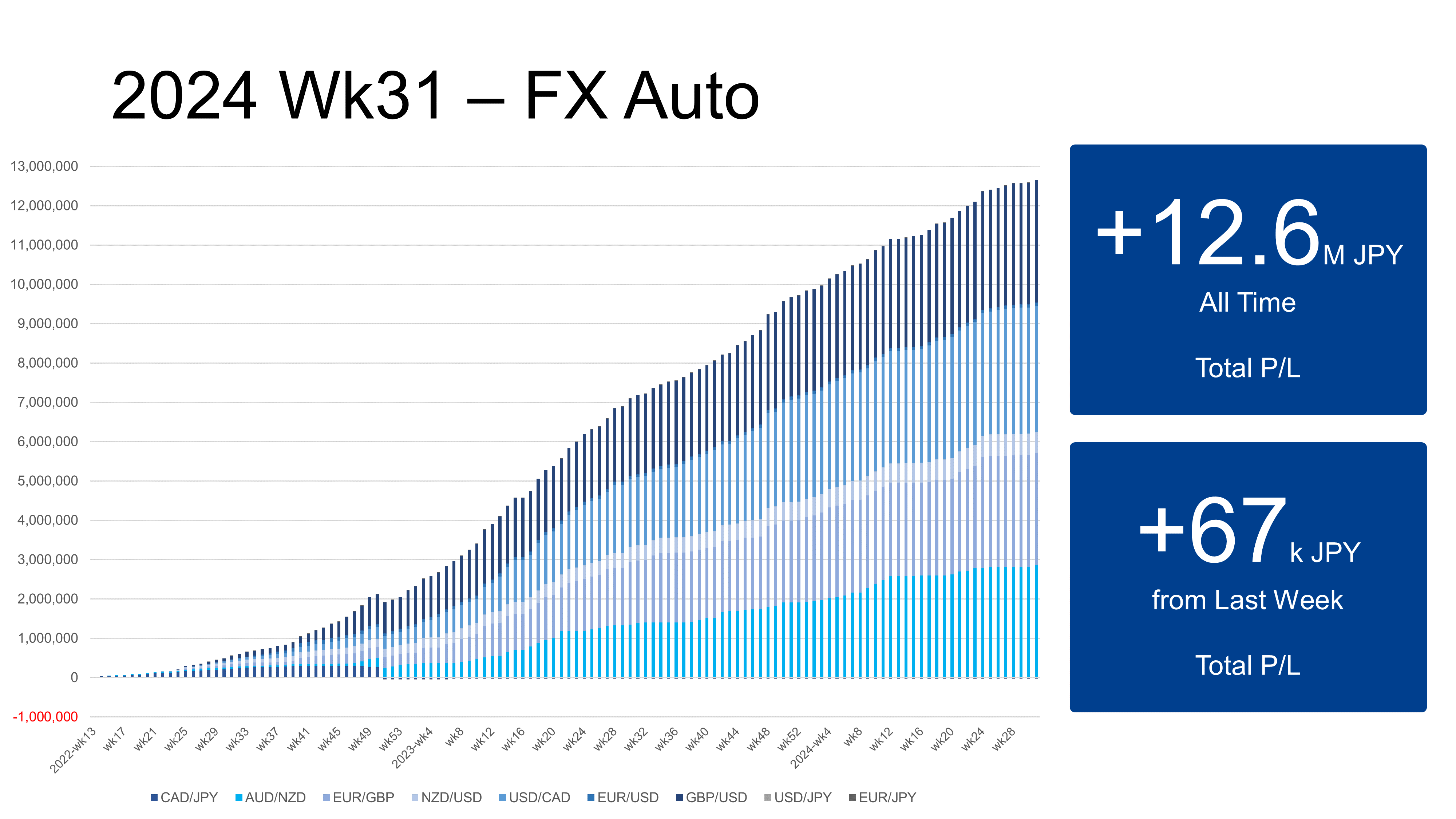

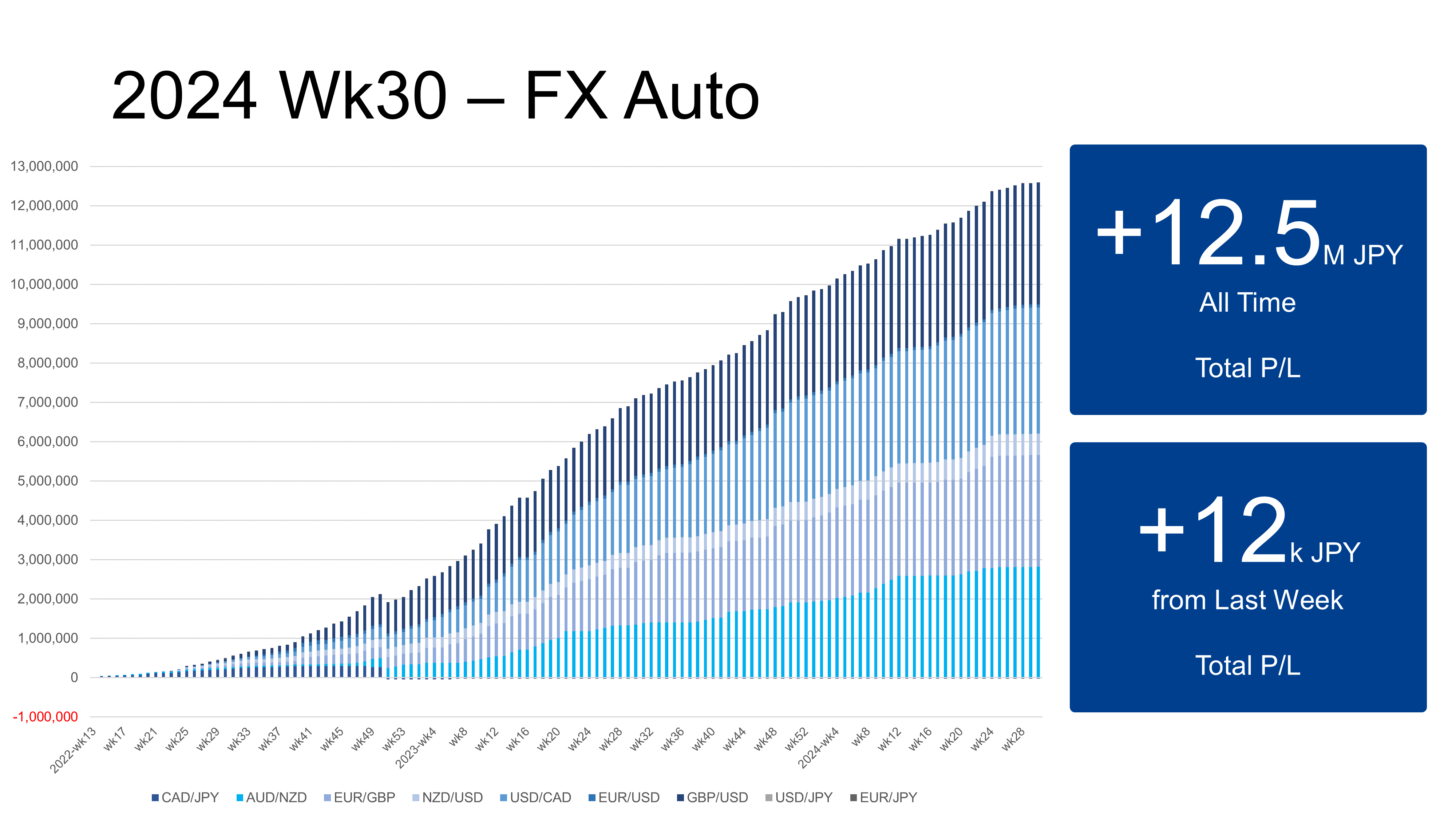

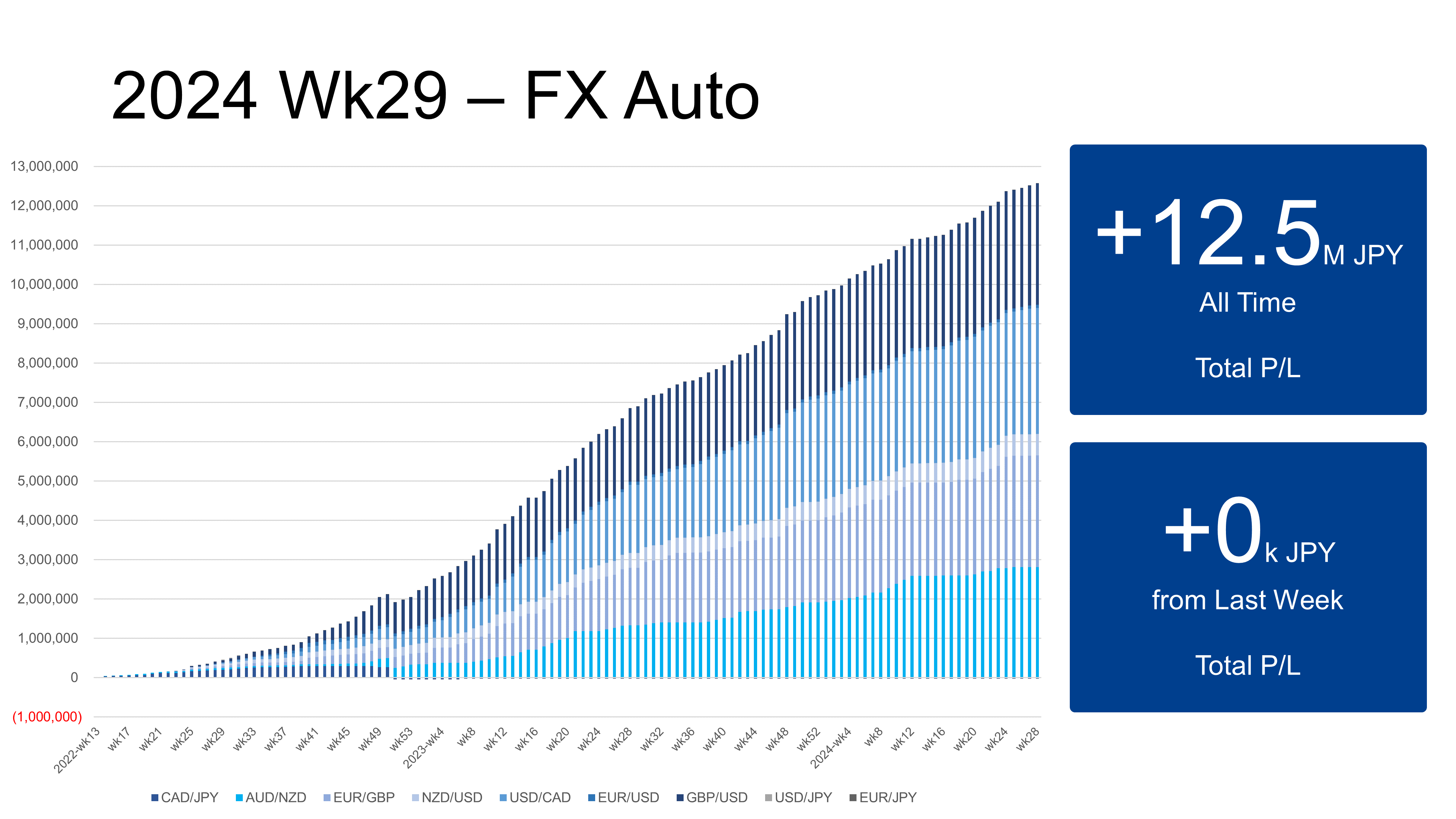

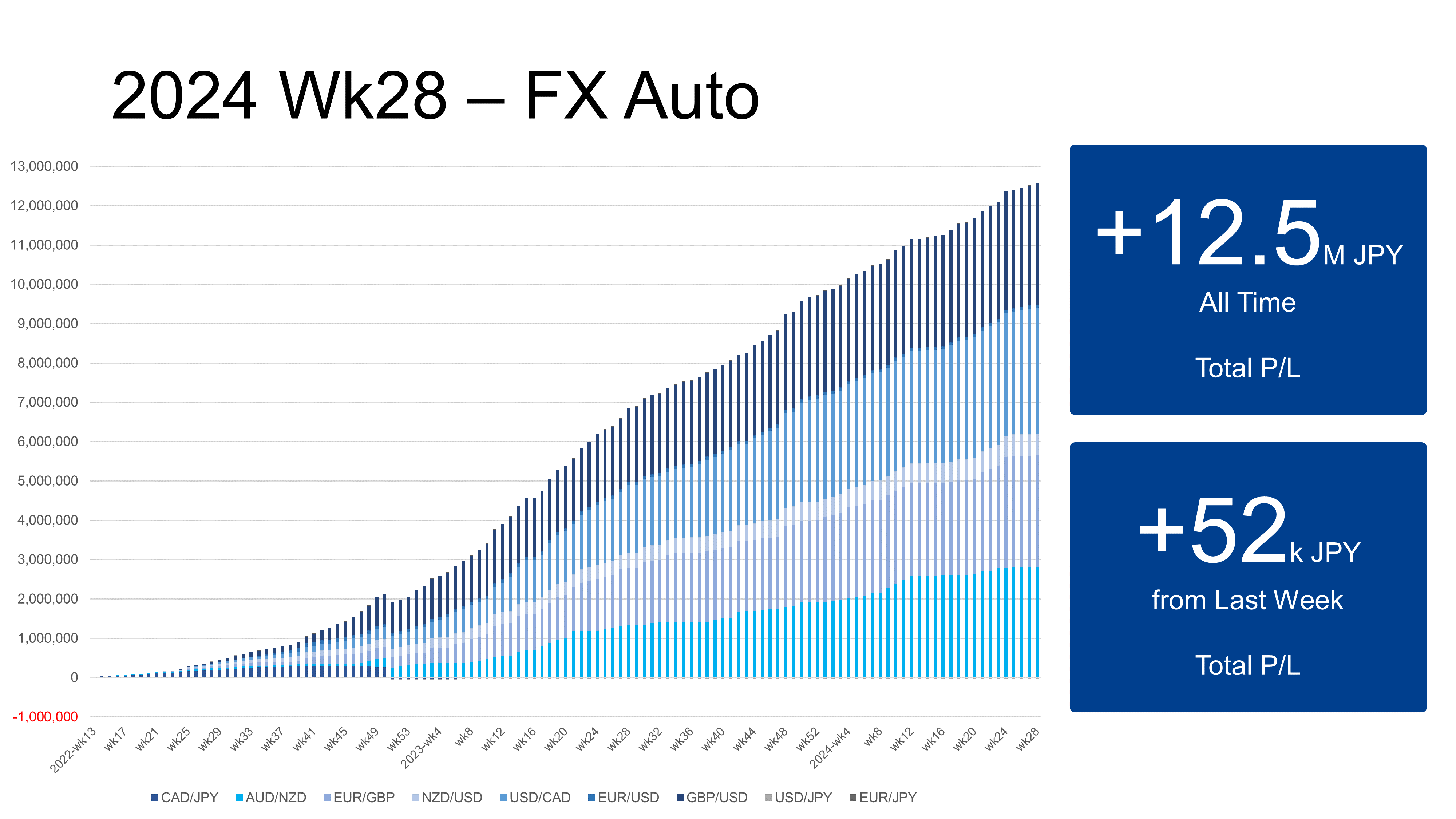

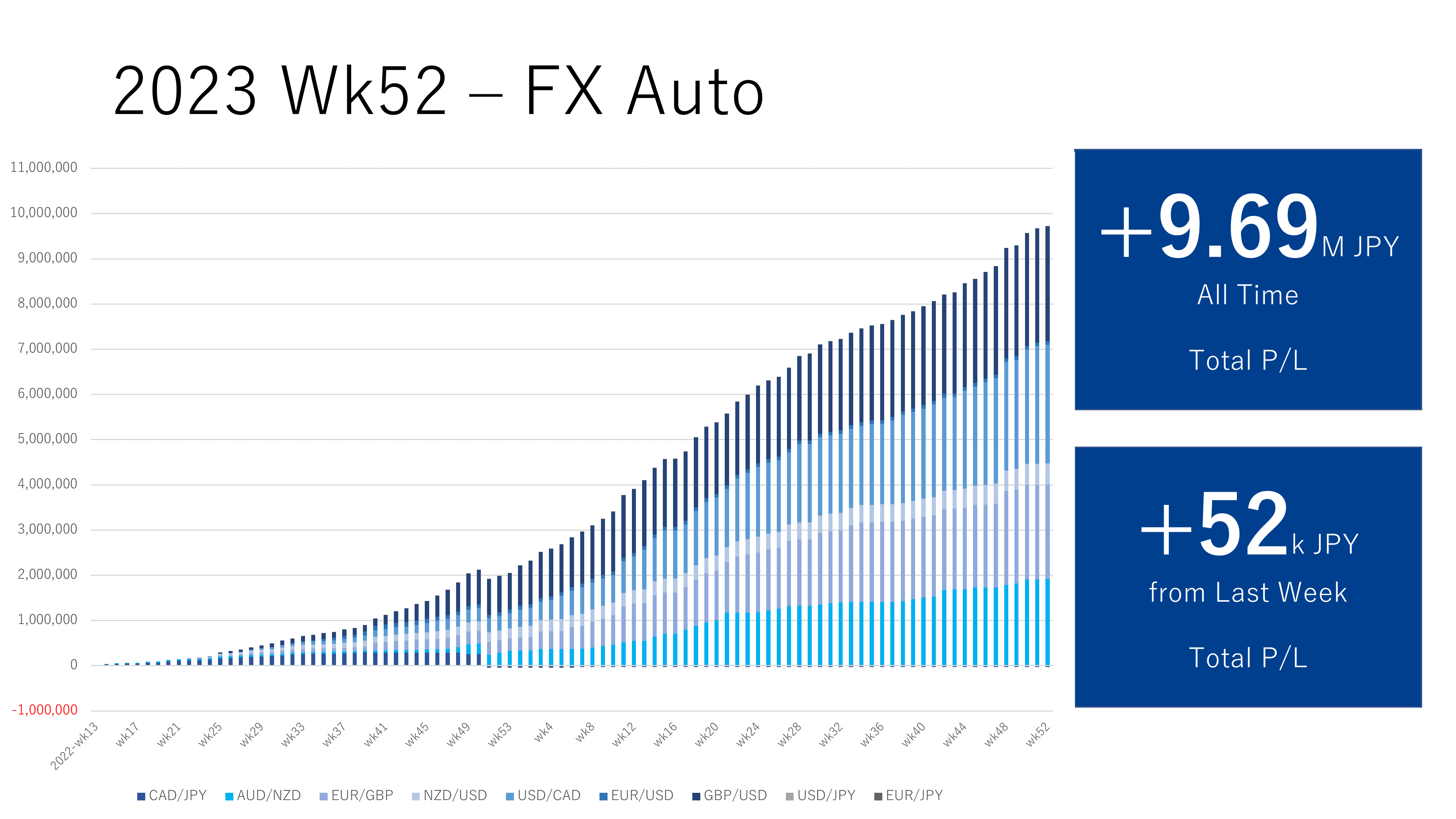

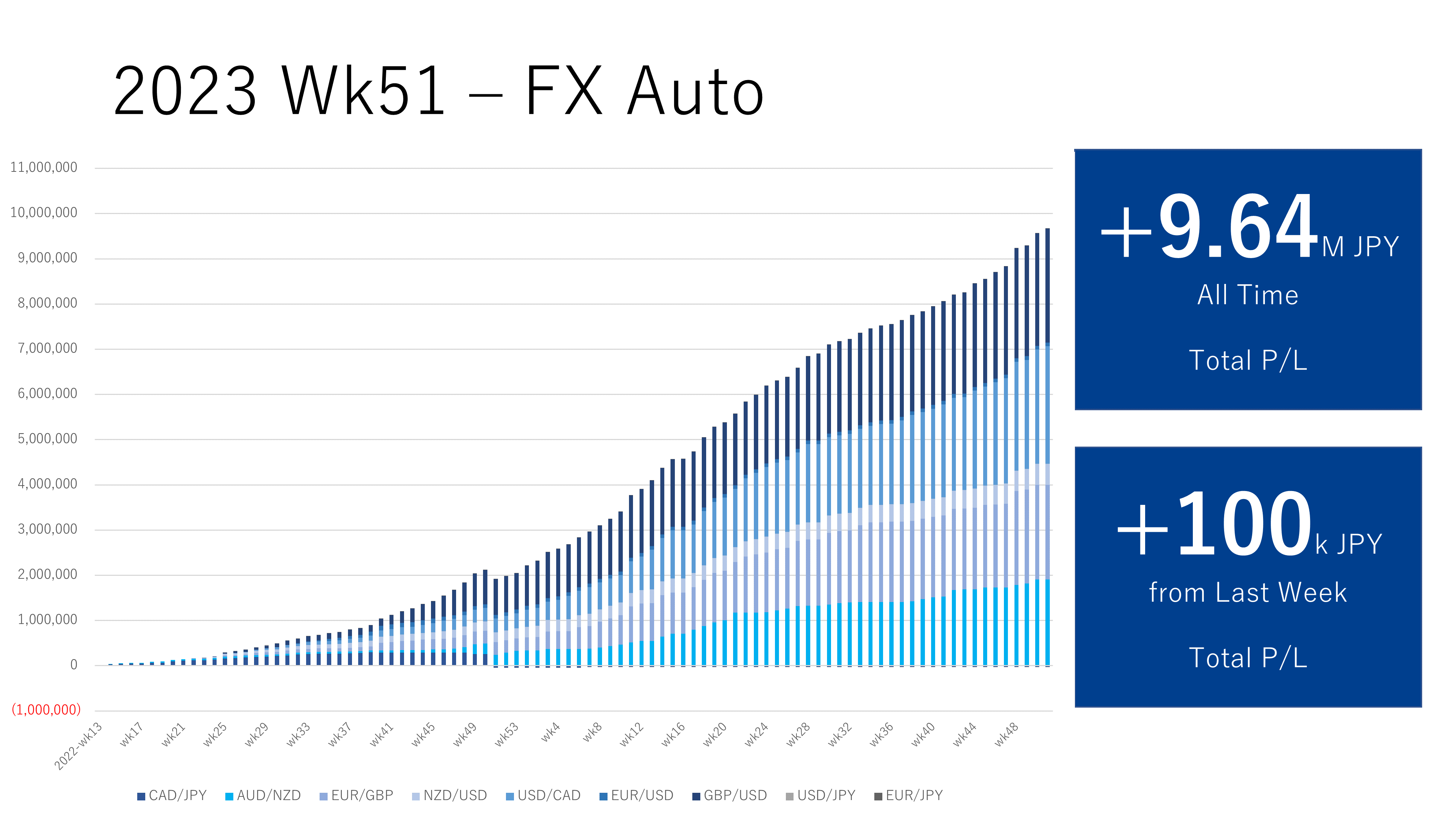

