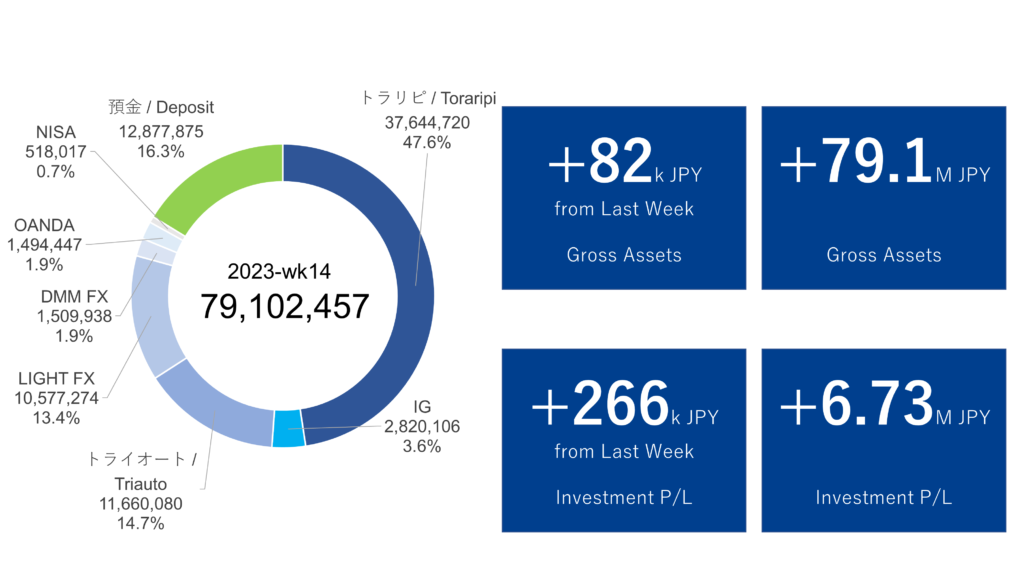

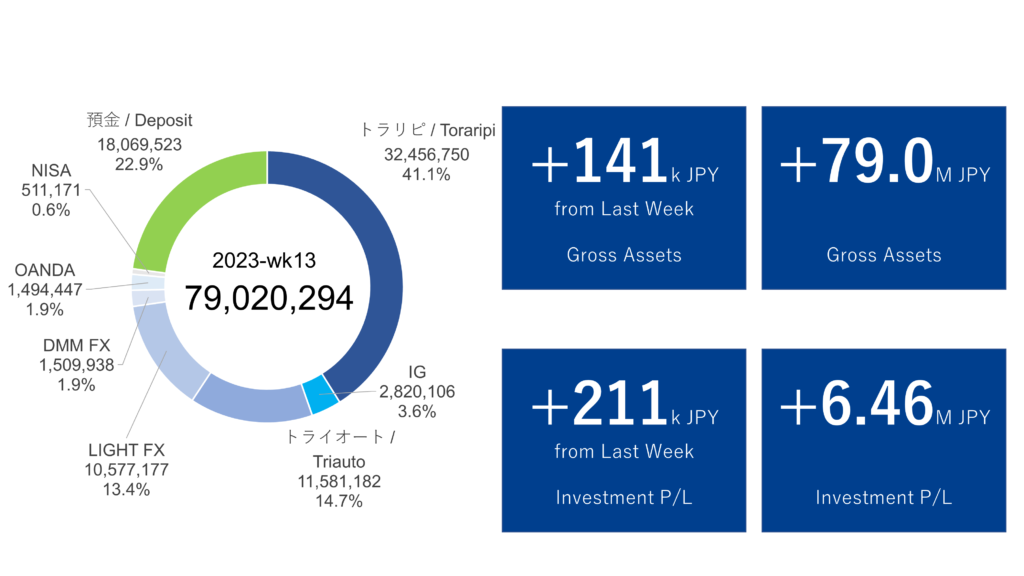

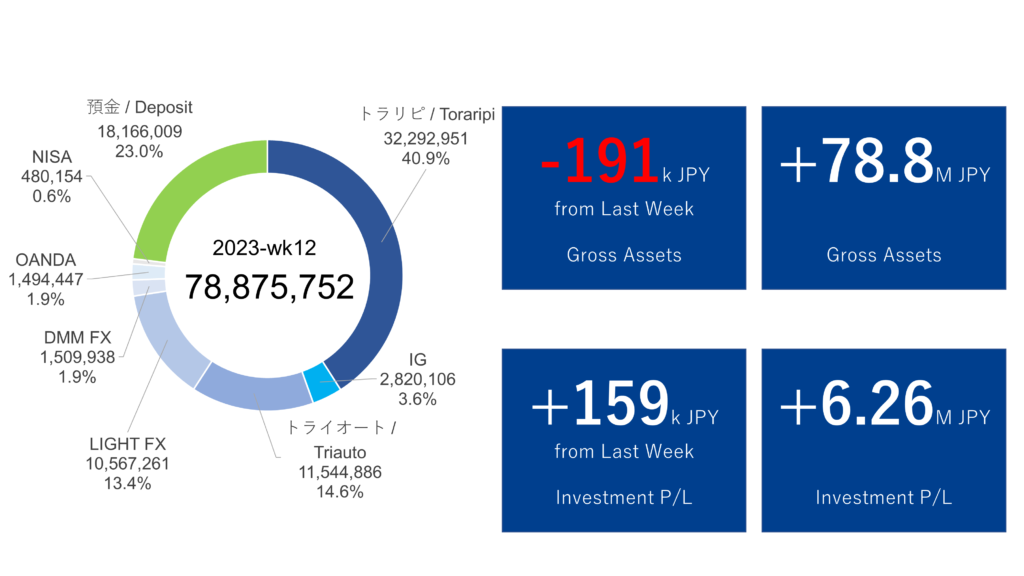

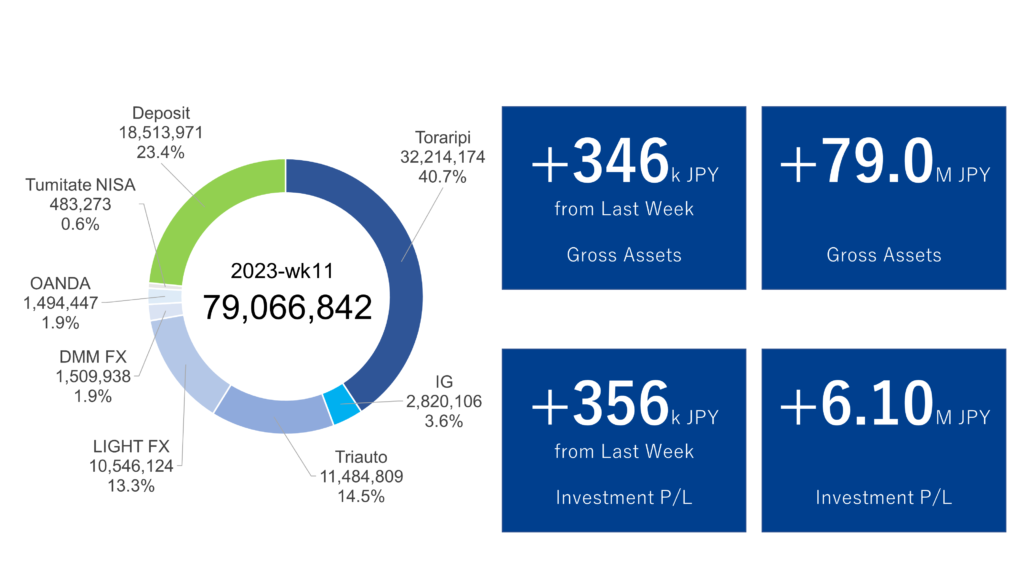

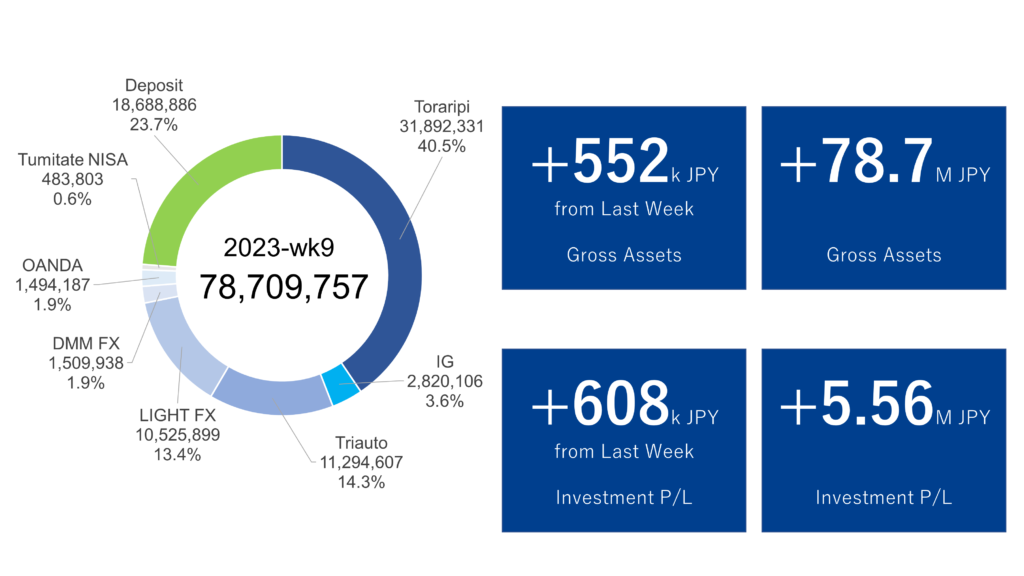

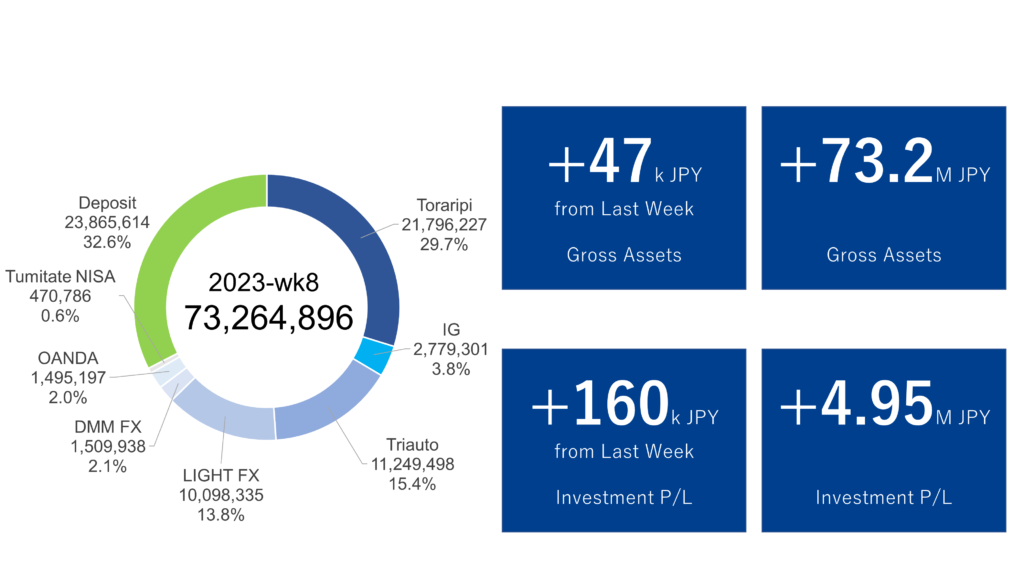

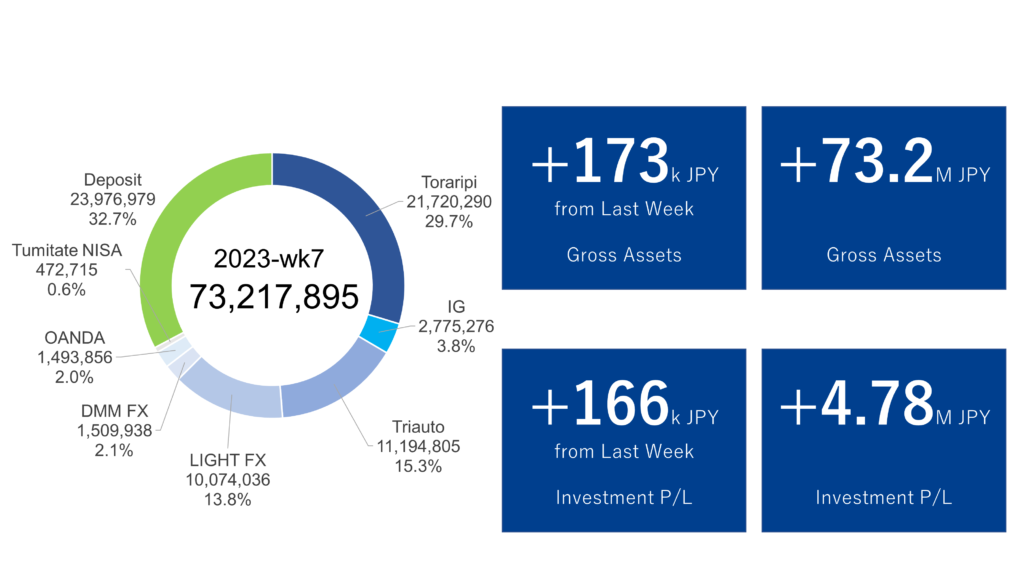

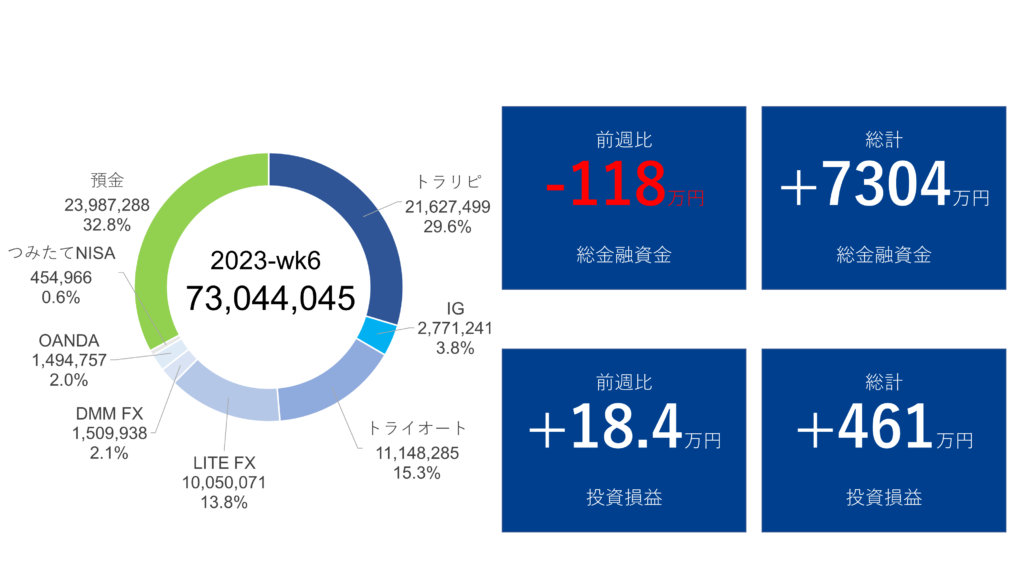

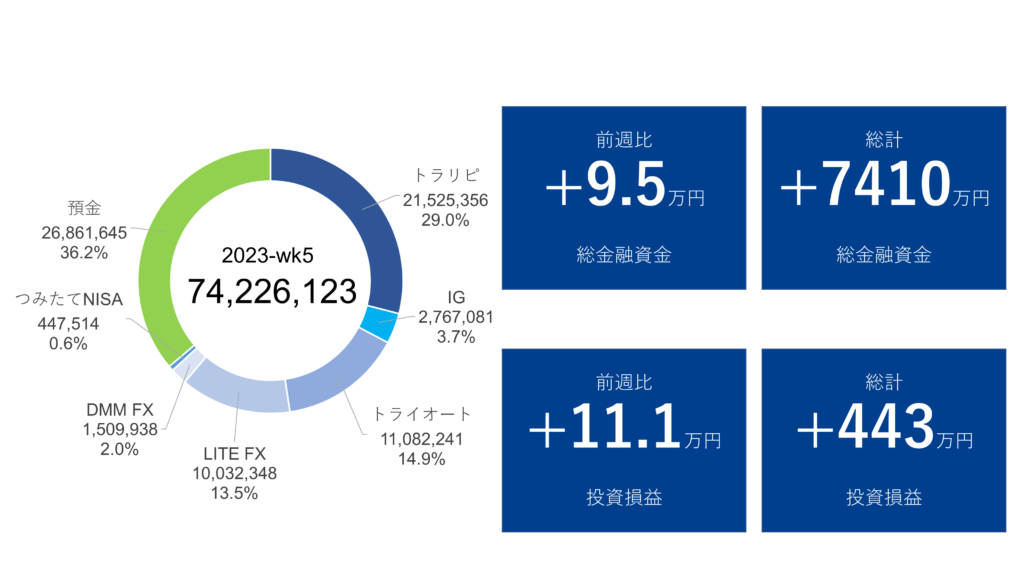

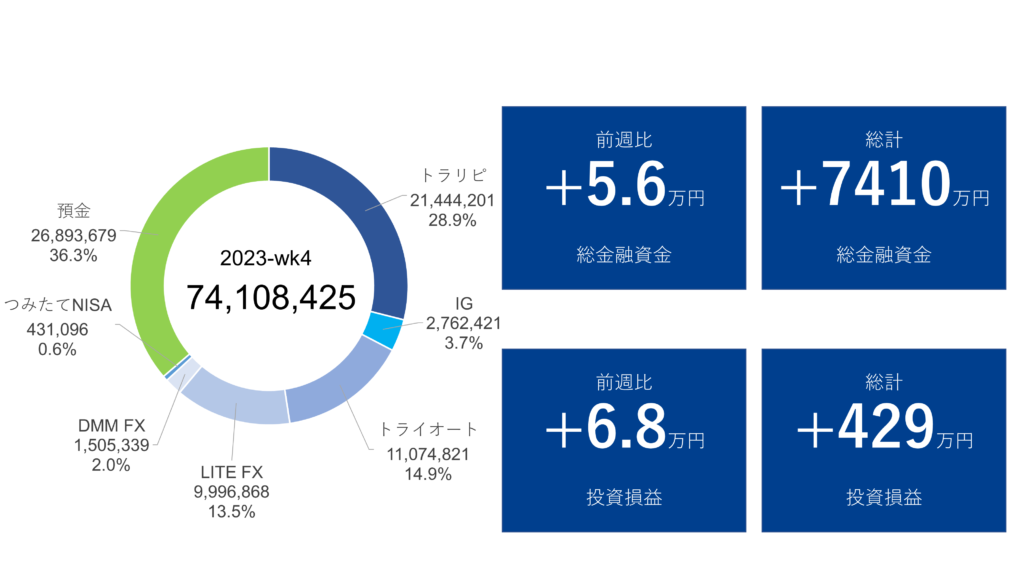

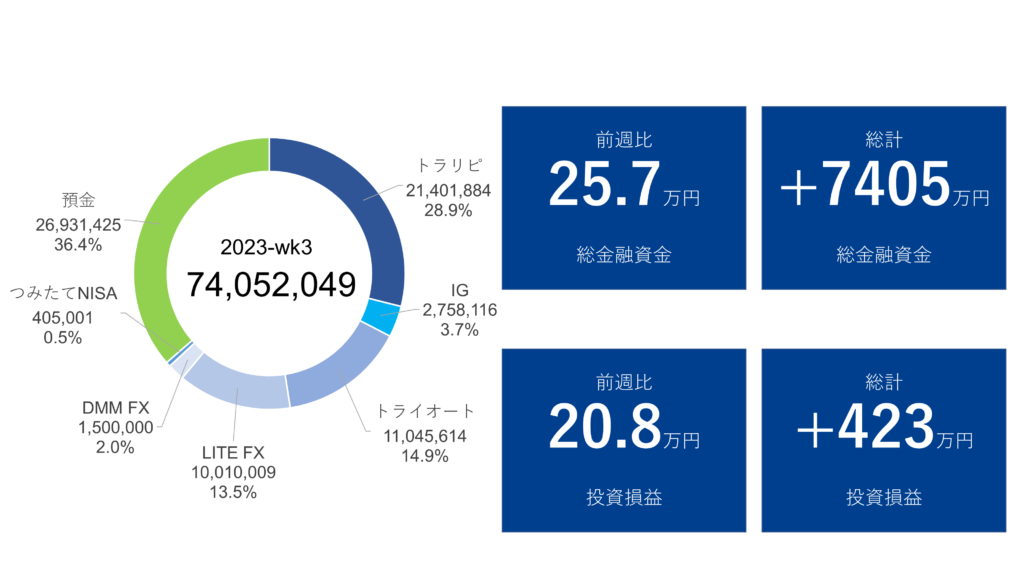

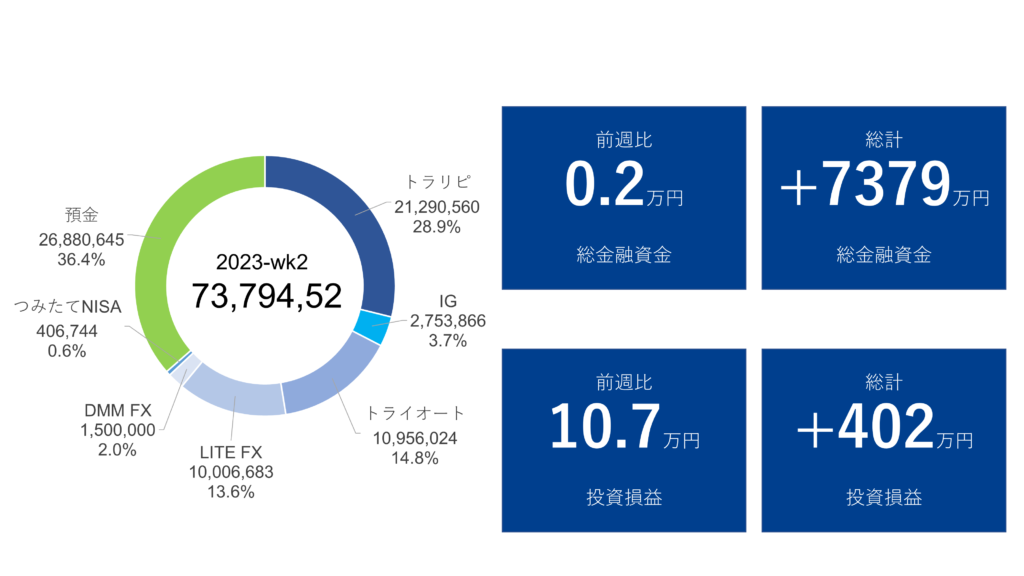

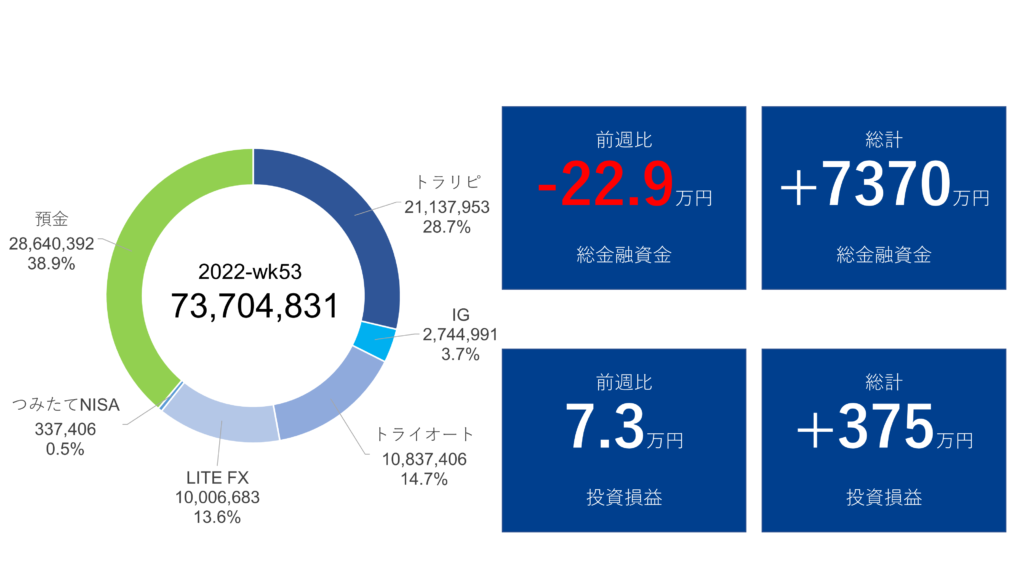

