The reports of Traripi and Triauto, which has been separately reported are combined in one page since Wk1, 2023.

Contents

Status of This Week

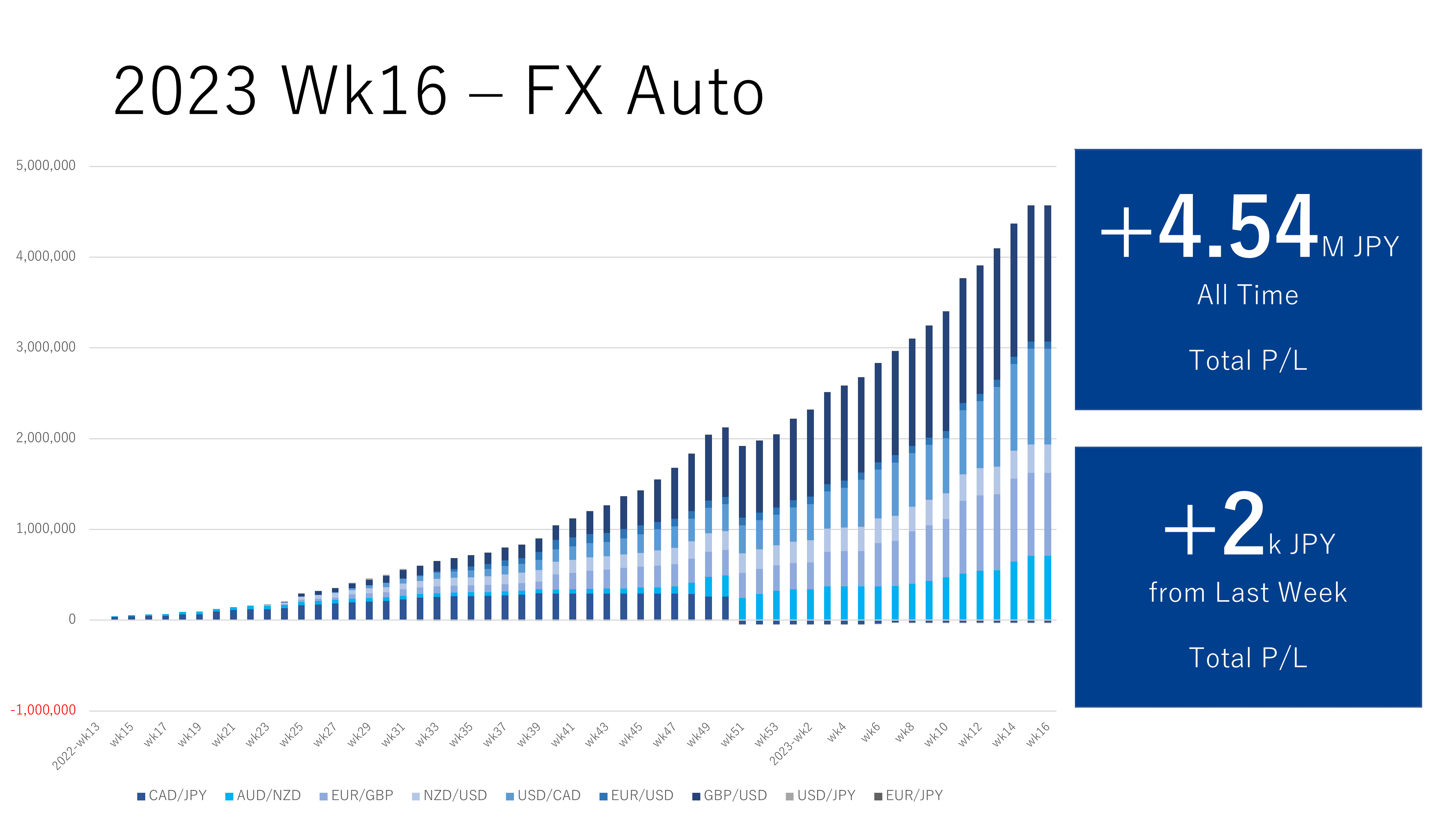

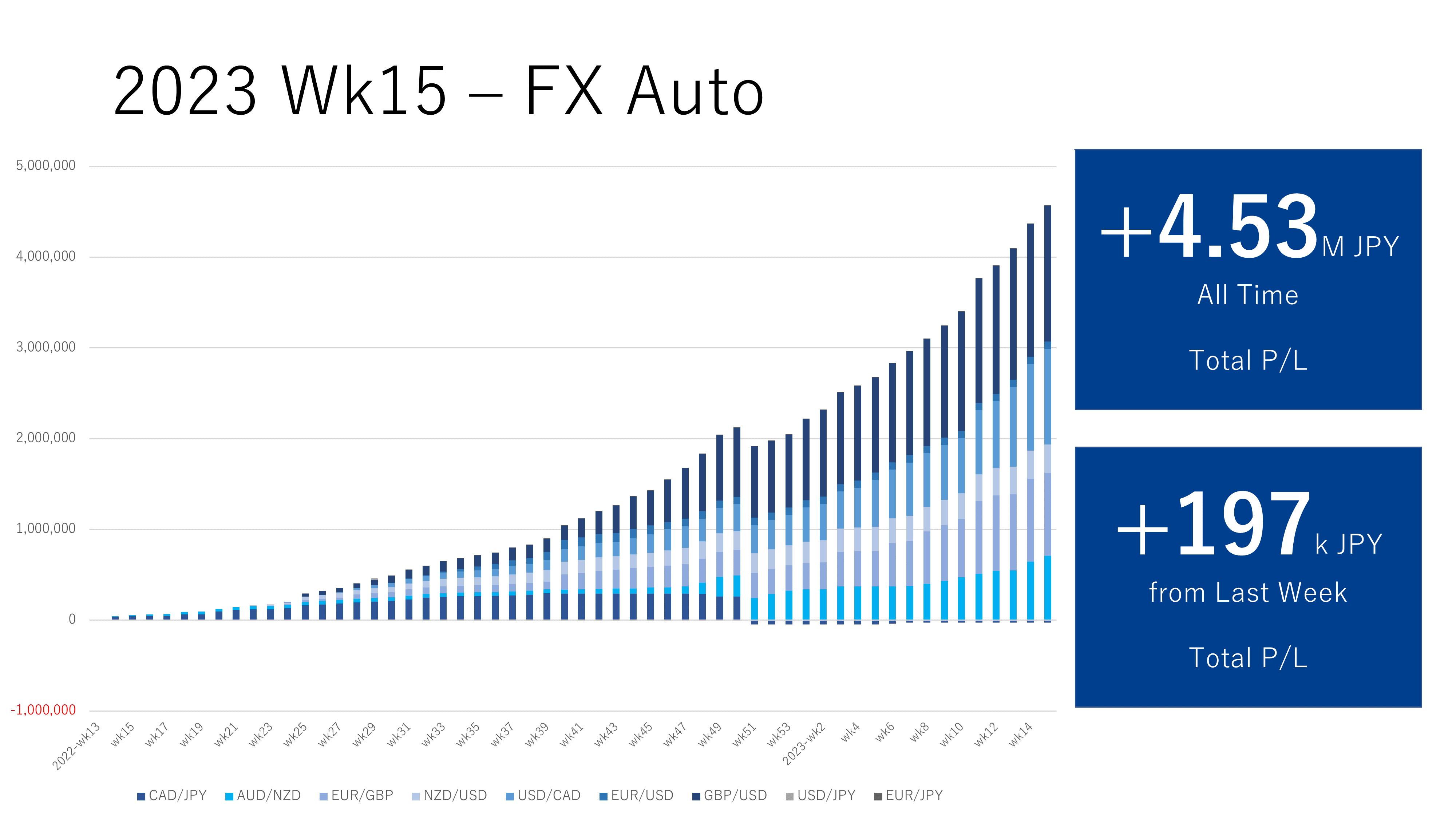

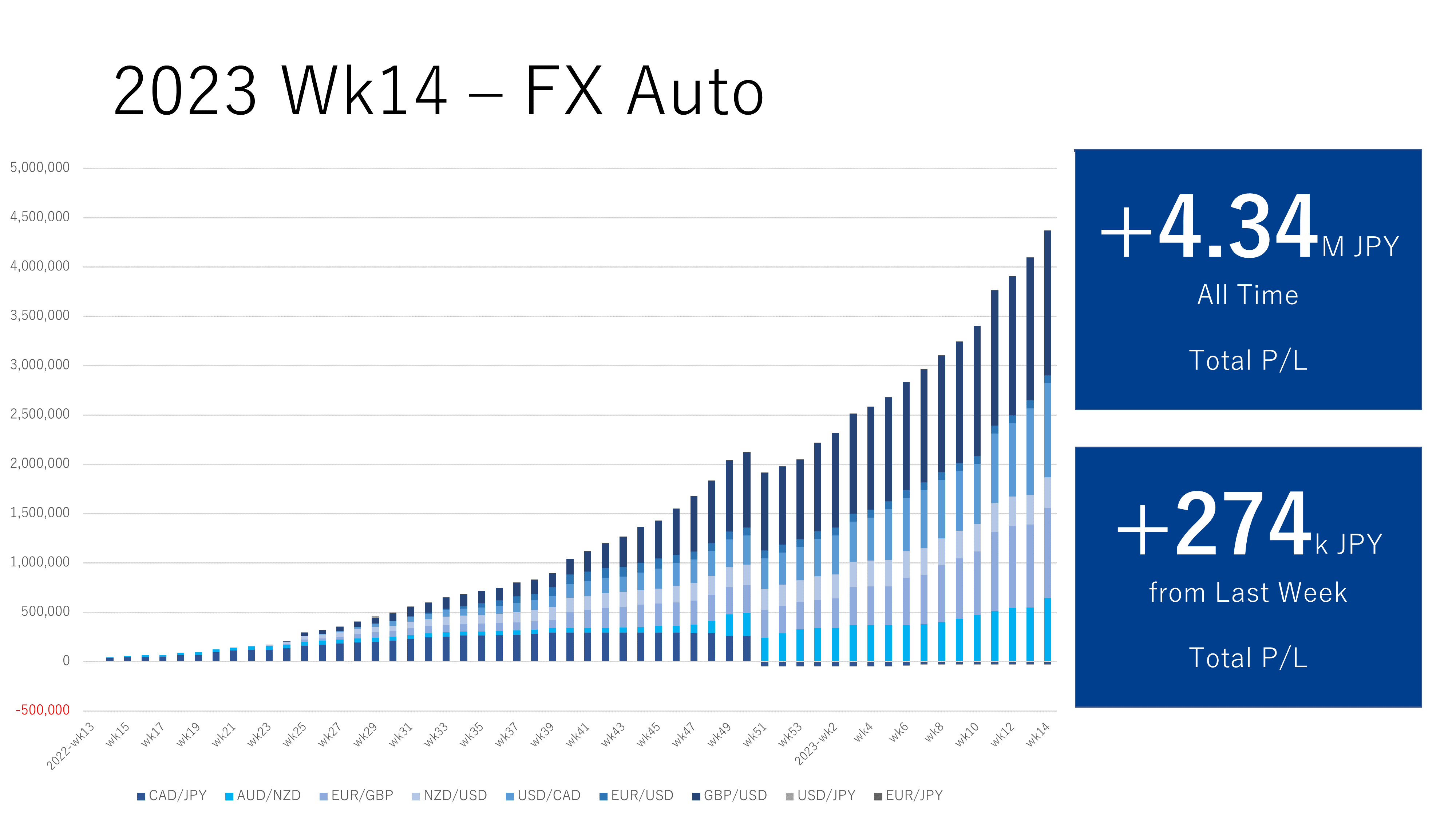

The total revenue of Toraripi and Triauto was JPY 166k.