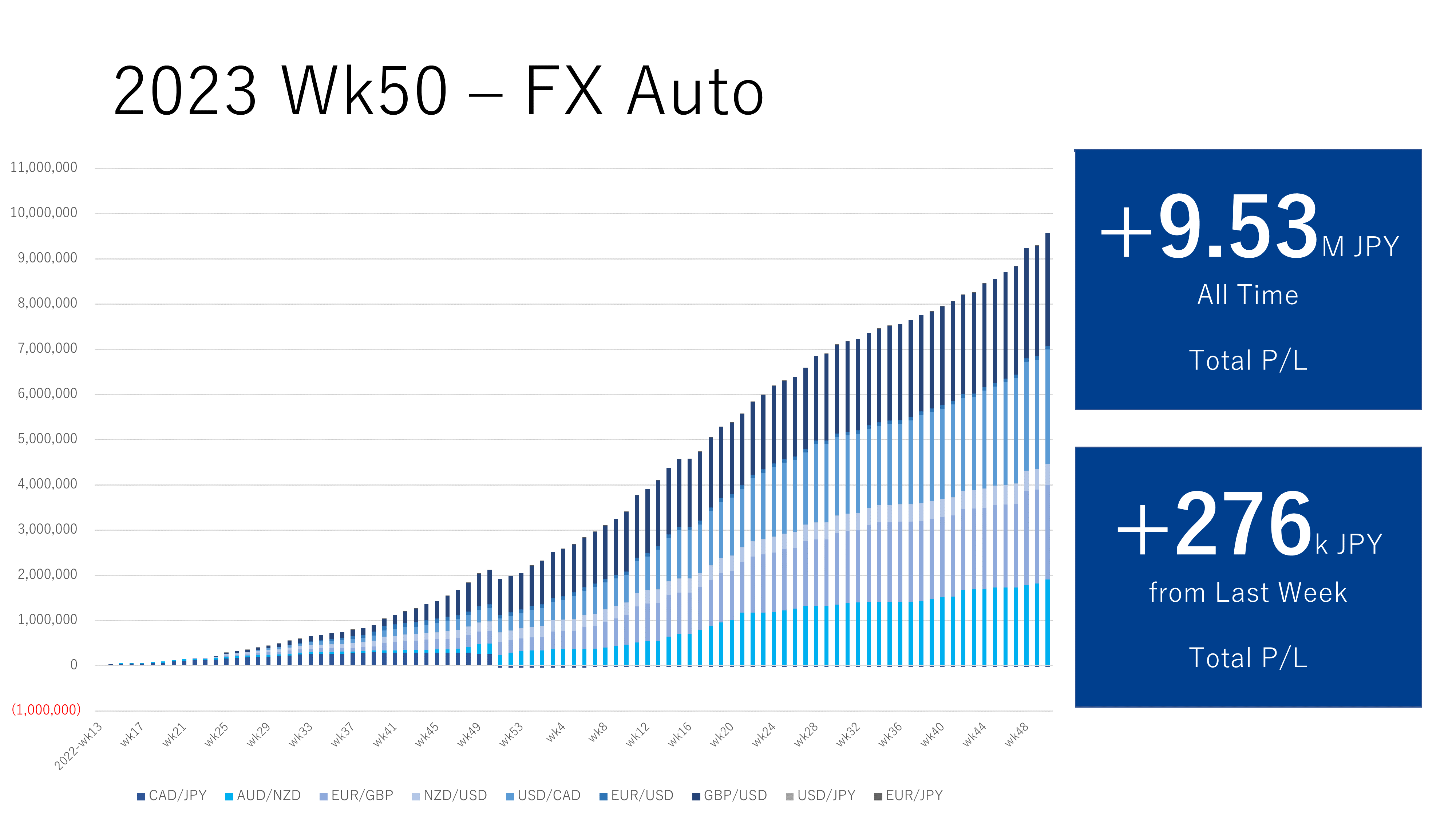

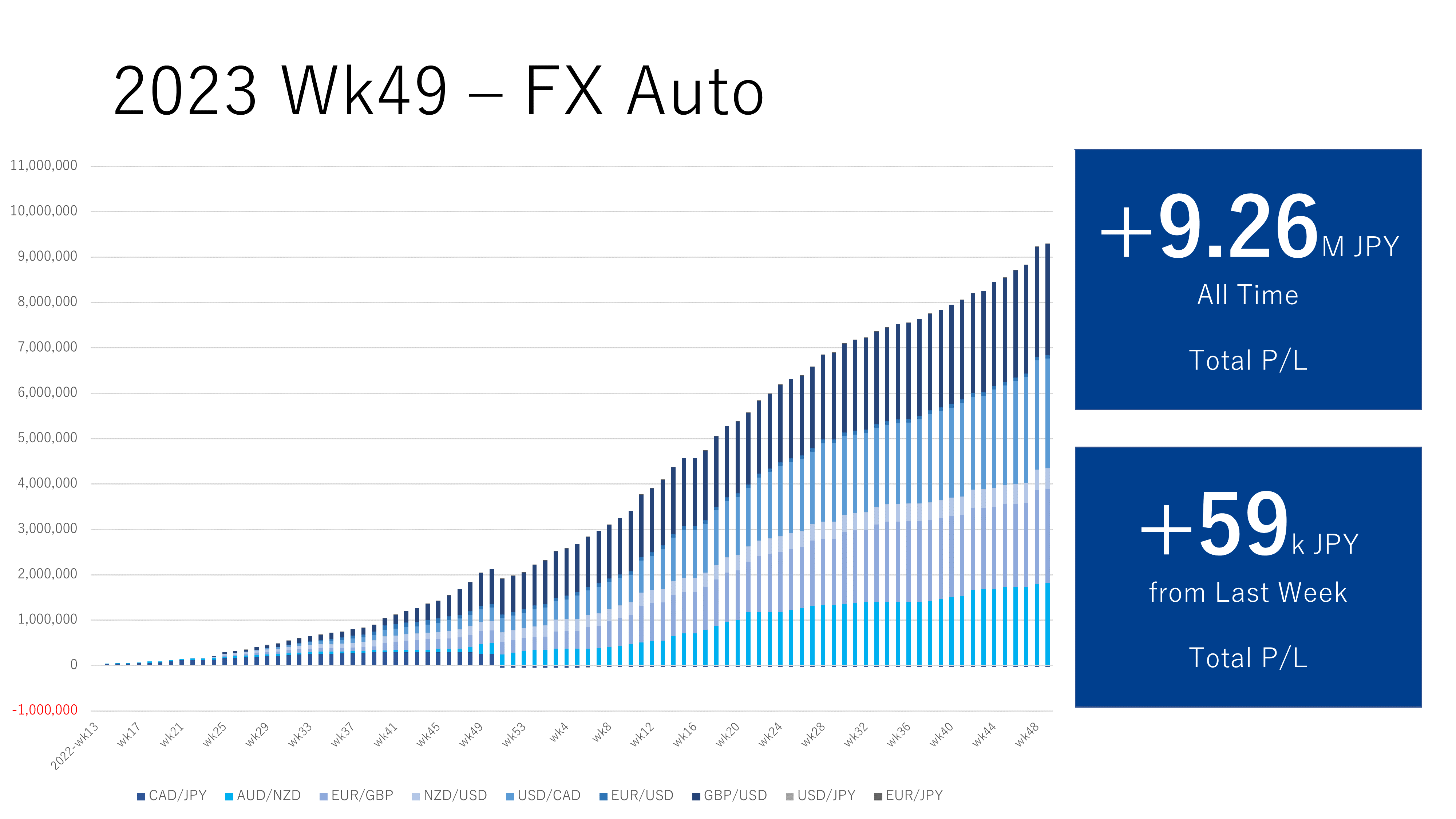

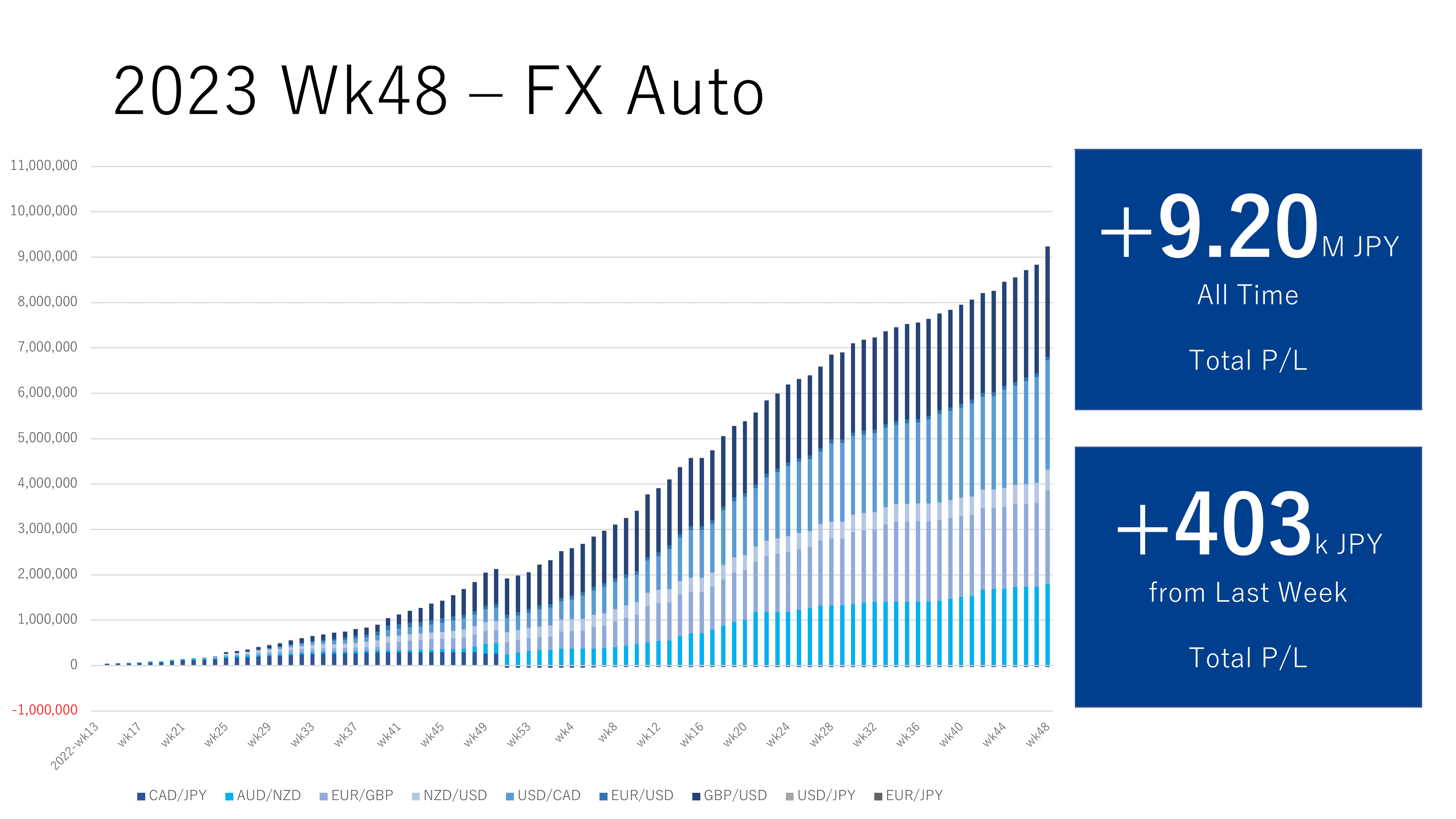

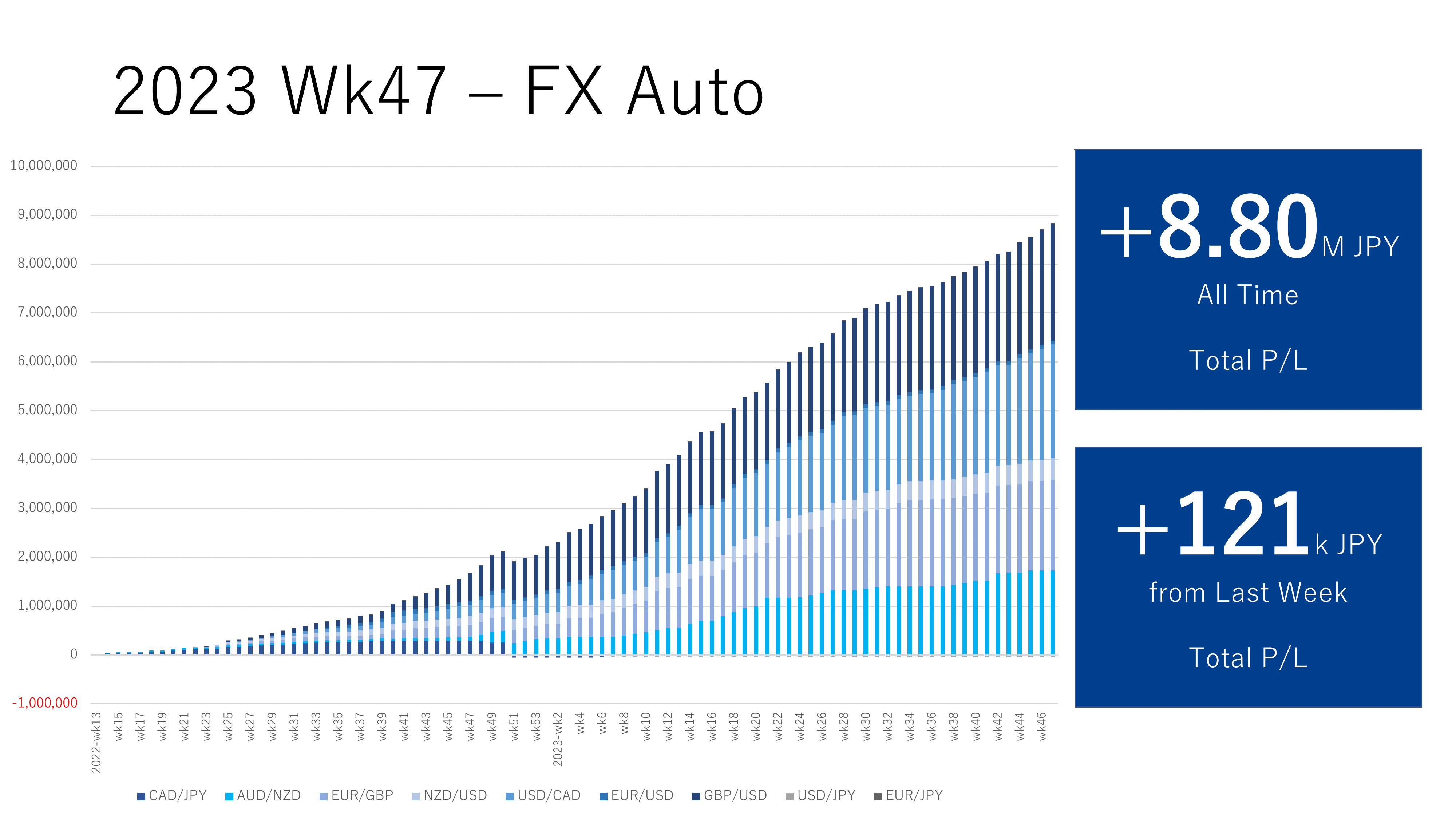

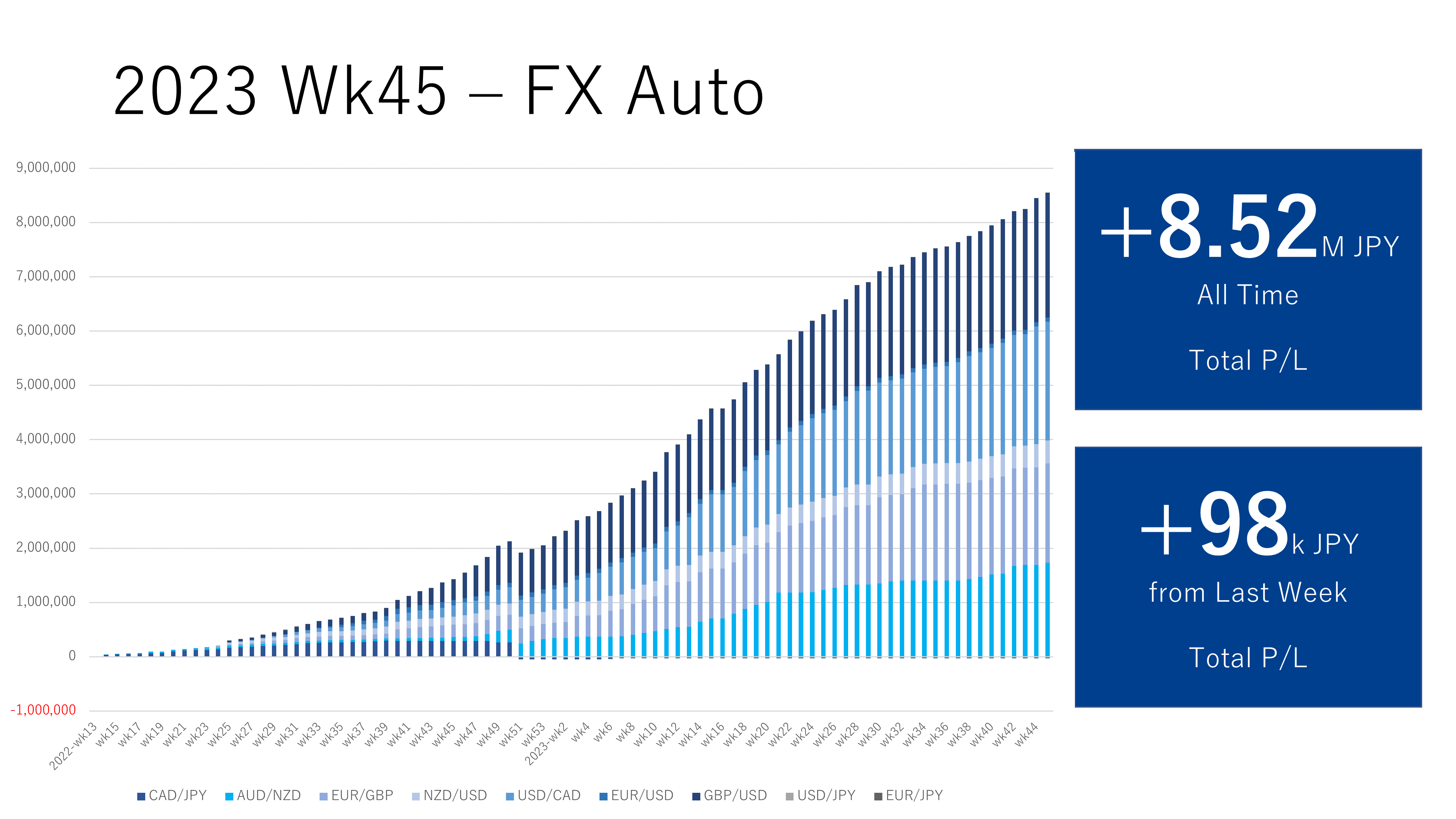

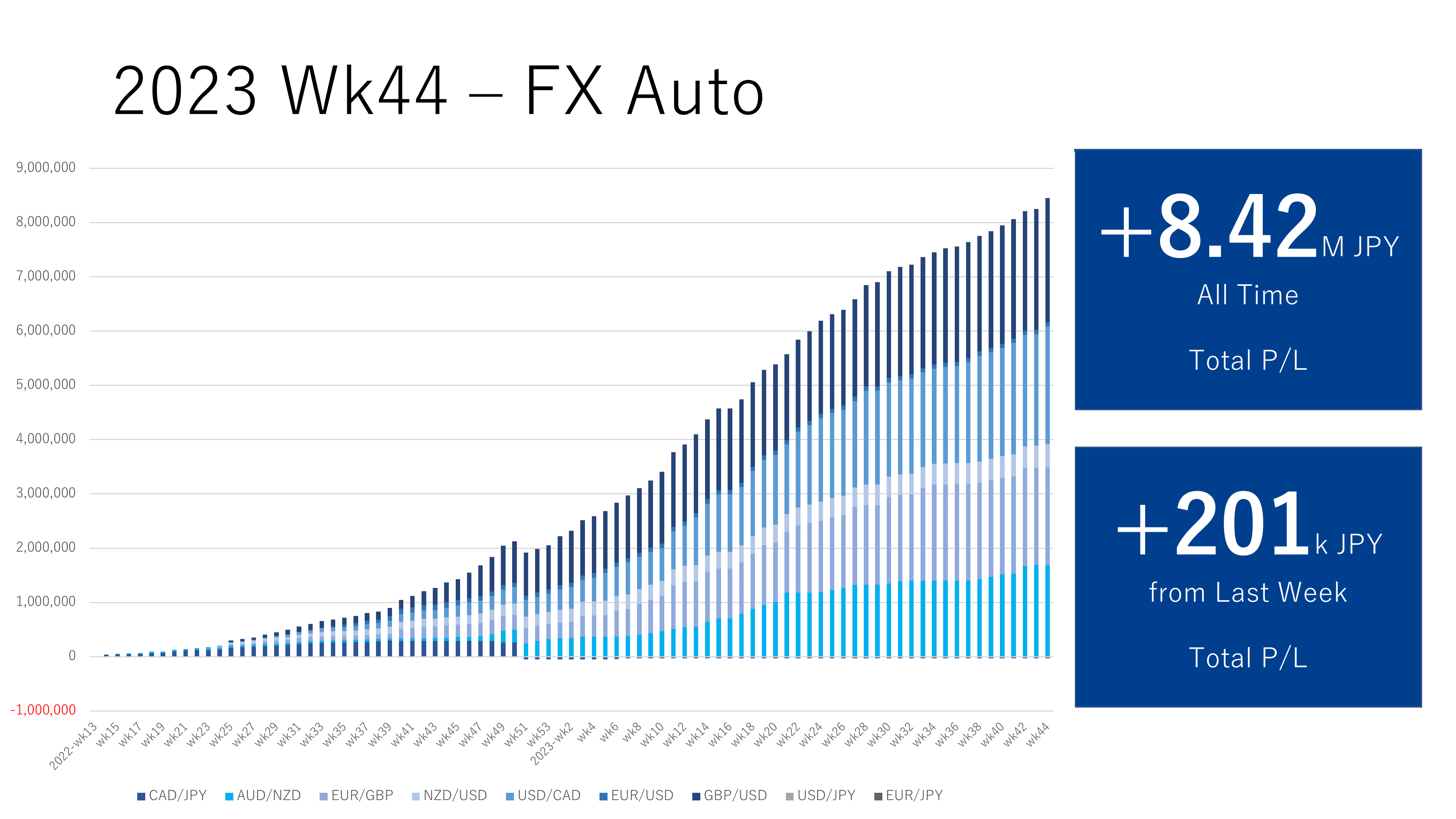

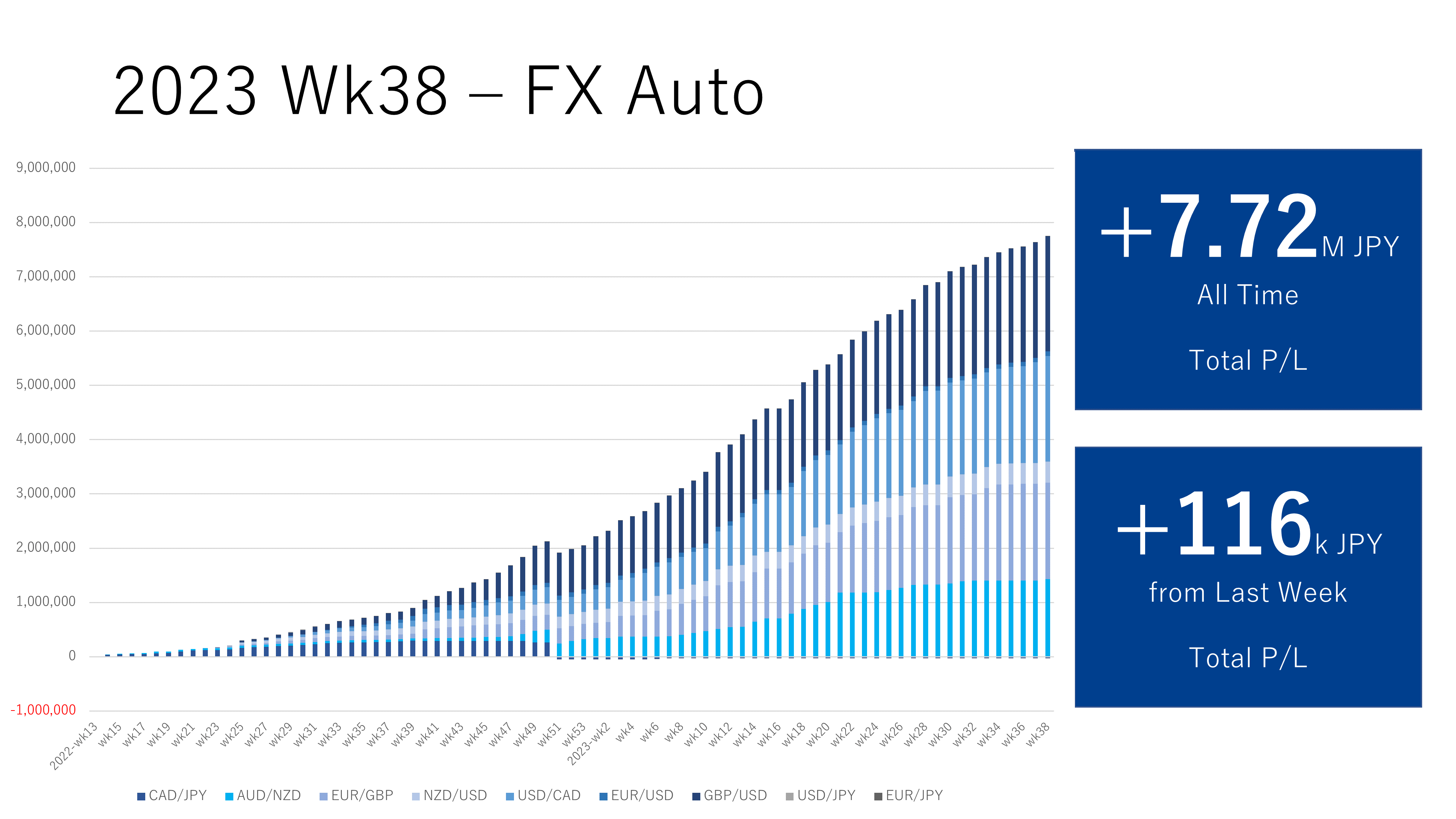

