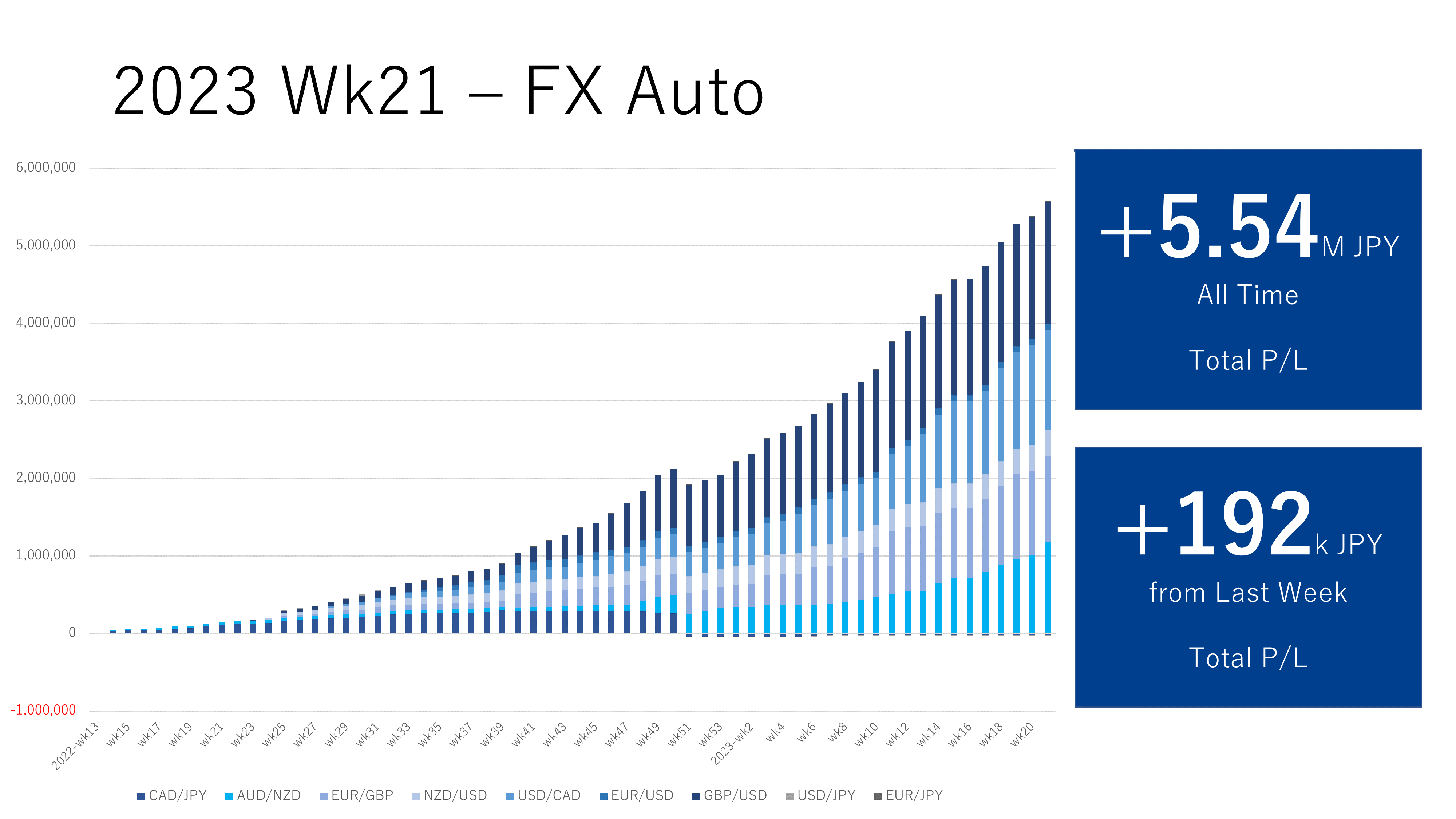

The reports of Traripi and Triauto, which has been separately reported are combined in one page since Wk1, 2023.