Breakdown of Earnings

- Toraripi JPY 2k

- Triauto JPY 0k

- Just in case, lots of settlement cannot be expected for Triauto as I settled most positions of Triauto.

It is getting better compared to the drought of last week.

This Week's Status

- AUD/NZD performed well throughout the week.

- I thought that AUD/NZD is a semi-regular position in my portfolio, but it became the most profitable currency pair in April.

- EUR/GBP Sell, GBP/USD Buy, and USD/CAD Sell are performed well and marked JPY 107k on the last day of April.

This year, I set the following goal first, so it may be a little tough, but I would like to think about how to achieve this without giving up.

Goal by End of Mar, 2023

Earn an average of JPY 1M/month (250K/week)

After quitting the company and starting the life of FIRE, I will do nothing if I don't set a specific goal. Thus I set a goal. I will whip myself!

Dashboards

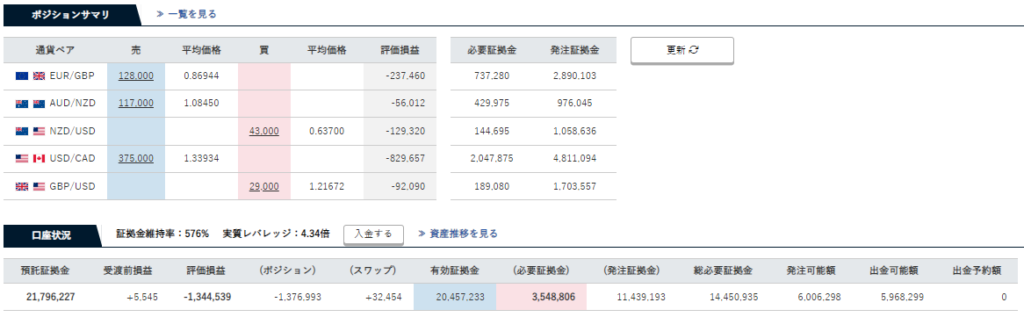

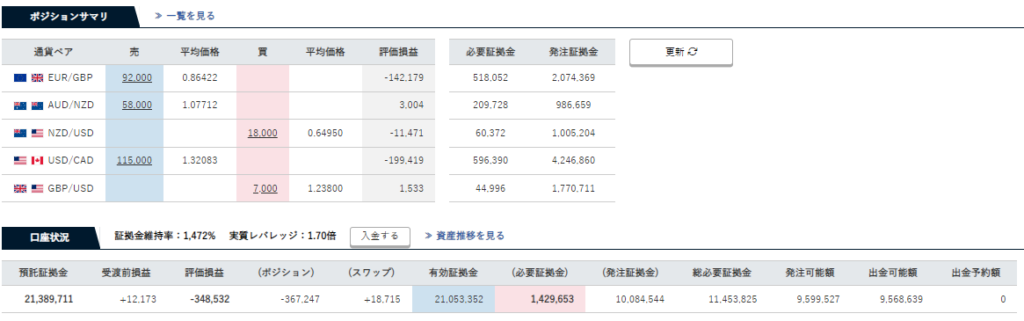

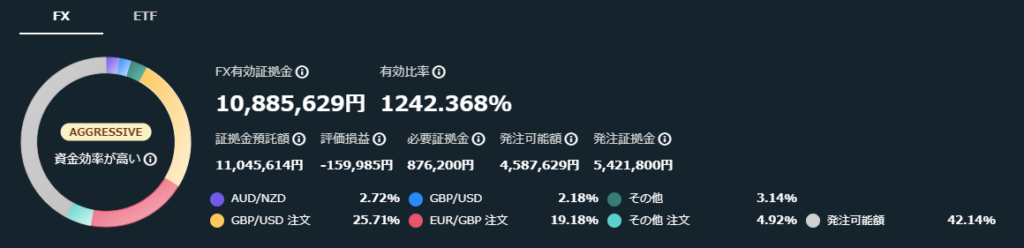

Here is the Position Summary of Traripi.

The unrealized loss has been increased due to new positions. It's not a stressful situation yet, but I'll keep monitoring the situation.

