The combined results of IG and LIGHT FX are shown for EUR/PLN.

Contents

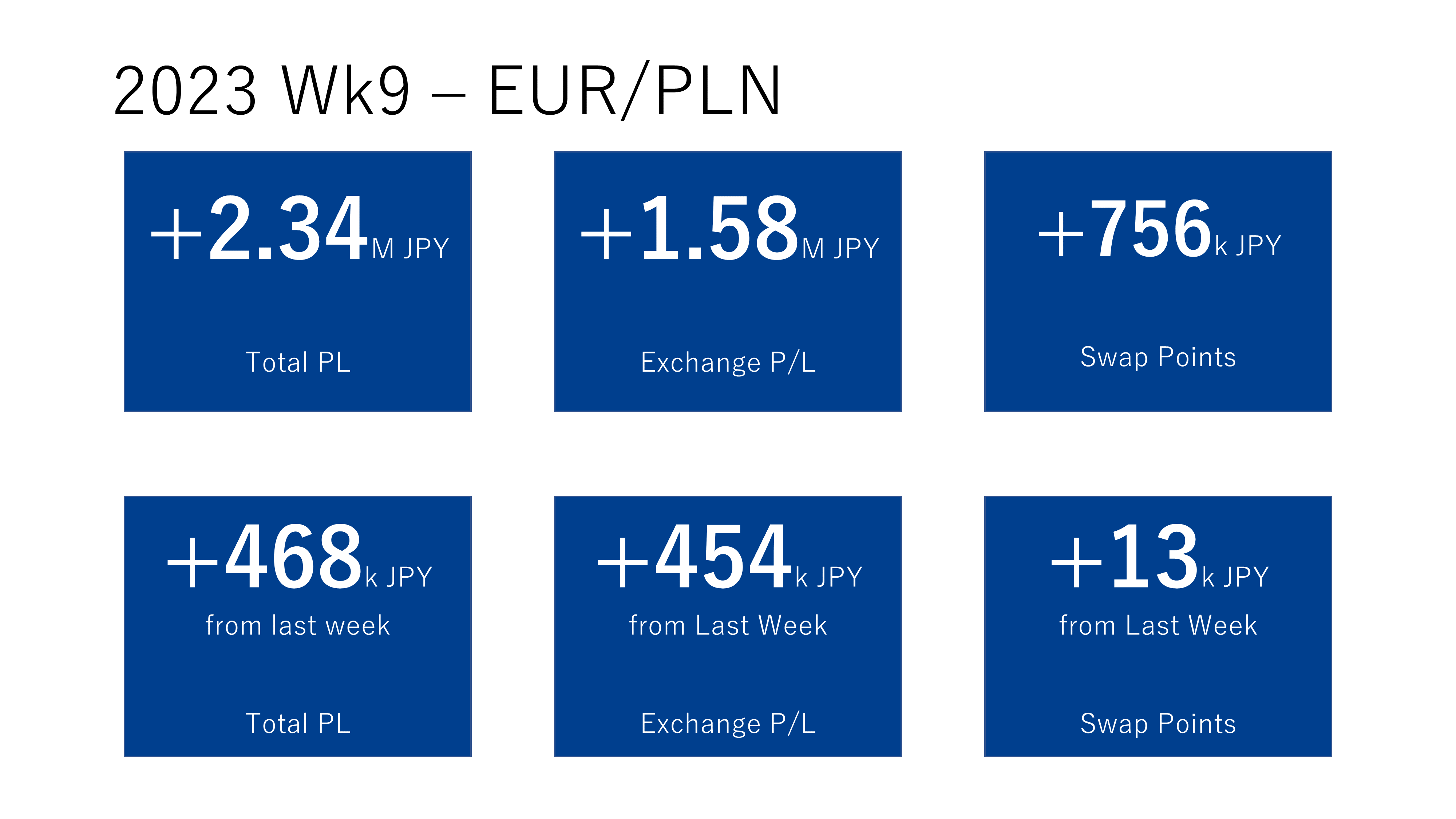

Status of This Week

Status of This Week

- Owing to a sharp drop of the rate, a large amount of profit, JPY 468k has been generated.