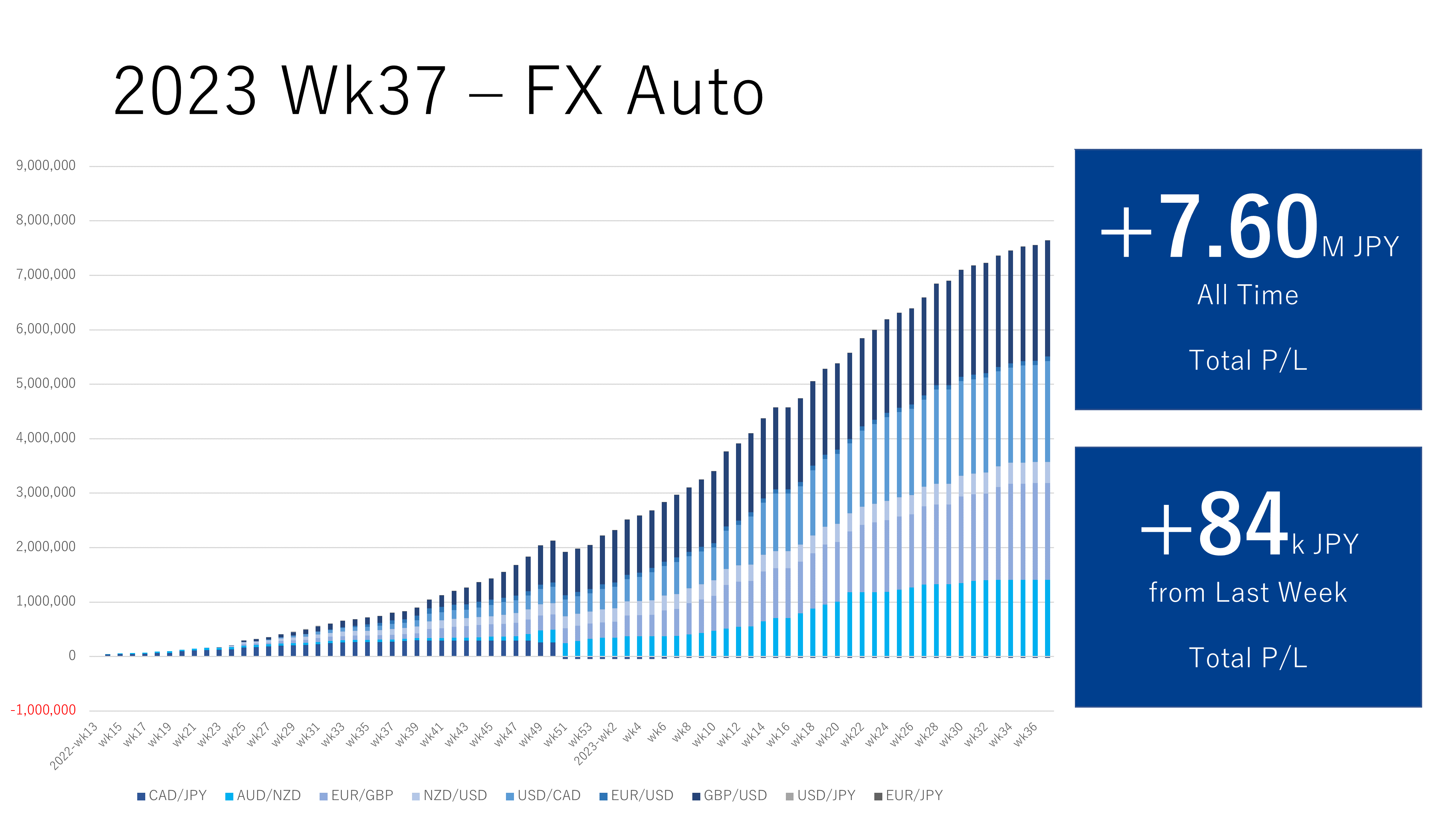

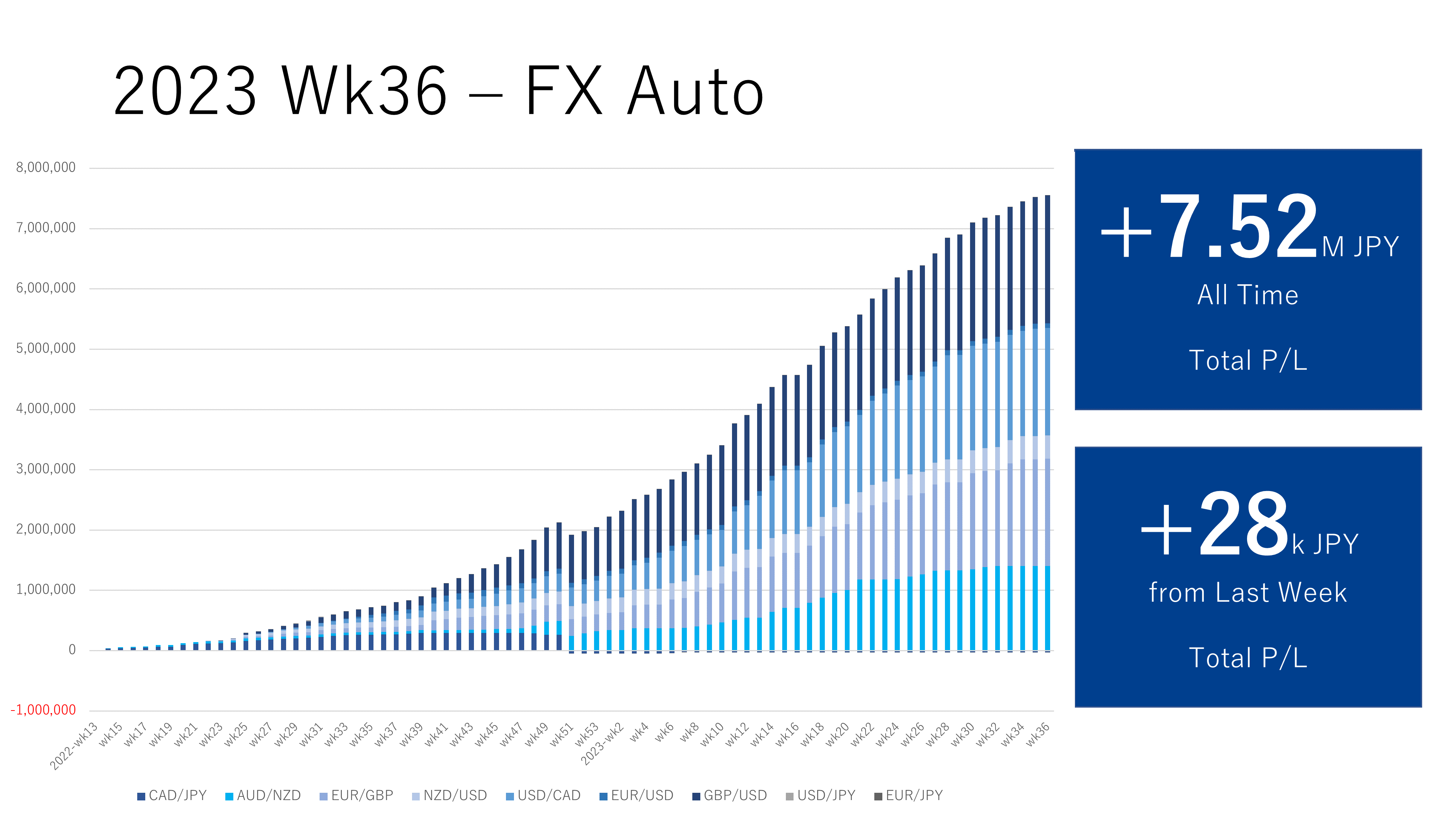

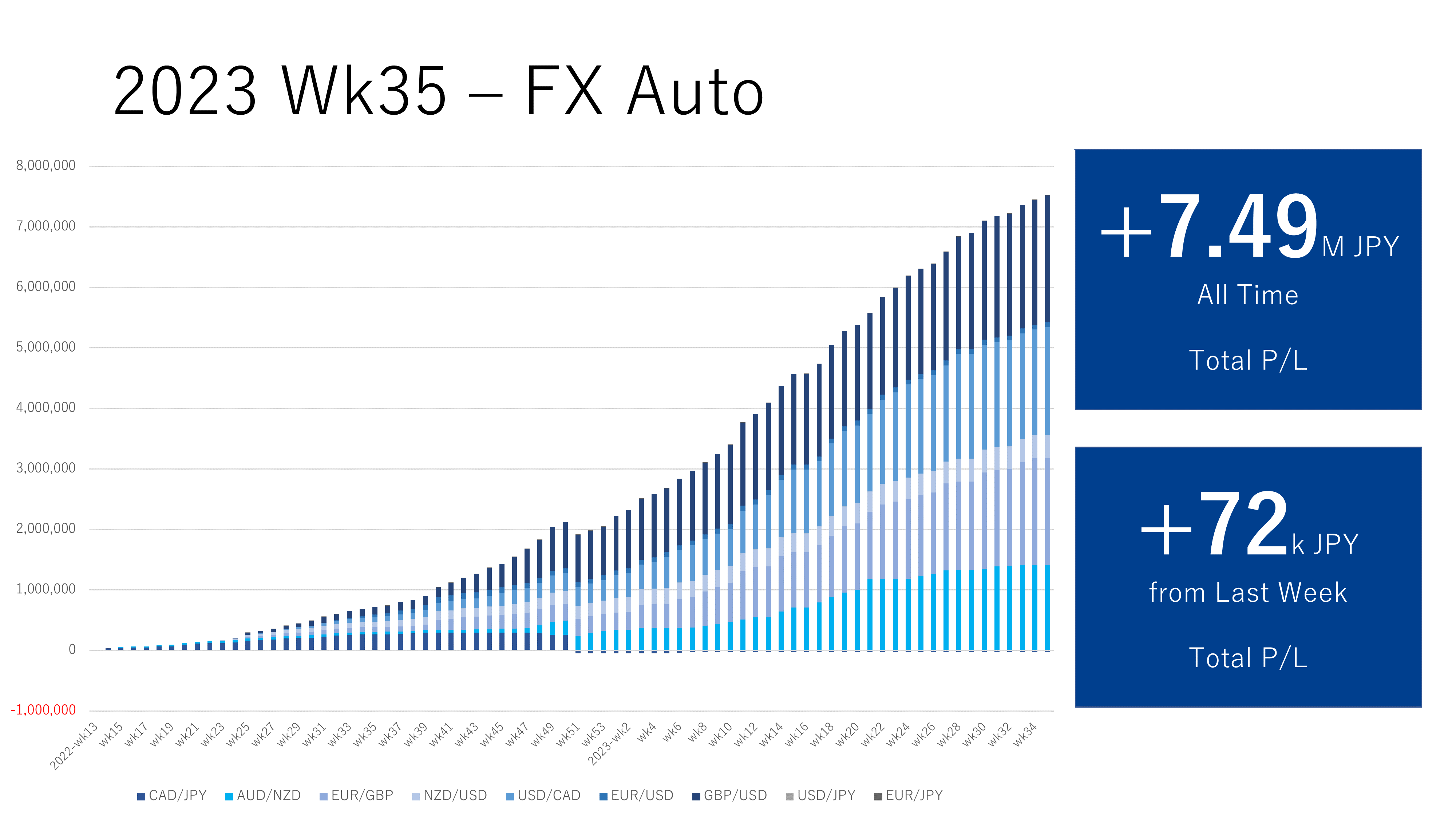

The reports are for Toraripi now. (The previous results include Triauto as well as Toraripi. until 21st week of 2023.)