Contents

Status of This Week

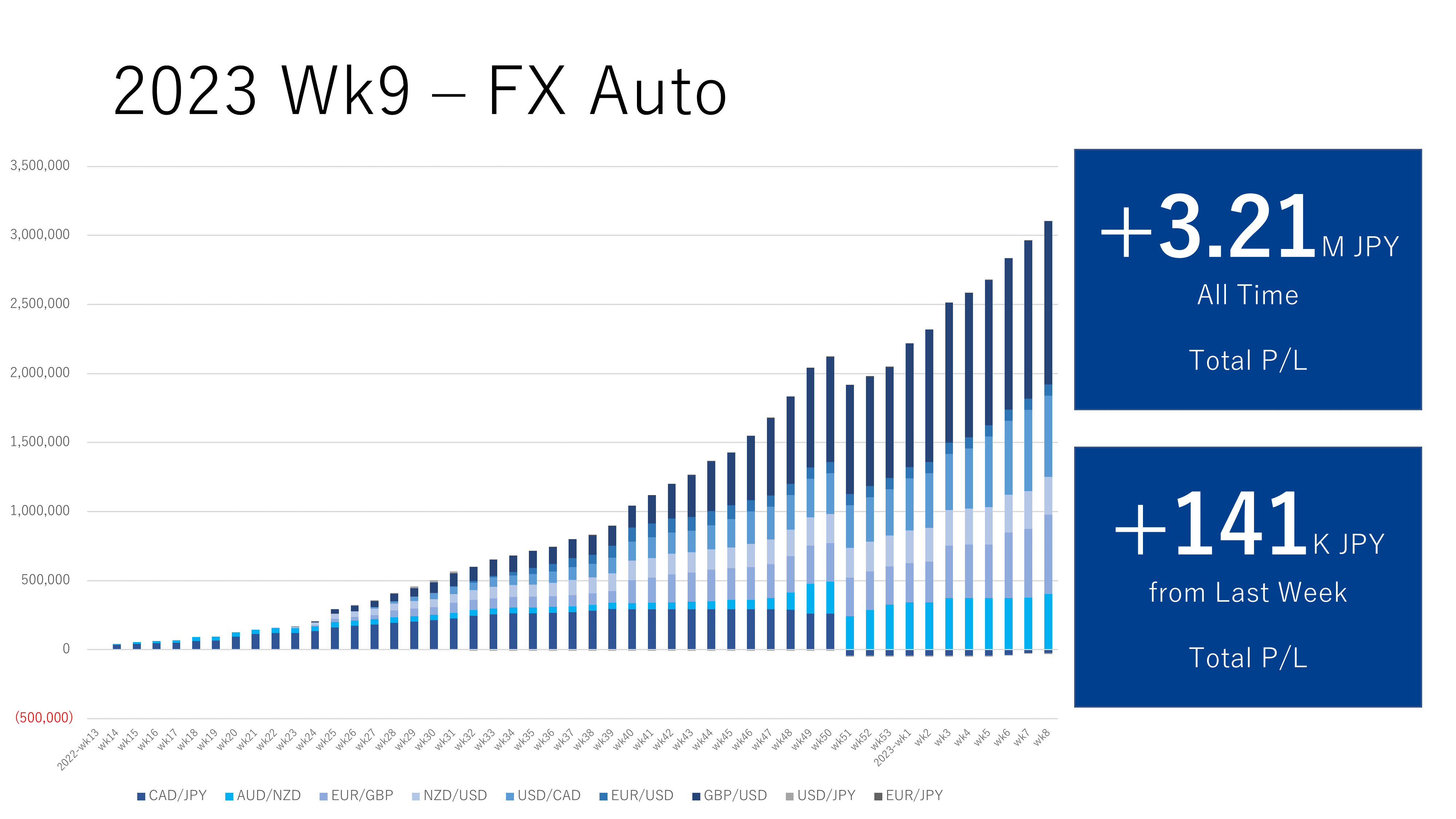

The total revenue of Toraripi and Triauto was JPY 192k.

Breakdown of Earnings

- Toraripi JPY 192k

- Triauto JPY 0

- Just in case, lots of settlement cannot be expected for Triauto as I settled most positions of Triauto. Since only discretionary positions remain, I would like to remove them from this automated trading page starting next week.

It had been a tough situation since last week, it was getting good on and after Wednesday

This Week's Status

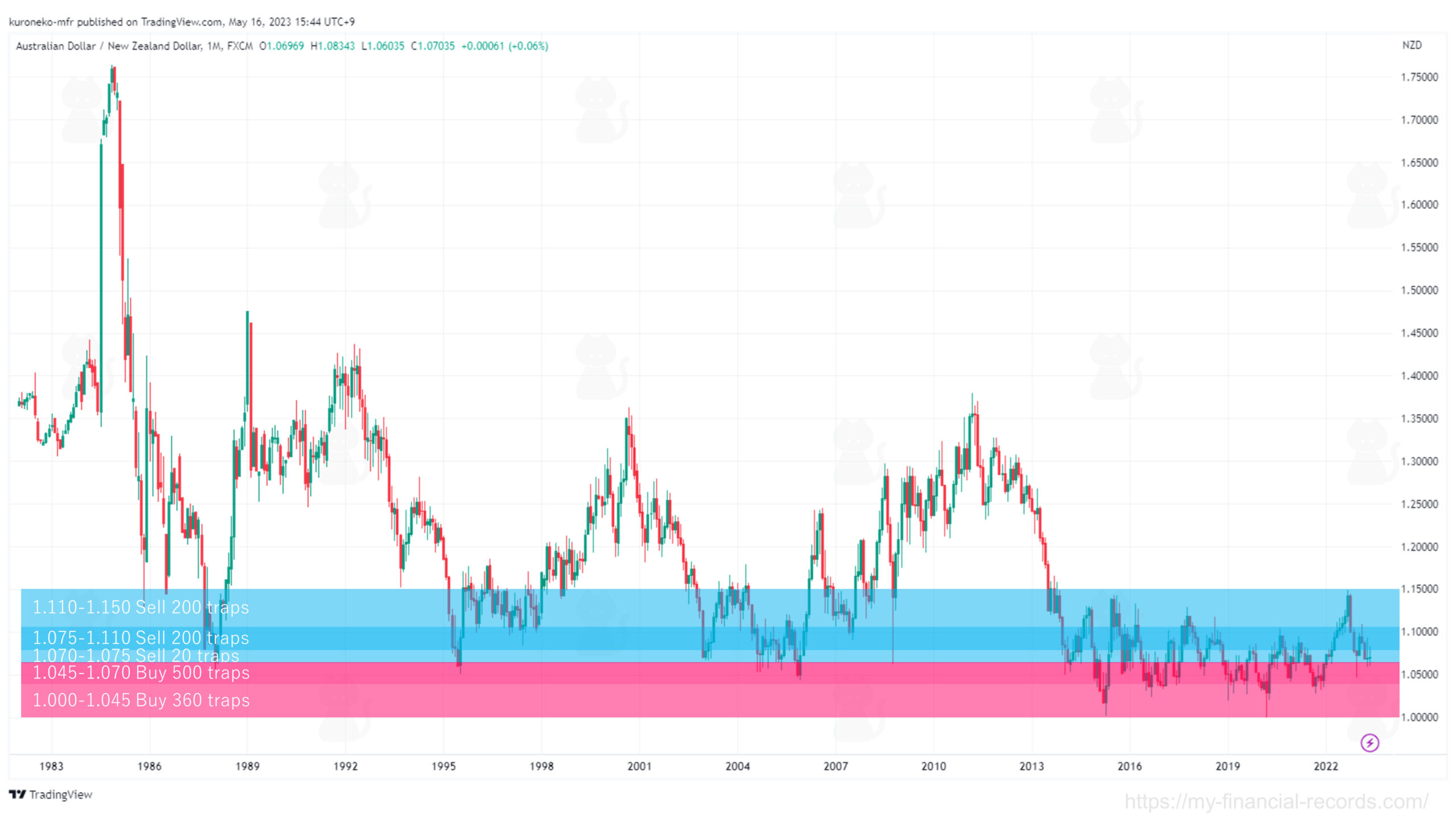

- AUD/NZD drove most gains. (Long positions has been used up already...)

- As the new positions are increased, I would like to expect the other currency pairs to be active soon.

This year, I set the following goal first, so it may be a little tough, but I would like to think about how to achieve this without giving up.

Goal by End of Mar, 2023

Earn an average of JPY 1M/month (250K/week)

After quitting the company and starting the life of FIRE, I will do nothing if I don't set a specific goal. Thus I set a goal. I will whip myself!

