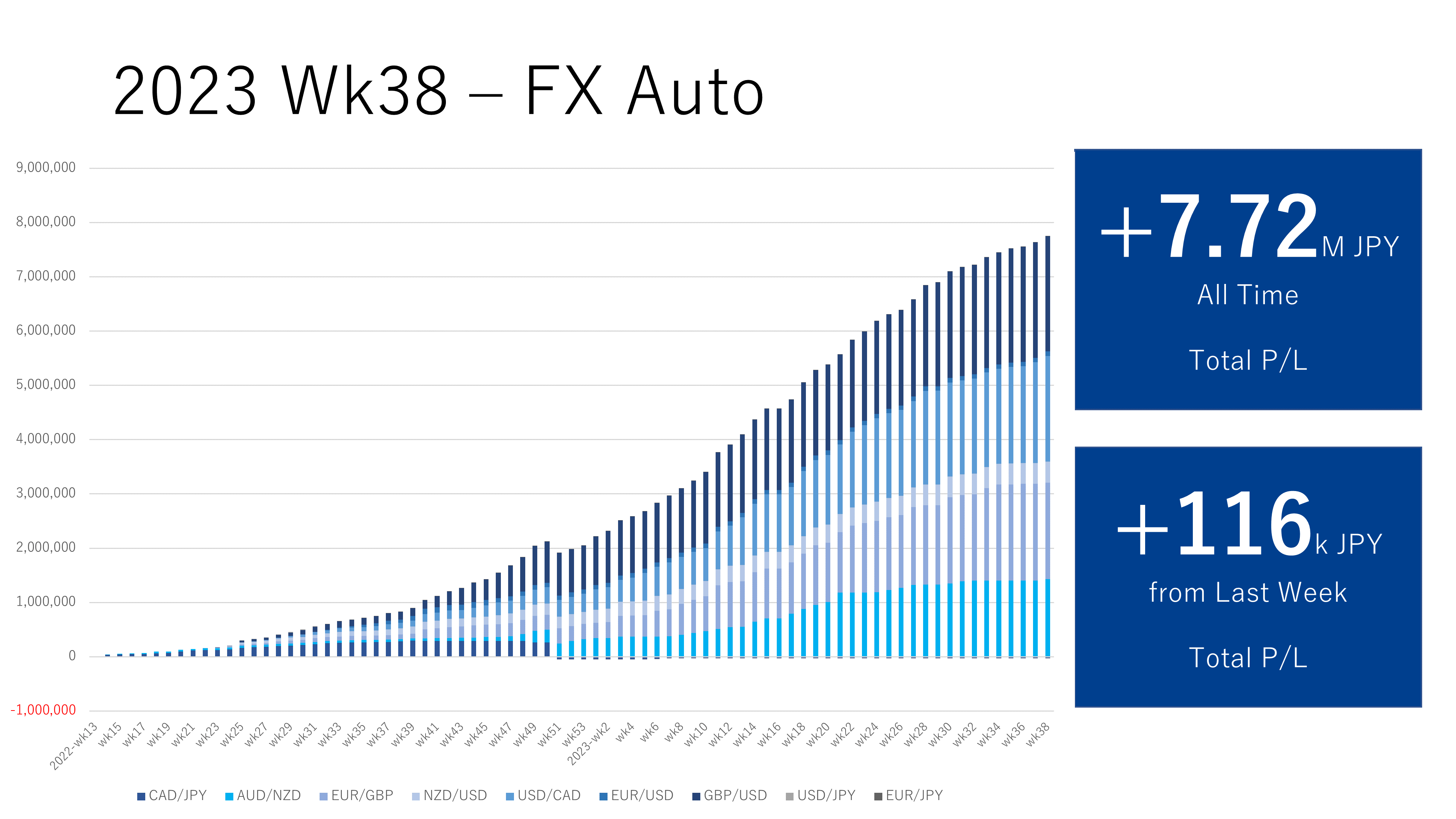

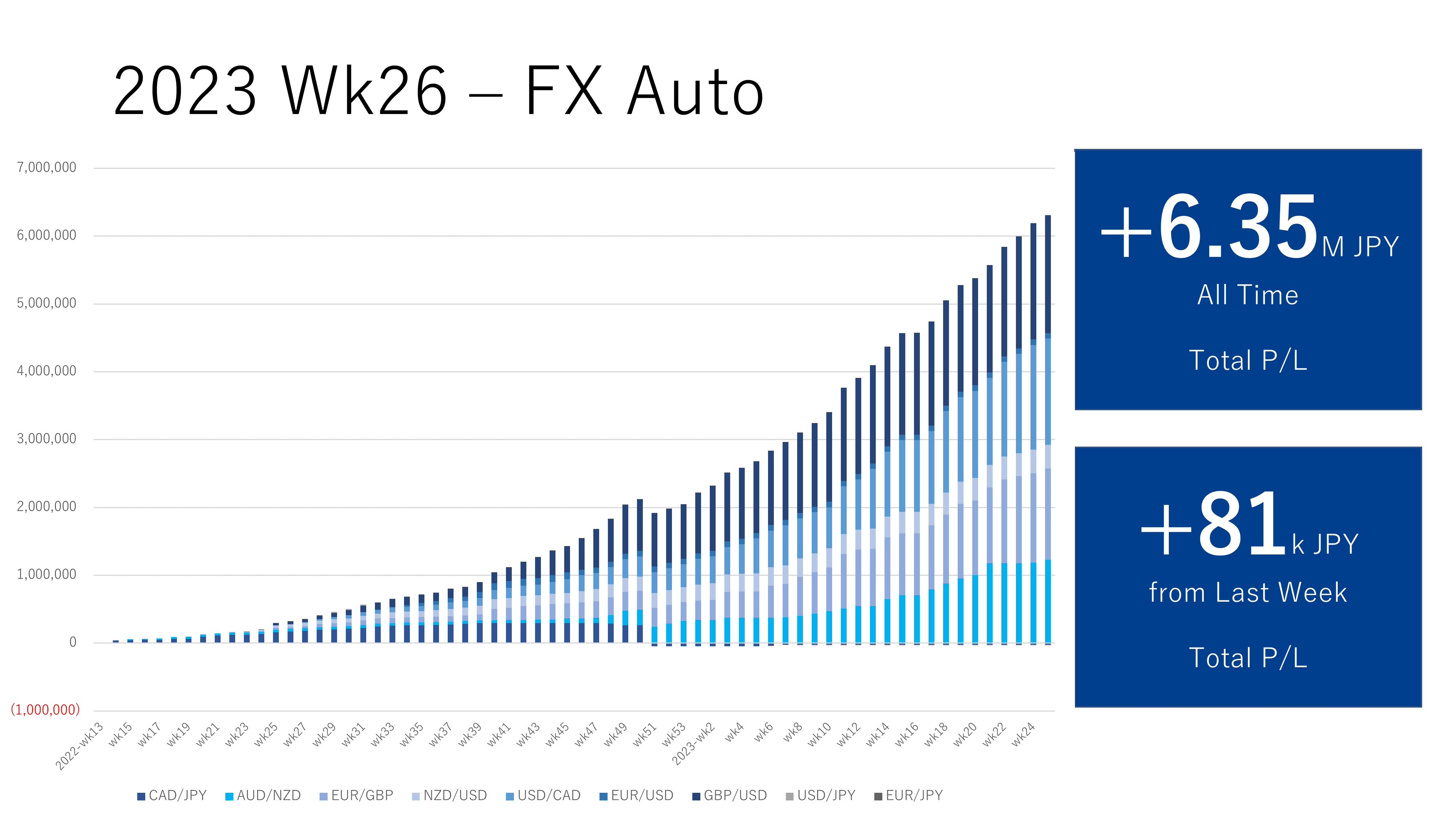

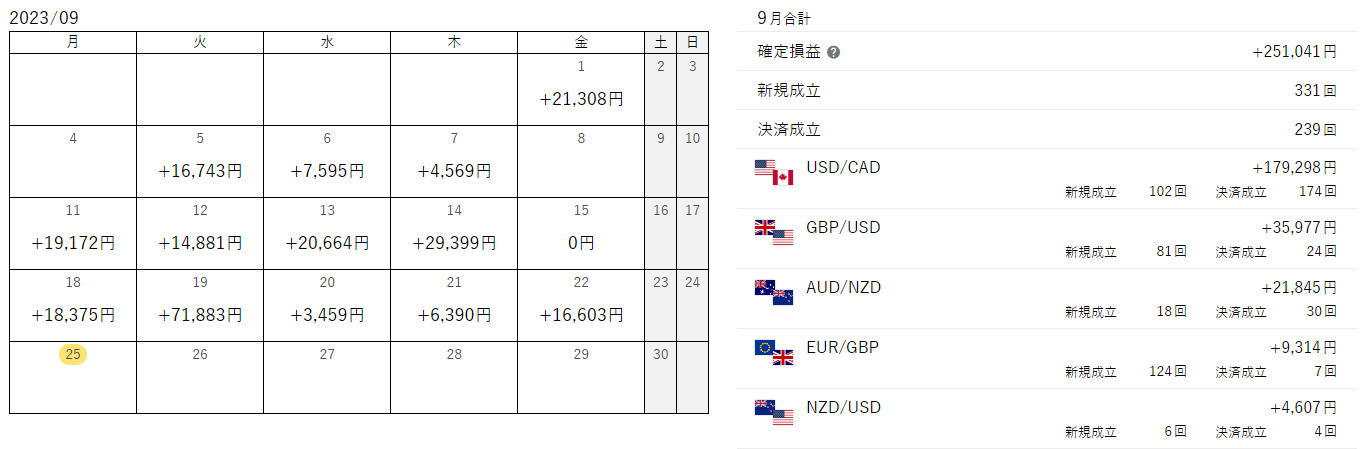

This week's Toraripi

- JPY 116k

- 71k profit owing to UAD/CAD drop on Tuesday, Sep 19th.

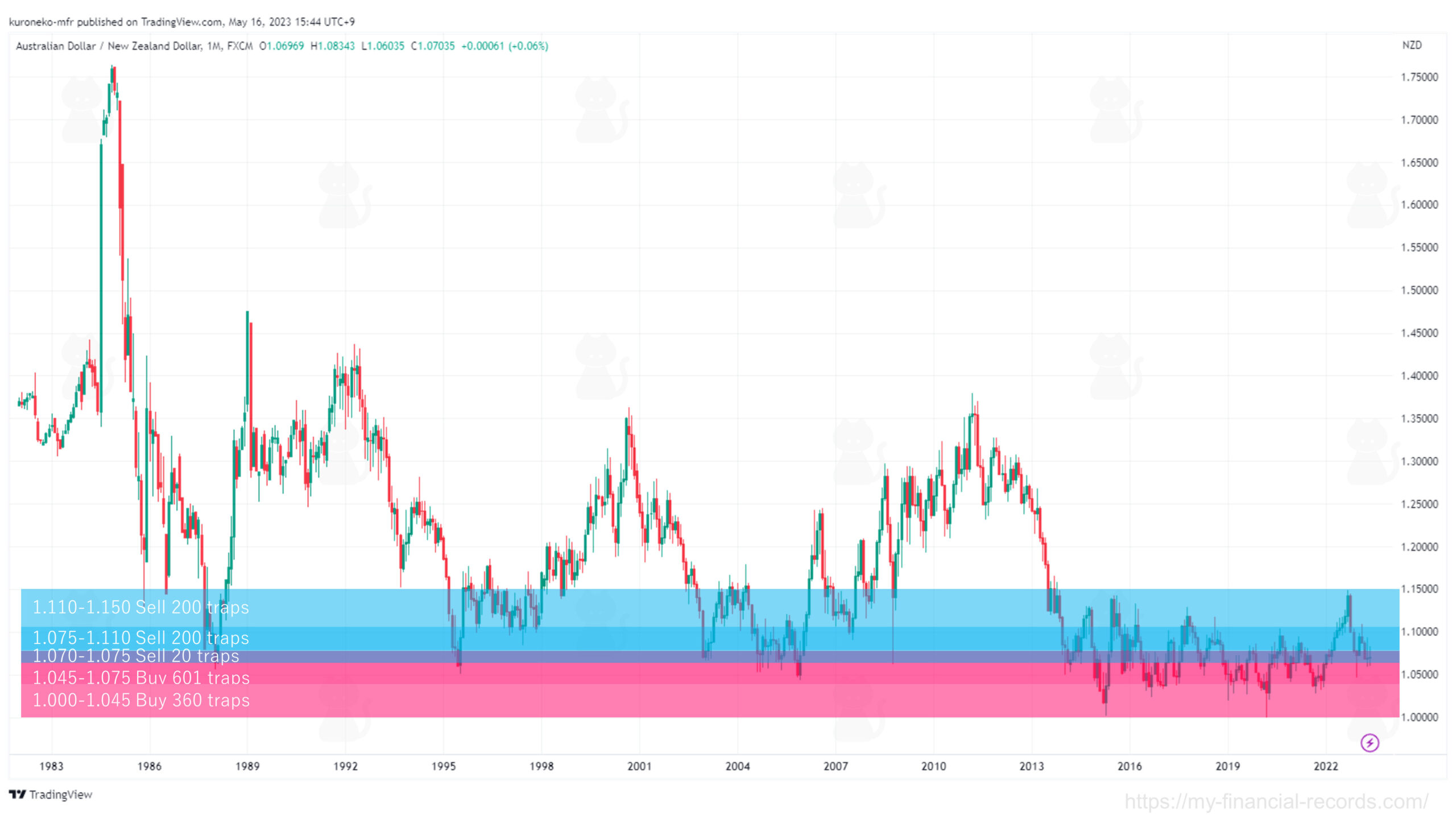

- The profit on Tuesday, Sep 22nd was due to a drop of AUD/NZD. It has been a long time since AUD/NZD made a solid profit.

This year, I set the following goal first, so it may be a little tough, but I would like to think about how to achieve this without giving up.

Goal by End of Mar, 2023

Earn an average of JPY 1M/month (250K/week)

After quitting the company and starting the life of FIRE, I will do nothing if I don't set a specific goal. Thus I set a goal. I will whip myself!