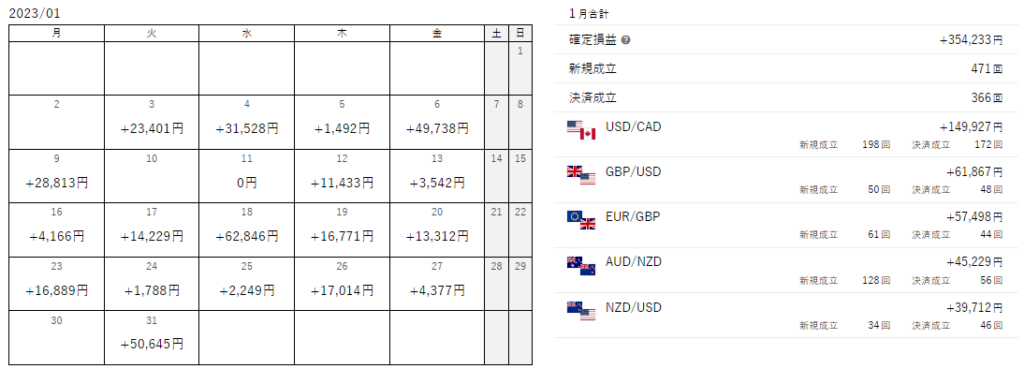

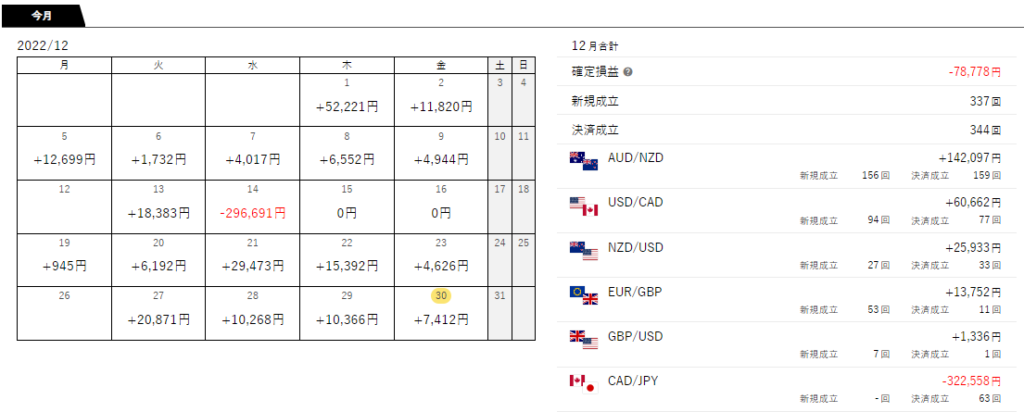

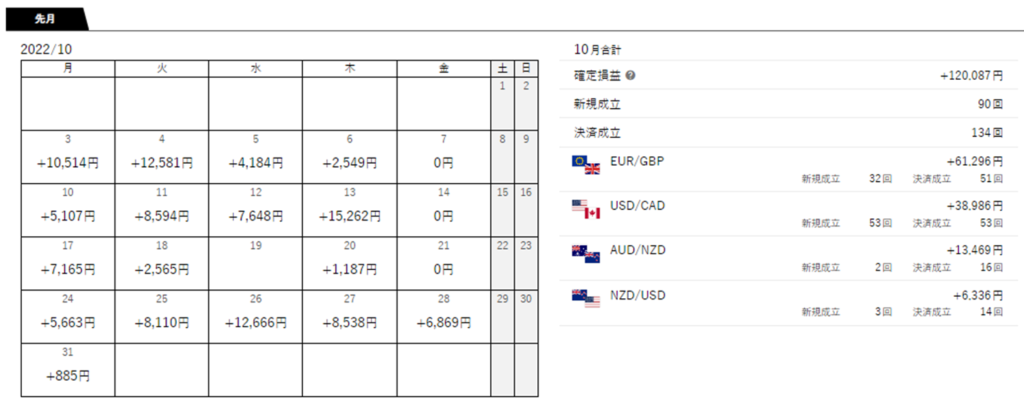

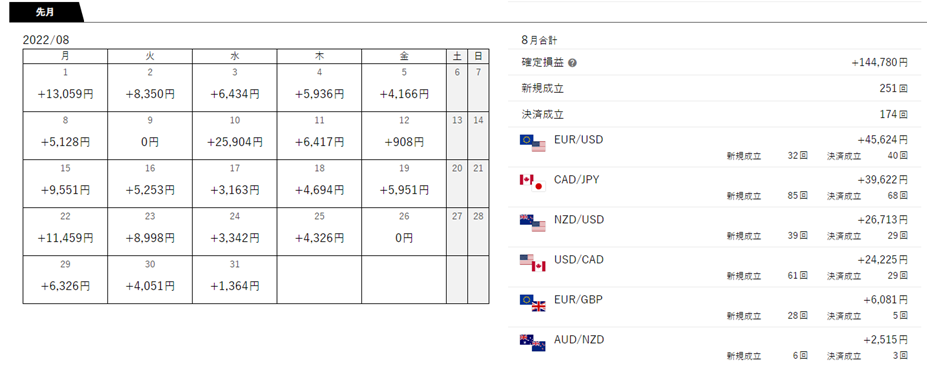

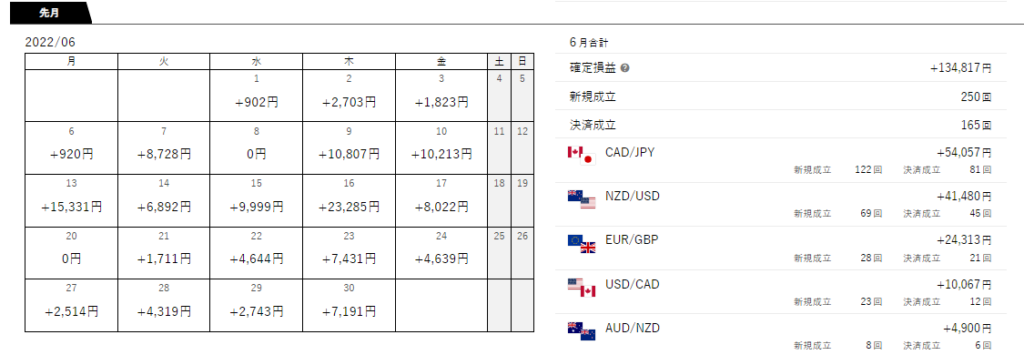

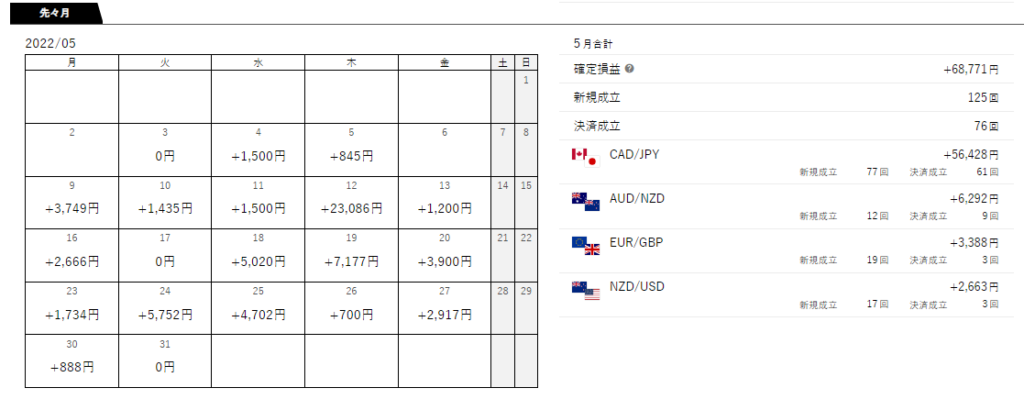

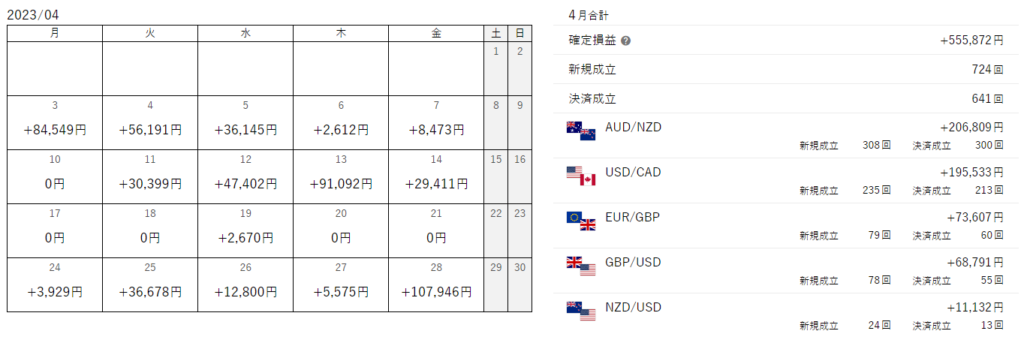

Establishment calendar of Traripi. There are clear days when revenue is generated and days when it is not.

It would have been nice if the momentum until second week continued until the end of month, but it's not going so well.