Dashboards

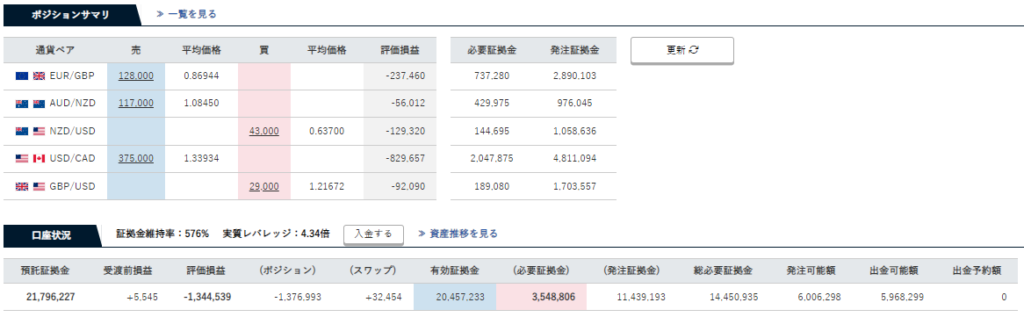

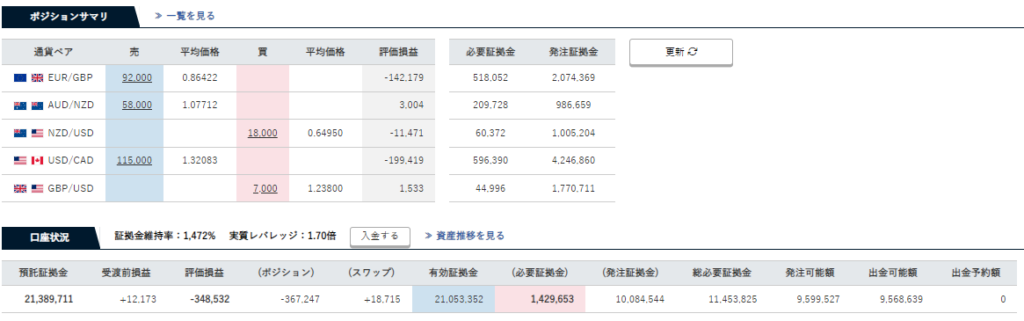

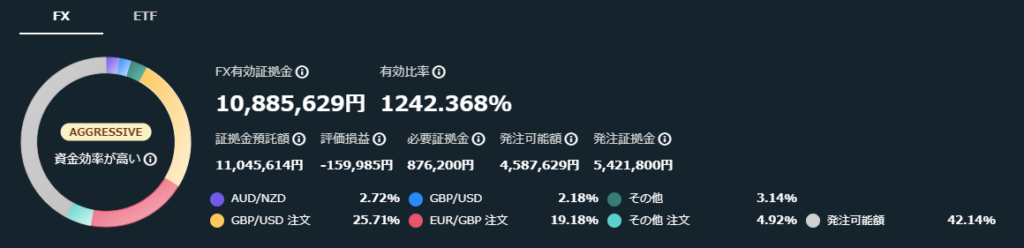

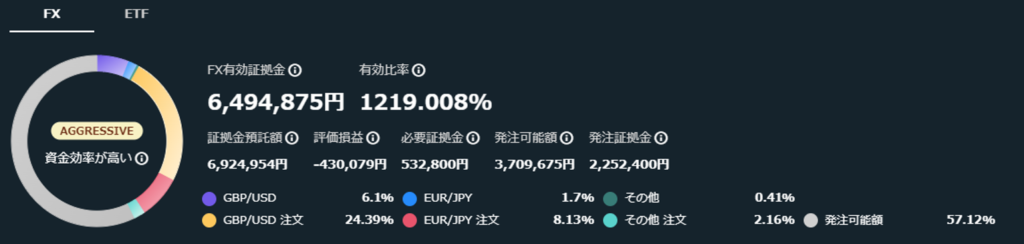

Position Summary of Traripi

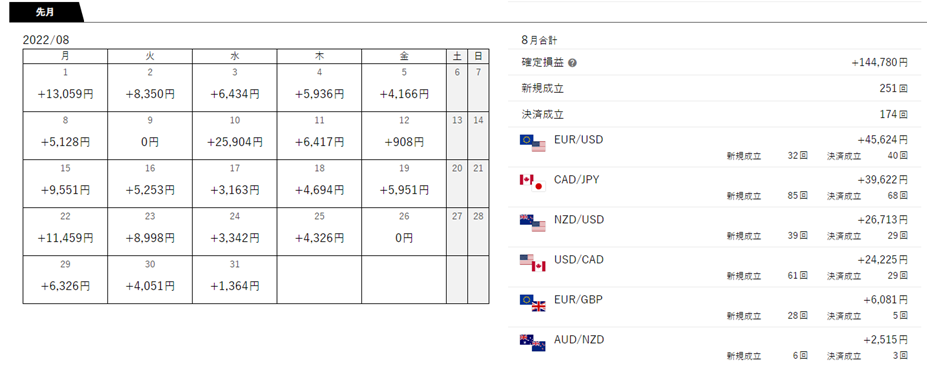

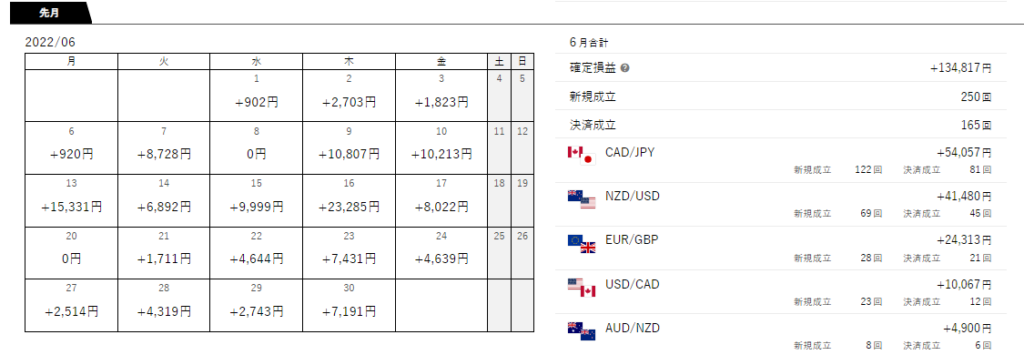