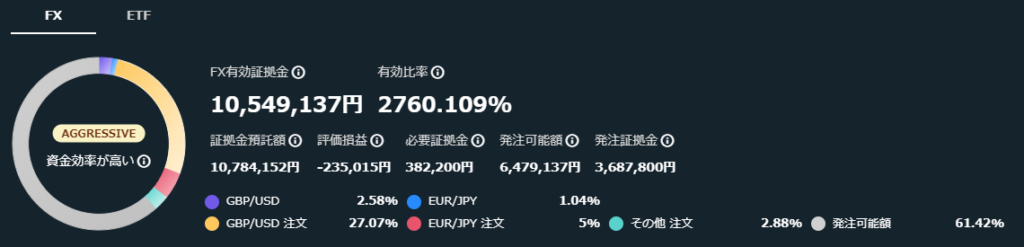

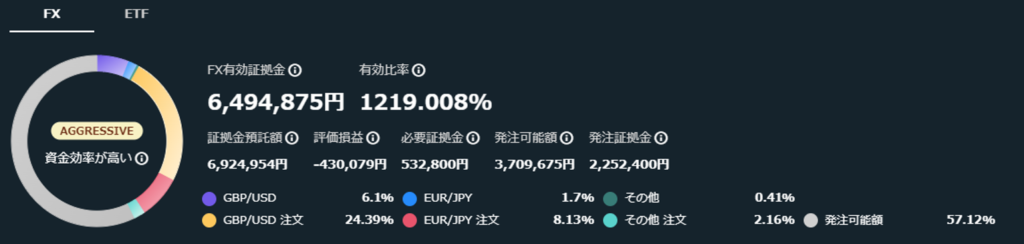

Dashboards

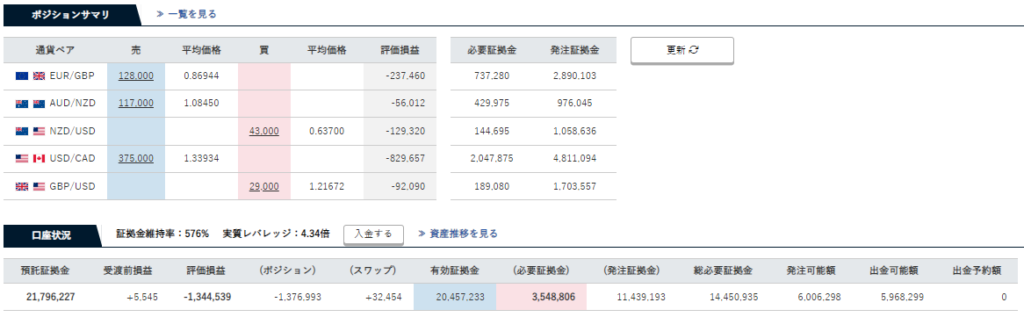

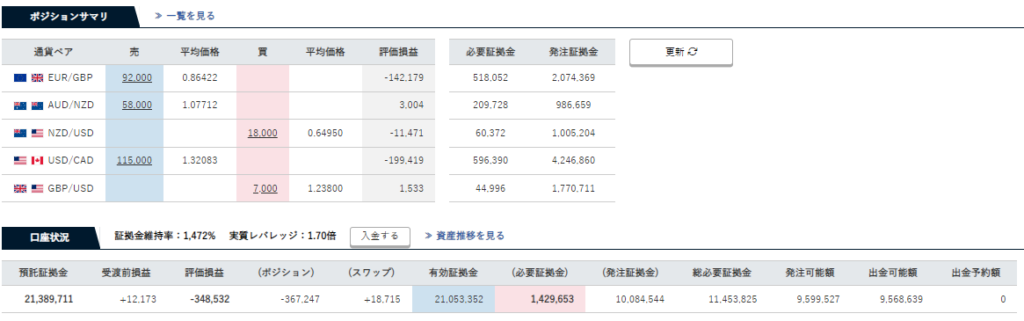

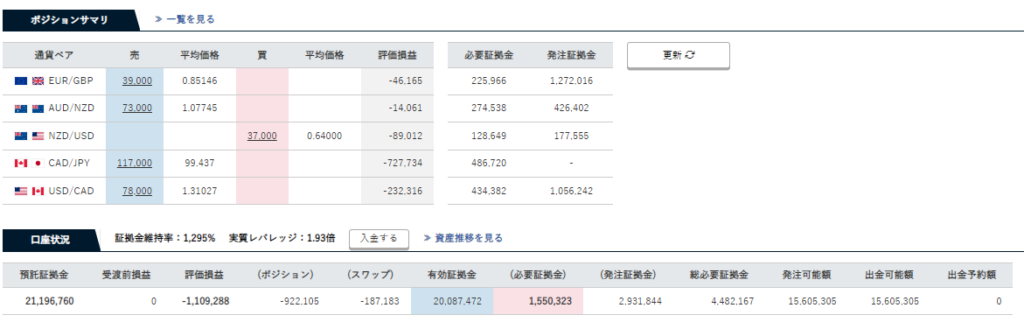

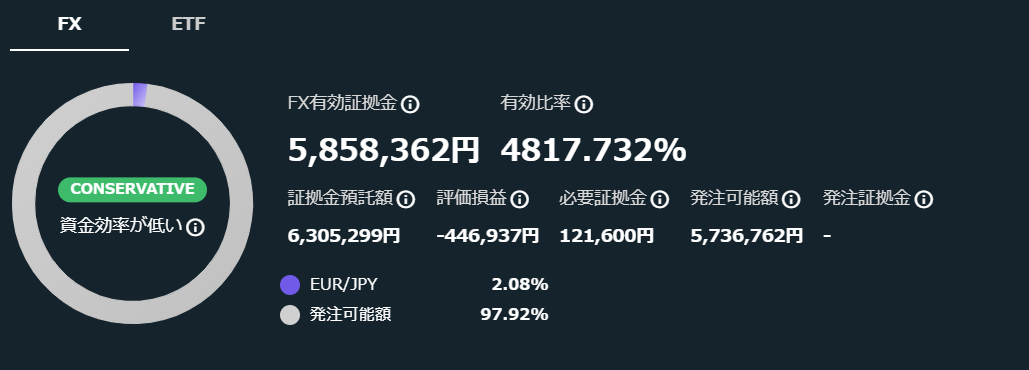

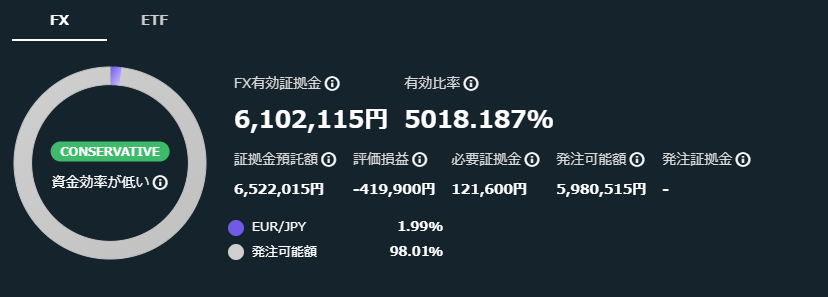

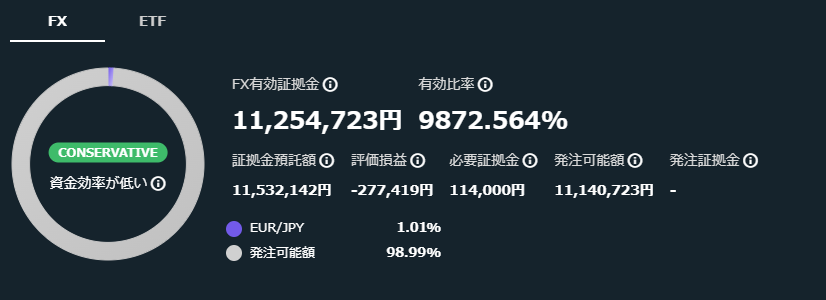

Position Summary of Traripi