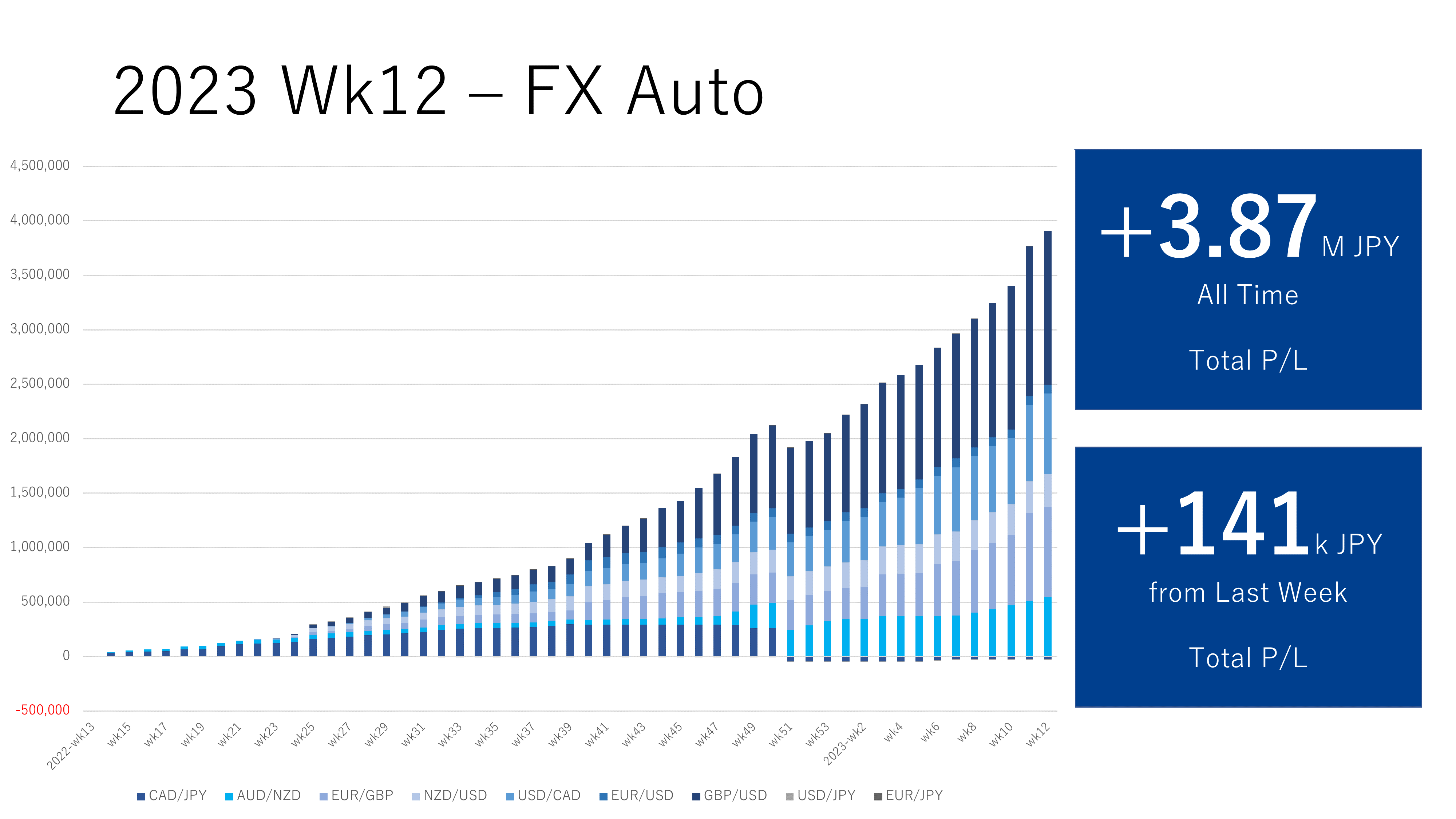

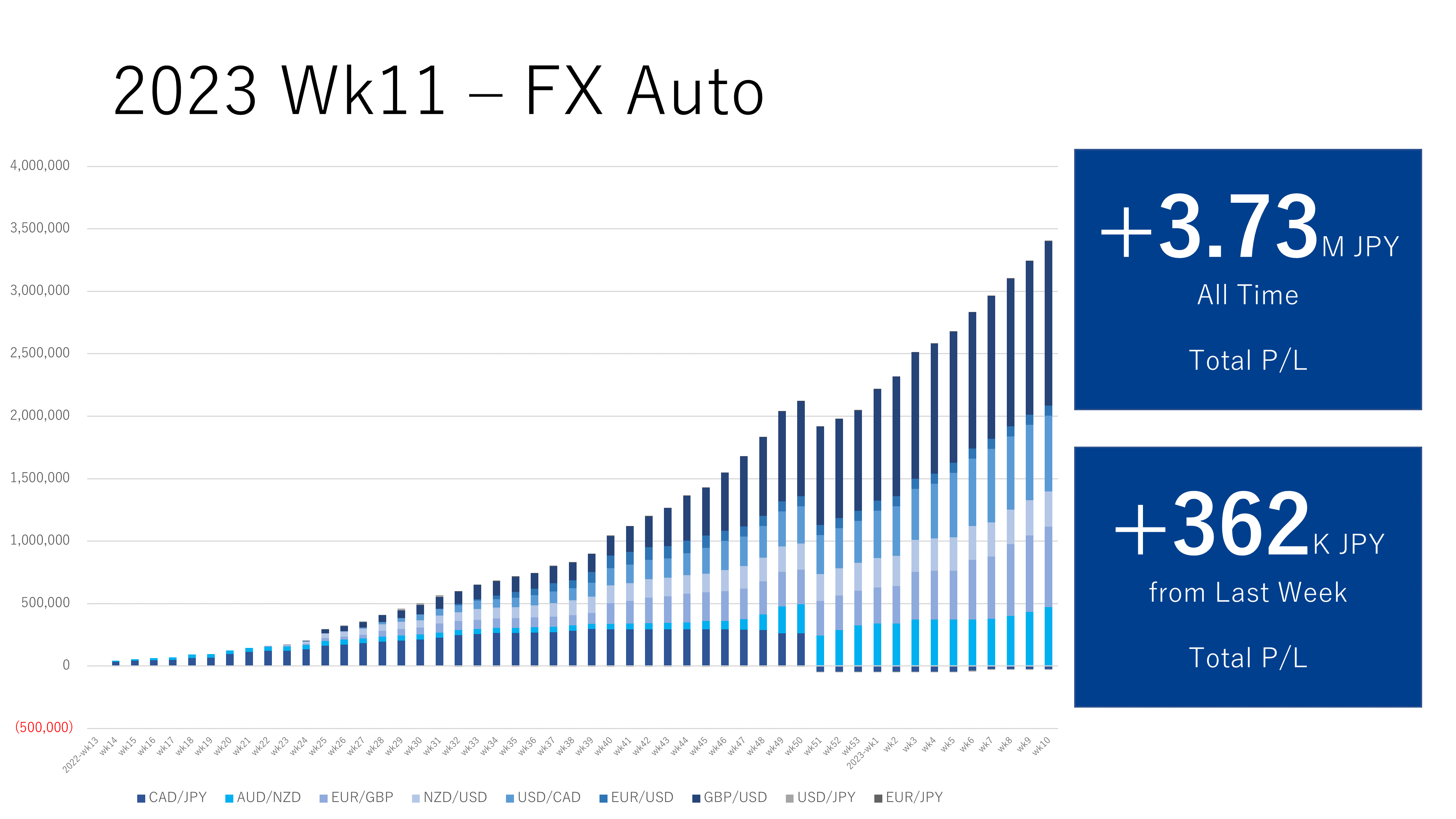

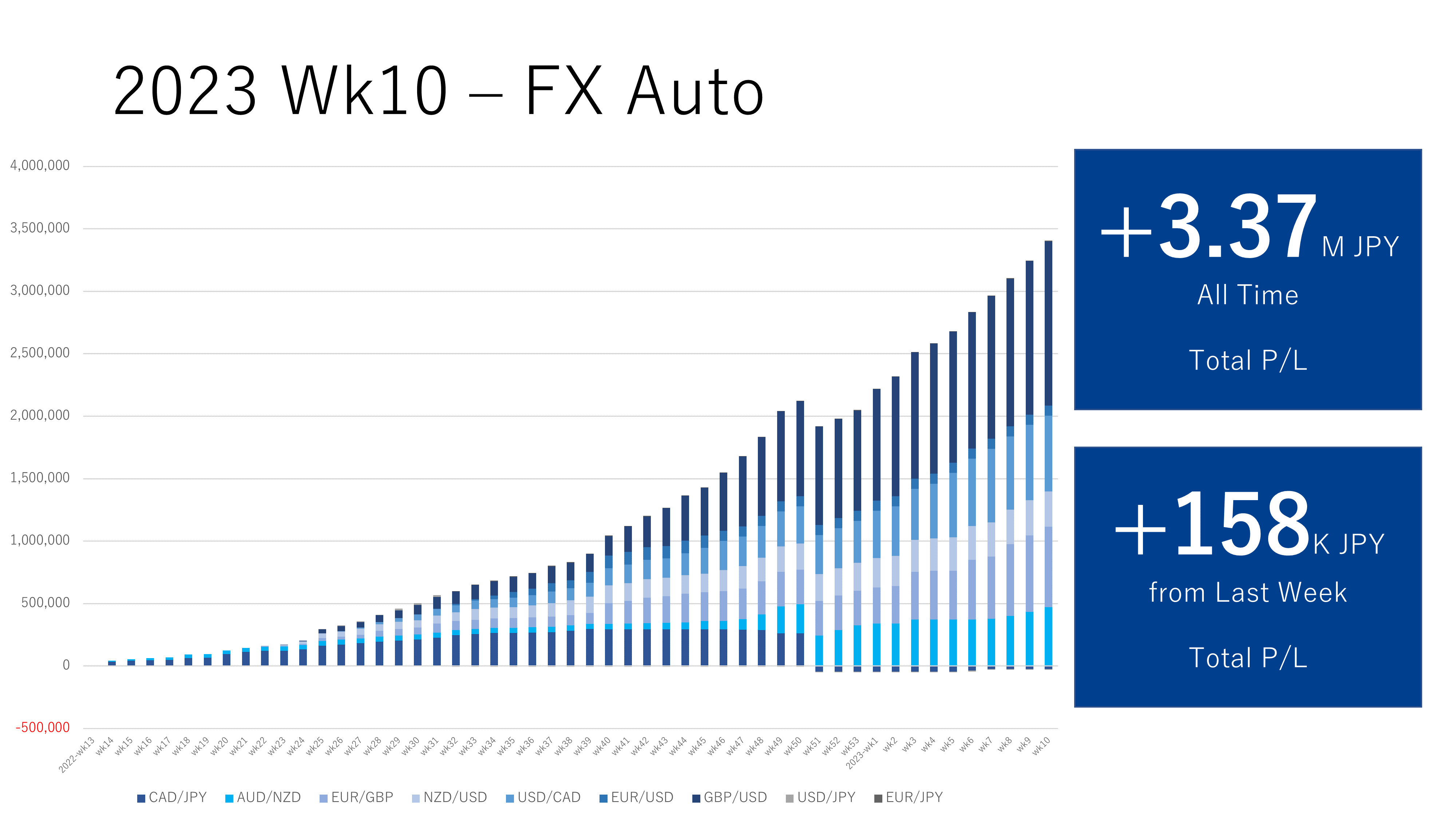

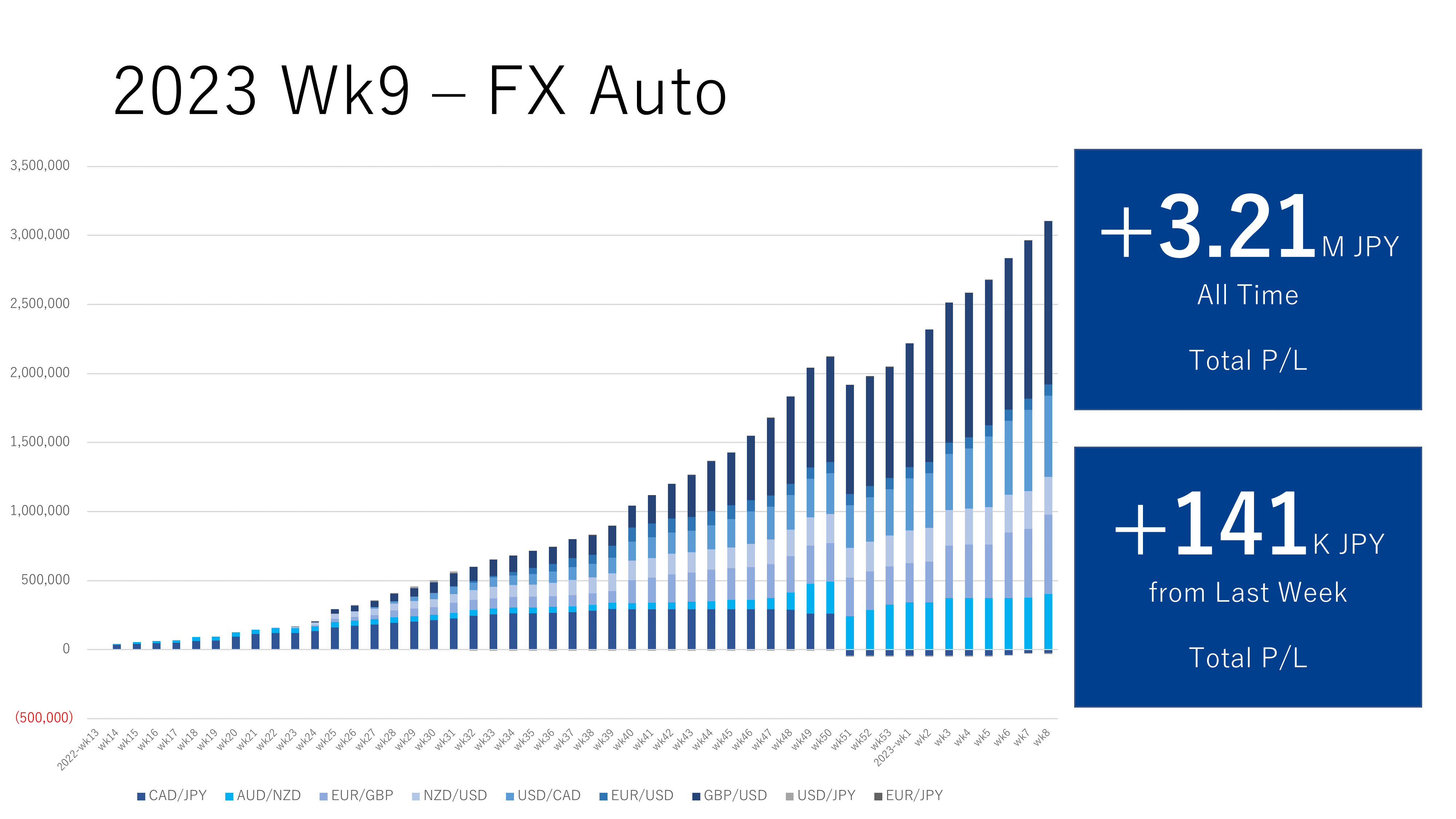

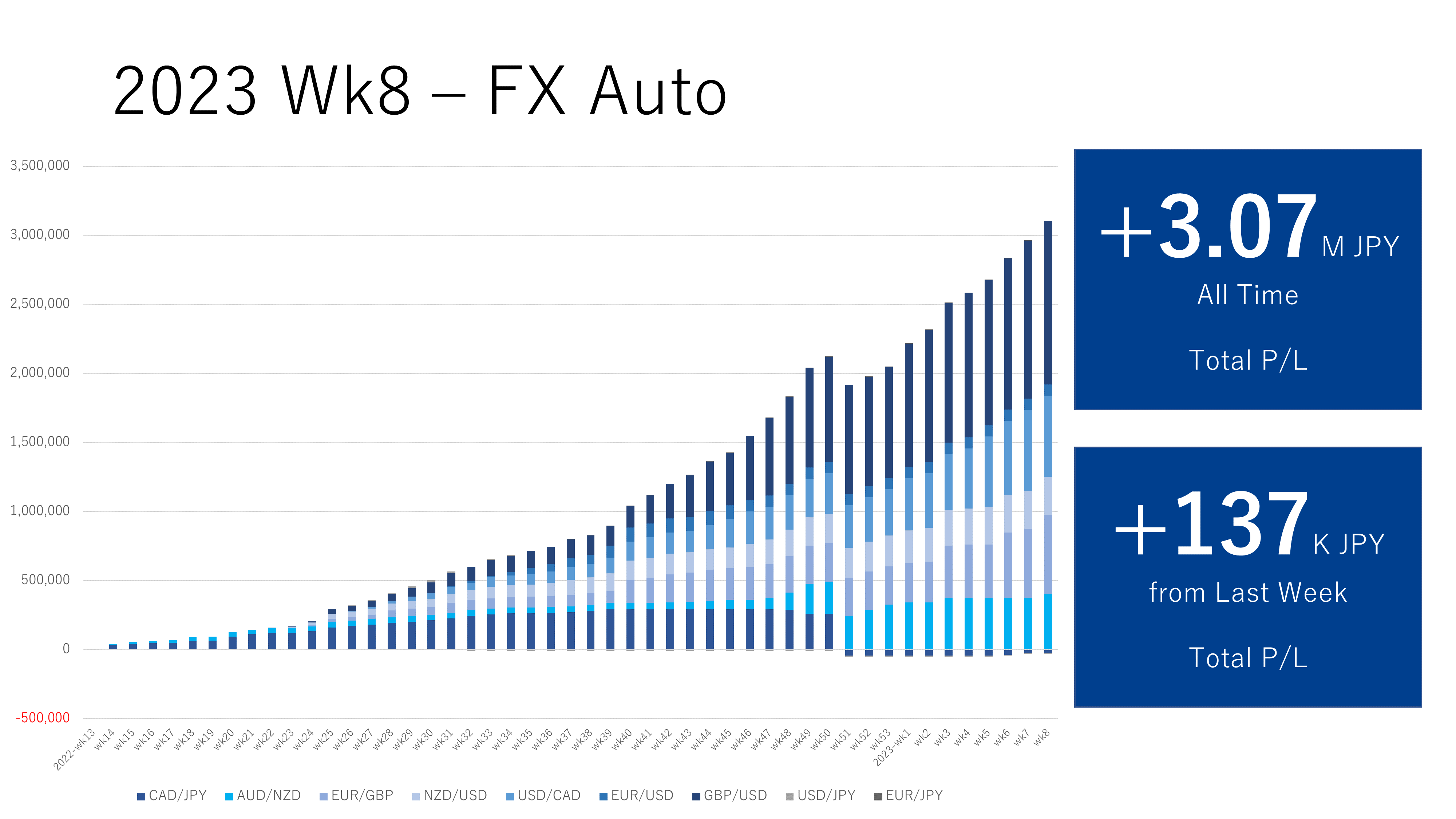

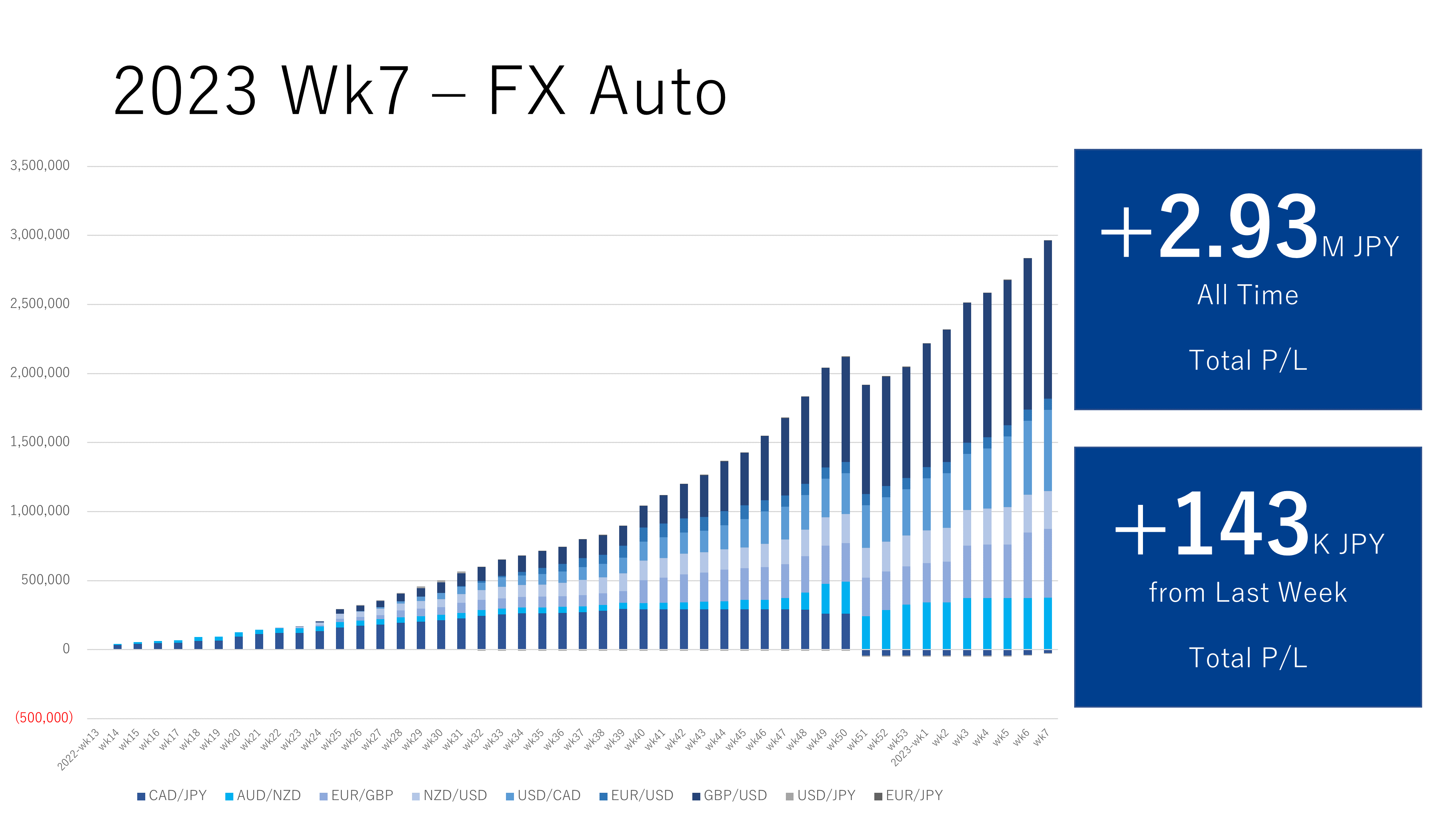

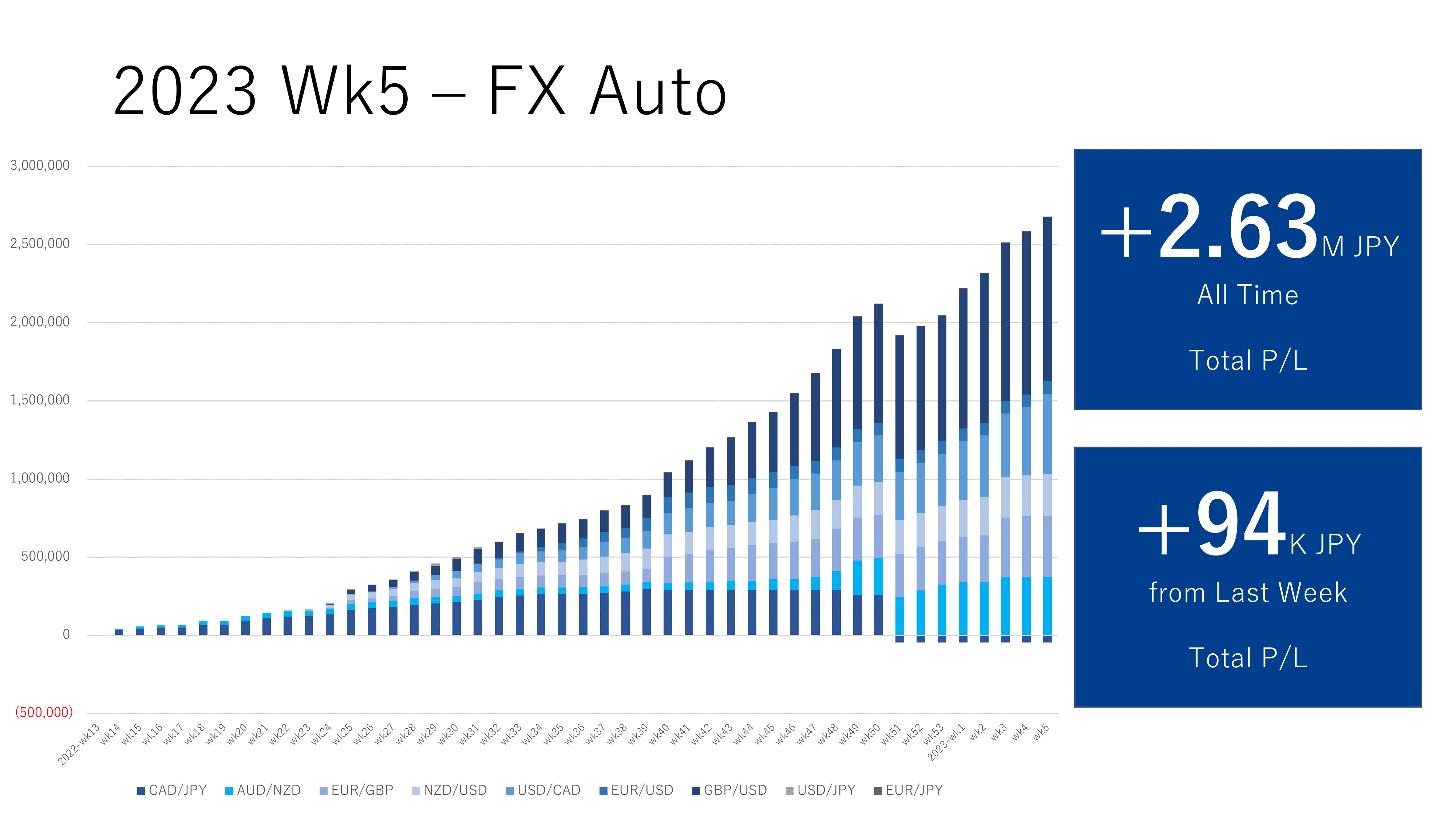

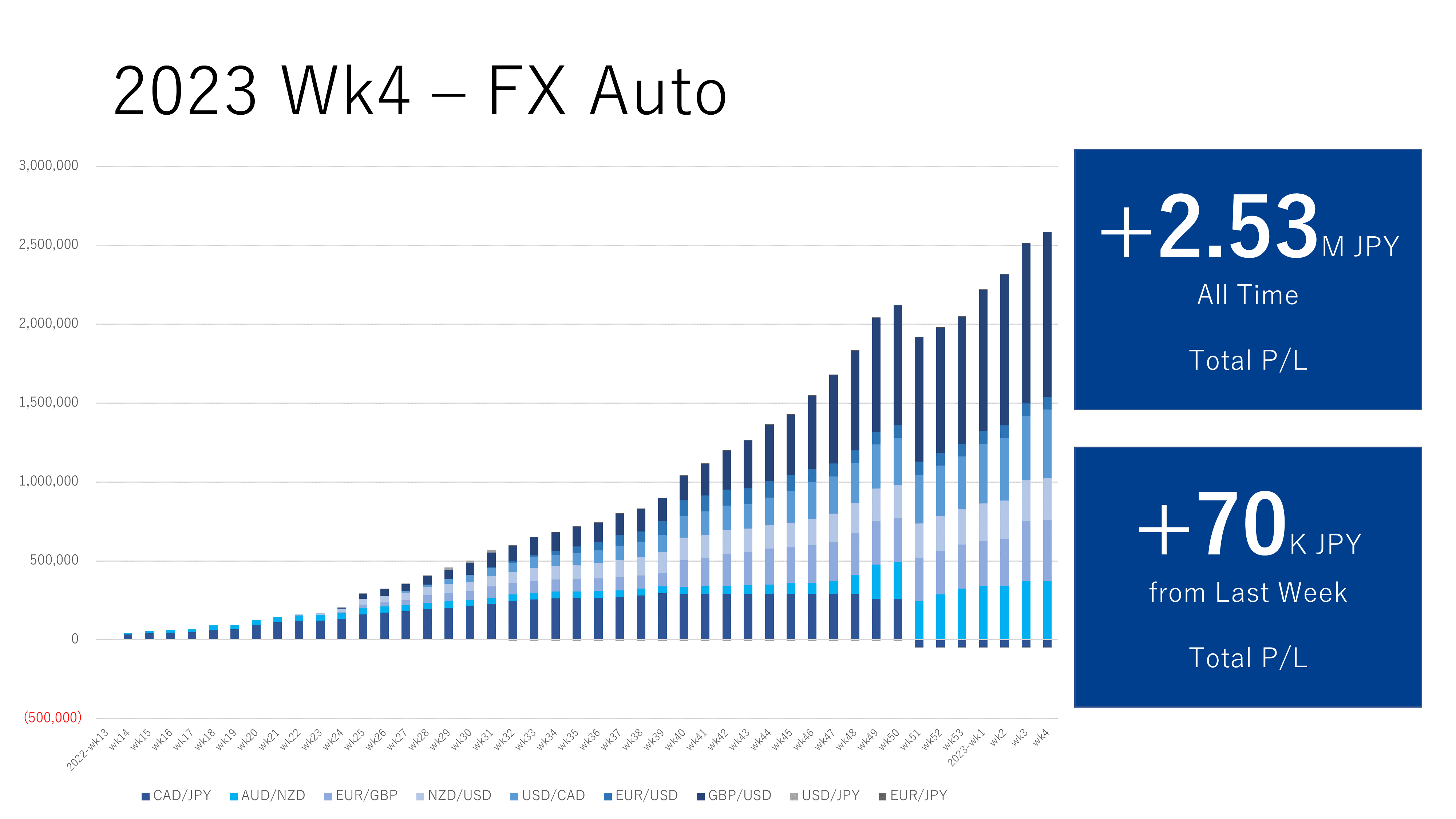

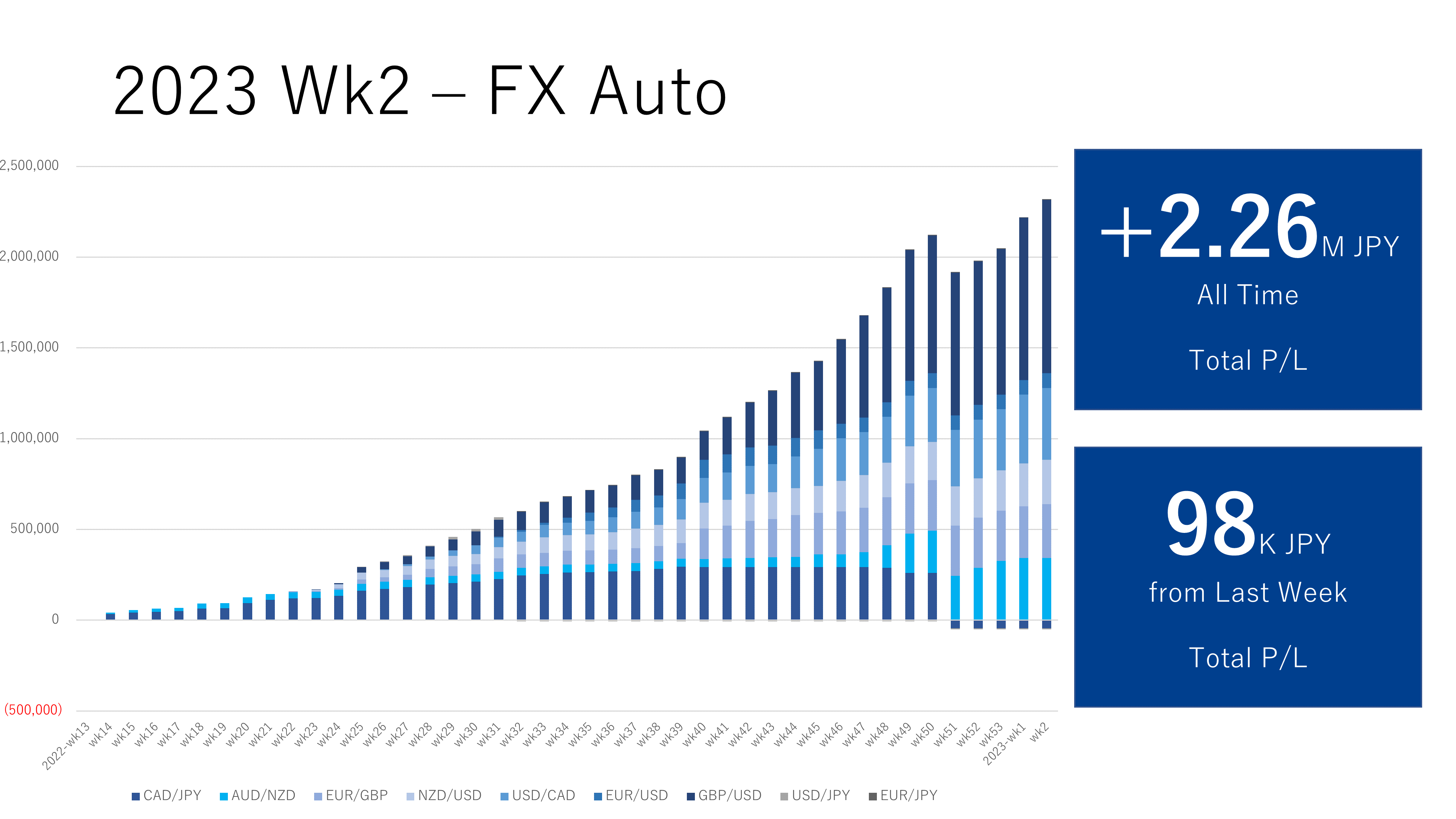

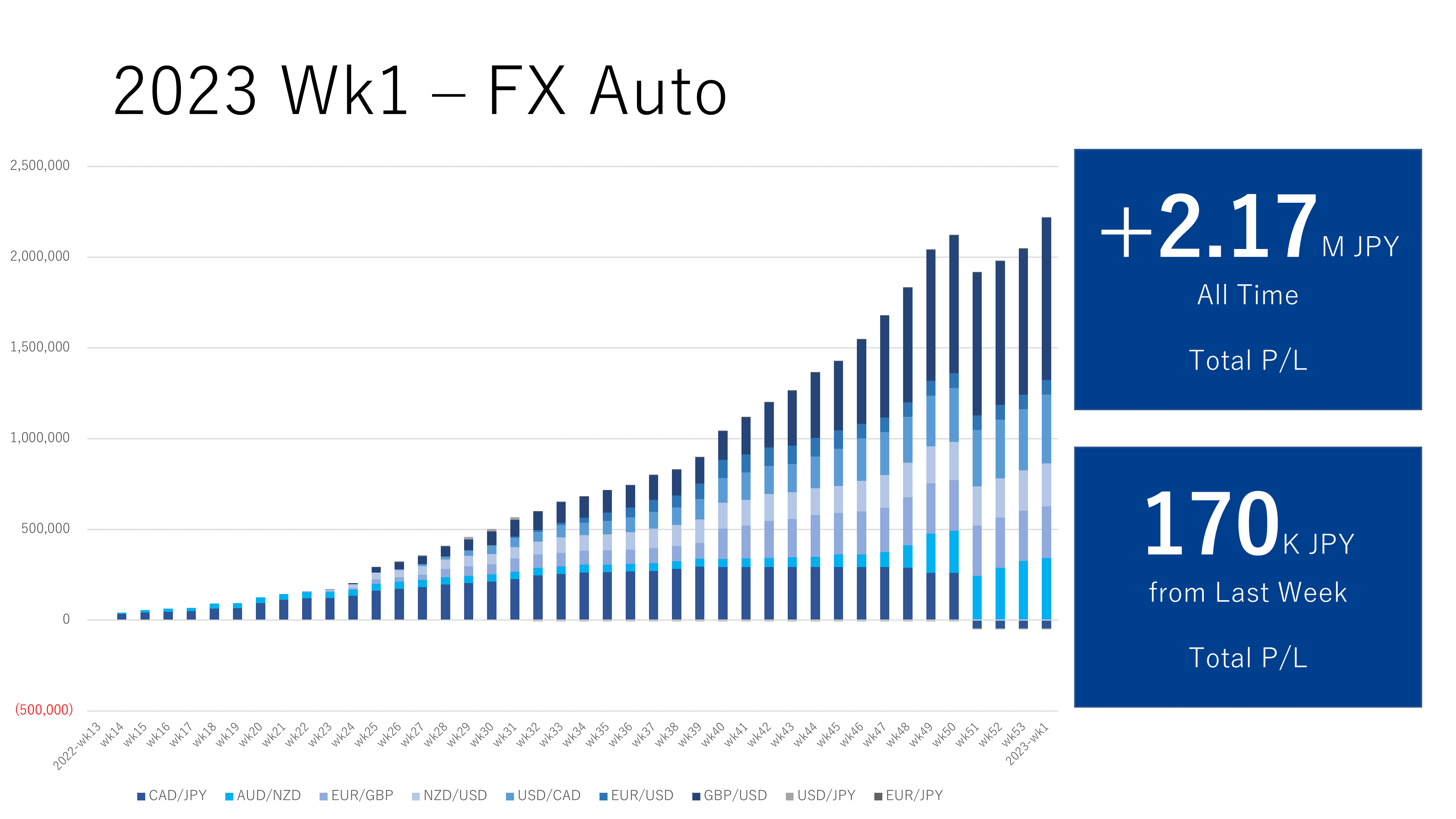

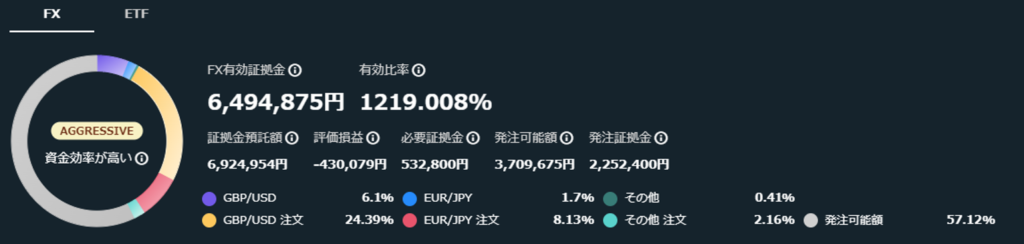