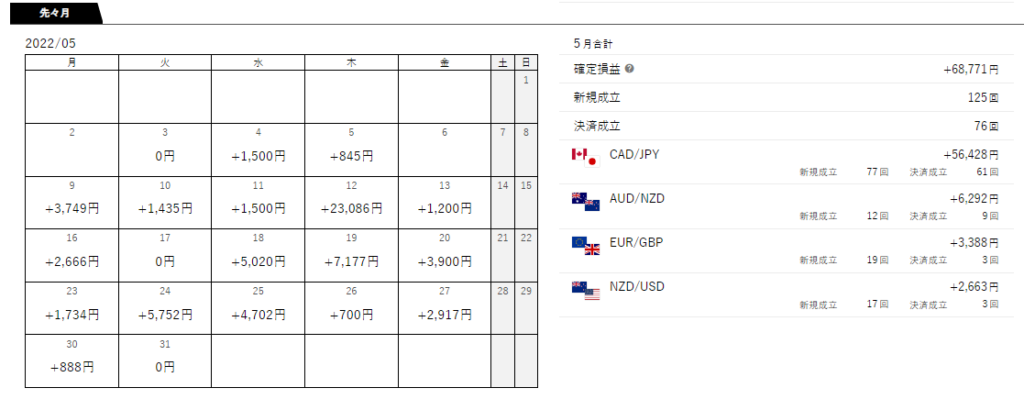

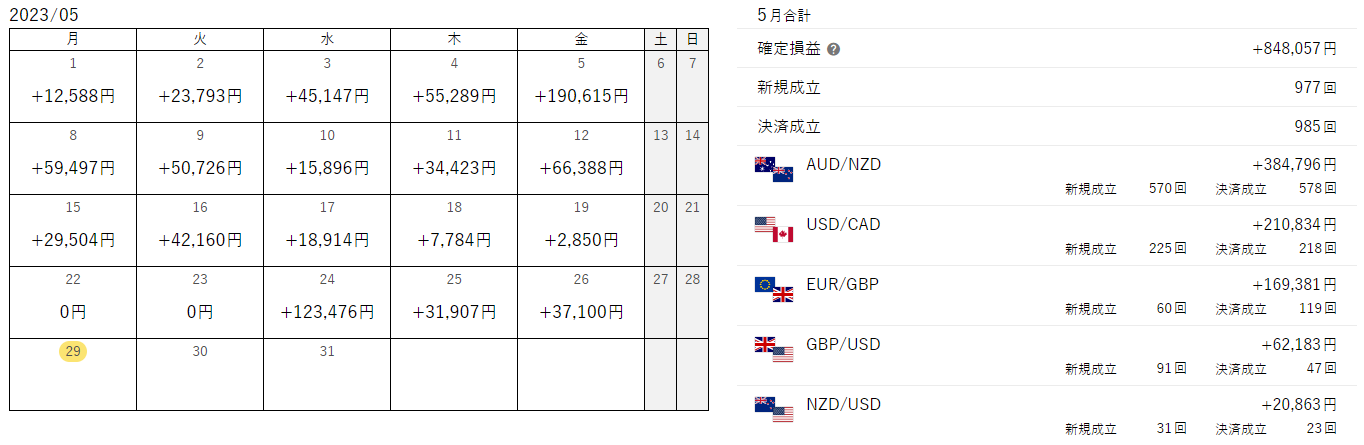

Establishment calendar of Traripi

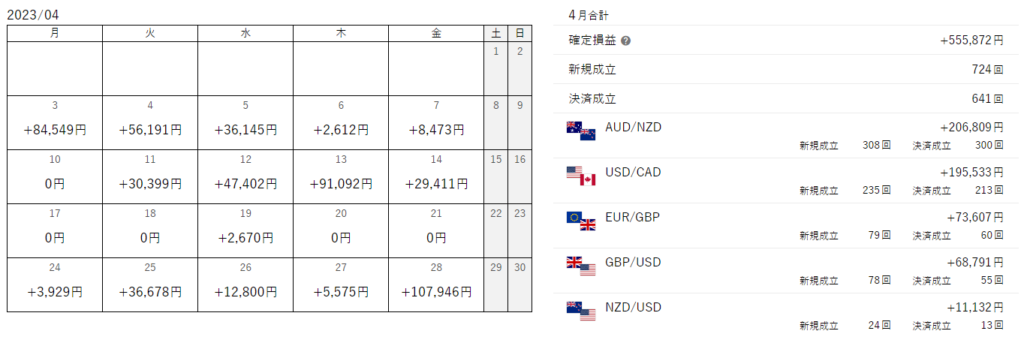

It had never reached 600k until last month, but it already exceeded 800k this month.

If Toraripi earns this level every month, it is very helpful.