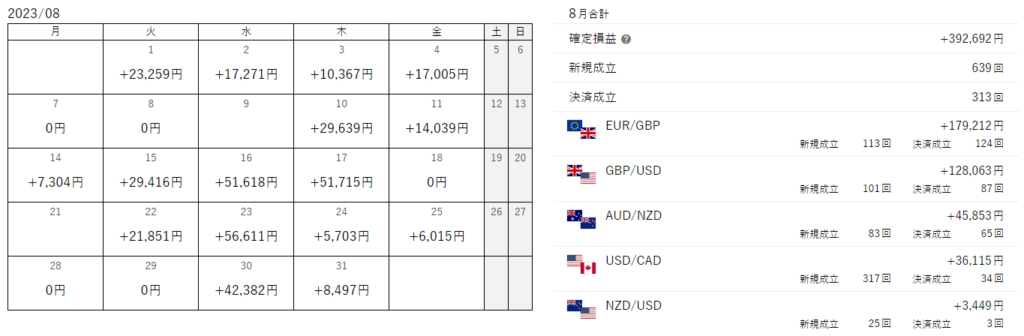

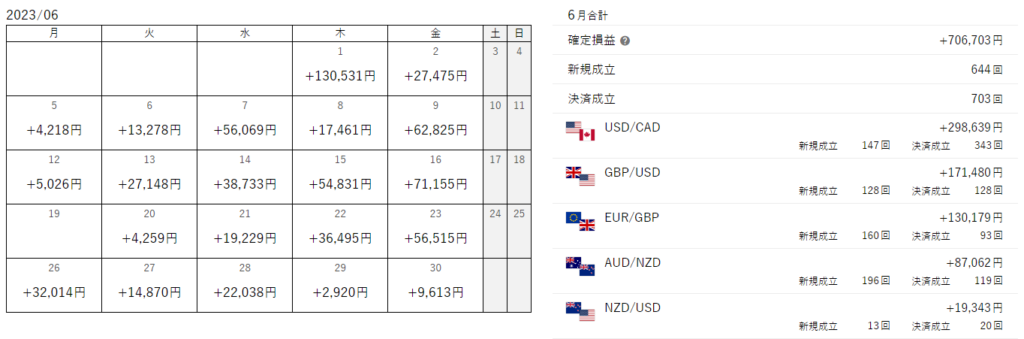

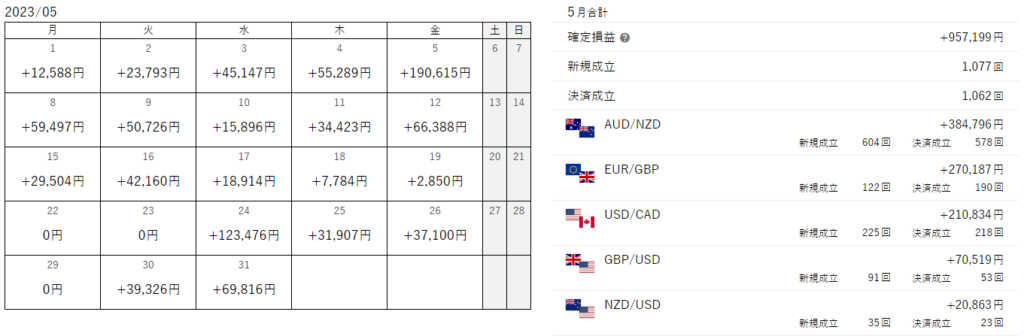

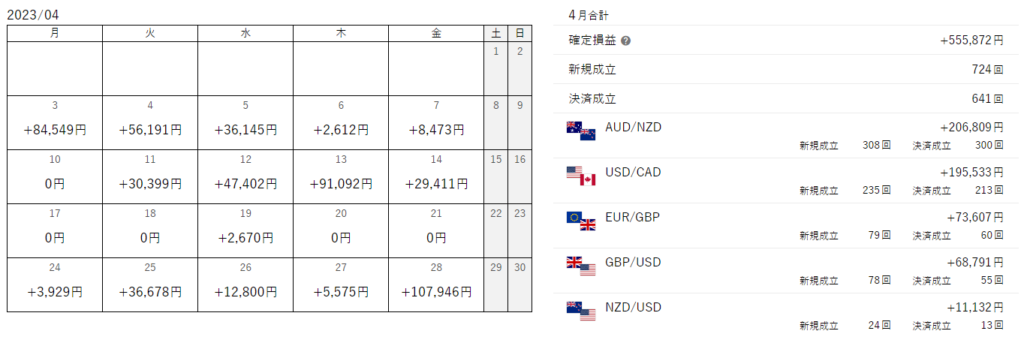

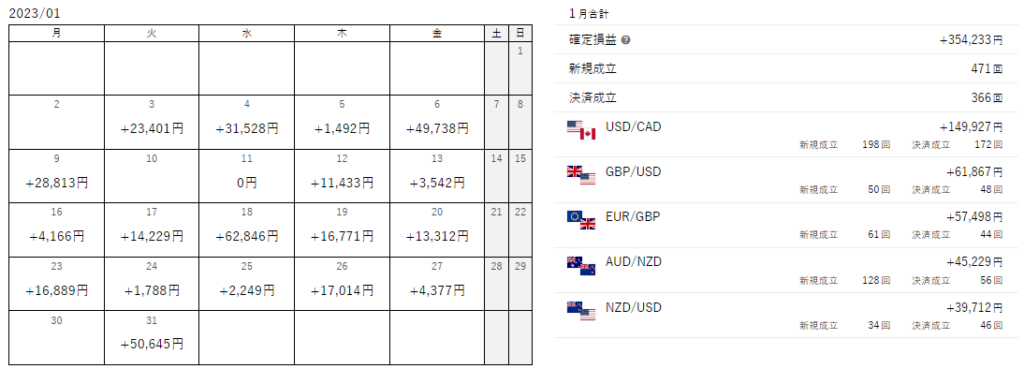

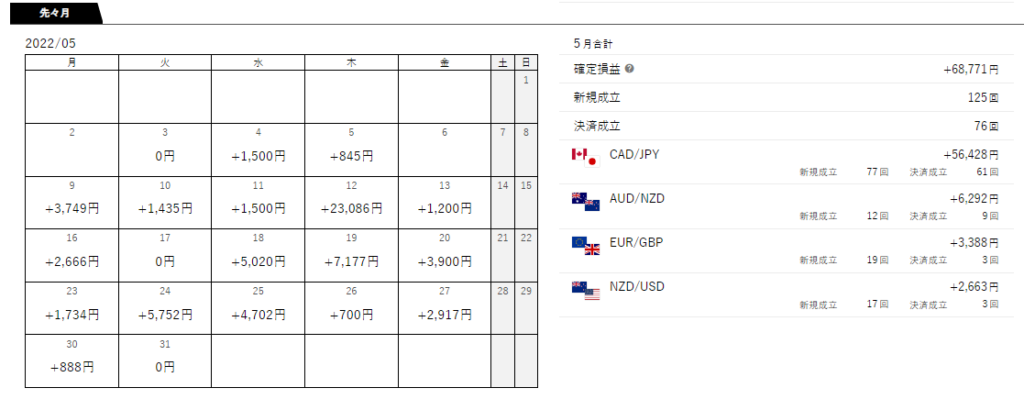

Establishment calendar of Traripi

Latest Settings

I am summarizing the settings of active currency pairs for my own reference.