Here is the dashboard of Triauto.

Latest Settings (Written in Toraripi style)

Here is the list of active currency pairs.

Changes of The Week

- Updated the status of USD/CHF.

There are no cross-yen currency pairs currently.

Immediately after the start of Toraripi, I had set the selling of CAD/JPY, but while the yen was swinging in the direction of extreme depreciation, I was hit by a negative swap, resulting in a drastic loss cut (the article in the link is in Japanese only).

I would like to participate in cross-yen currency pairs again when the yen swings in the direction of appreciation and it becomes possible to enter by buying, or when the yen raises interest rates and negative swaps are no longer a concern.

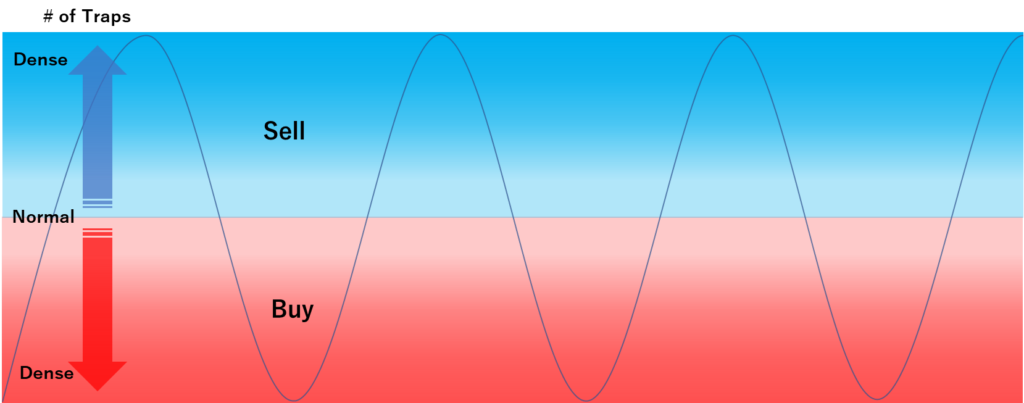

The setting differs depending on the currency pair, but I basically have the following image.