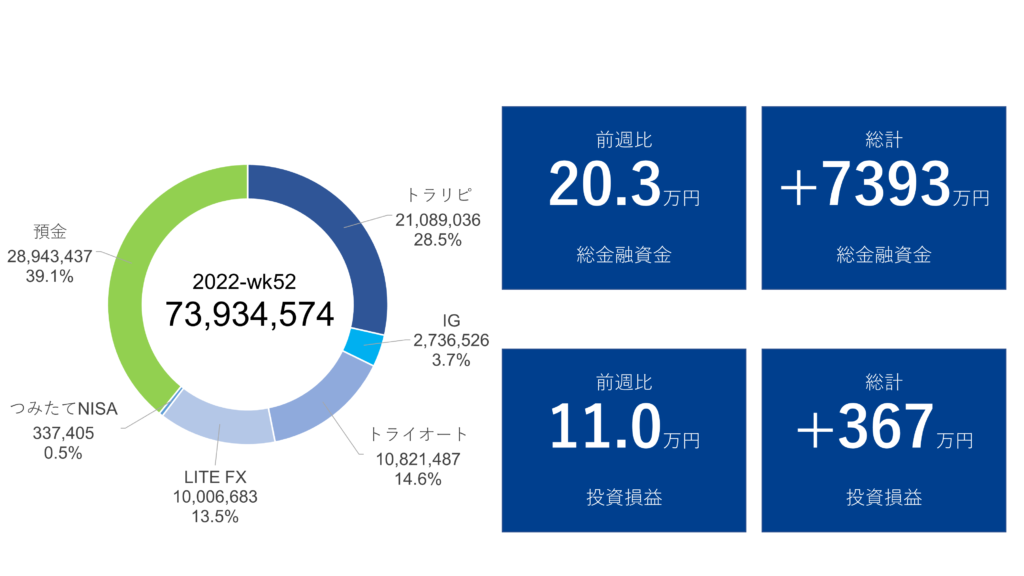

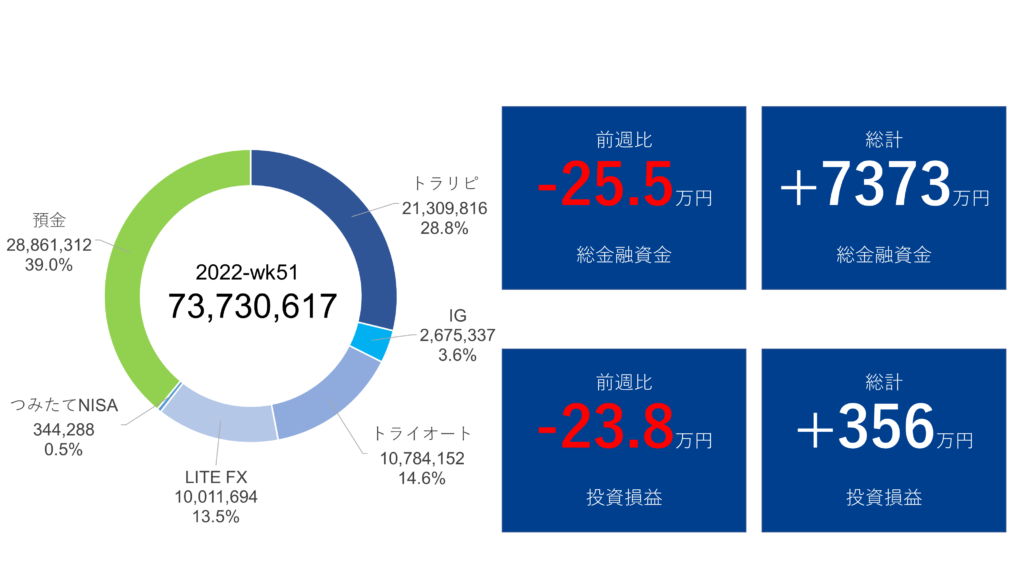

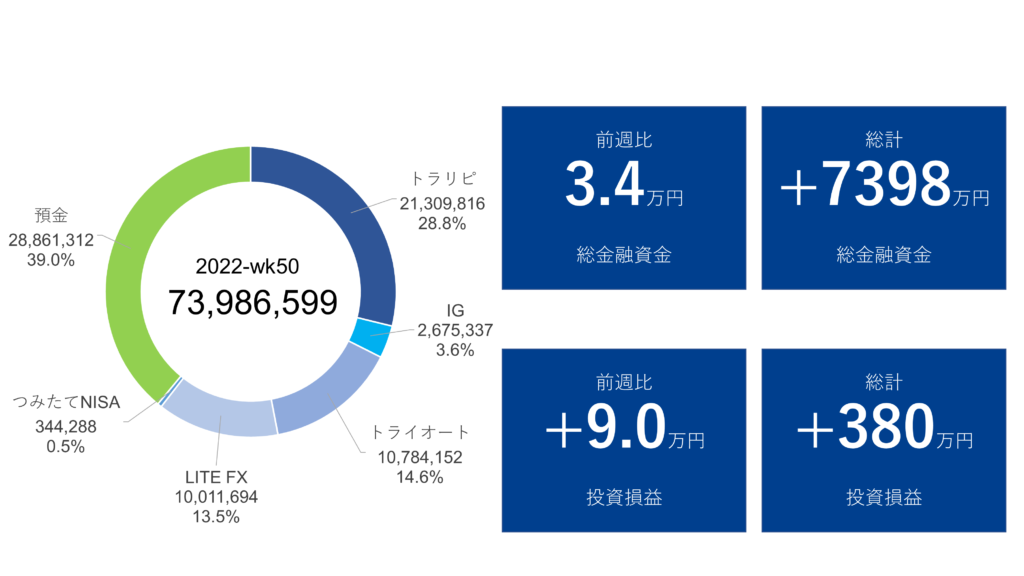

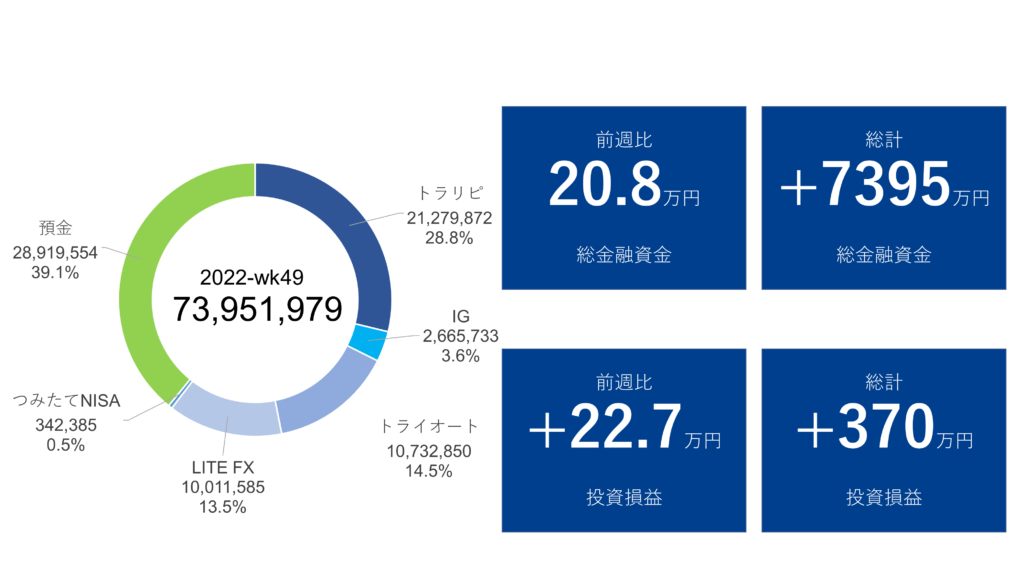

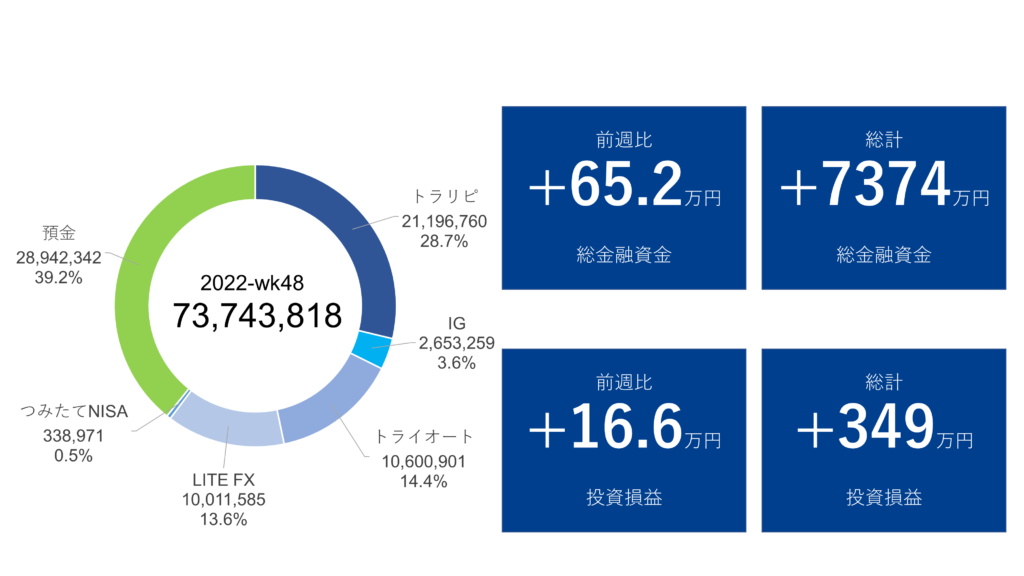

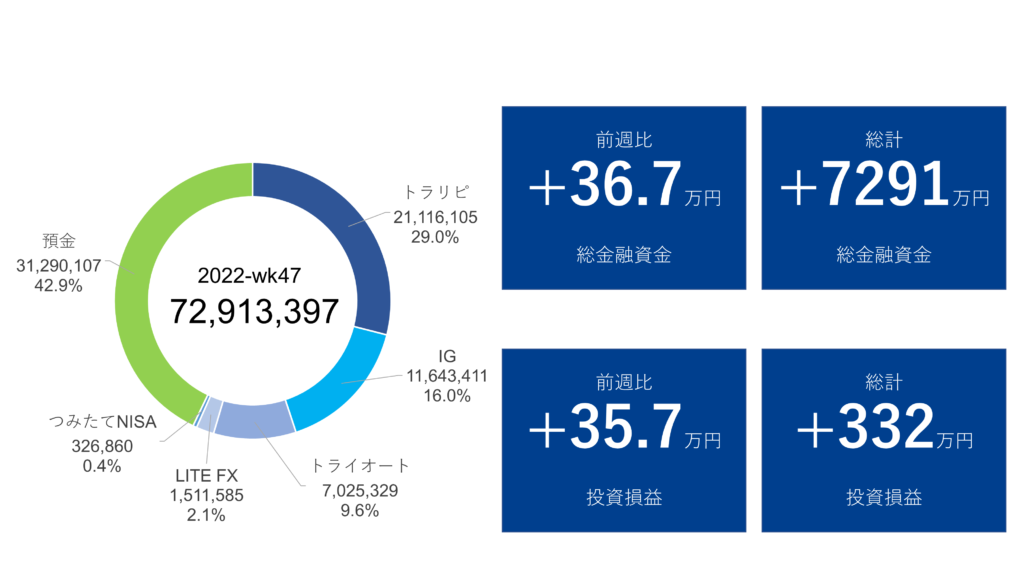

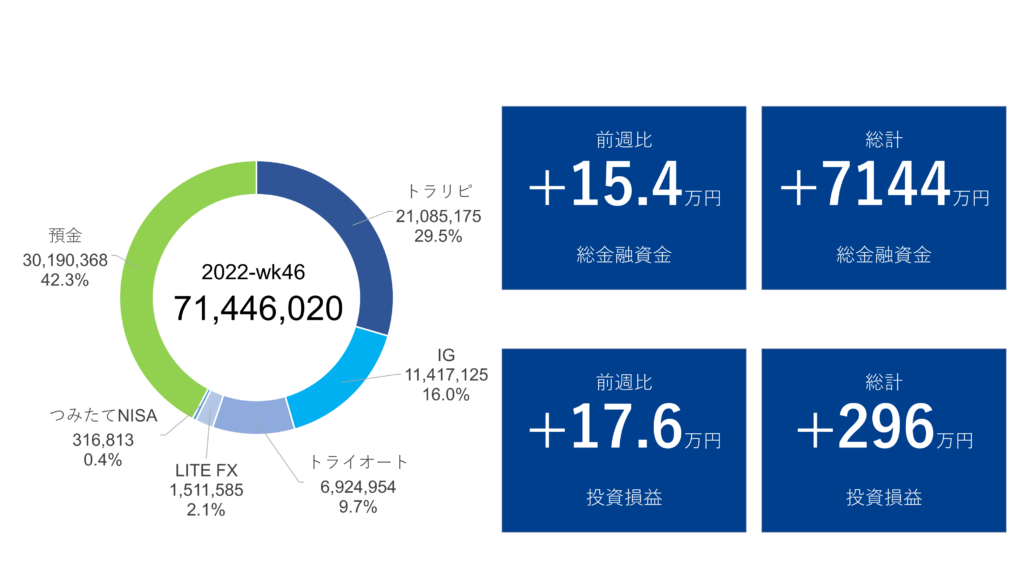

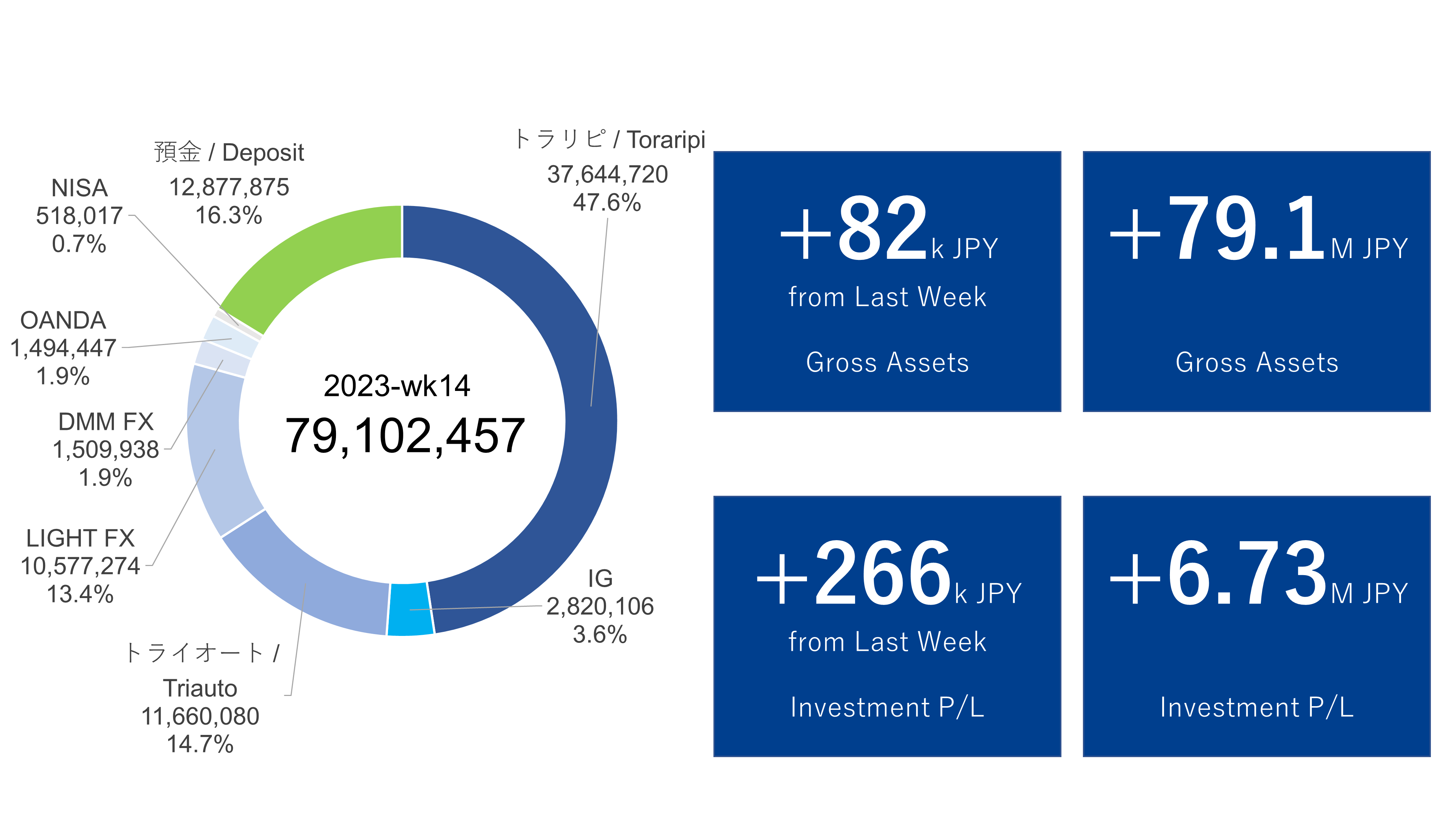

Gross Assets of This Week

Here is the status of gross assets.

This Week's Status

- This week's investment income is JPY 262k.