- Pre-receipt swaps are included in weekly reports already, and the newly acquired swaps this week are JPY 13k as reported above.

- Total profit without the swap points of JPY 62,078 is JPY 396,476! (For EUR/PLN, it is meaningful to check earned swap points week by week. Thus swap points before receipt are also reflected in my weekly reports.)

The exchange rate only went up to just below 4.8 and fell below 4.7, but the profit was large enough.

EUR/PLN made more profit in a day than Toraripi or Triauto makes in a month!

The growth from last week is amazing.

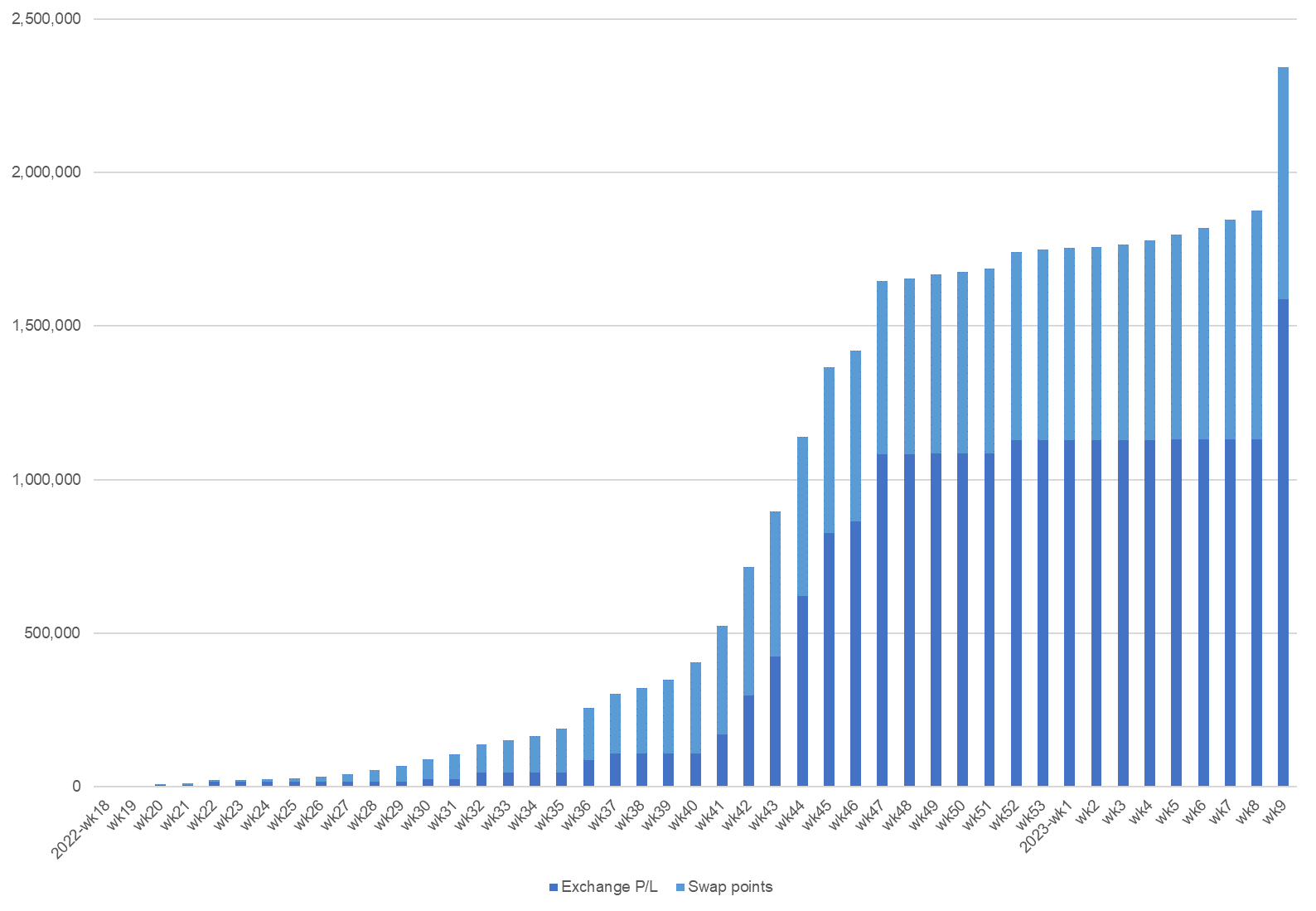

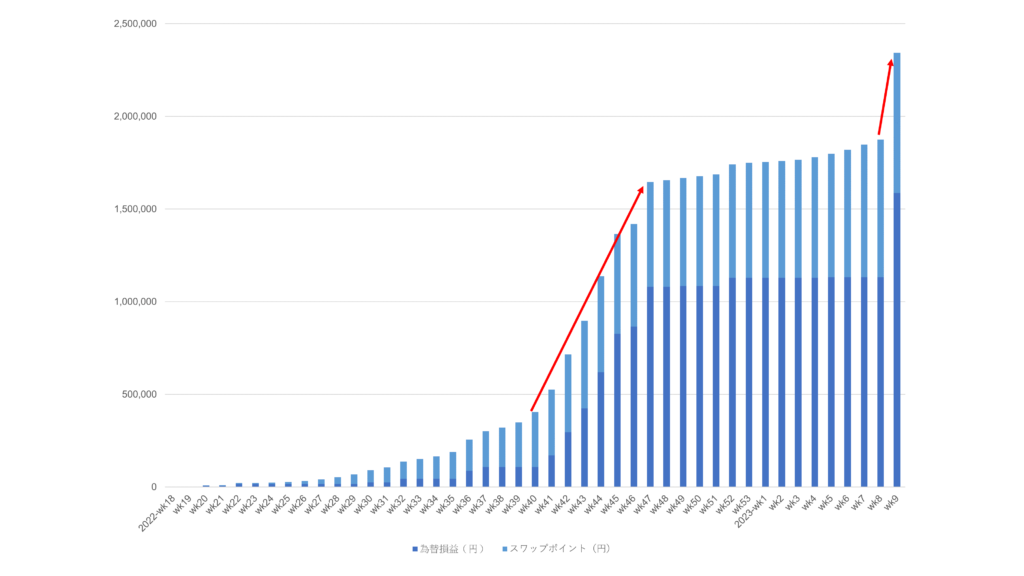

From wk41 (week of Oct 2nd) to wk47 (week of Nov 13th) last year, I thought it was amazing as the gained profit exceeded JPY 1.2M in those weeks. However, the slope of the bar chart is even sharp this time.

Setting the large number of traps (i.e. manual IFD orders) aggressively from 4.7 to 5.0 paid off this time.

I miss swap points. So, I want EUR/PLN goes up again soon.

I also set IFD traps corresponding to the settled positions this week. Don't forget that as the exchange rate may rise soon.

However, I was caught in the limit shown below, so please be careful if you want to do it like me. (I do not think there are people who set a lot of traps, and who also invest a lot in EUR/PLN...)