It is not different from a general Half & Half strategy, but it has dense traps at the lower and upper zone of the assumed range.

The reason for this setting is as follows. Initially, I tried various things, but this setting increases the profit.

The Reason for Kuroneko-style Half & Half

- Positions obtained at the edge of the range can be held with less unrealized losses (as long as the price moves within the assumed range).

- Positions obtained at the edge of the range are expected to be settled relatively quickly (unless the price is within the assumed range).

- If holding the positions obtained in the middle of the range to the edge of the range, the unrealized loss will be increased largely. So, it is better to keep the number of traps in the middle so that you can withstand.

- For those who has affordable budget, it is okay to increase the number of traps in the center of the assumed range. Recently I also have denser settings for some currency pairs.

In addition, if the price rises or falls outside the assumed range, I think it is okay to set more traps there.

Though it depends on the situation, but you can do it if you are confident that it will return to the assumed range. It requires courage.

However, if it shifts to a completely different range than the expected range, loss cut may happen. So please be careful in your operation.

Here is supplementary information about the settings for each currency pairs below.

Supplementary Information for Currency Pair Settings

- For the pairs operated in both Traripi and Triauto, both settings are described side by side.

- For the sake of convenience, the tri-auto settings are also described as Toraripi-style settings.

- Please note that there are currency pairs with slightly different ranges or settings between Traripi and Triauto.

- When operating with the Kuroneko-style setting, you can reduce (or increase) the number of traps according to your own budget. Please don't overdo.

- Profit width is wider for aiming high profit.

- The number of settlements might be decreased when the profit width is wide. If you want to have a greater number of settlements, you may narrow the profit width.

- If I had more money, I would narrow the profit width and increase the amount of currency per trap. The profit rate may go down, but the absolute value of earned money should go up. (I will be able to earn more money quickly.)

- The ideal is to "leave it alone", but I've been repeatedly changing, adding, or deleting the settings. This week's change is highlighted with red.

Even when the settings are working well, I tend to modify them for better performance!

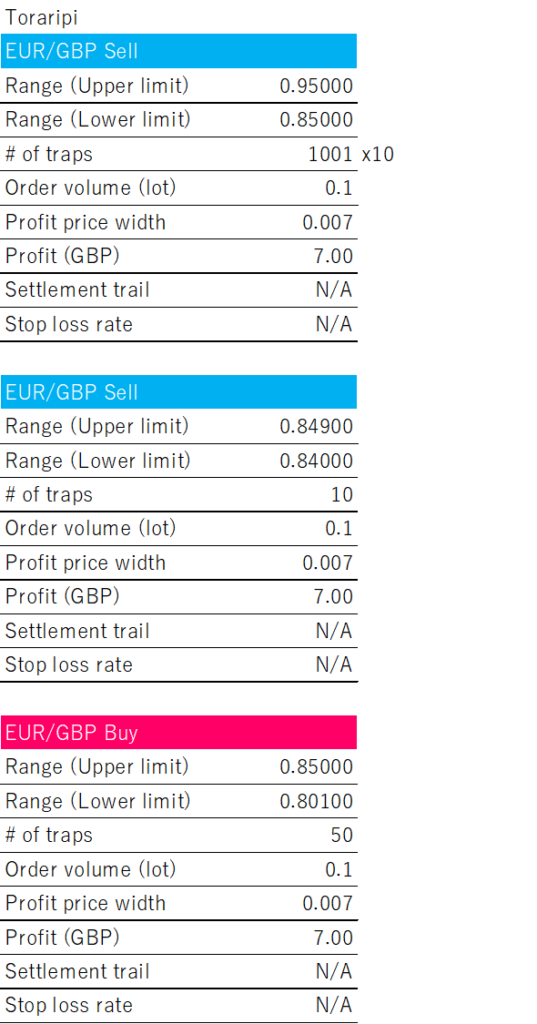

EUR/GBP

As the swap point is now positive for selling, I feel comfortable even if I hold a position for a long time.

As the standard or original trap width for me is 0.001 (i.e. 101 traps in 0.1 width), and when I increase the number of the traps from there, it is written as xx times in tables.

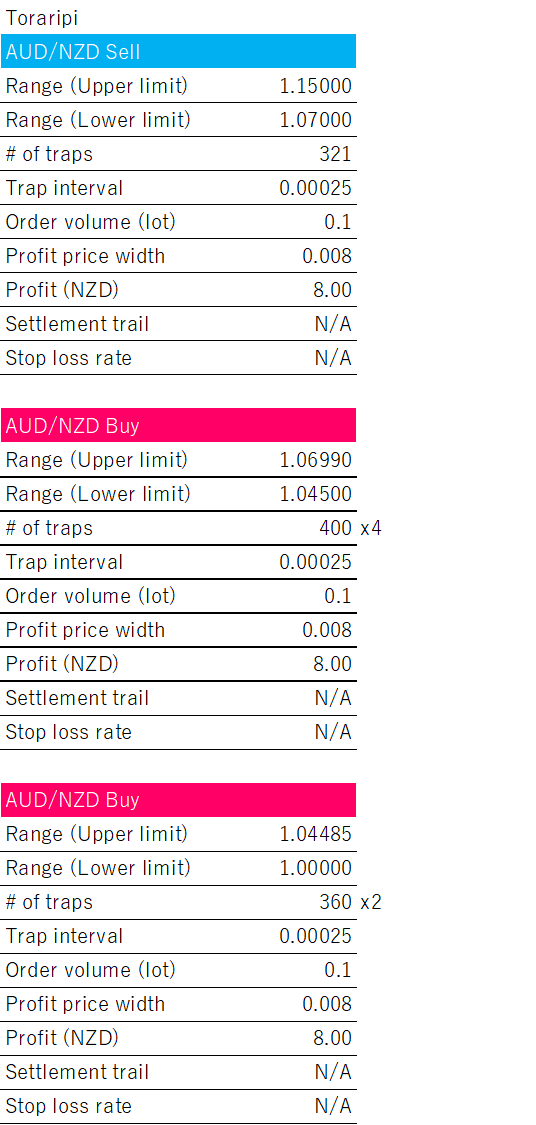

AUD/NZD

AUD/NZD is based on Toraripi settings. Triauto setting just uses surplus budget.

I will add the range above 1.085, but it seems the price will rise above 1.085 again, I will do it when the price starts to drop.

Regarding the change from 0.01 to 0.007 on the profit price width, I will continue to look at any impact caused by this change. has been changed to 0.007.

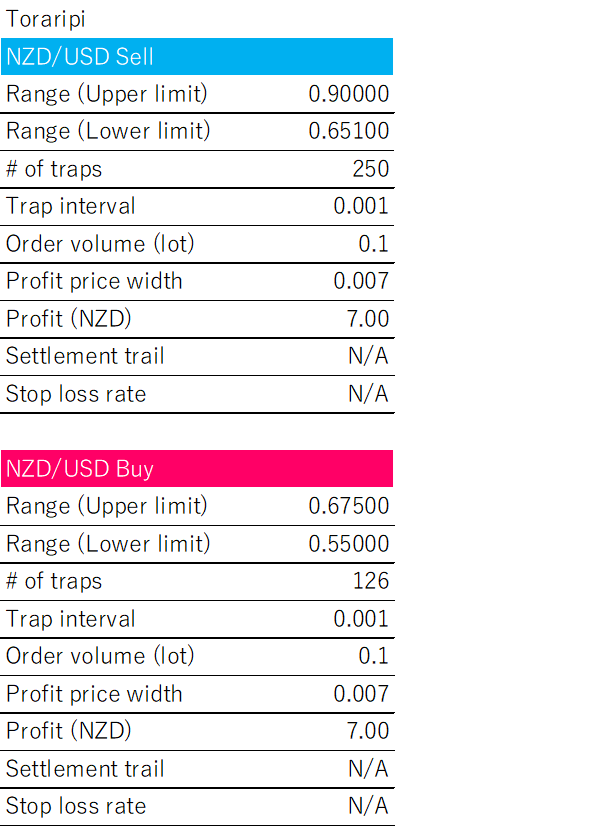

NZD/USD

NZD/USD still does not make lots of money, I think it will perform well depending on the price fluctuations.

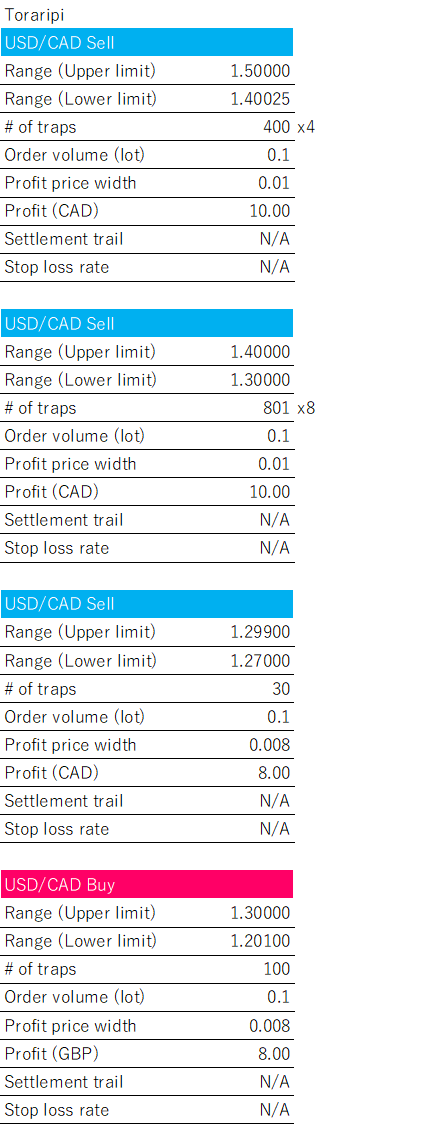

USD/CAD

Toraripi released USD/CAD in May, 2022. It may be a good pair as Toraripi is pushing.

The results so far have been pretty good, and the volatility may be reasonably high.

(According to Hirose Tusho Inc.(ヒロセ通商), volatility of USD/CAD was 744763.7 pips in 2022 and ranked 14th among their currency pairs.)