In addition, I am learning every day by looking at the settings of many people who publish information on the Internet (regardless of the amount of investments). Therefore, I am also sharing my settings.

(I would like to give back to everyone who disclose their information.)

However, I cannot guarantee the performance with my settings. So please invest at your own risk.

Updates of The Week

- There is no update for this week.

There are no cross-yen currency pairs currently.

Immediately after the start of Toraripi, I had set the selling of CAD/JPY, but while the yen was swinging in the direction of extreme depreciation, I was hit by a negative swap, resulting in a drastic loss cut (the article in the link is in Japanese only).

I would like to participate in cross-yen currency pairs again when the yen swings in the direction of appreciation and it becomes possible to enter by buying, or when the yen raises interest rates and negative swaps are no longer a concern.

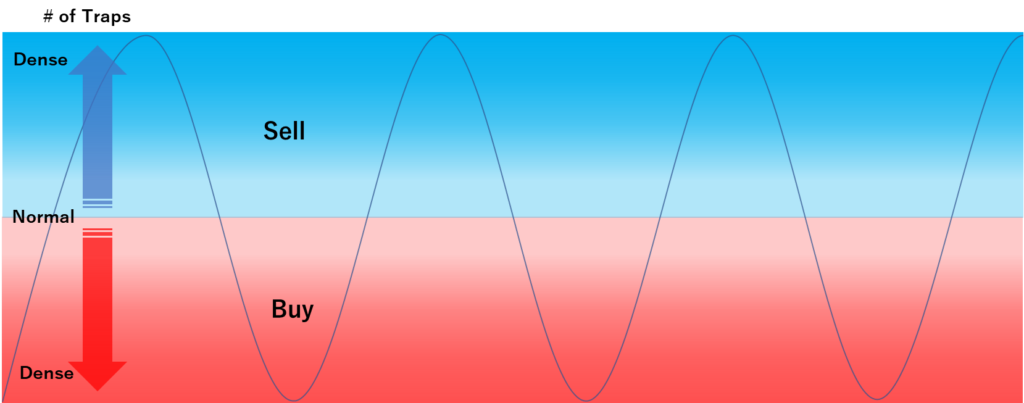

Operational Policy

- Avoid settings that make me nervous and unable to sleep. NOT to be ejected from the Forex market.

- Avoid loss cutting even in the worst case simulation

- When adding traps or making changes, iterate simulation always.

- Avoid extremely high negative swap points

- Given the risk of holding positions for a long period of time, I am avoiding extremely high negative swap points.

- I am trading currency pairs with some negative swaps, but it is desirable to have a little positive swap points overall.

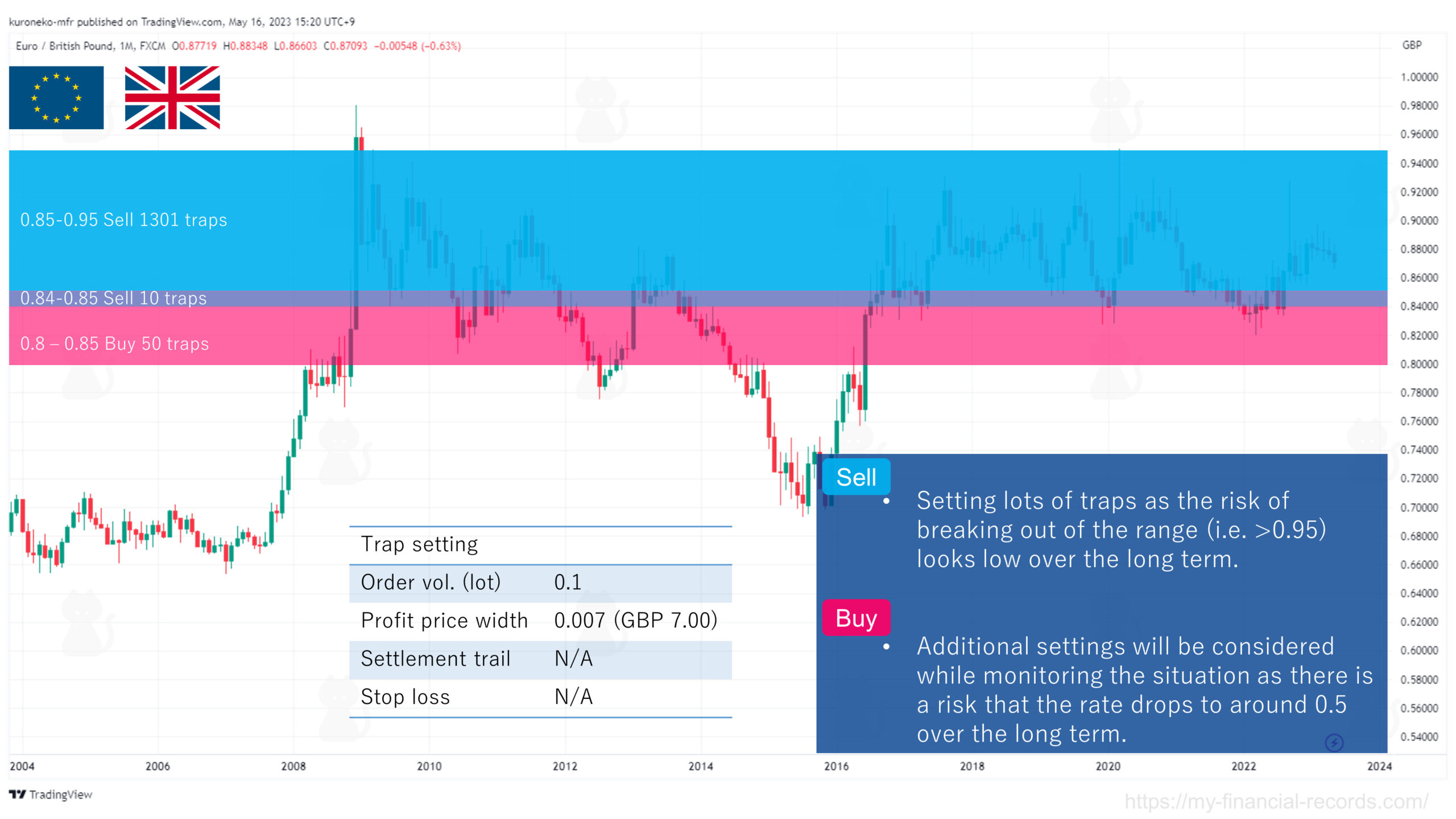

EUR/GBP

I love this currency pair as the swap point is currently positive for selling and I feel comfortable even if I hold the positions for a long time.