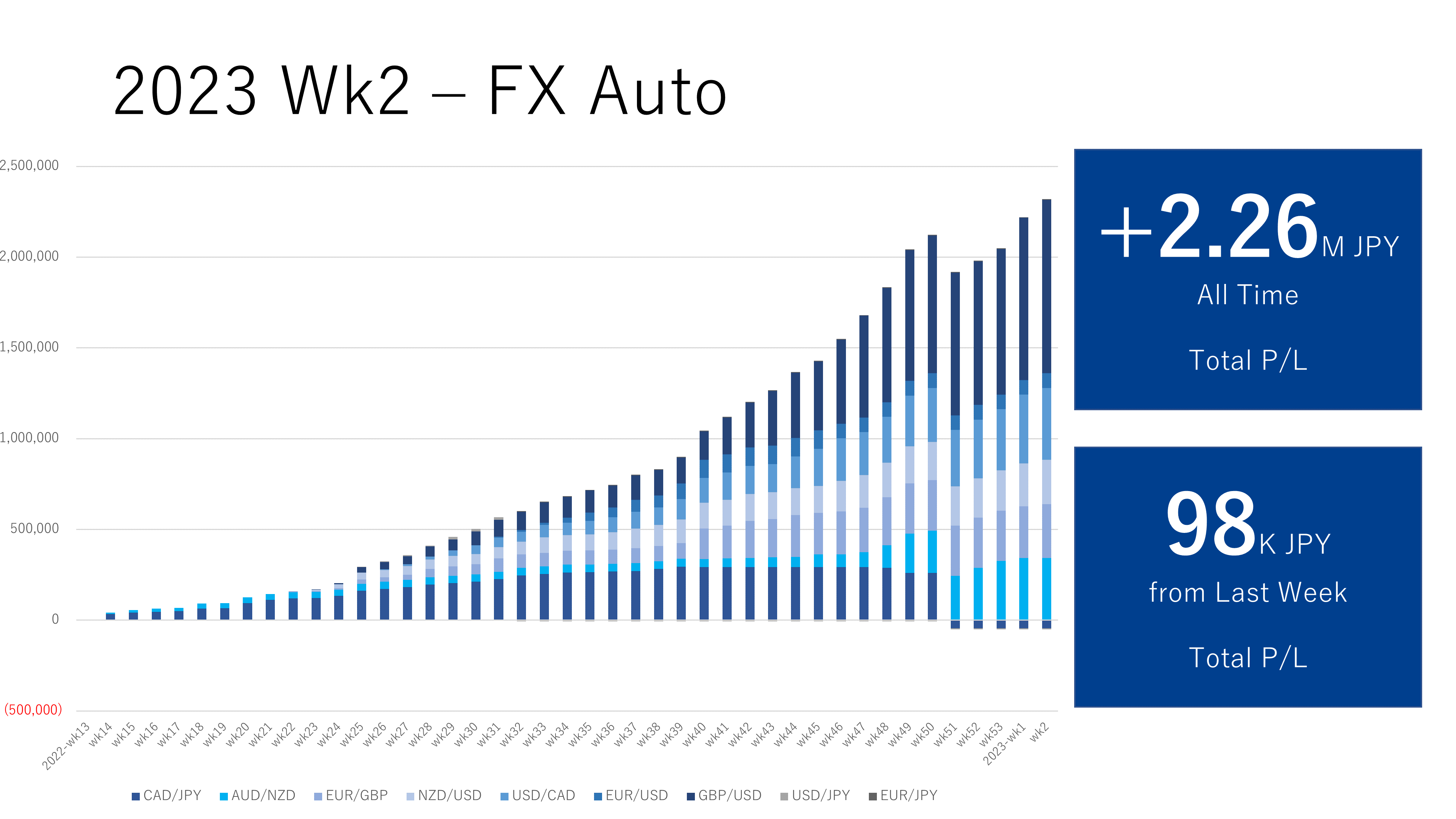

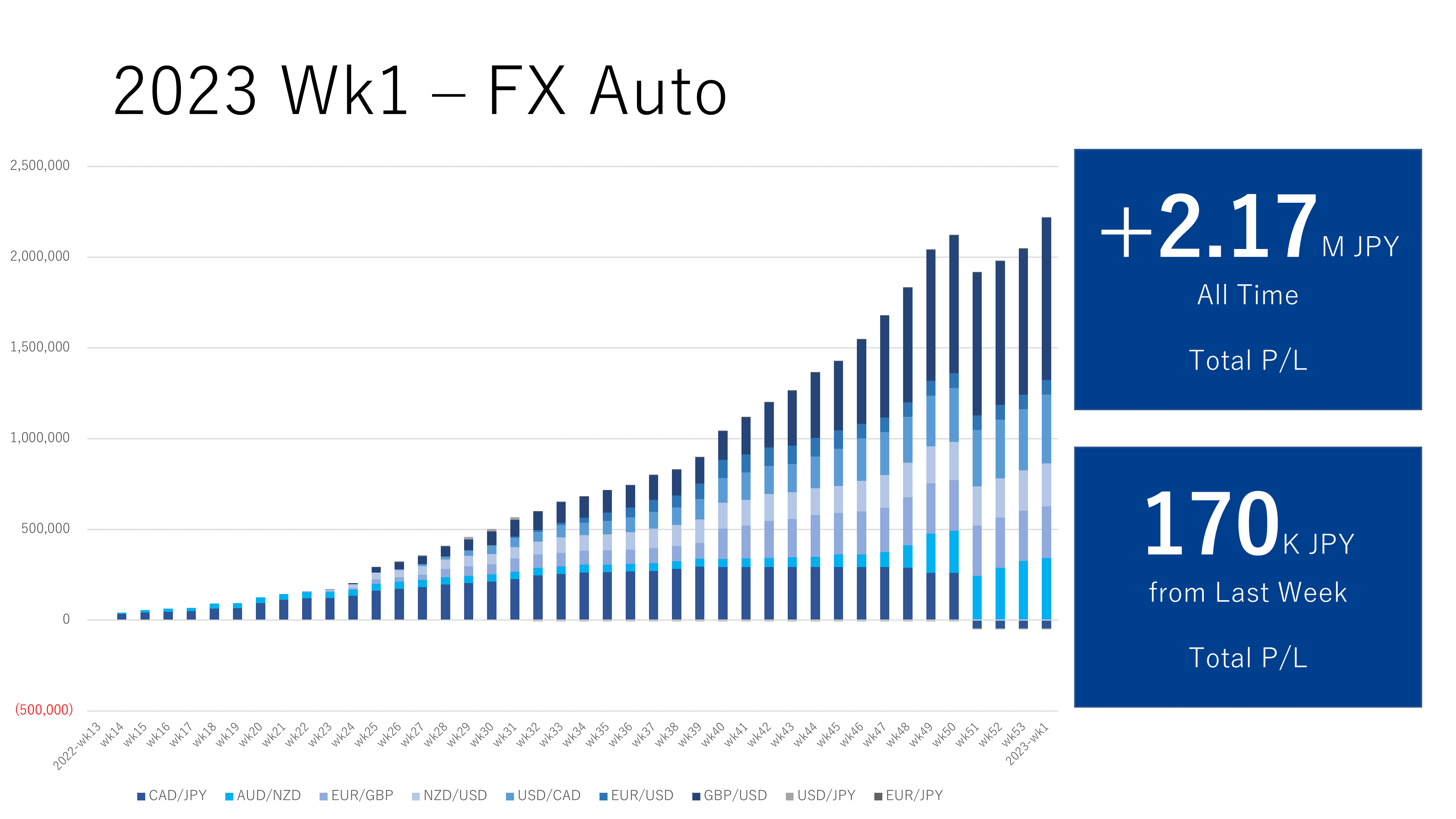

Dashboard of Triauto

The positions of GBP/USD has gone.

Latest Settings (Written in Toraripi style)

I am summarizing the settings of active currency pairs for my own reference.

Changes of The Week

- No update for the currency pair settings this week.

There are no cross-yen currency pairs currently.

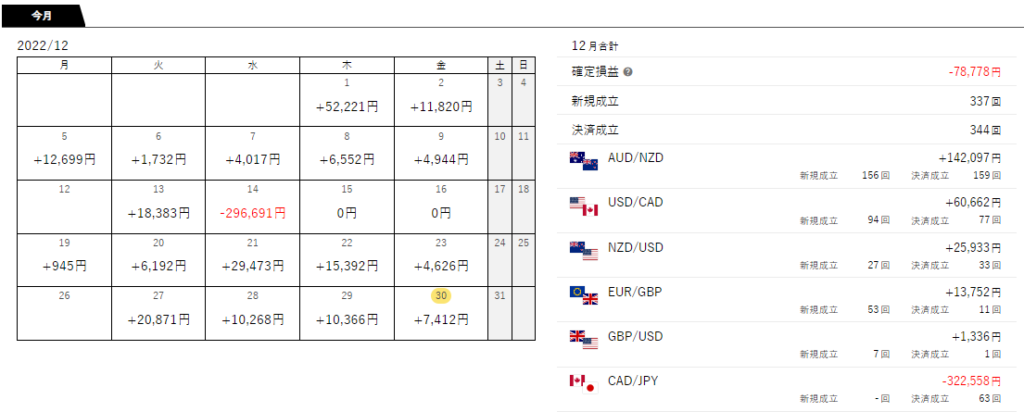

Immediately after the start of Toraripi, I had set the selling of CAD/JPY, but while the yen was swinging in the direction of extreme depreciation, I was hit by a negative swap, resulting in a drastic loss cut (the article in the link is in Japanese only).