Contents

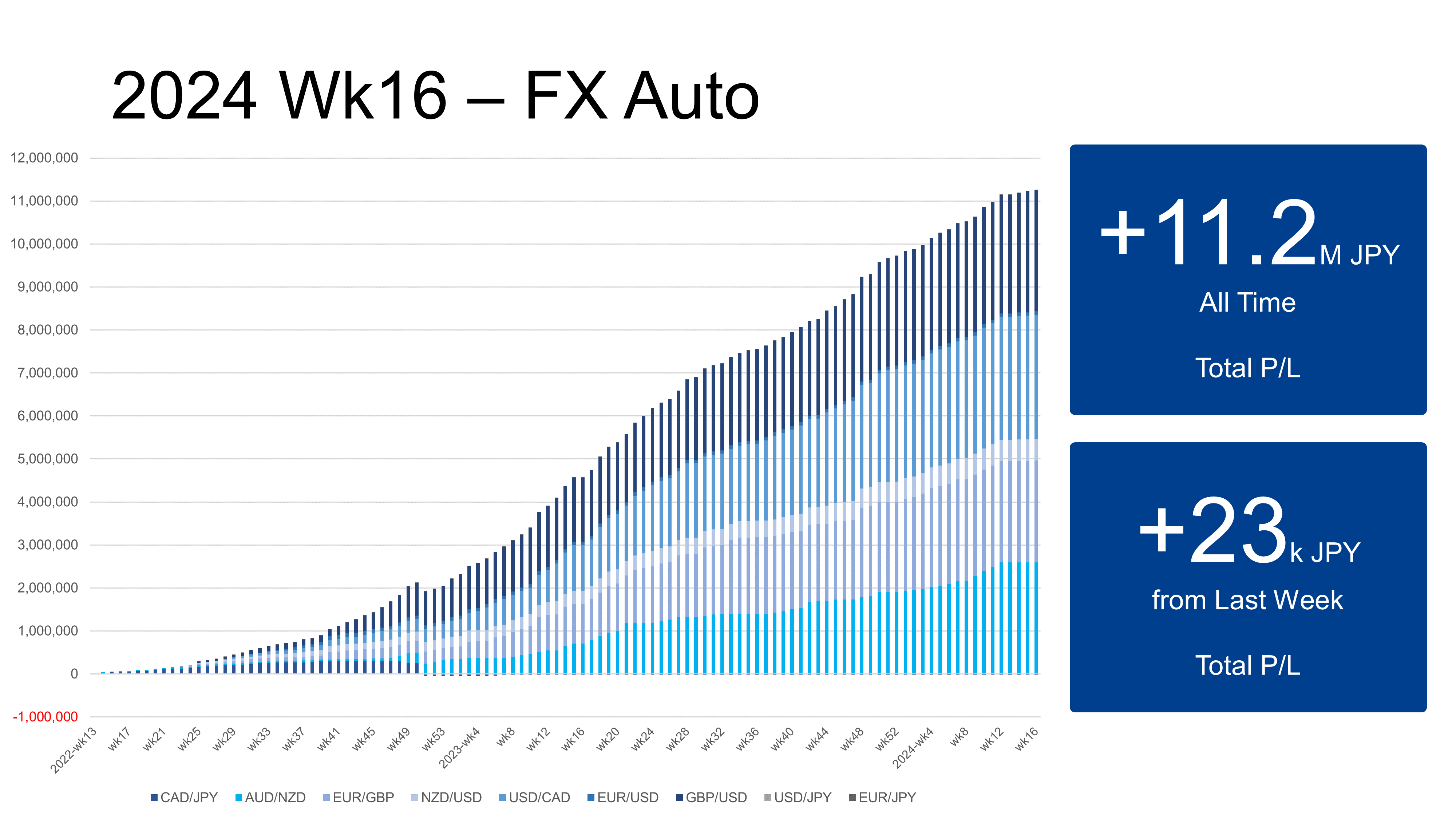

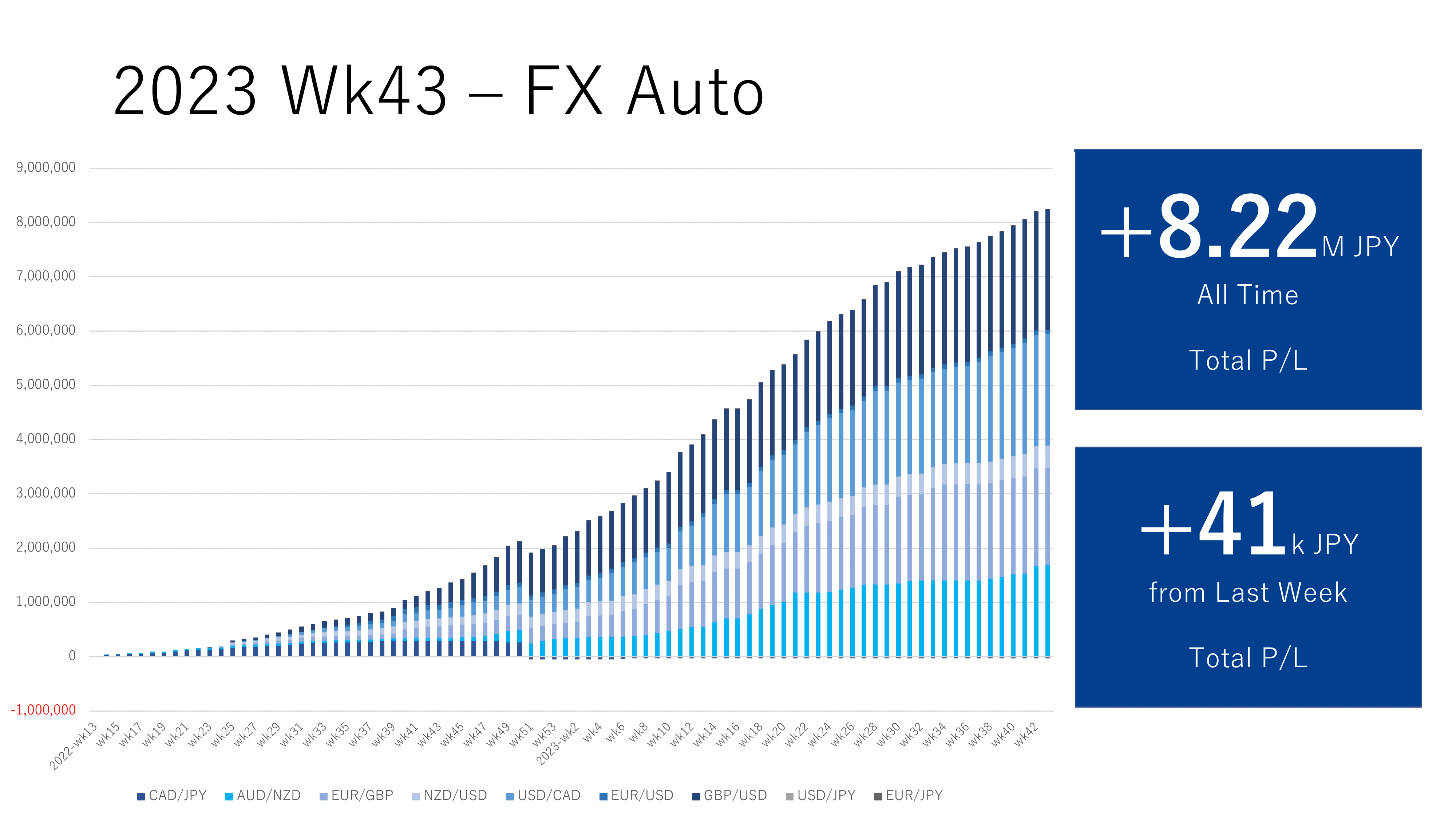

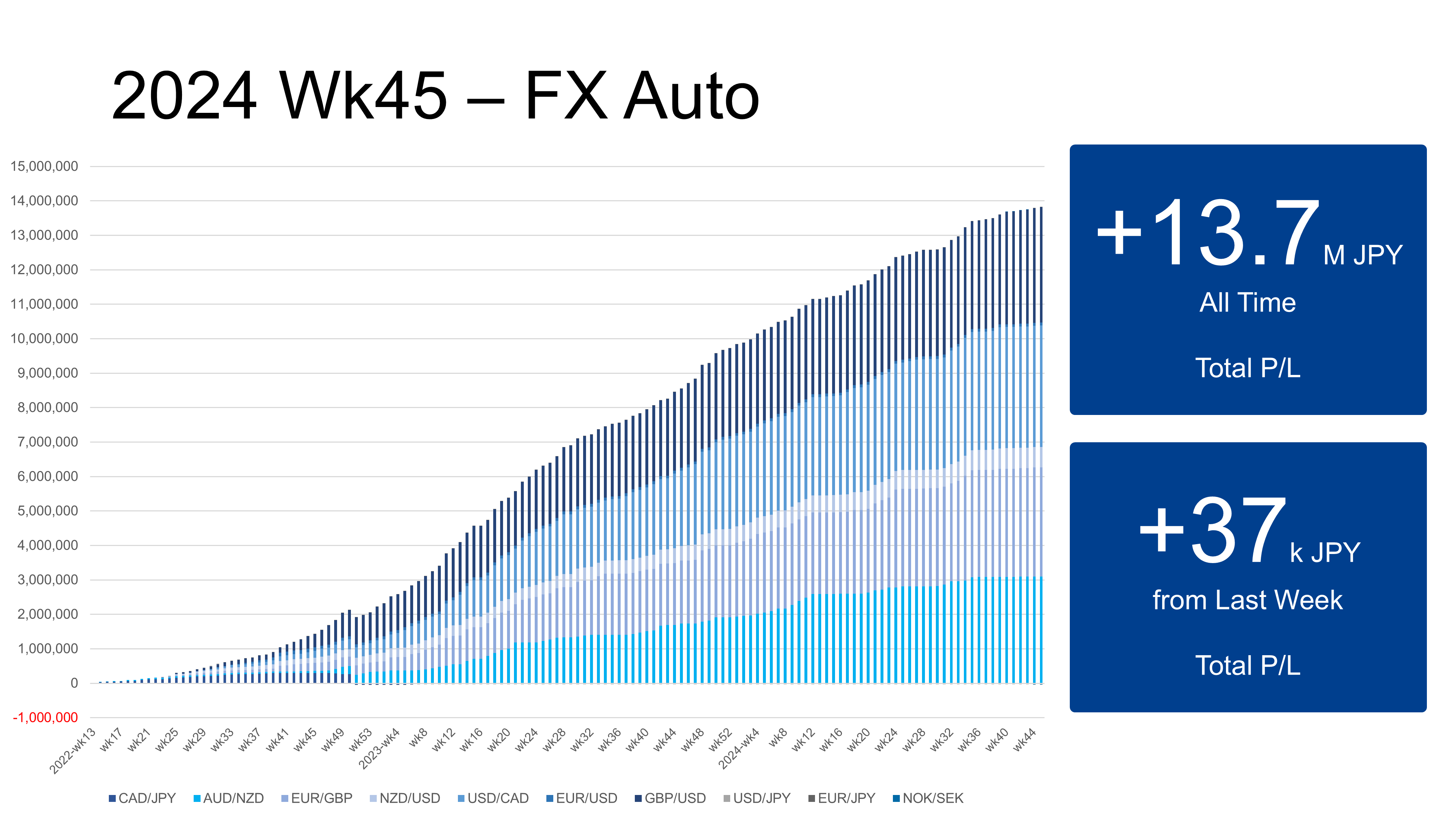

Status of This Week

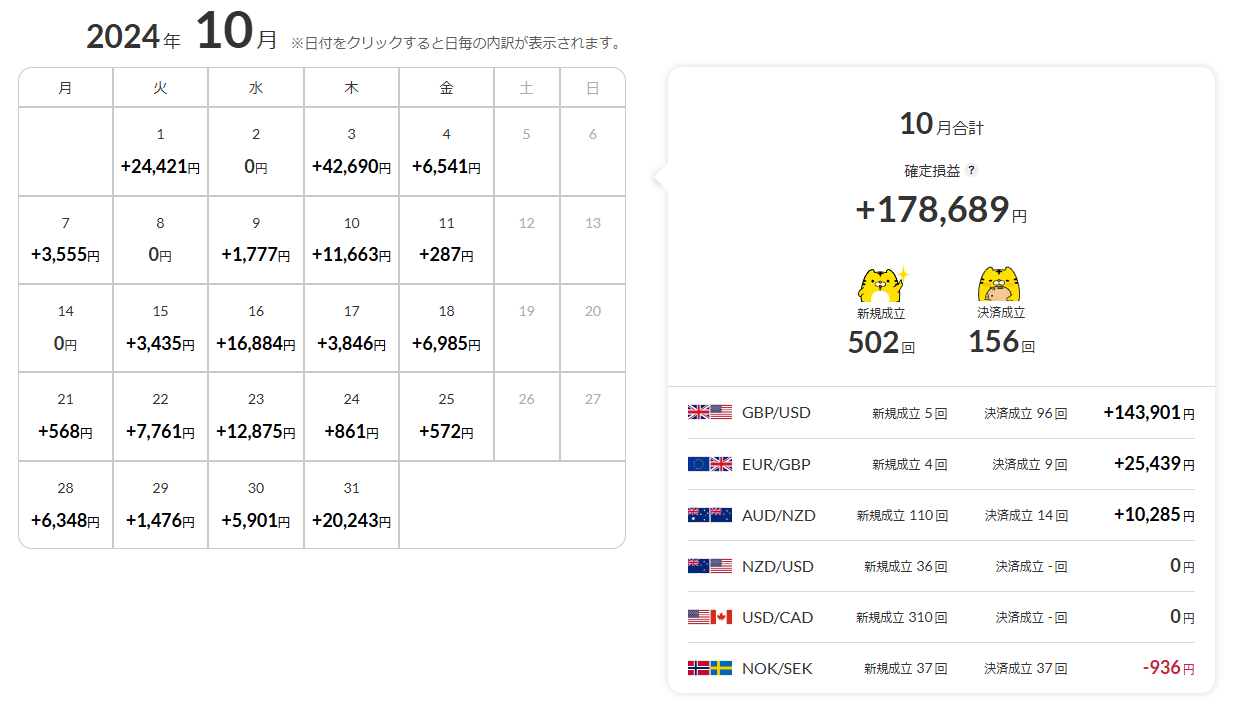

This week's Toraripi

- JPY 22k

- There was almost no volatility this week. October is really a tough month...

Goals

- As my way of thinking has gradually changed, I would like to pursue the profit goals including discretionary trading, etc., rather than increasing profit margin of automated trading (i.e. Toraripi) only.

- I would like to keep the current profit margin for the Automated trading for safe operation.

- As the biggest part of my assets is in the Automated trading, I would like to avoid risky settings for a good sleep.

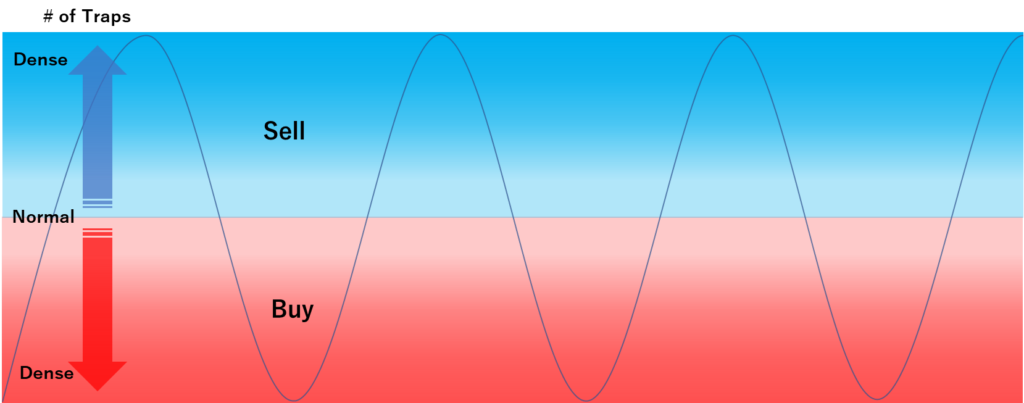

- I will add additional traps while watching how the deposit increases。

- The goals listed until 2023 have been moved to the Gross Assets page.

After quitting the company and starting the life of FIRE, I will do nothing if I don't set a specific goal. Thus I set a goal. I will whip myself!