List of Current Positions

All the positions of both IG and LIGHT FX were settled once during this week.

As I was afraid that the rate might not be below 4.7 for a long time, I feel lucky that I was able to settle all the positions, which were obtained below 4.7, without any losses.

The positions with LIGHT FX already are increased to 2.5 lots by the end of the week.

I did not have time to correct 0.1 lot orders in 5 pips increments to 0.2 lots orders in 10 pips increments. Thus the positions of 0.1 lots and 0.2 lots are mixed. 💦

Current Trade Settings - EUR/PLN (Selling)

The settings are basically same for both IG and LIGHT FX. However, you can order from 0.1 lot (1k currency units). There is also a range where I ordered 0.1 lot with the 1/10 interval. (Please be aware of the order limitation when placing many orders.)

Please click here for the ordering procedures with IG.

EUR/PLN (Traripi-style Descriptions)

Here is the descriptions of the current settings in Toraripi style.

| Range (Upper) | 5.0 |

| Range (Lower) | 4.7 |

| Order volume (10K) | 1 |

| # of traps | 61 |

| Trap interval | 0.005 |

| Profit price width | 0.07 |

| Profit (PLN) | 700 |

The profit price range settled at 0.07 at first, but I will change it flexibly.

If I can obtain some positions at 4.9 or higher, I think I will hold them to around 4.75 at least.