I would like to participate in cross-yen currency pairs again when the yen swings in the direction of appreciation and it becomes possible to enter by buying, or when the yen raises interest rates and negative swaps are no longer a concern.

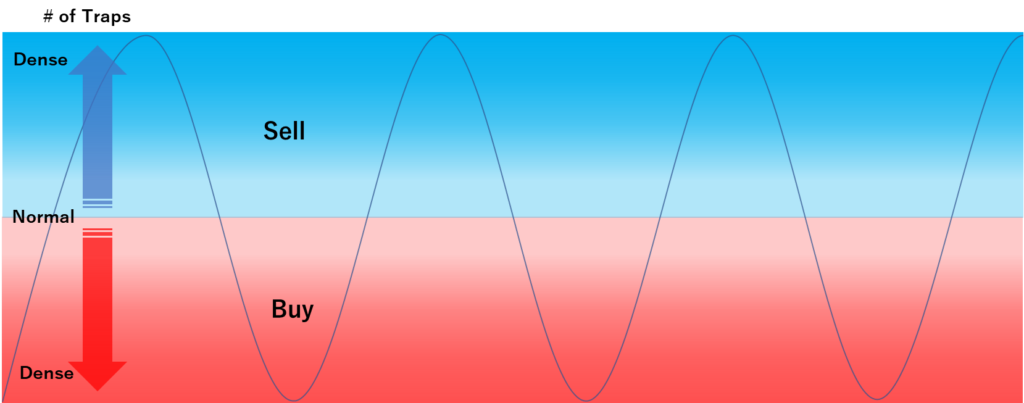

Operational Policy

- Avoid settings that make me nervous and unable to sleep. NOT to be ejected from the Forex market.

- Avoid loss cutting even in the worst case simulation

- When adding traps or making changes, iterate simulation always.

- Avoid extremely high negative swap points

- Given the risk of holding positions for a long period of time, I am avoiding extremely high negative swap points.

- I am trading currency pairs with some negative swaps, but it is desirable to have a little positive swap points overall.

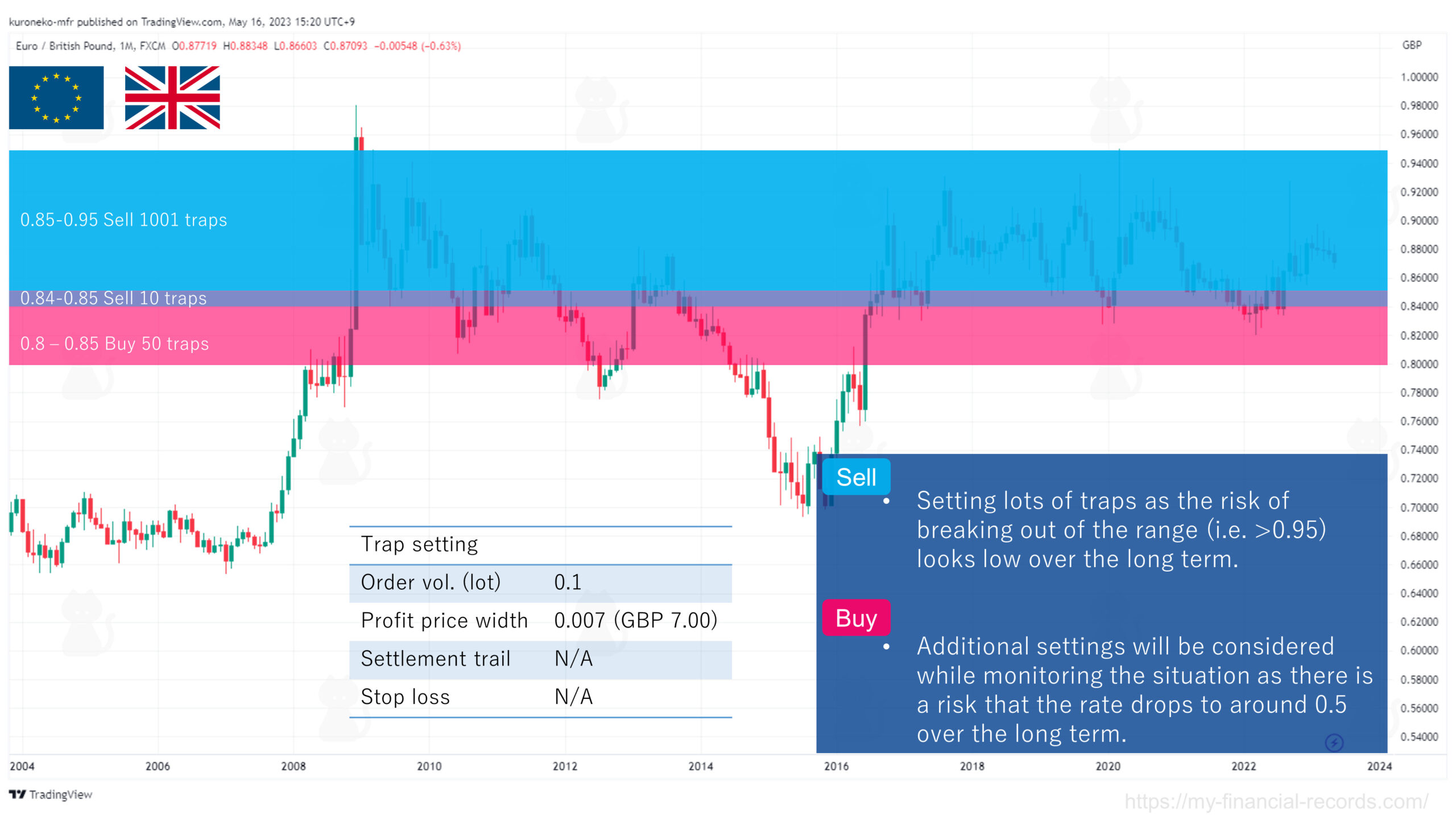

EUR/GBP

As the swap point is now positive for selling, I feel comfortable even if I hold a position for a long time.

As the standard or original trap width for me is 0.001 (i.e. 101 traps in 0.1 width), and when I increase the number of the traps from there, it is written as xx times in tables.

I love this currency pair as the swap point is currently positive for selling and I feel comfortable even if I hold the positions for a long time.