The performance was good until Wed, but became worse in the latter half of the week.

The goal described in Automated Forex Trading is now moved to this page as a overall goal. Also, the goals for 2024 and beyond are added.

Profit Goals

- End of Mar, 2023

- JPY 250k/week (12.5M/year)

- Dec, 2024

- 360k/week (18M/year)

- Dec, 2025

- 400k/week (20M/year)

- The biggest goal: NOT to be ejected from the Forex market

- Avoid excessive risks even if it is to achieve the profit goals.

*The annual profits listed are on a 50 week basis and it will be slightly upside with 52 weeks.

The goals for March 2023 is achieved only with automated trading in some weeks, but I cannot say that it is achieved "on average". So, I will continue to work on improvement.

As it seems difficult to achieve the goals for 2024 and beyond only with Forex, I will consider how to achieve them including means.

(Though I do not want to remember my work at the company too much💦) when I was a company employee, I was able to overcome high goals that I felt impossible by considering how to acheieve them.

After quitting the company and starting the life of FIRE, I will do nothing if I don't set a specific goal. Thus I set a goal. I will whip myself!

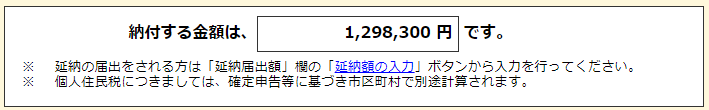

Tax Return for 2022

2022 is the year I started Forex and the invest term is not all year, the income tax for Forex was just under JPY 600K. After considering the deduction for donations (ふるさと納税: Hometown Tax) the income tax was about JPY 400K.

However, there were some other profits of about JPY 2.6M (other than salary or Forex) which are classified as a progressive taxation. Due to the last annual salary as an office worker, the tax rate was painful and the income tax was over JPY 0.8M. 0.8M income tax for 2.6M income??

The total income tax is about 1.3M in JPY...

Too expensive!

I decided not to work hard for progressive taxation as the harder I work, the more I lose.

Don't raise the tax ratio for Forex!

Supplementary Information on Gross Assets

In order to increase income as much as possible, I am reviewing the settings and making additional settings, and am reporting the current settings collectively in the category, Automated Forex Trading.

In the future, I would like to consider further additional settings, it will be reported in a timely manner.

Supplementary info

- The gross assets are under my control. I don't include the account that I put our family's living expenses or my wife's asset. (I am only showing the assets which are visible to me.)

- The asset status does not include unrealized gains and losses. (When there are lots of unrealized losses, the actual gross assets will be decreased.)

- The week-over-week value shows a pure increase or decrease. If there is an asset transfer, it is not reflected.

- If transferring assets from deposits to investments, the transferred funds will not be reflected in week-over-week investment gains and losses.

- Additional funds from the assets which are not shown here might be added later in case I decided those can be used for investment. In such case, gross asset can be increased regardless of week-over-week gain.