Ordering Procedures for IG

- On the ordering board, select "売 (Sell)", and "IFD (If Done)".

- Enter "ロット数 (# of lots)"

- In this example, the minimum lot of 1 lot (10,000 currency) is entered.

- Enter "注文レート (Order Rate)"

- In this example, the order is at 5 (5.0). It is the upper limit of my assumed range.

- Enter "指値 (Settlement rate)"

- For IFD orders, specify the settlement rate in advance. IG requires input in pips, which is different from the other Japanese brokers, you man need to be careful a little.

- In this example, entering 2,500, which means the settlement at 4.75 when it falls 2,500 pips from 5.0 of the sell order.

- After entering it, the settlement rate of 4.75 and the profit of PLN 2,500 will be displayed below. So check if they are intended numbers. (If PLN/JPY = 30, the profit is JPY 75,000.)

- Confirm the entered numbers and finally click "指値注文発注 (Place Limit Order)" to complete the order.

Notes: Interest Rate, etc.

ECB Governing Council Meeting March 16, 2023 (Thu)

NBP Monetary Policy Council Meeting March 7-8, 2023 (Wed)

At its February 2, 2023 meeting, the ECB raised the interest rates of the main reference operations by 0.5 points to 3.0%.

The National Bank of Poland also announced after its February 8 meeting that the reference rate will remain unchanged at 6.75%, which is the 5th time in a row.

According to Reuters interview with a MPC member of the NBP, he seems to recognize that the current interest rate policy is having some effect. If the situation does not change, it can be read that the current interest rate will not be raised for the time being and will be maintained. However, this is a temporary paused, and he did not deny the possibility of raising interest rate again.

Considering that the ECB is raising interest rates further and the swap points will drop, I think the risk to invest a large amount of money is a little high.

Looking at the long-term chart, it is also worrisome that the is raising continuously.

I am also monitoring PLN/JPY as BOJ does not raise the interest rates. I am also looking at other high-swap currency pairs for a good entry point. After the yen has fallen a little bit, it will be easier to enter MXN/JPY and ZAR/JPY. I wish I could start investment before the current depreciation of the yen progresses.

Please let me know if you have any recommendations for entries from now on.

It's really a memorandum for myself, but I'm attaching the pages of the meeting schedule for the ECB (European Central Bank) and NBP (National Bank of Poland).

Cost of Holding Positions with IG

IG now charges cost for holding positions, "Daily Admin Fee" independently. They say the cost was previously included in the swap points and automatically deducted, but now it is shown separately.

In addition, IG starts to charge daily based "Daily Admin Fee" for weekend as well. Previously IG charged "Daily Admin Fee" only for one day even in weekends regardless of # of days, but now IG takes care of # of days in weekends.

It is a small deterioration....

Settings under Consideration

EUR/CZK - Selling

I am checking EUR/CZK for an entry point for a long time along with EUR/PLN, but in 2022 when I began to consider entry, CZK was getting strong, which makes difficult to enter. (In the case of EUR/PLN, PLN was getting weaker against the euro, which makes easy to enter.)

I was going to invest when the rate exceeds 25.5, but it getting lower and lower.💦

Moreover, since the beginning of 2023, swap points have fallen largely like EUR/PLN. The difficult situation for entry continues for me.

PLN/JPY - Buying

While the swap points for selling EUR/PLN is dropping sharply, I am also considering PLN/JPY again.

While ECB is likely to raise interest rates continuously, it seems BOJ will not raise its interest rate aggressively at least until the Governor of BOJ, Kuroda is replaced (on Apr 8th, 2023). (In December 2022, there was a small surprise when the allowable fluctuation range for long-term interest rate manipulation was raised from +/-0.25% to +/-0.5%.) While there is a certain gap in the interest rates between NBP and BOJ, it is good to study investment.

I am thinking the ideal entry point is JPY 28, but it is just ideal. If the rate goes below 29, then I will start to consider for entry.

MXN/JPY - Buying

When I expanded my investment coincided with the yen depreciation in 2022, MXN/JPY was soaring and it was difficult to enter.

Since it is an entry for buying, the ideal entry point is 5.5, but I will think about it when the rate falls below 6.0.

I will continue to check the status and will inform you here when the situation allows entry.