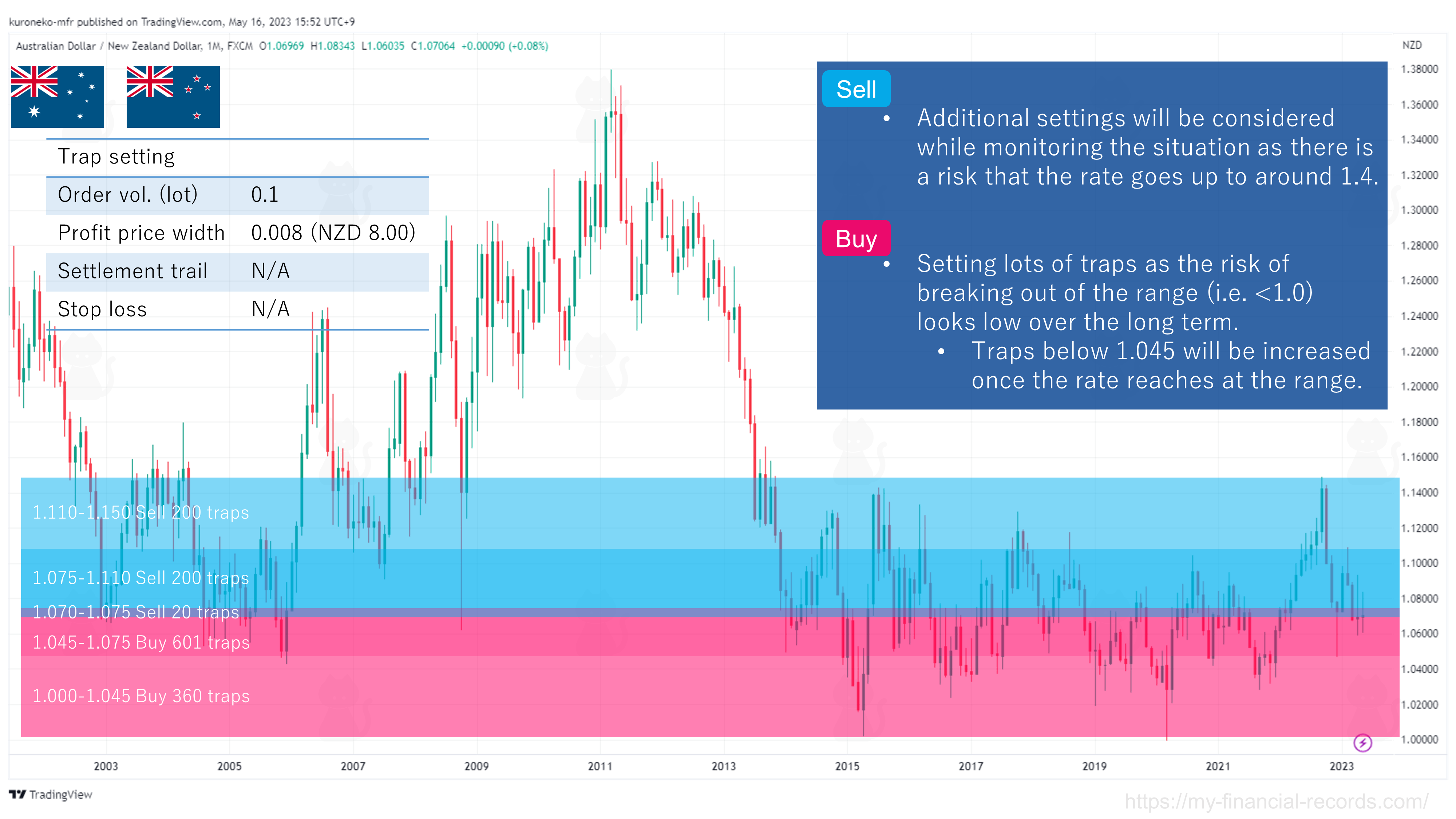

AUD/NZD

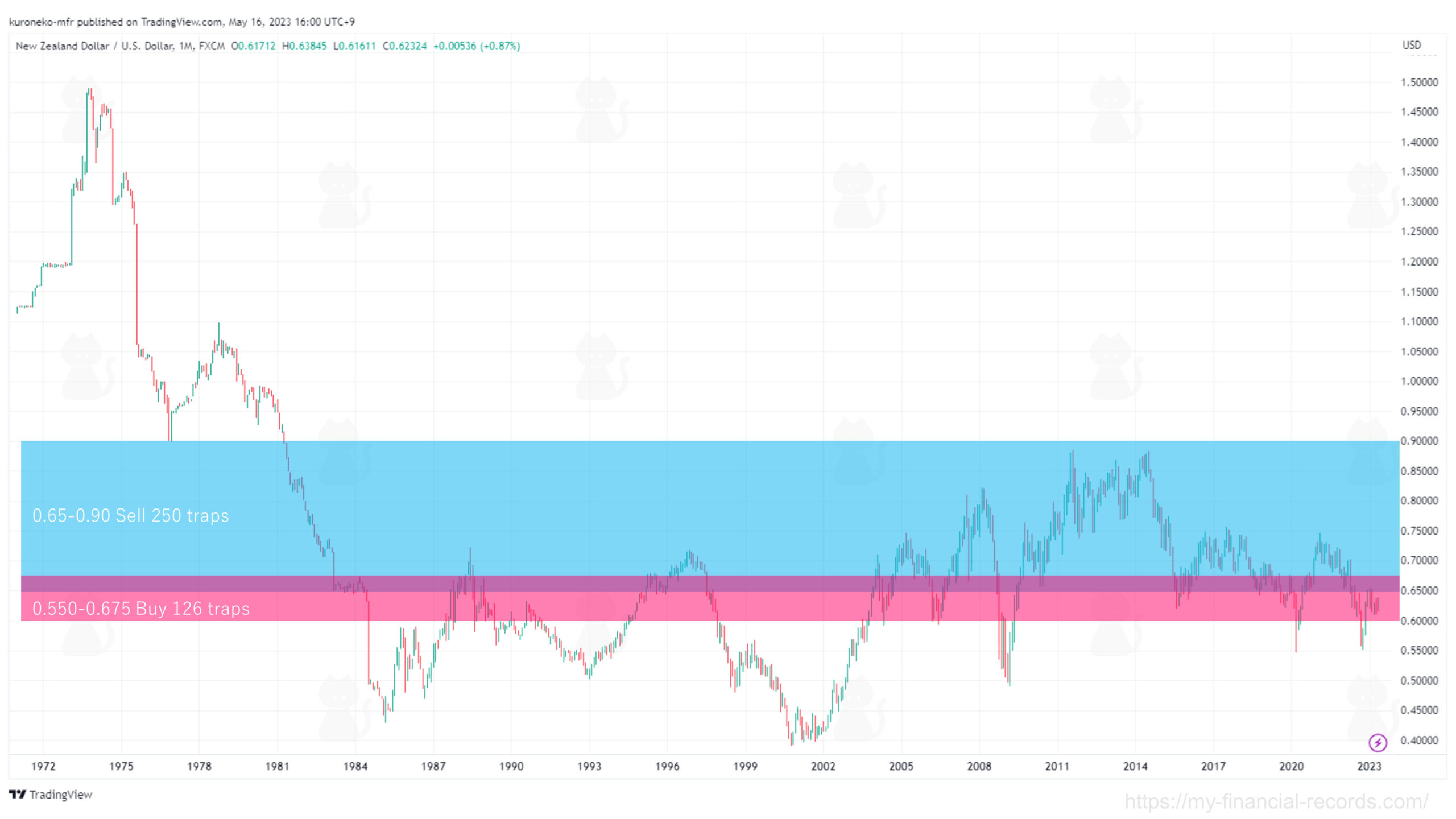

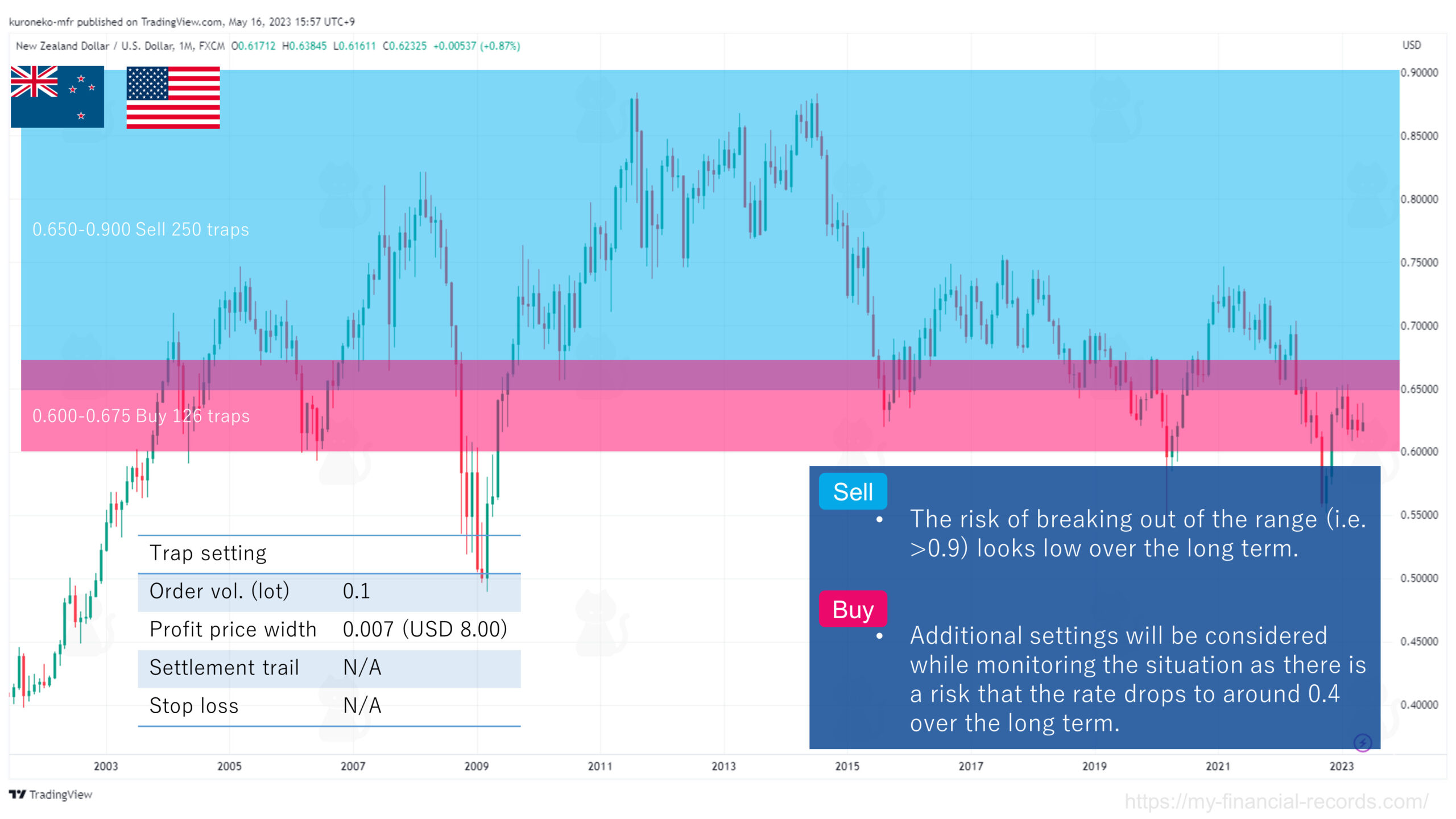

NZD/USD

To be honest, so far the volatility of this currency pair has not been very high, but I will continue to invest from the perspective of risk diversification.

For those who will start Toraripi newly, I think it is good to start with the other currency pairs.