Dashboards

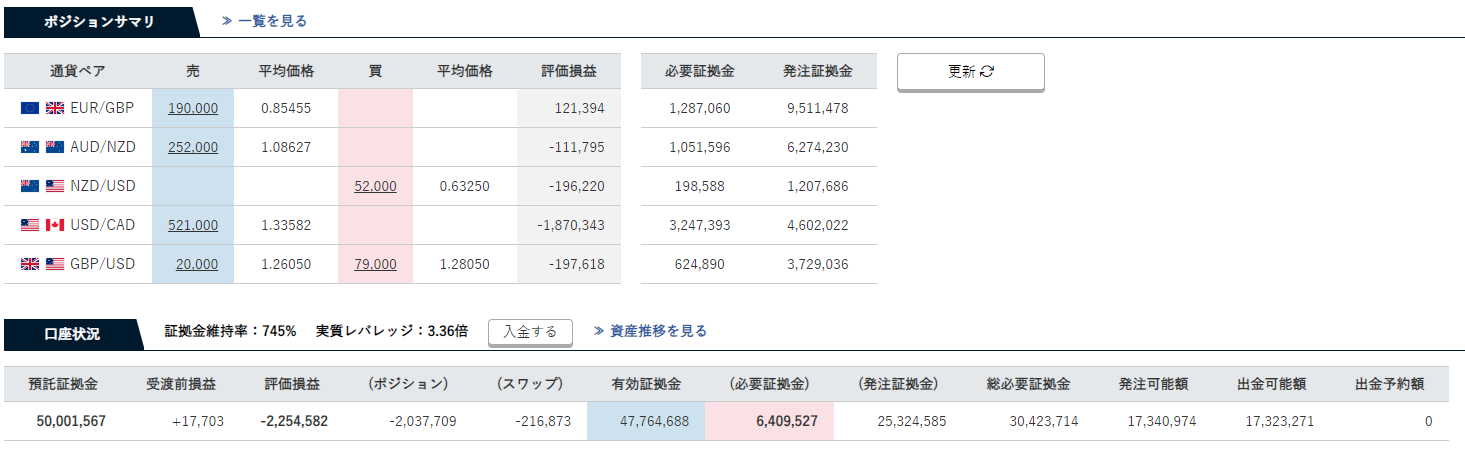

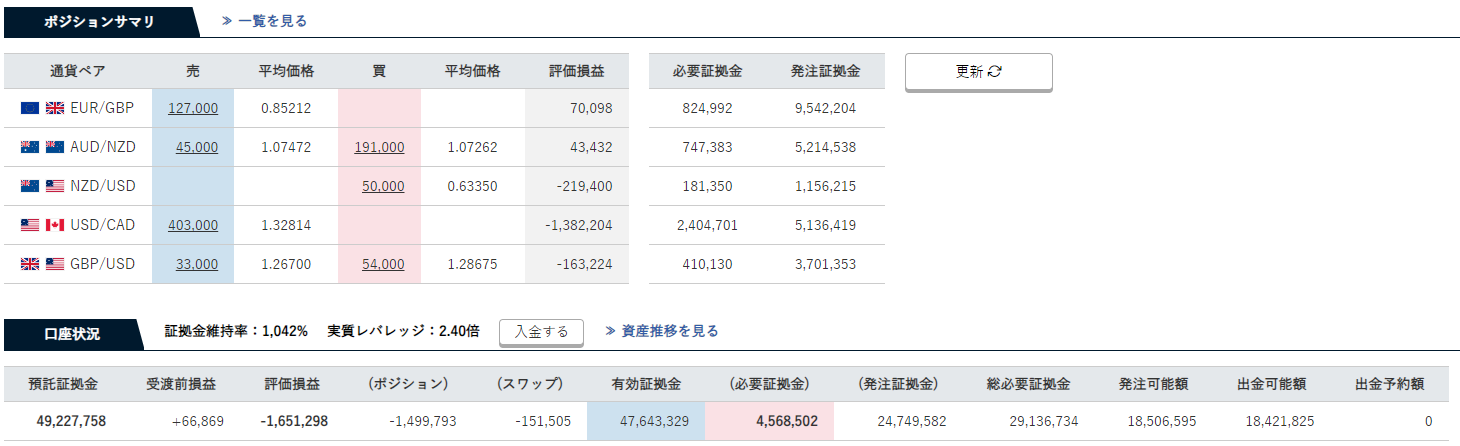

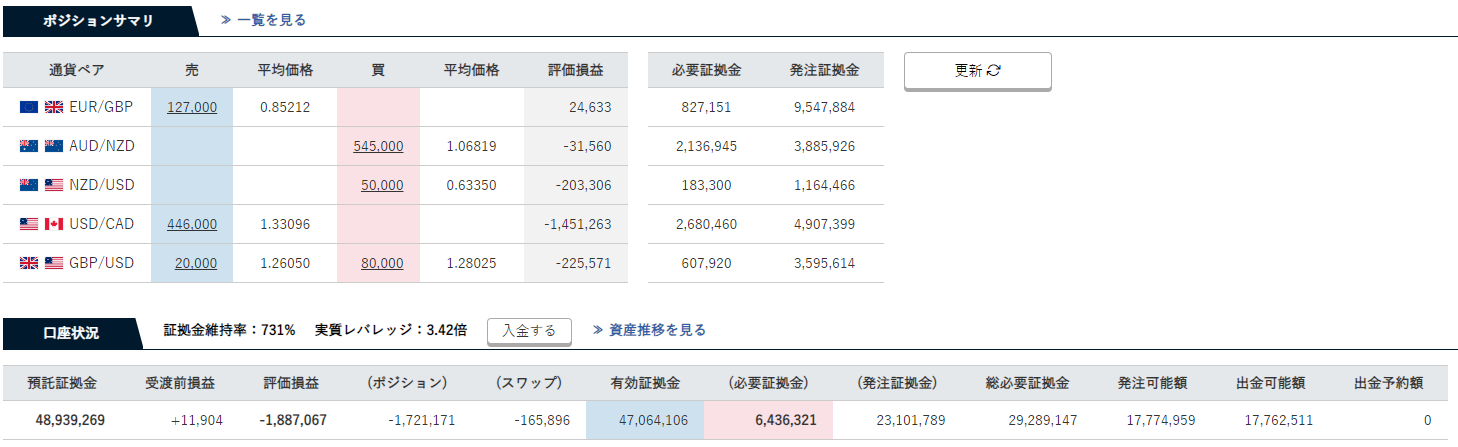

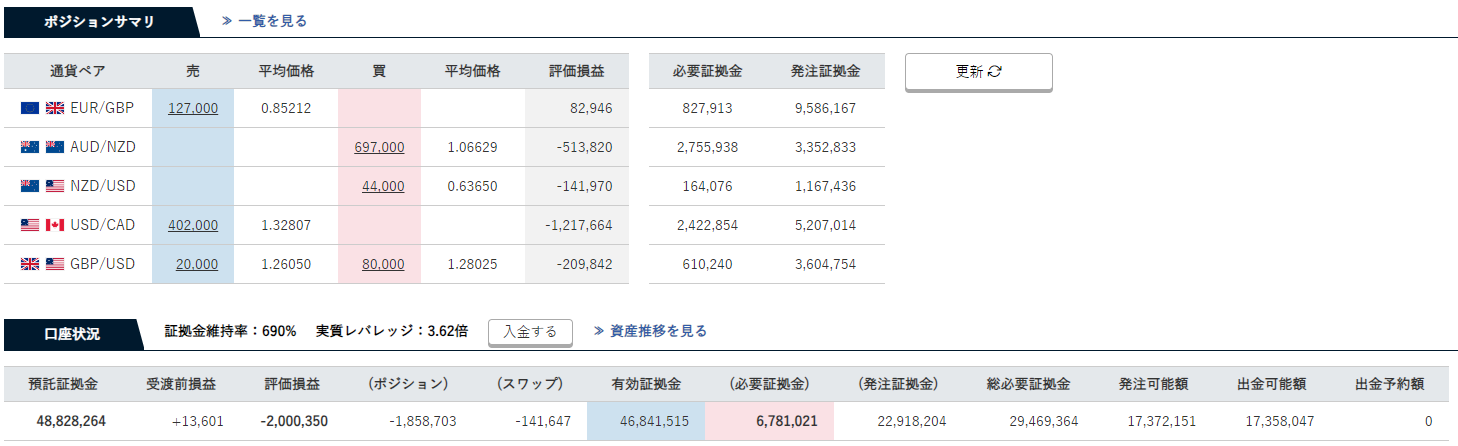

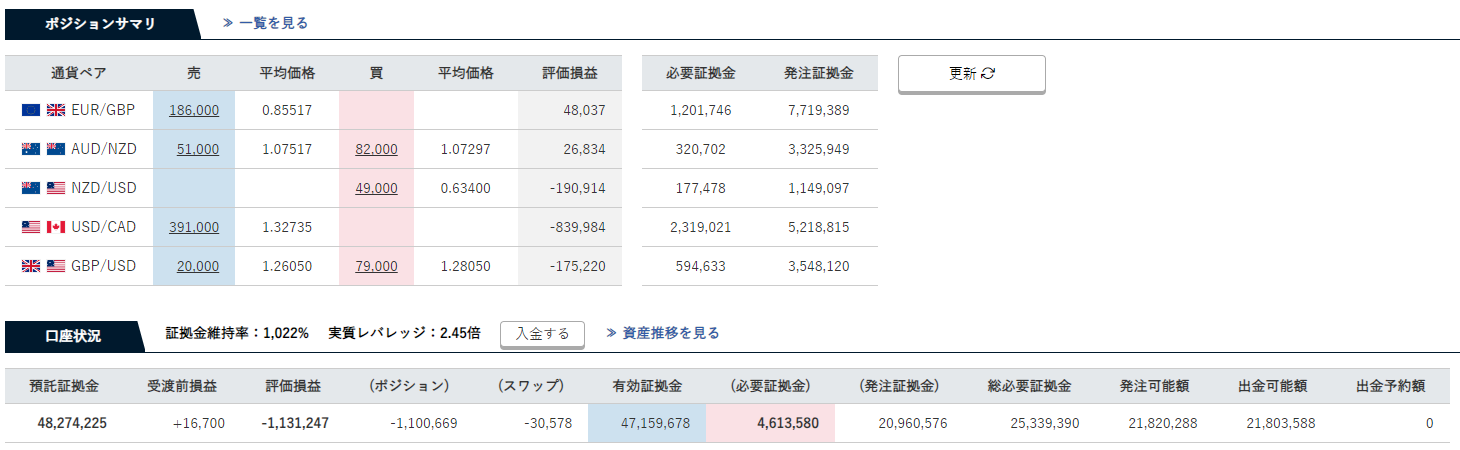

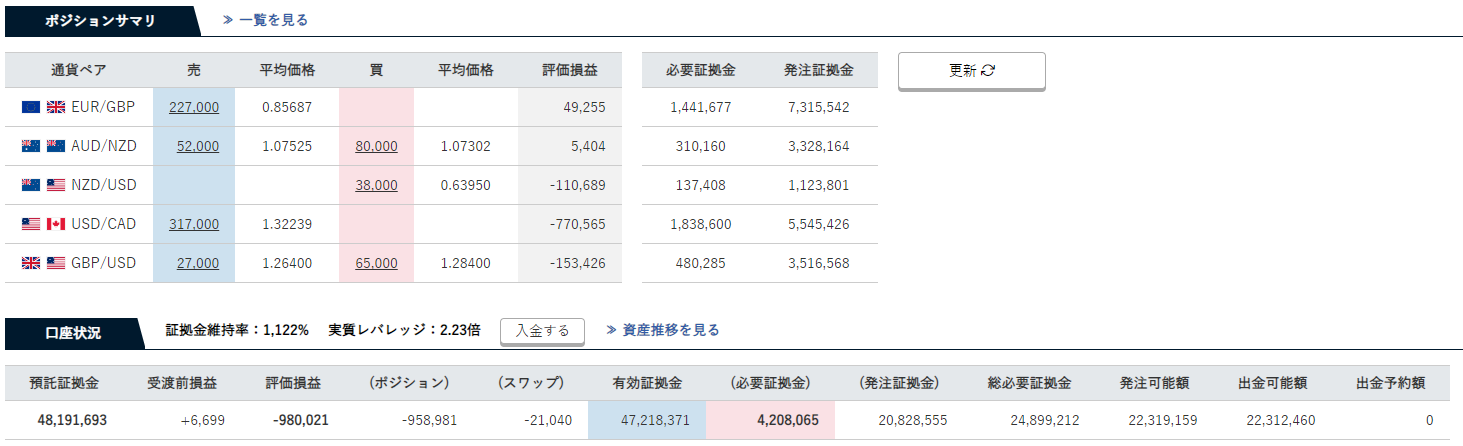

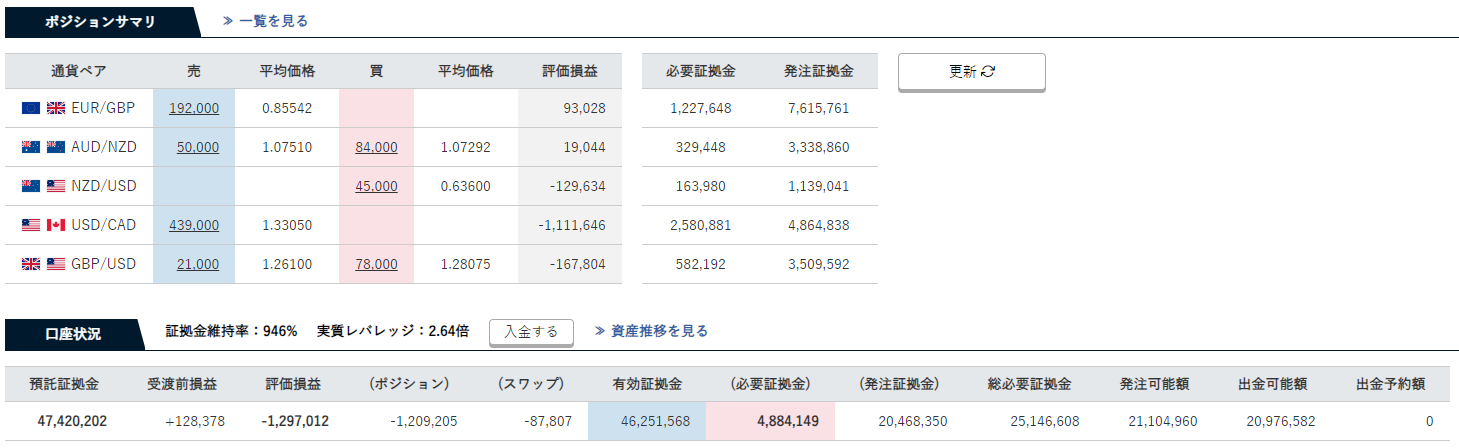

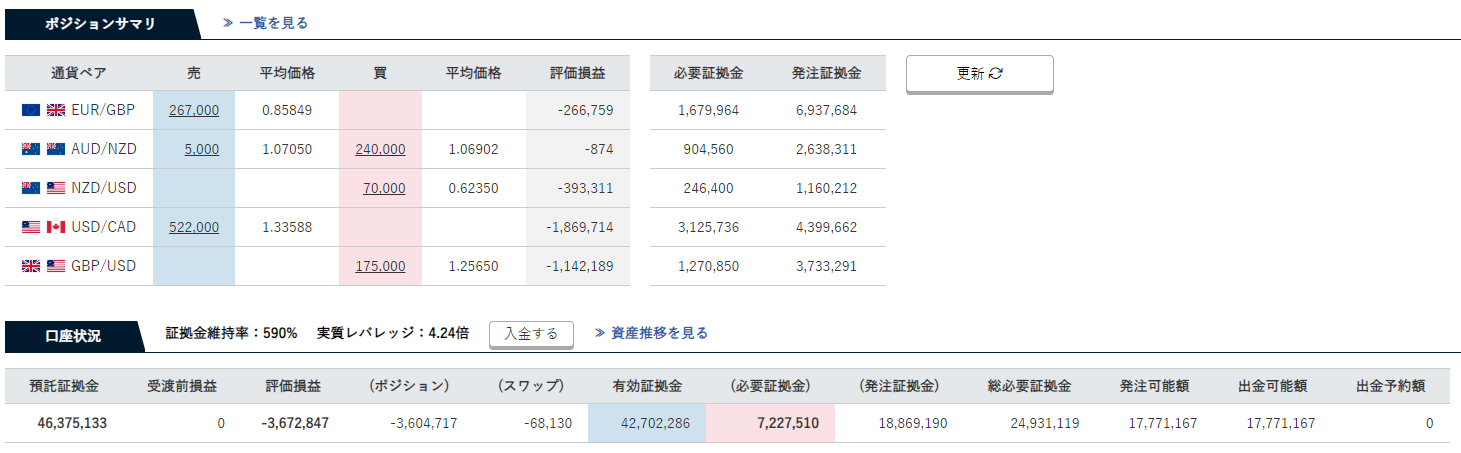

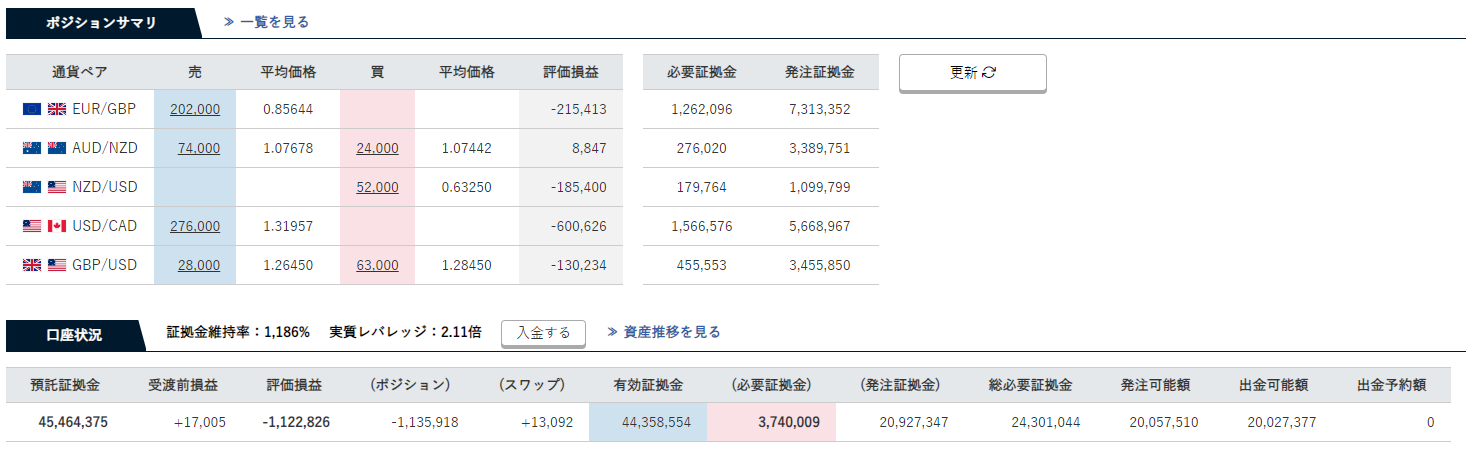

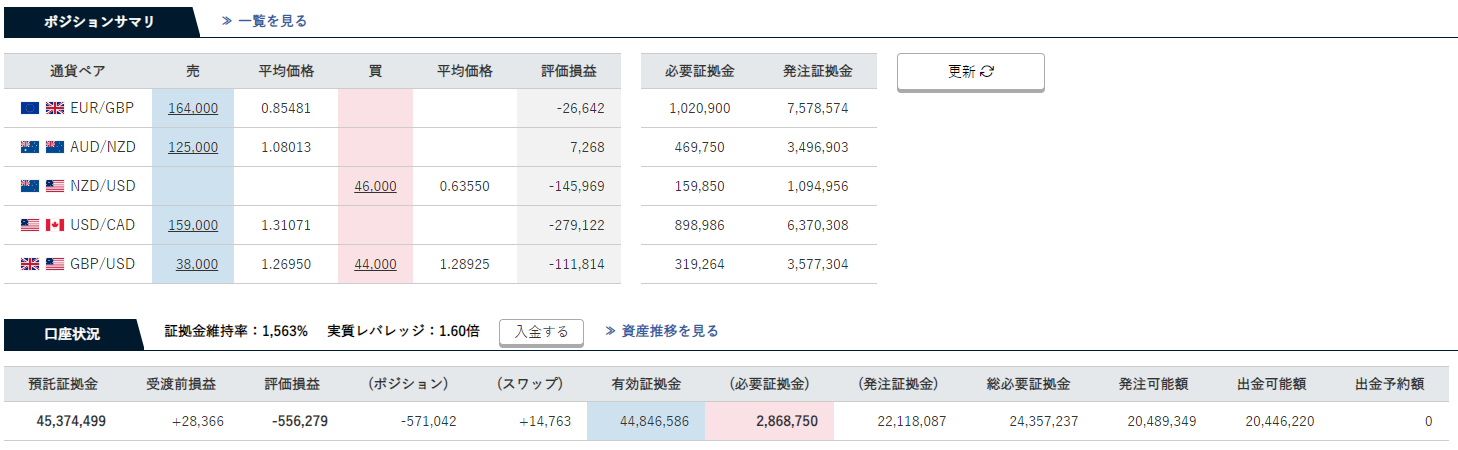

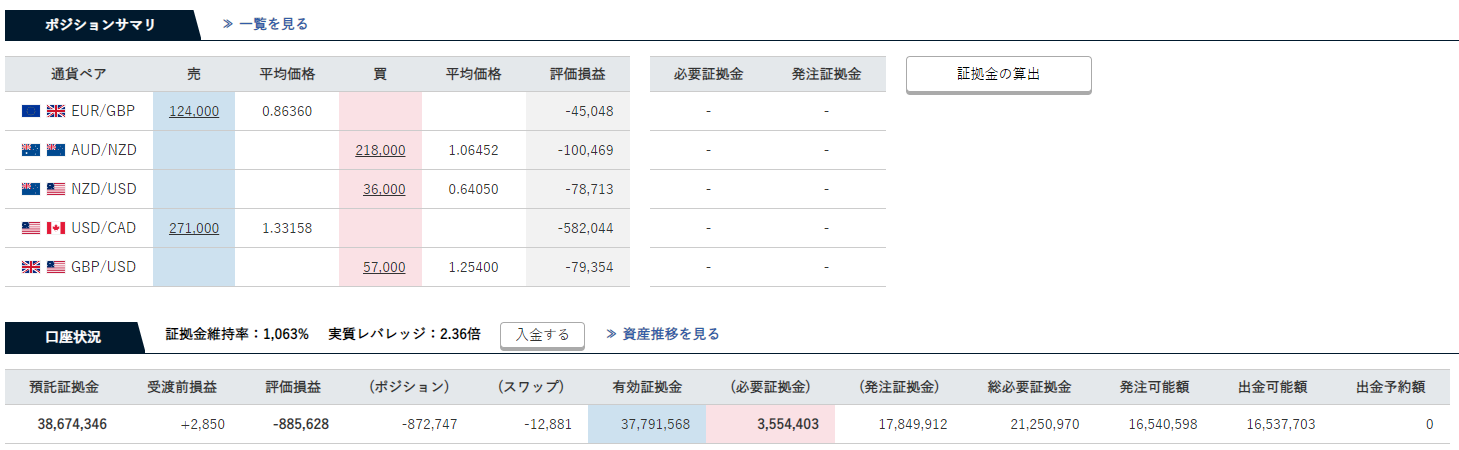