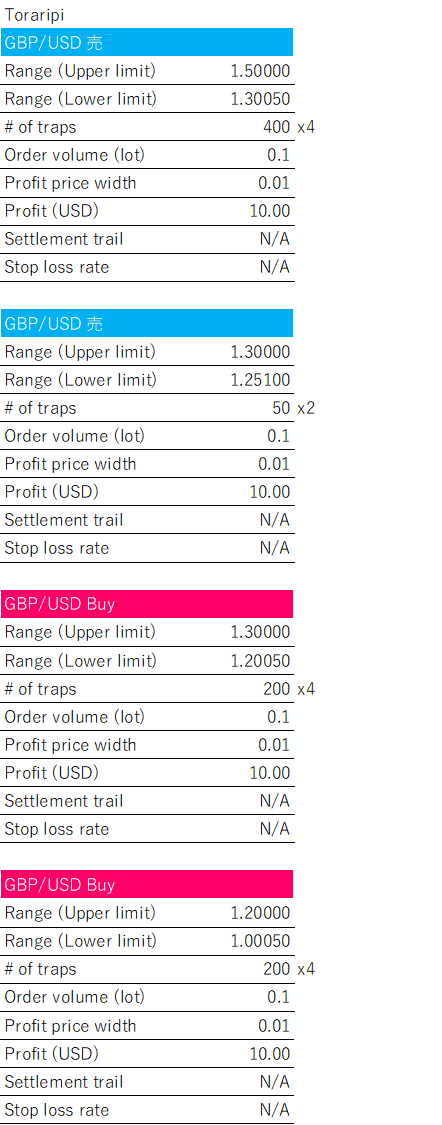

GBP/USD

In 2022, GBP/USD was low historically and was approaching 1.0 for a while. Therefore, entry with buying was very easy for this currency pair.

I started with Triauto, and applied similar setting to Toraripi in late 2022 as this pair shows strong performance.

Settings under Consideration

CAD/JPY - Withdrawn temporarily

CAD/JPY has become the biggest loss cut in my history.

I suffered from negative swaps for a long time, but when it fell below 100 yen in mid Dec, 2022, I did a loss cut.

I think the next entry point will be when the JPY becomes stronger and it is easy to buy it.

EUR/USD - Withdrawn temporarily

I would like to set selling to avoid negative swaps, but it is not the time and I have temporary withdrawn from this currency pair.

I think the entry by selling should exceed 1.1. Ideally, above 1.2.

I will continue to check the chart and hope to resume when I have a good entry point. At that time, I would like to inform you here.

EUR/AUD

This pair is not for Traripi but for Triauto.

To avoid negative swaps with buying, I am waiting for the timing when I can enter from selling.

I see the border between selling and buying at about 1.55. I am thinking the entry with selling will be made after exceeding 1.6.

AUD/USD

When introducing NZD/USD, I also compared it with AUD/USD as they have close correlation. As AUD/USD has relatively high negative swap points for buying, the entry with selling was preferred, but it was not the timing.

Even if the correlation with NZD/USD is close, the countries are different from Australia and New Zealand, and it will diversify the risk somewhat.

Extra: GBP/AUD

As GBP/AUD is not handled by Traripi or Triauto, it is easily traded with automated trading. However, swap points are relatively low for both buying and selling as both currencies have similar interest, it is easy to trade this currency pair. To enter from selling with positive swap points, I am watching if it falls more. If the price is below 1.7, I will start to buy this pair.

I am thinking to use DMM or OANDA for this trade.

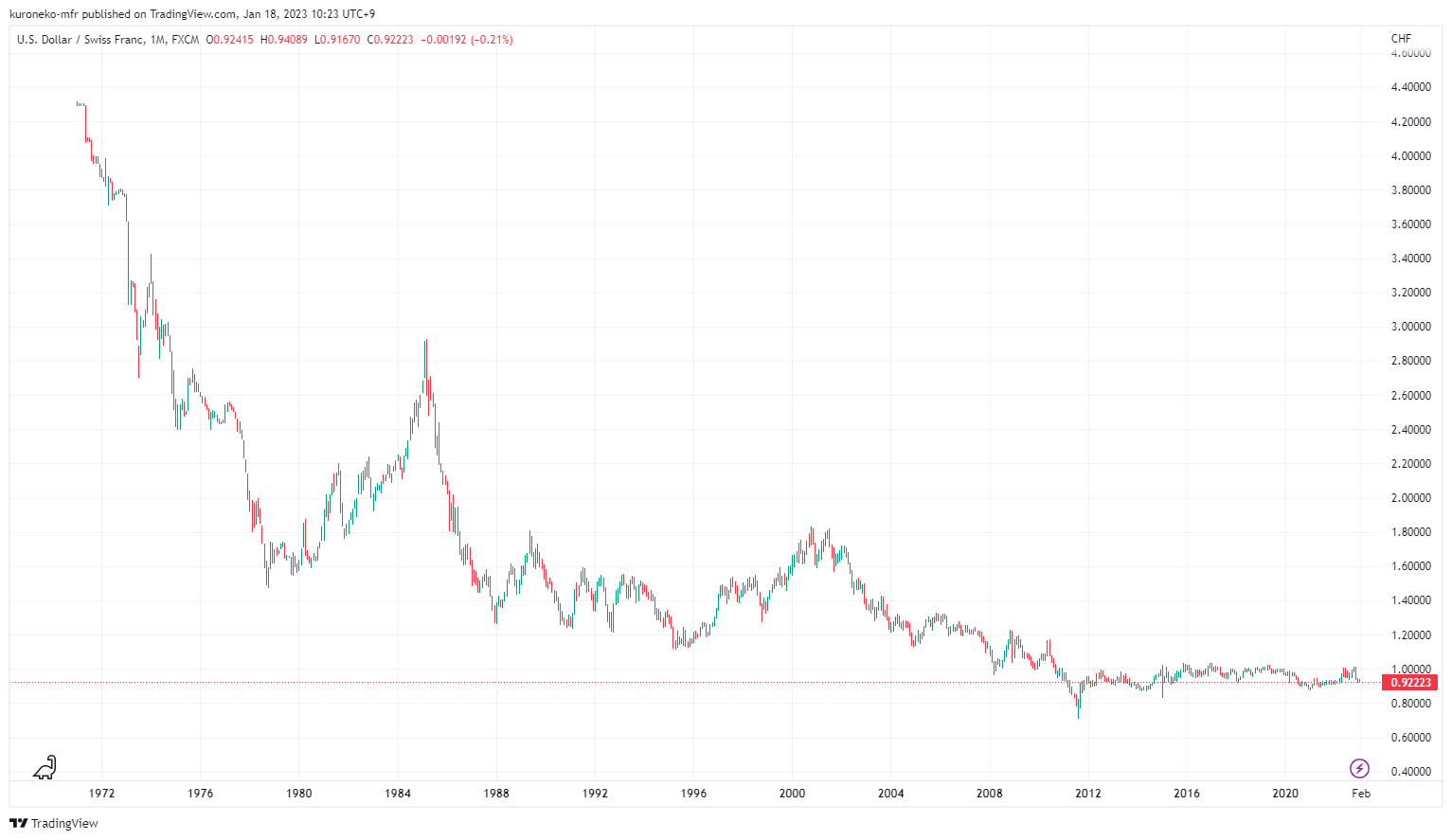

Extra: USD/CHF Updated

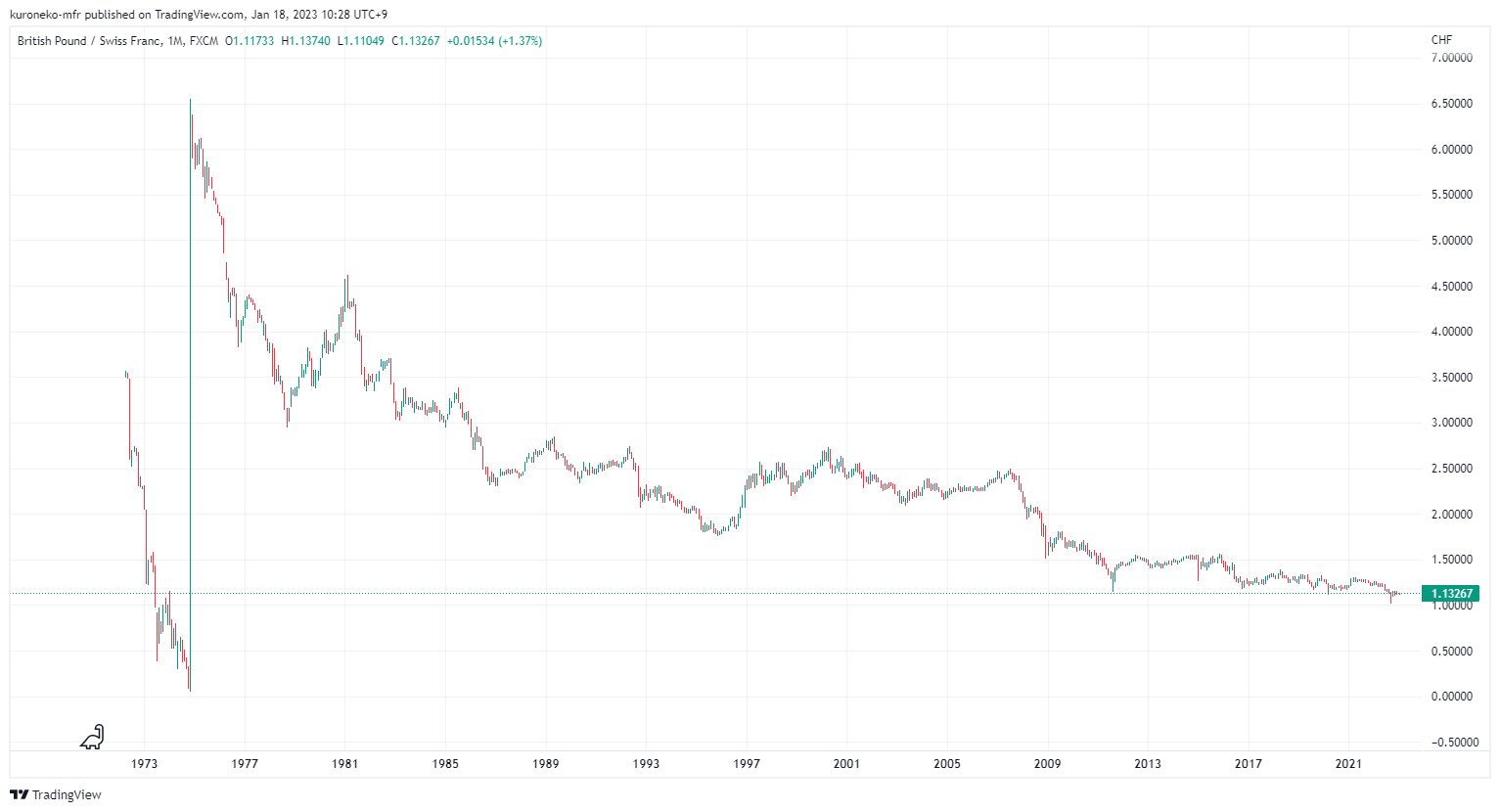

As the swap point is high, it may be easy to start with buying if looking at the long-term range. Like the other CHF pairs, it may be a unilateral downtrend, but the historical fluctuation of this pair has not been that extreme. Over 30 years, it has stayed in the range of 0.8 to 1.8.

I previously wrote that "If it falls below 0.9, I am buying this currency pair". As I felt that the rate might drop more, I was watching the status for a while.

Eventually, I owned some positions this week. I want to settle them as those positions already have unrealized gain, but I am holding them for a while with receiving swap points. If the rate drops more, I will increase the number of positions.

The swap point of buying GBP/CHF is also high. The price range is between 1.0 and 2.5 over 30 years. However, it looks like a one-sided downtrend this 10 years compared with USD/CHF.