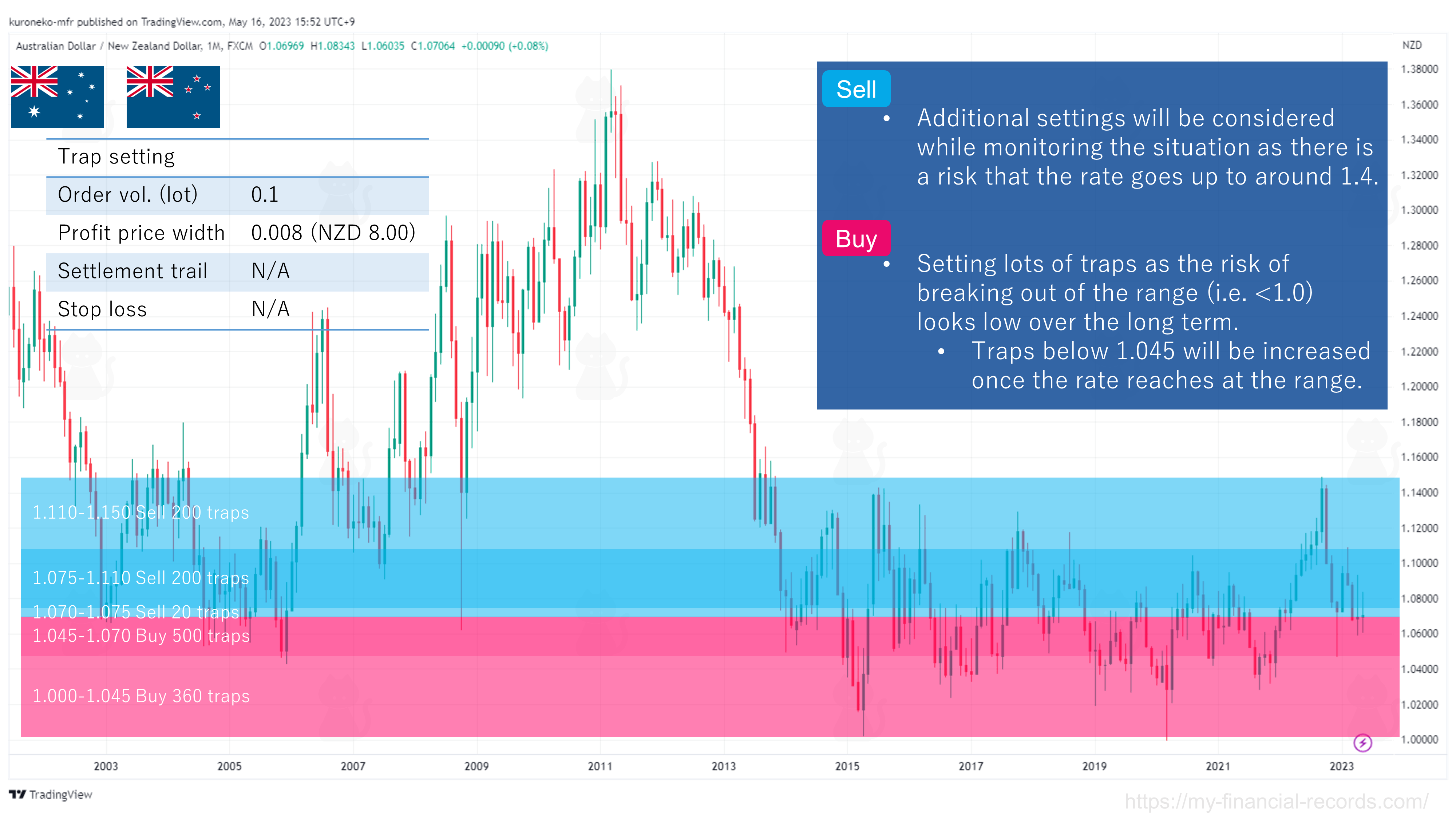

AUD/NZD

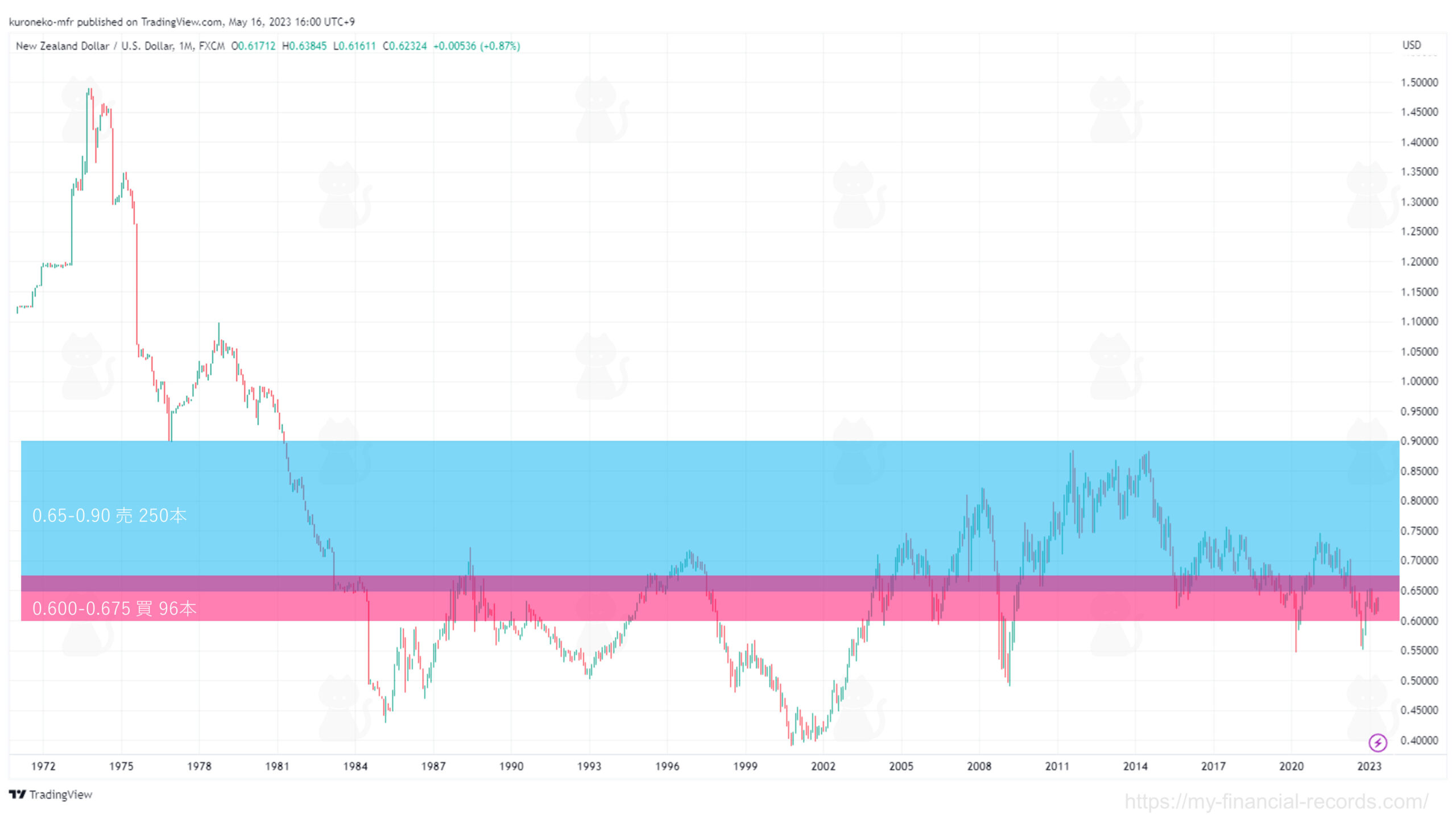

NZD/USD

To be honest, so far the volatility of this currency pair has not been very high, but I will continue to invest from the perspective of risk diversification.