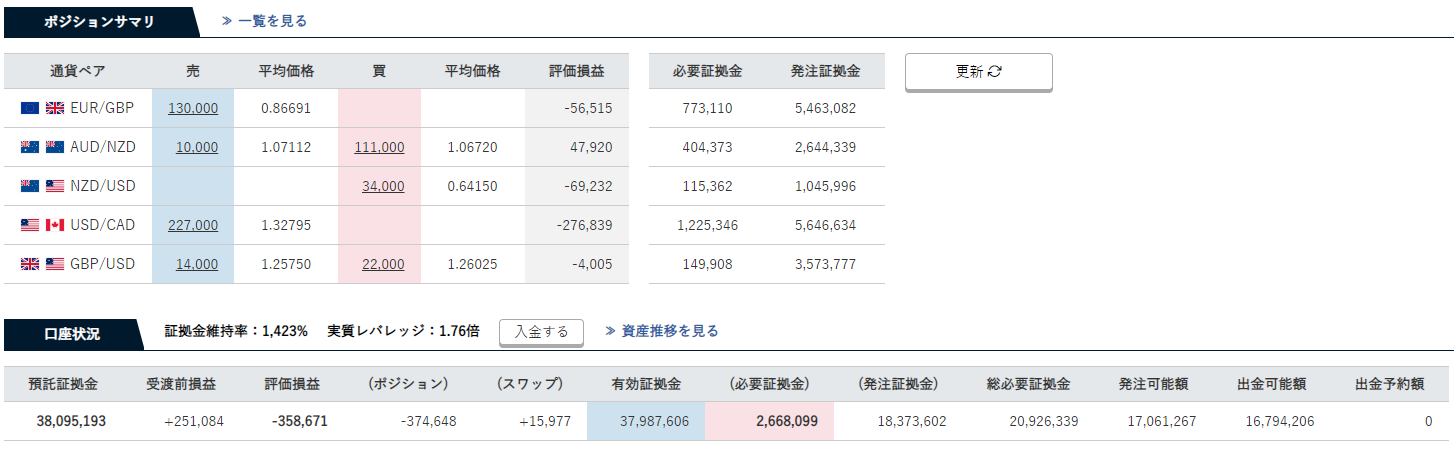

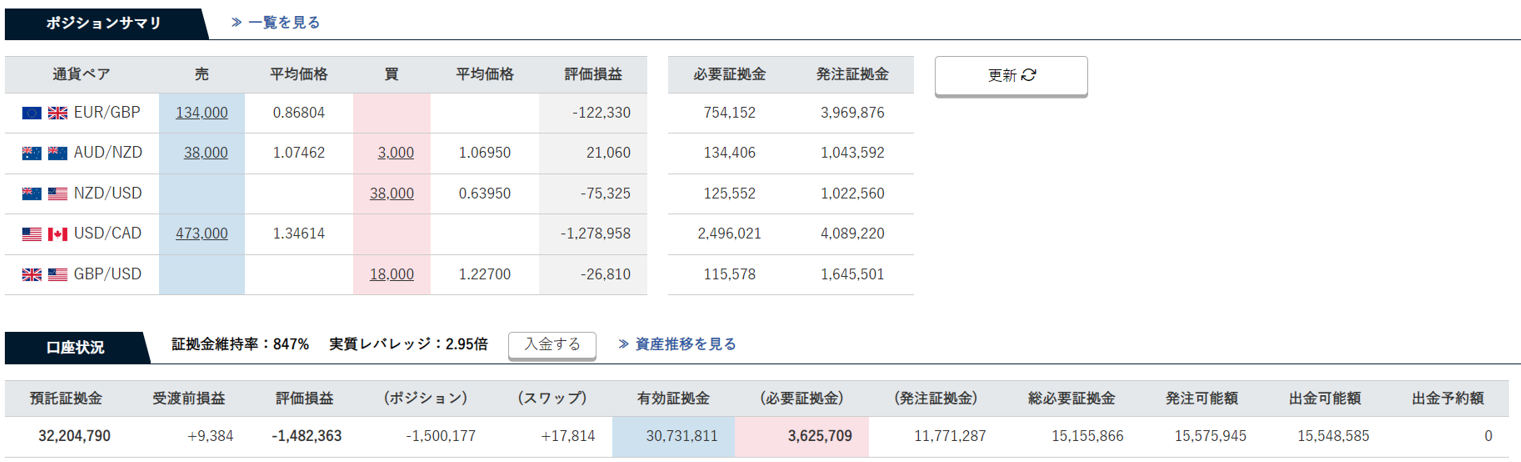

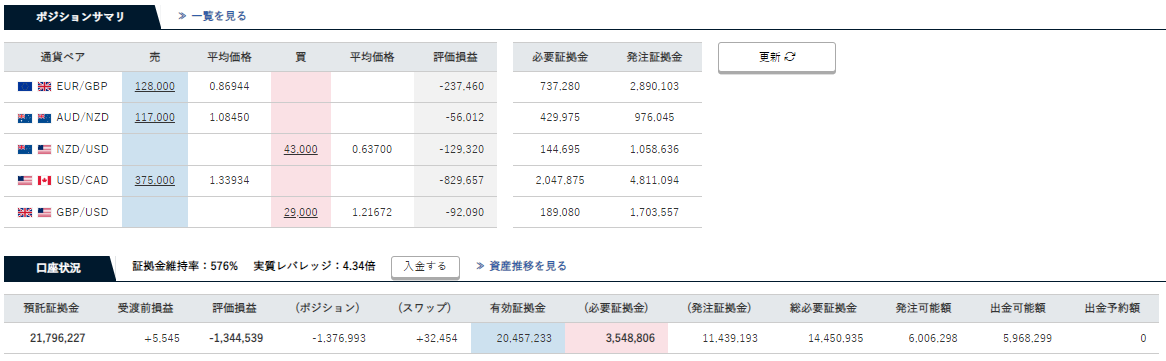

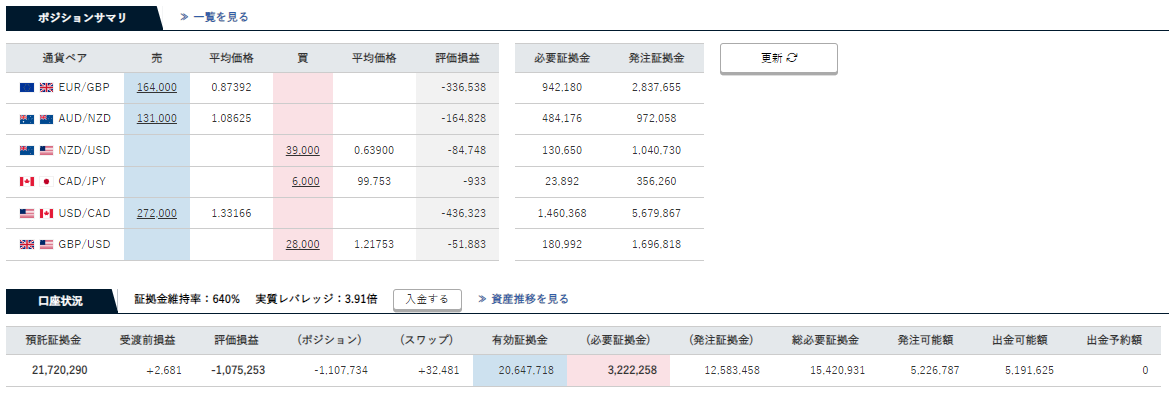

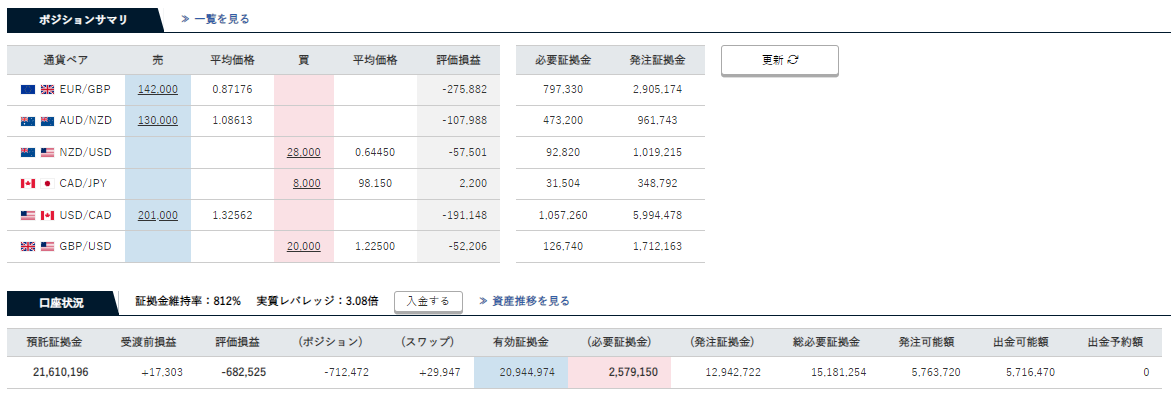

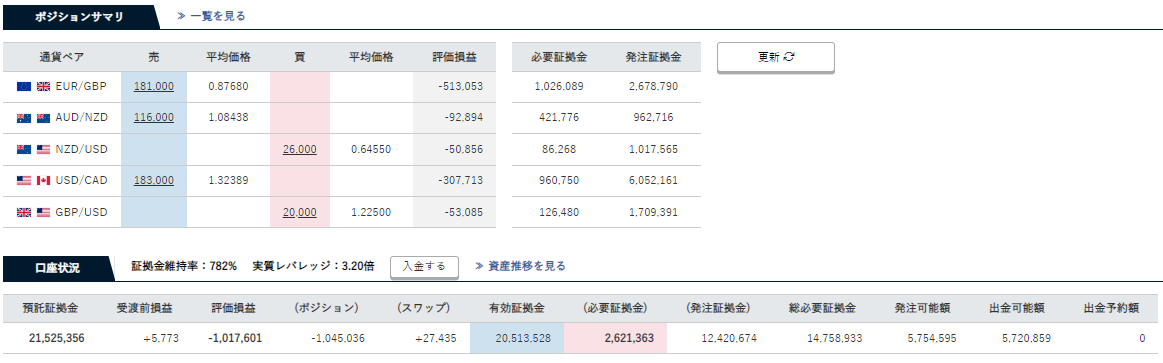

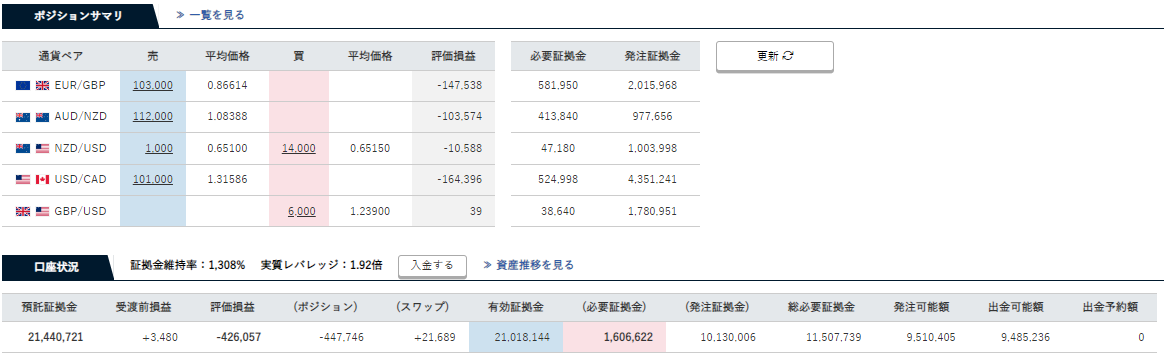

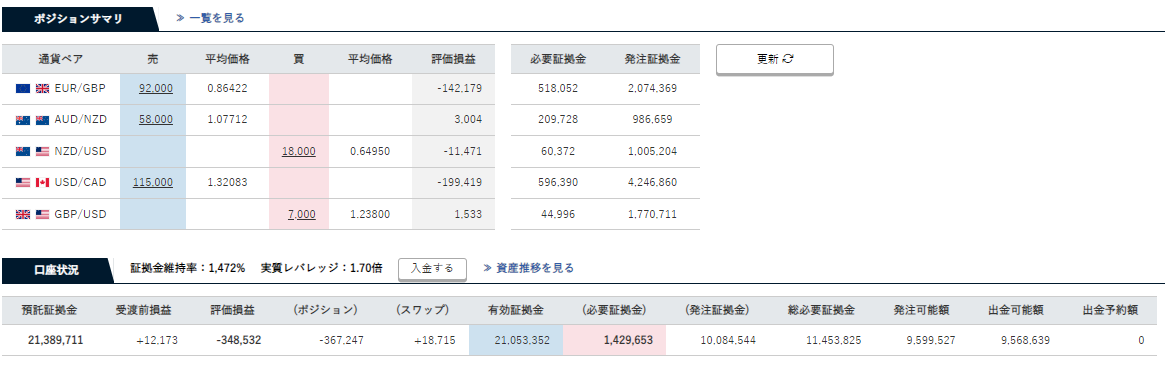

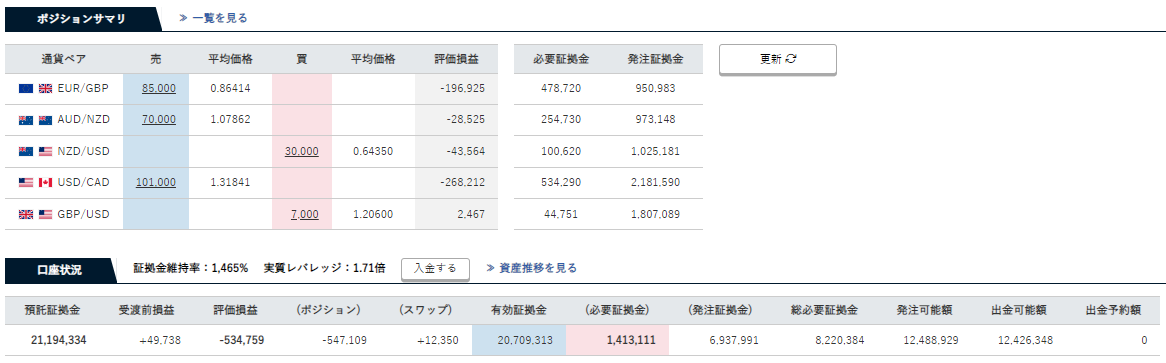

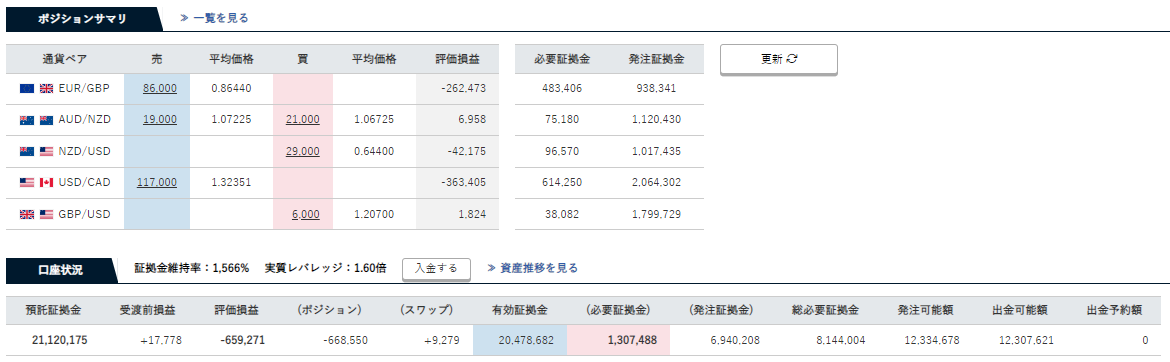

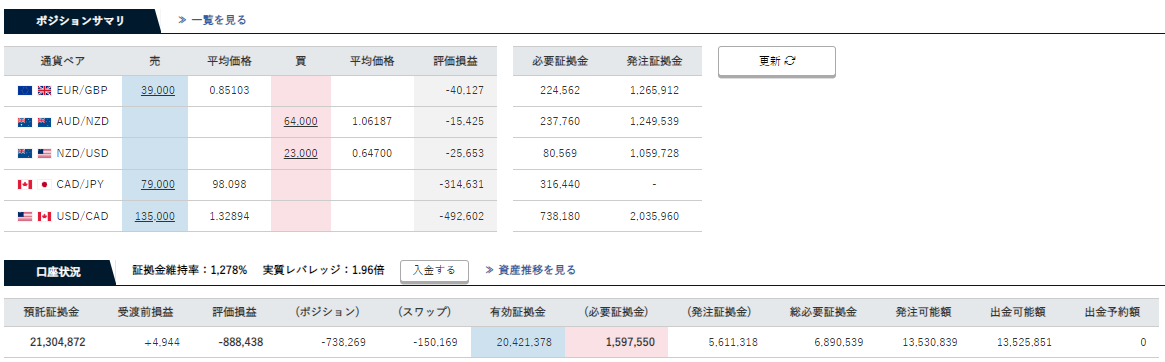