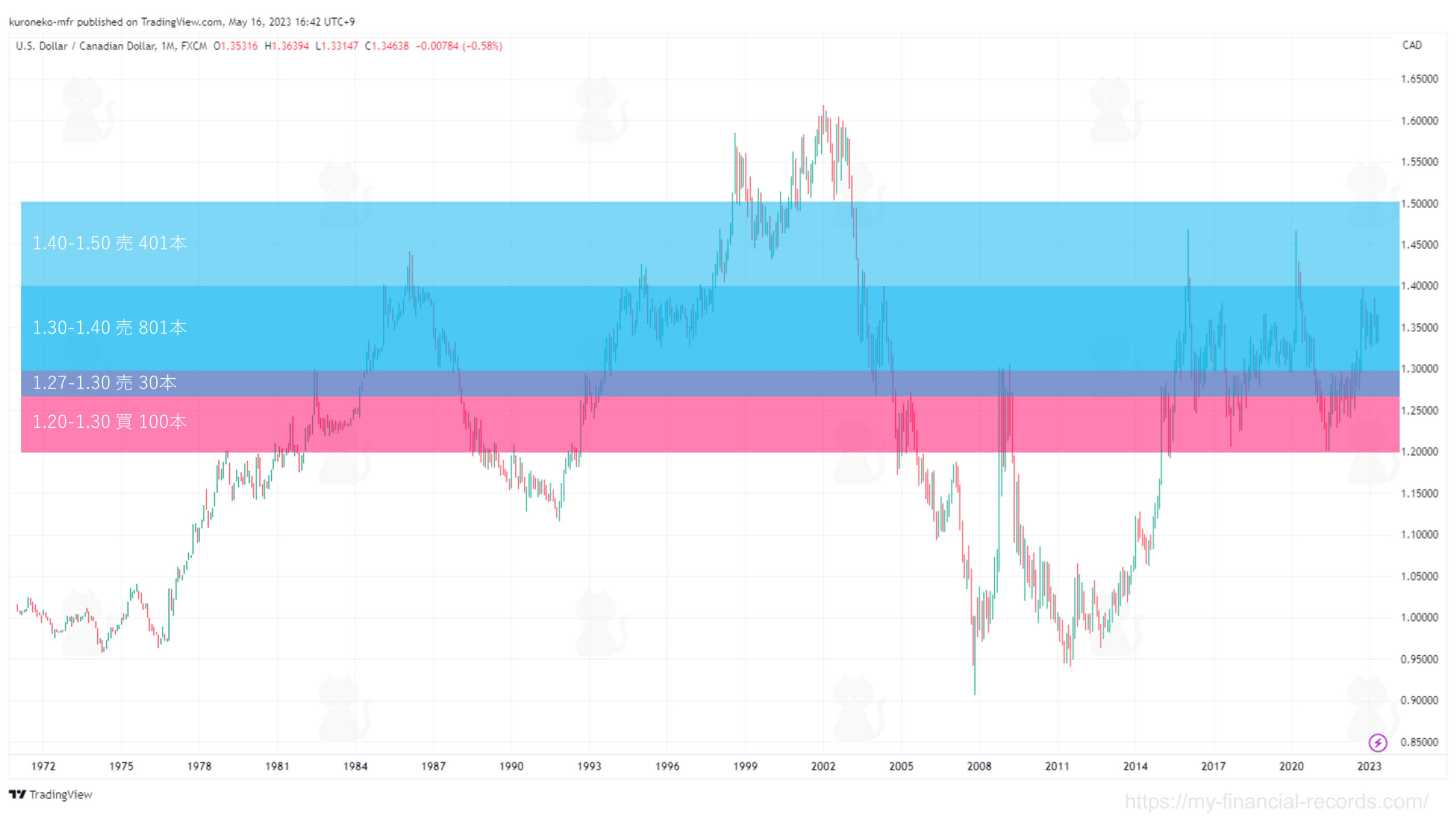

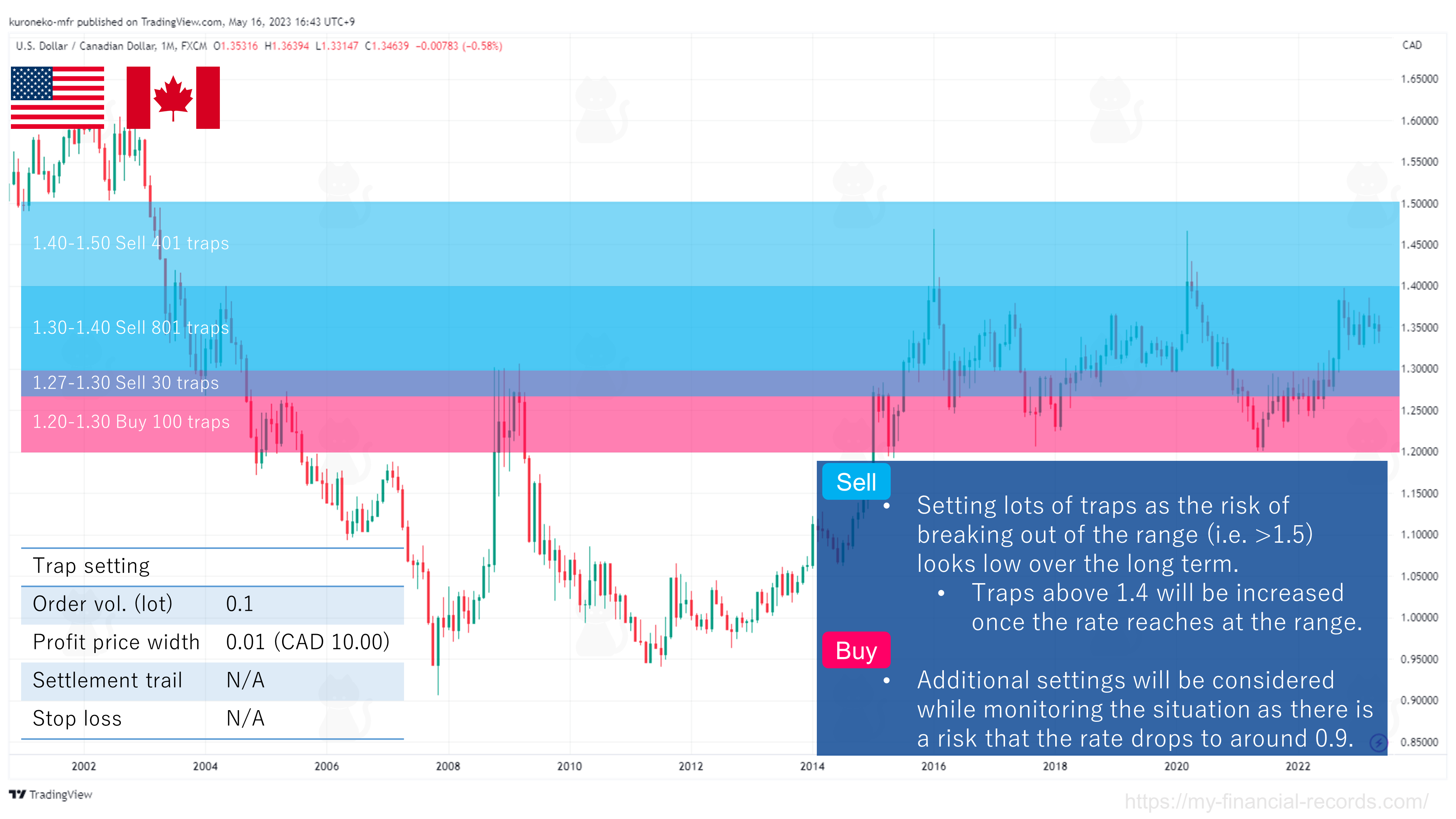

USD/CAD

GBP/USD

Settings under Consideration

CAD/JPY - Withdrawn temporarily

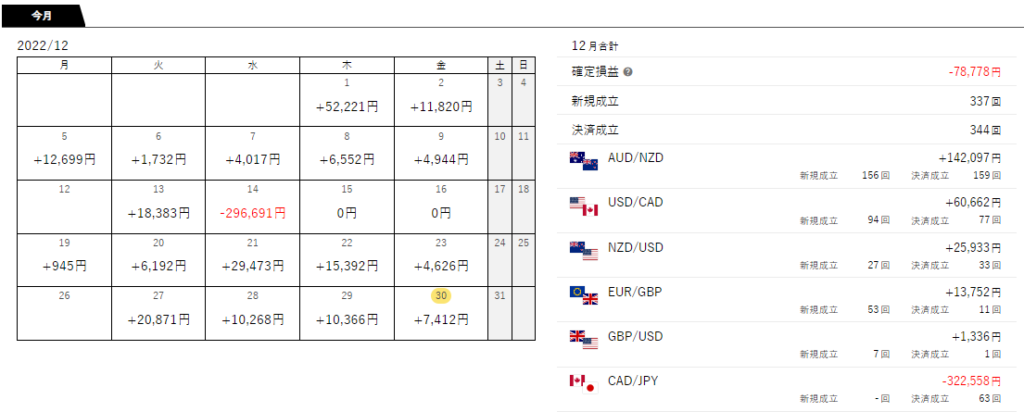

CAD/JPY has become the biggest loss cut in my history.

I suffered from negative swaps for a long time, but when it fell below 100 yen in mid Dec, 2022, I did a loss cut.

I think the next entry point will be when the JPY becomes stronger and it is easy to buy it.

EUR/USD - Withdrawn temporarily

I would like to set selling to avoid negative swaps, but it is not the time and I have temporary withdrawn from this currency pair.

I think the entry by selling should exceed 1.1. Ideally, above 1.2.

I will continue to check the chart and hope to resume when I have a good entry point. At that time, I would like to inform you here.

EUR/AUD

This pair is not for Traripi but for Triauto.

To avoid negative swaps with buying, I am waiting for the timing when I can enter from selling.

I see the border between selling and buying at about 1.55. I am thinking the entry with selling will be made after exceeding 1.6.

(Currently, the rate exceeds 1.6, but I am still monitoring the situation. The EUR interest rate is approaching it of the AUD, and if holding a short position for a long time, I am not sure if the positive swap will be maintained depending on the future interest rate situation.)

AUD/USD

When introducing NZD/USD, I also compared it with AUD/USD as they have close correlation. As AUD/USD has relatively high negative swap points for buying, the entry with selling was preferred, but it was not the timing.

Even if the correlation with NZD/USD is close, the countries are different from Australia and New Zealand, and it will diversify the risk somewhat.

Extra: GBP/AUD

As GBP/AUD is not handled by Traripi or Triauto, it is easily traded with automated trading. However, swap points are relatively low for both buying and selling as both currencies have similar interest, it is easy to trade this currency pair. To enter from selling with positive swap points, I am watching if it falls more. If the price is below 1.7, I will start to buy this pair.

I am thinking to use DMM or OANDA for this trade.

Extra: USD/CHF

Please see the latest USD?CHF post in this category for the latest status. As a profit has been made, I prepared a separate page.