For those who will start Toraripi newly, I think it is good to start with the other currency pairs.

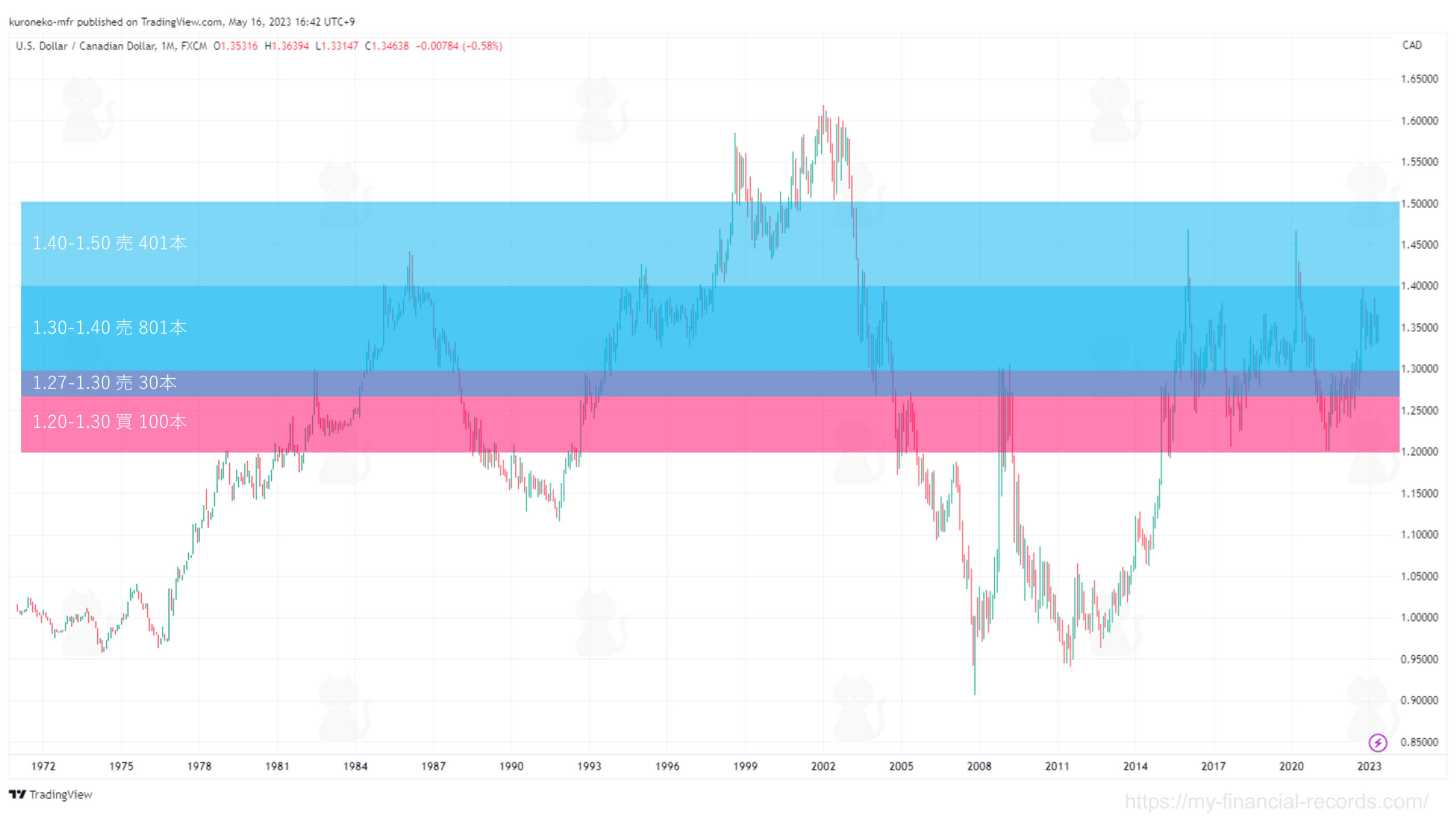

USD/CAD

GBP/USD

Settings under Consideration

CAD/JPY - Withdrawn temporarily

CAD/JPY has become the biggest loss cut in my history.

I suffered from negative swaps for a long time, but when it fell below 100 yen in mid Dec, 2022, I did a loss cut.

I think the next entry point will be when the JPY becomes stronger and it is easy to buy it.

EUR/USD - Withdrawn temporarily

I would like to set selling to avoid negative swaps, but it is not the time and I have temporary withdrawn from this currency pair.

I think the entry by selling should exceed 1.1. Ideally, above 1.2.

I will continue to check the chart and hope to resume when I have a good entry point. At that time, I would like to inform you here.

EUR/AUD

This pair is not for Traripi but for Triauto.

To avoid negative swaps with buying, I am waiting for the timing when I can enter from selling.

I see the border between selling and buying at about 1.55. I am thinking the entry with selling will be made after exceeding 1.6.

(Currently, the rate exceeds 1.6, but I am still monitoring the situation. The EUR interest rate is approaching it of the AUD, and if holding a short position for a long time, I am not sure if the positive swap will be maintained depending on the future interest rate situation.)

AUD/USD

When introducing NZD/USD, I also compared it with AUD/USD as they have close correlation. As AUD/USD has relatively high negative swap points for buying, the entry with selling was preferred, but it was not the timing.

Even if the correlation with NZD/USD is close, the countries are different from Australia and New Zealand, and it will diversify the risk somewhat.

Extra: GBP/AUD

As GBP/AUD is not handled by Traripi or Triauto, it is easily traded with automated trading. However, swap points are relatively low for both buying and selling as both currencies have similar interest, it is easy to trade this currency pair. To enter from selling with positive swap points, I am watching if it falls more. If the price is below 1.7, I will start to buy this pair.

I am thinking to use DMM or OANDA for this trade.

Extra: USD/CHF

Please see the latest USD?CHF post in this category for the latest status. As a profit has been made, I prepared a separate page.