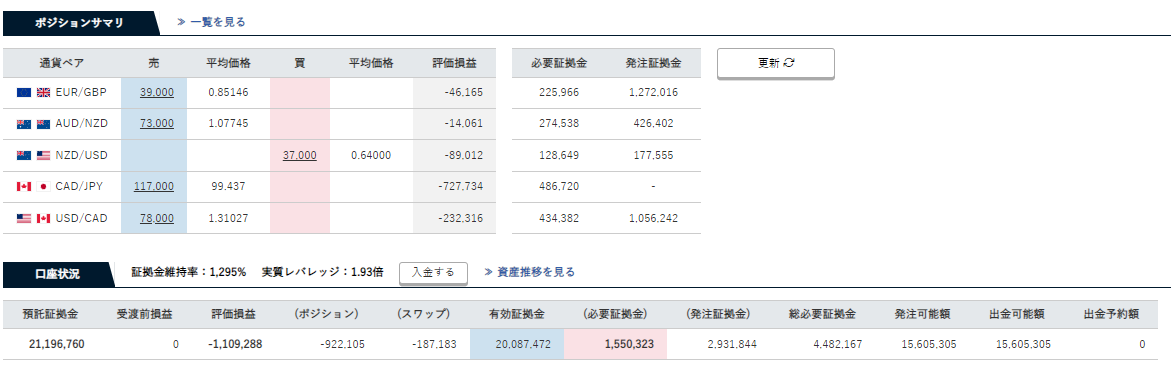

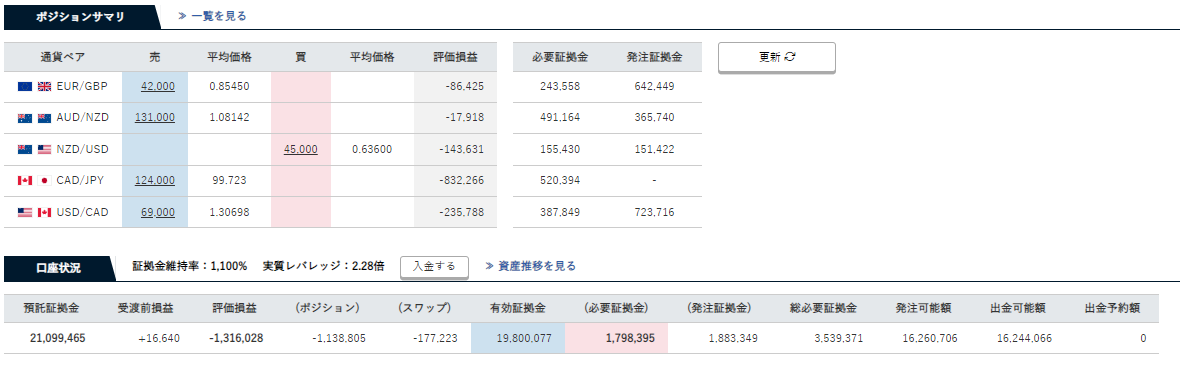

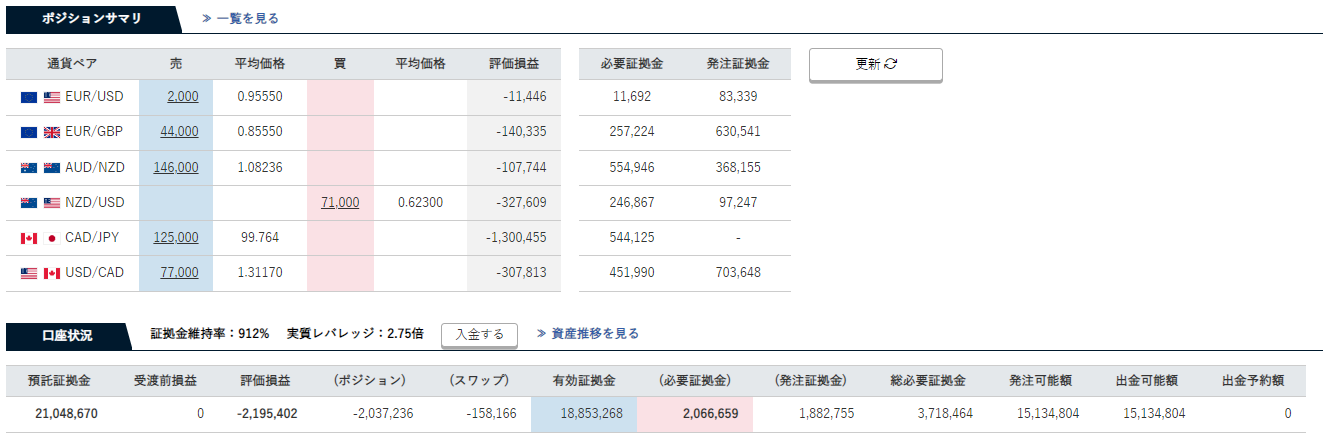

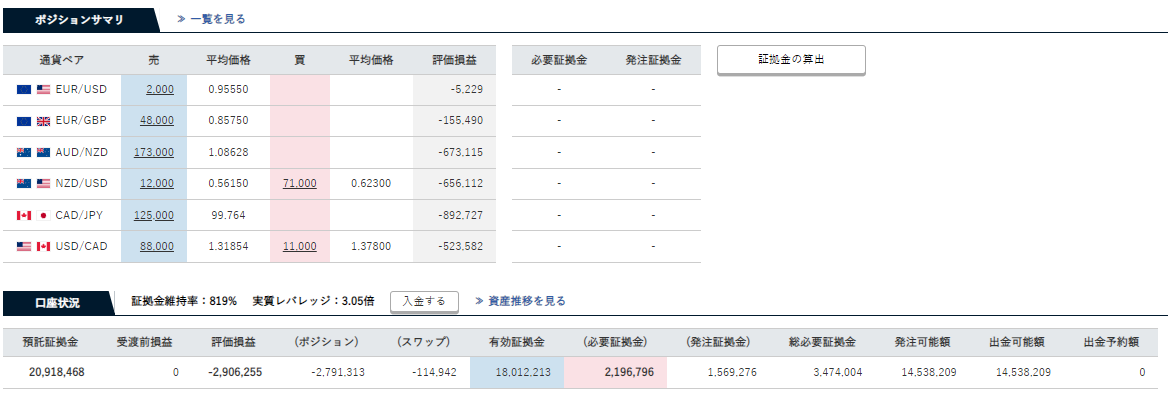

Position Summary of Traripi

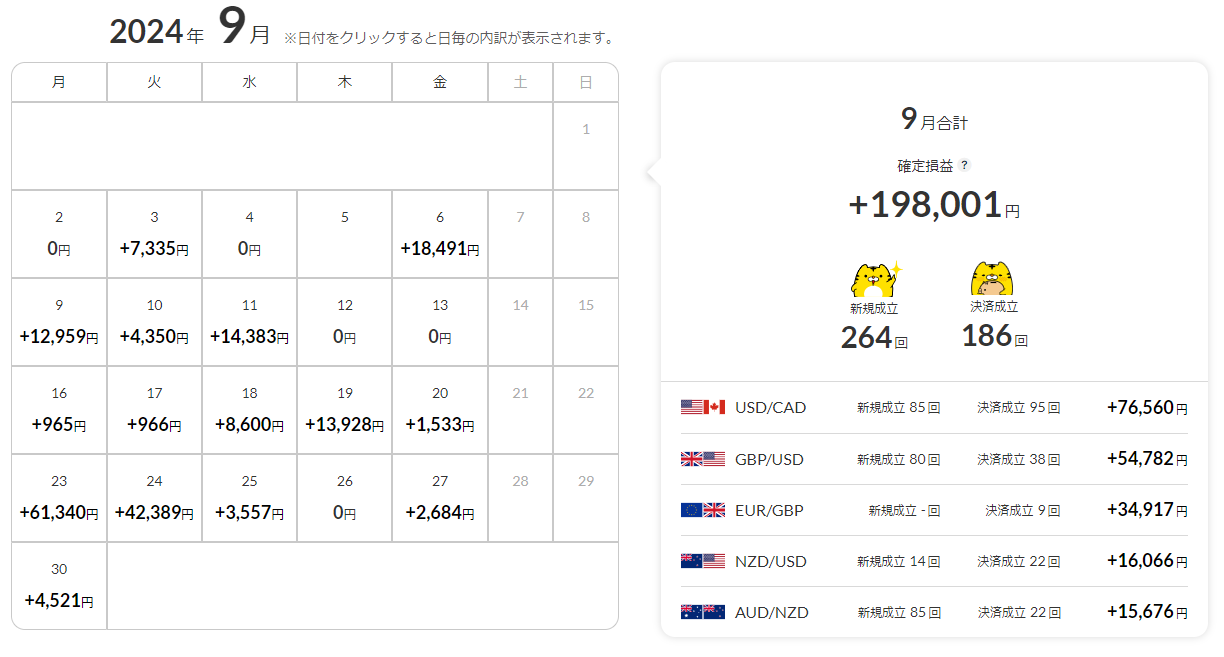

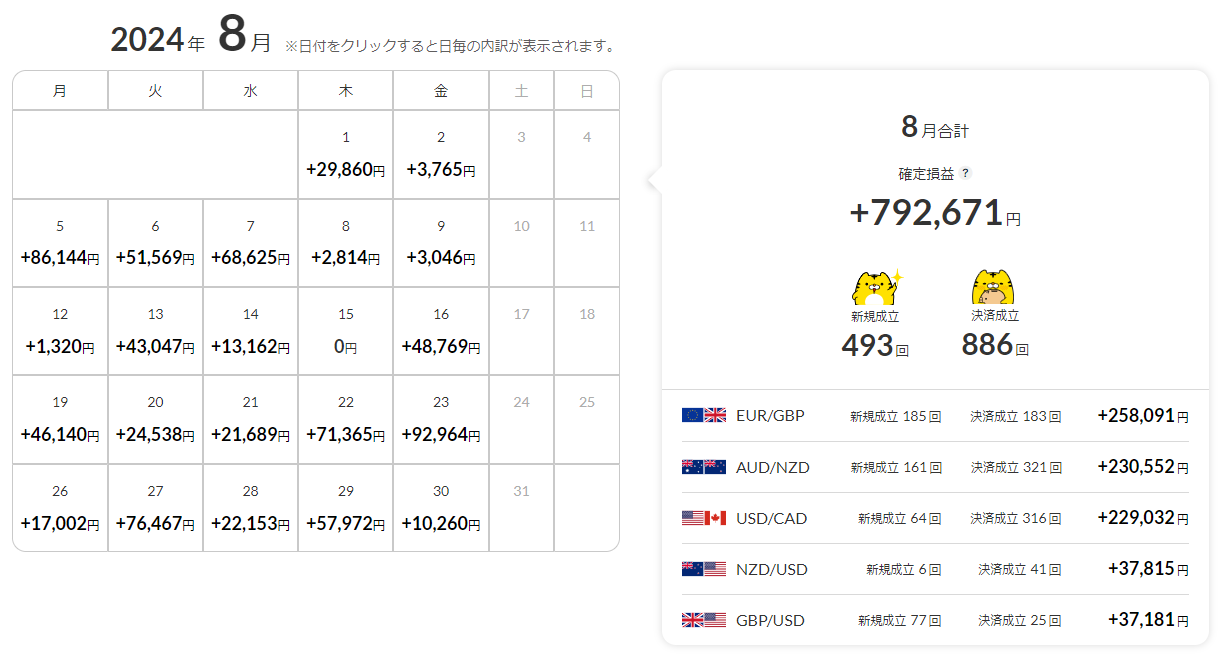

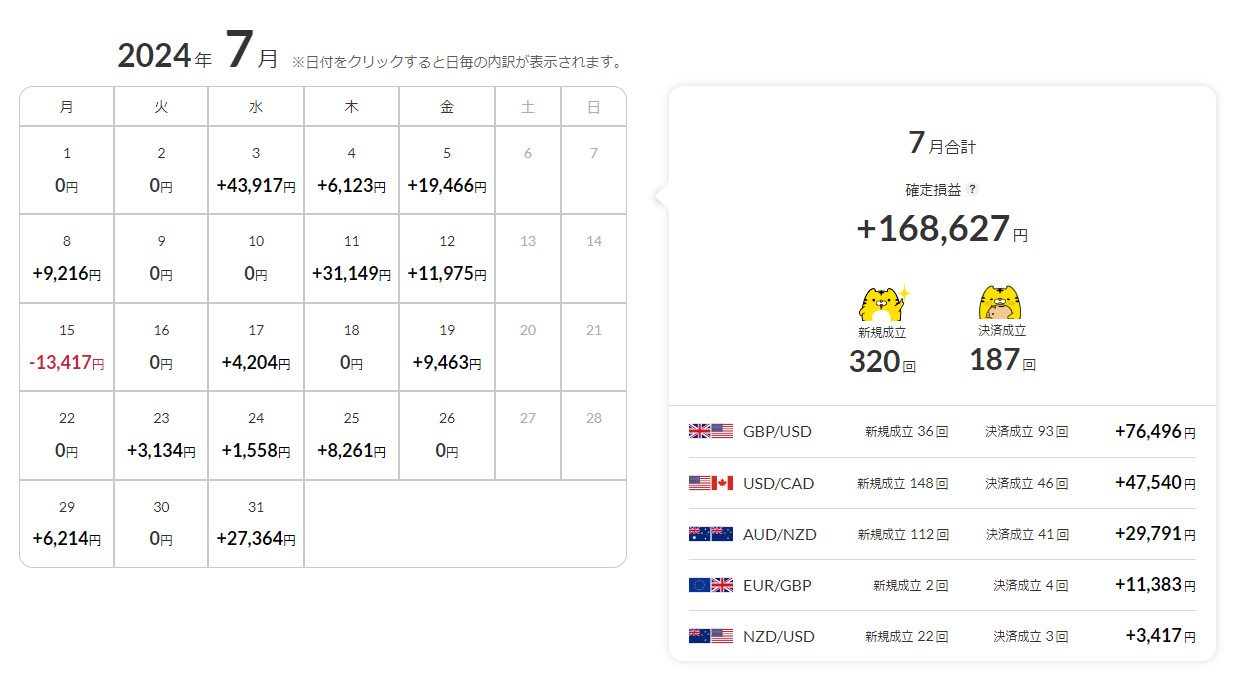

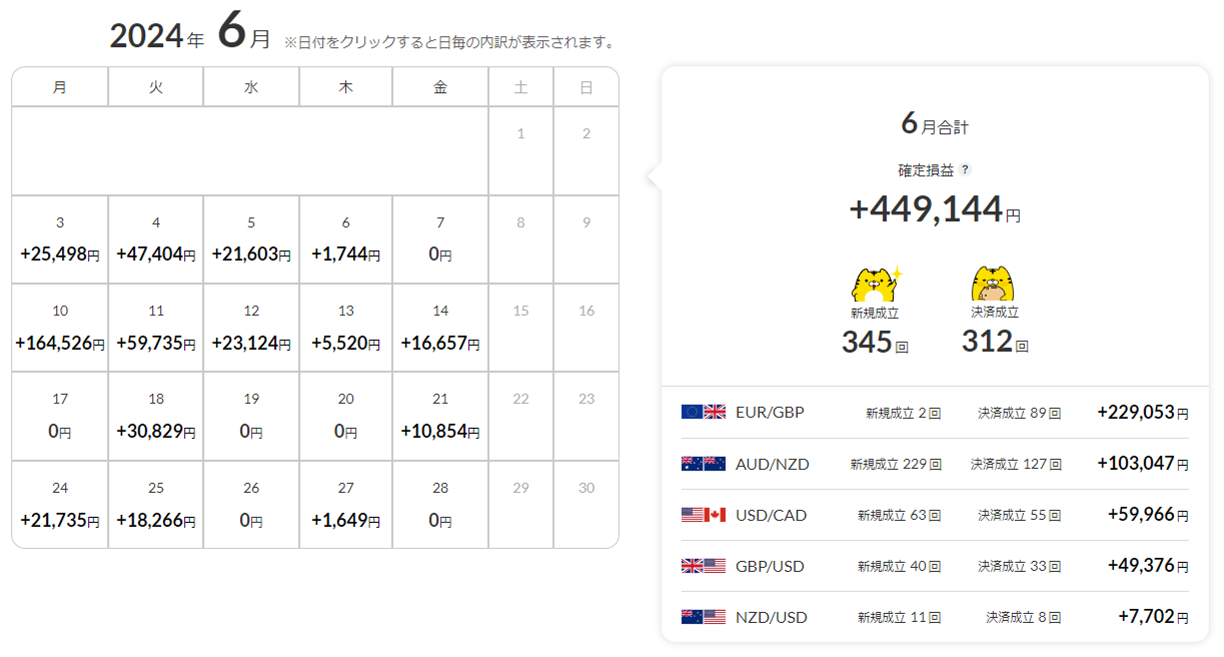

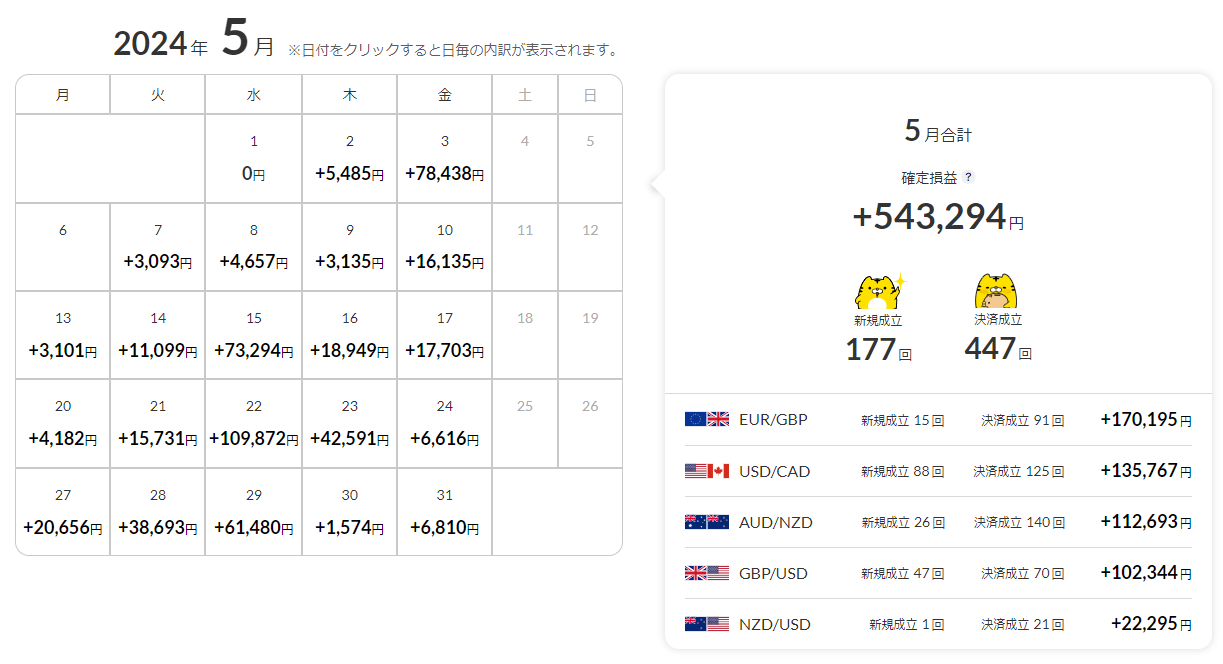

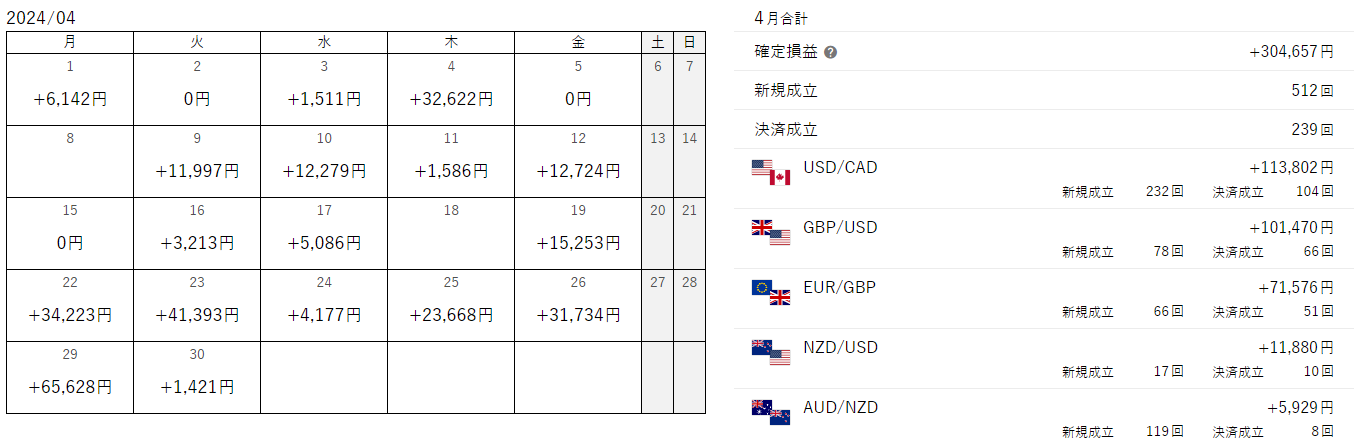

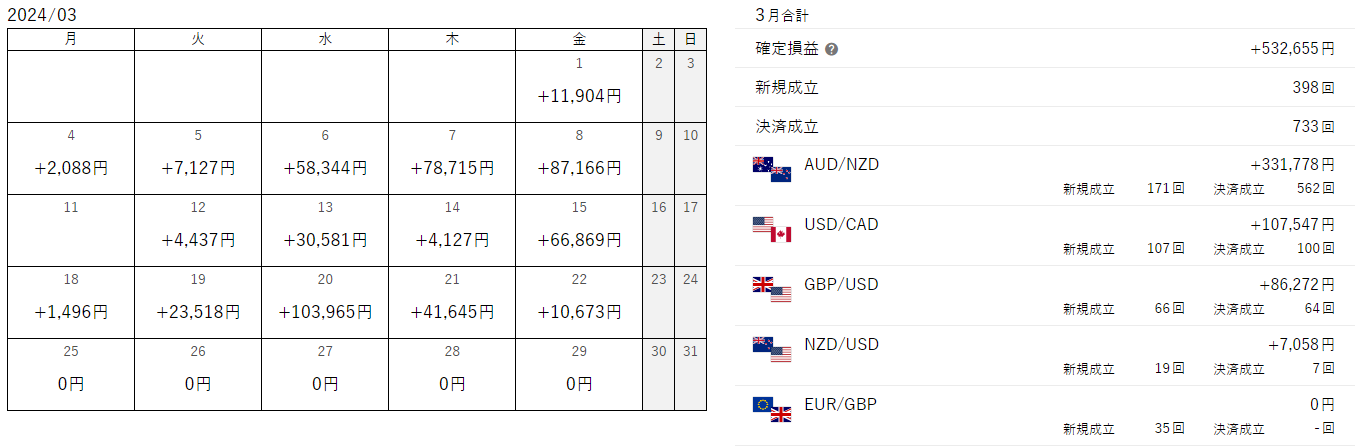

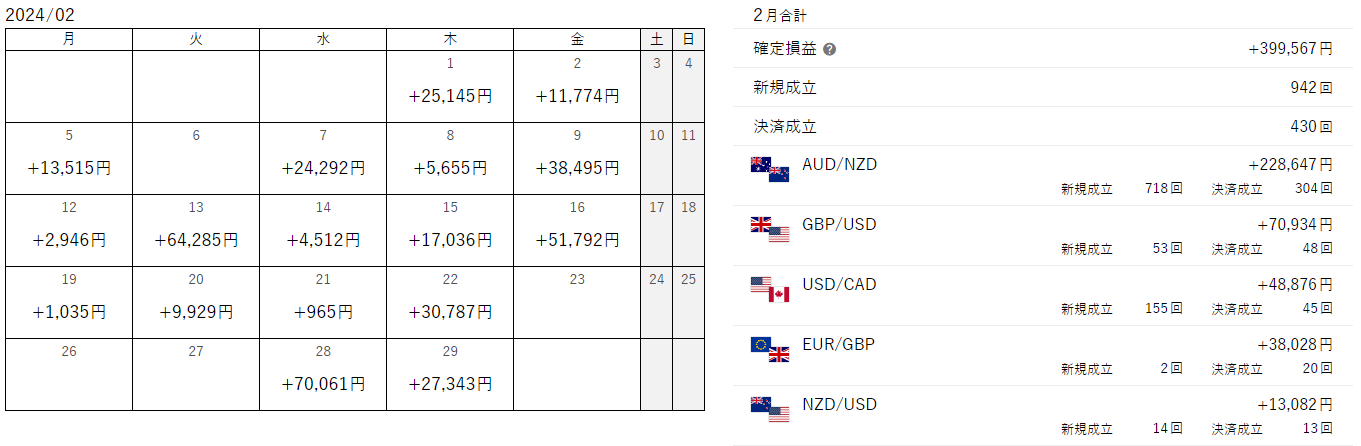

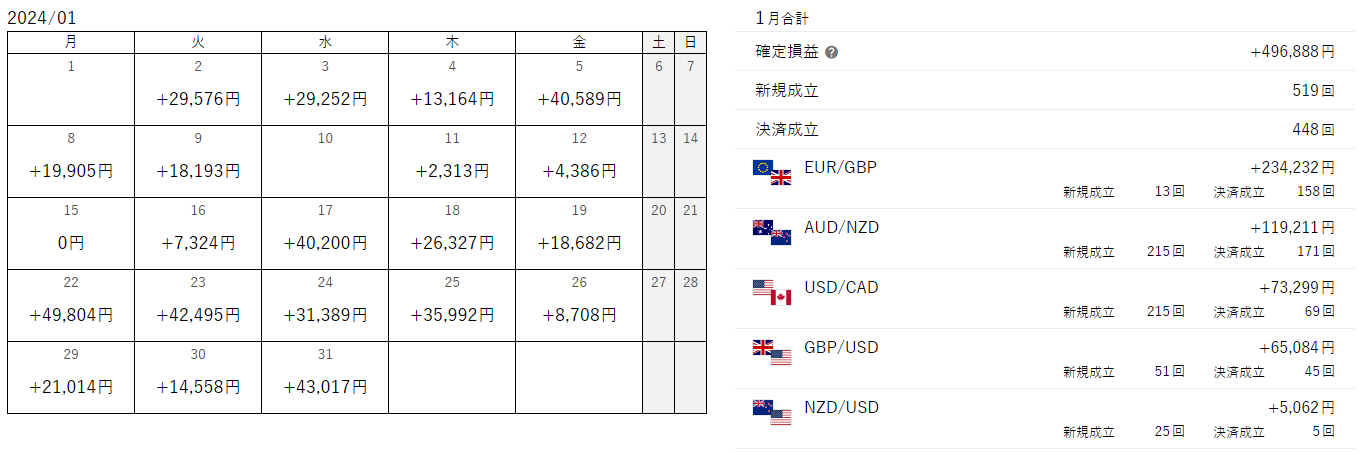

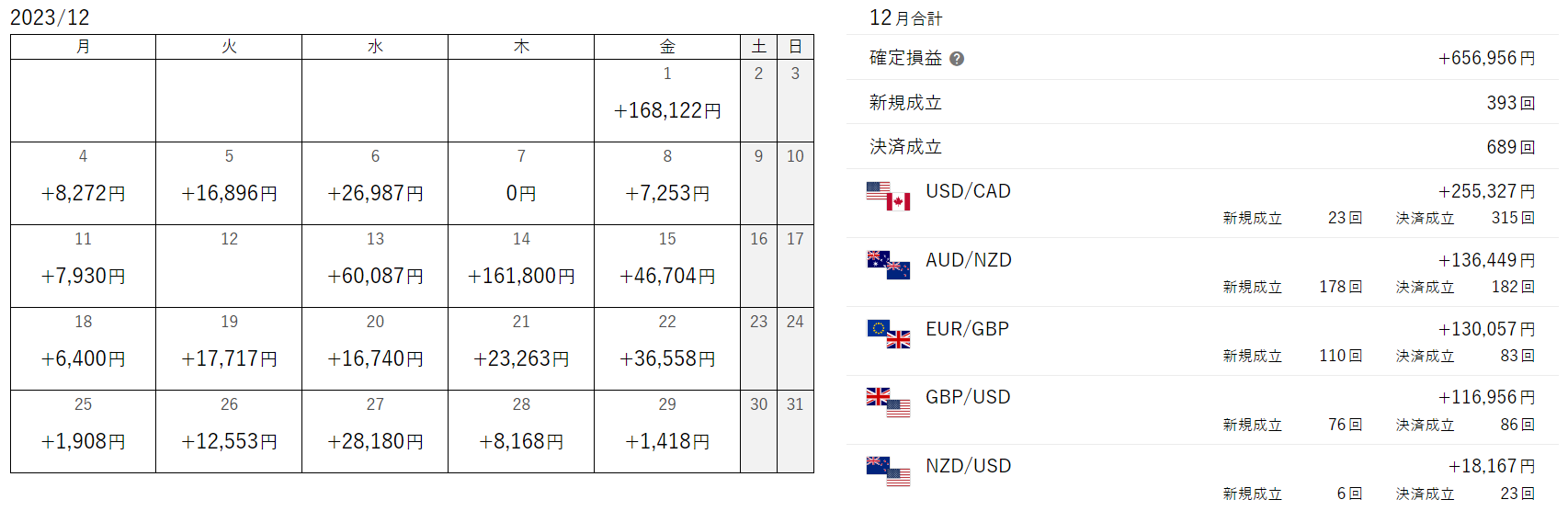

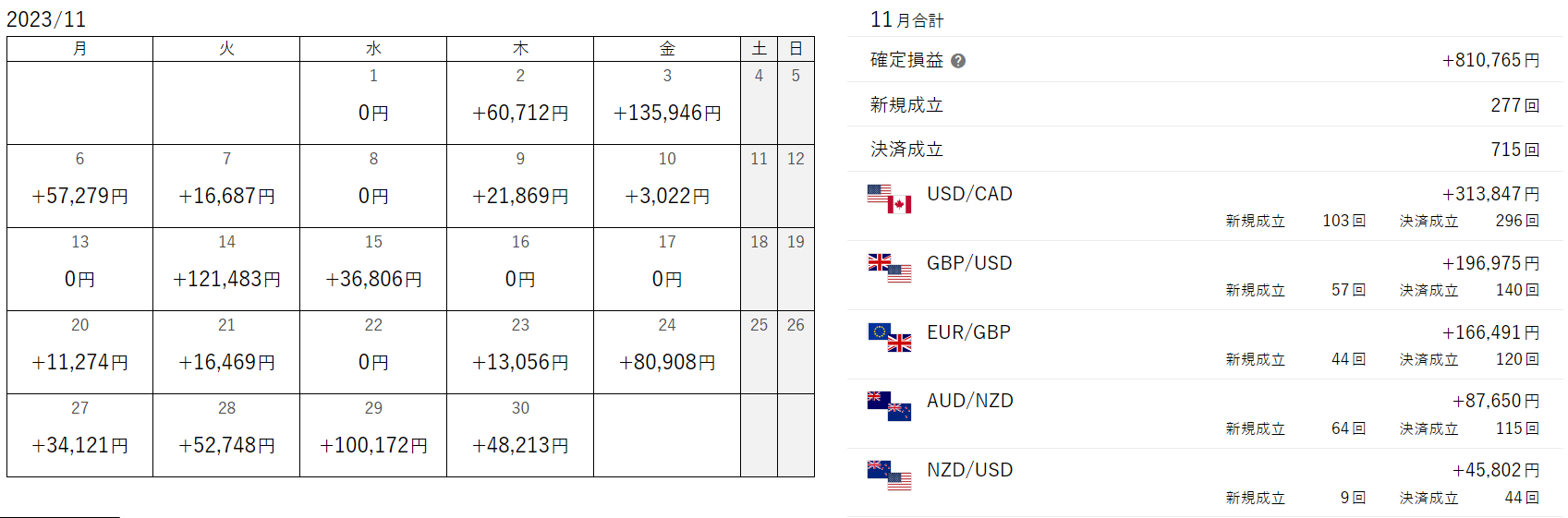

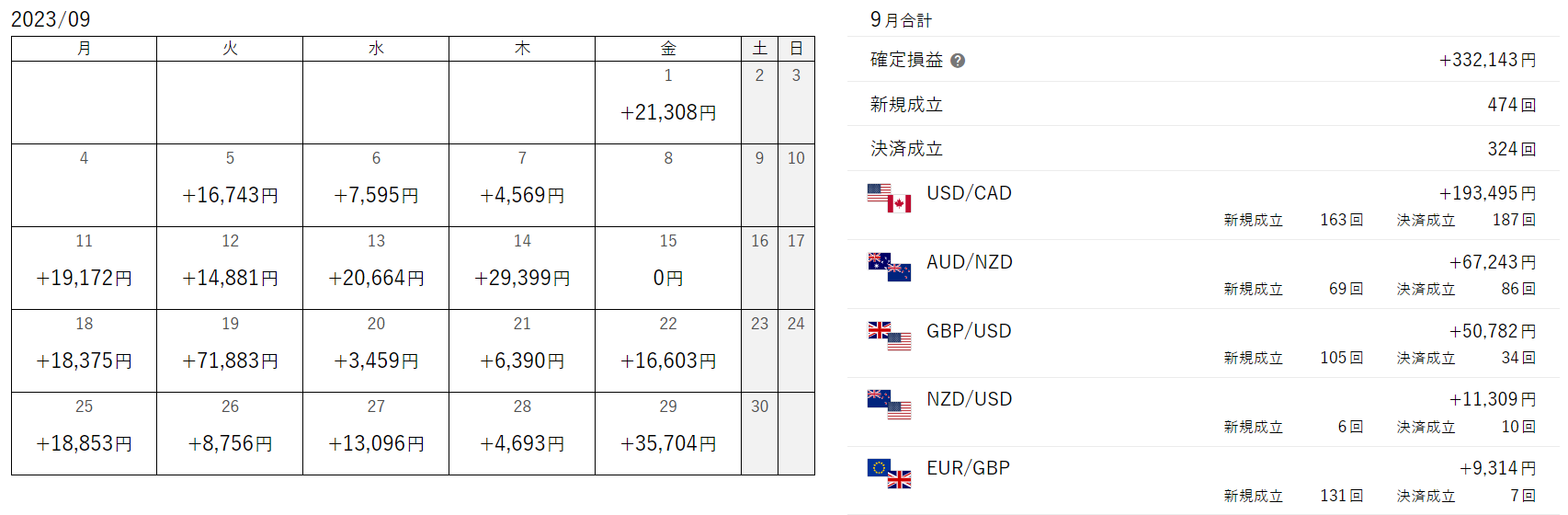

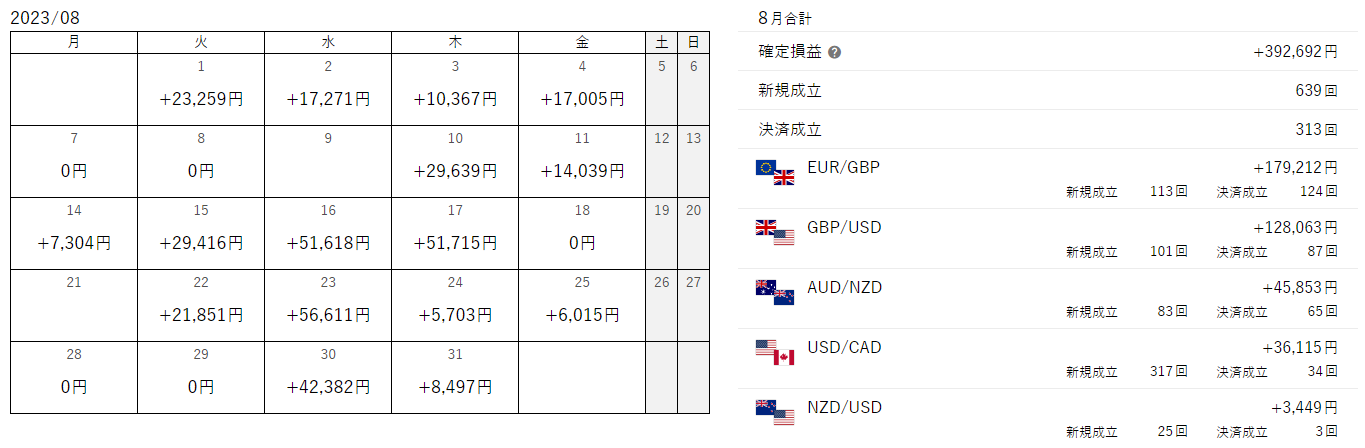

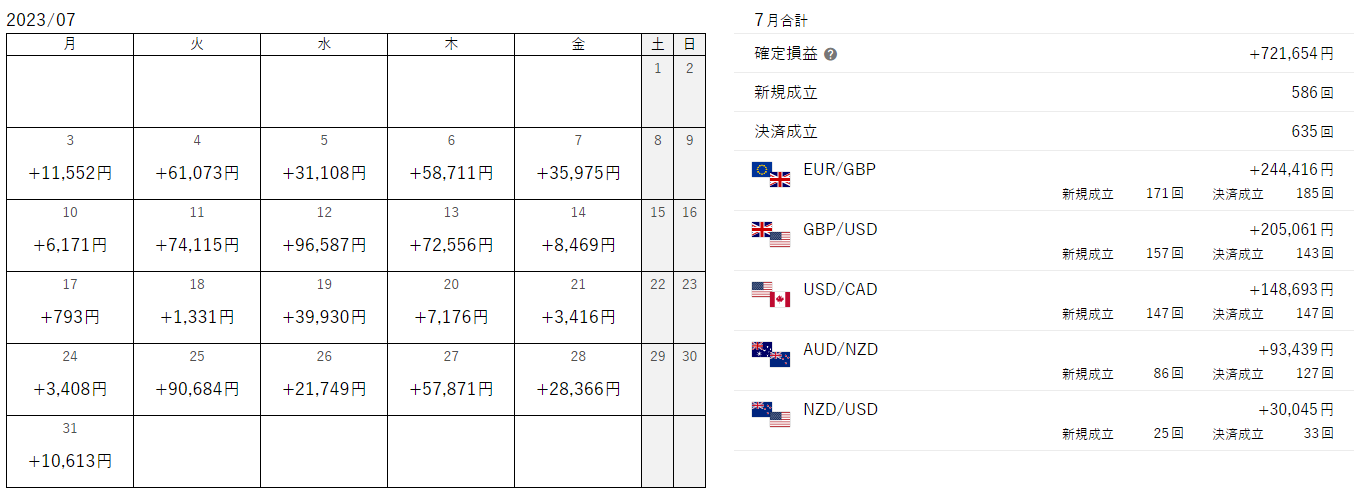

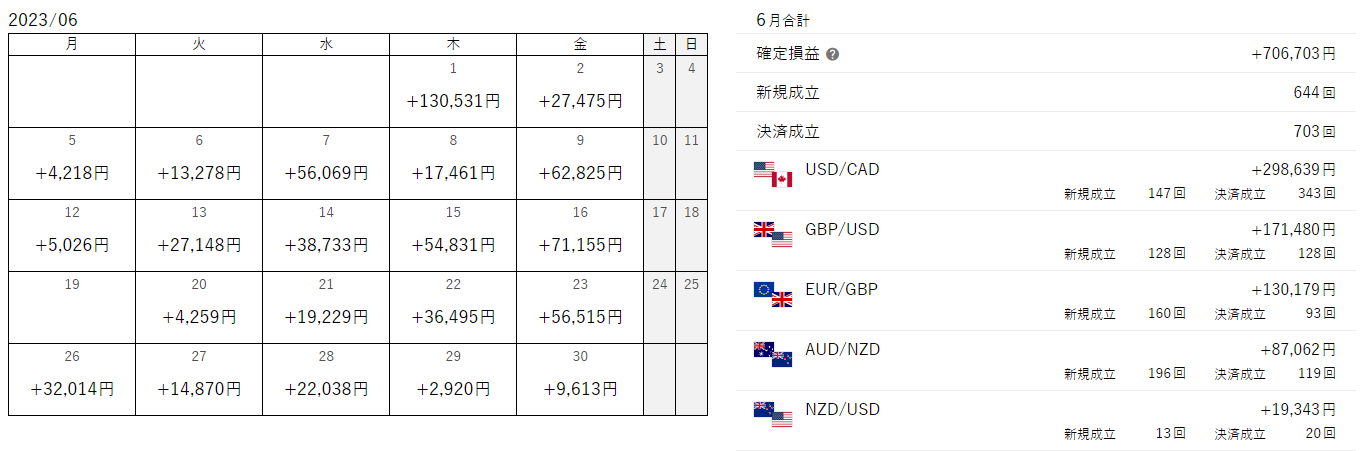

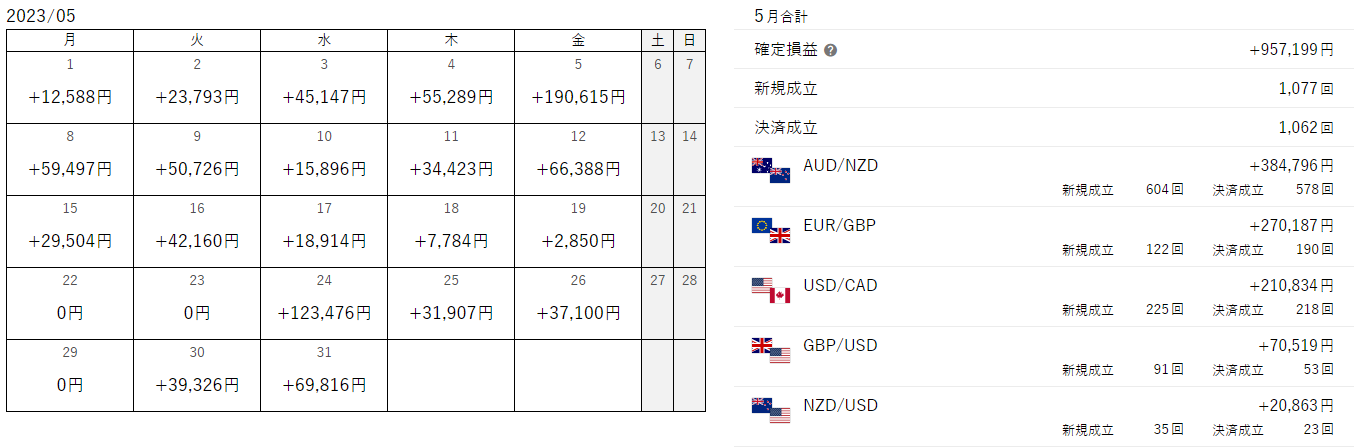

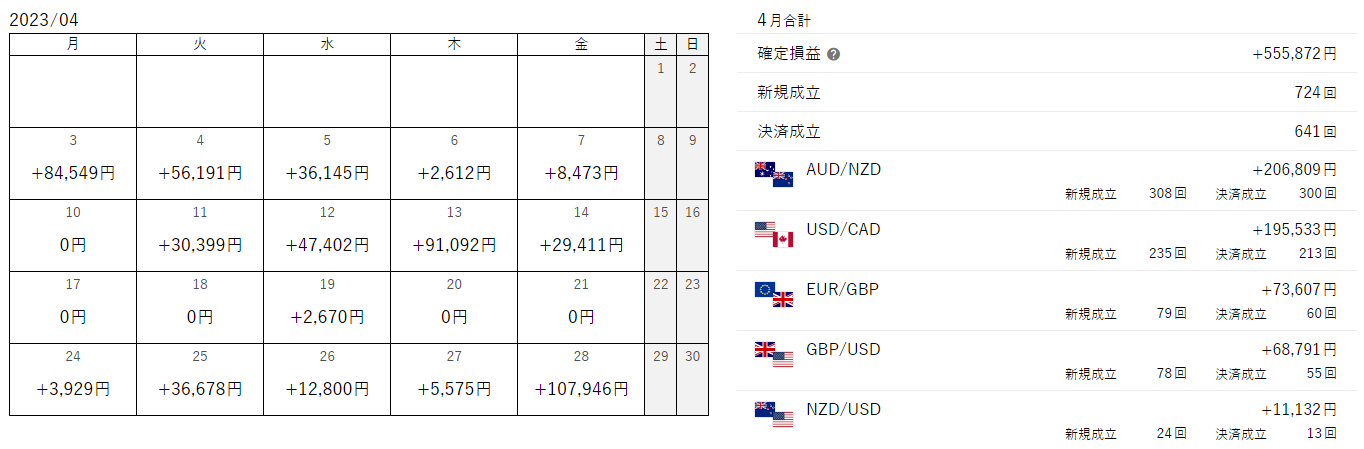

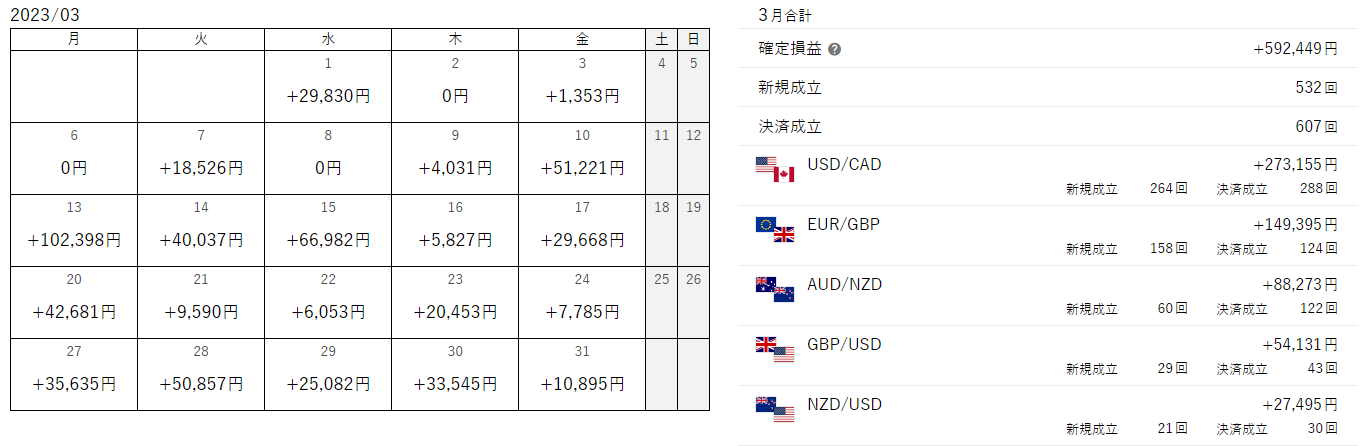

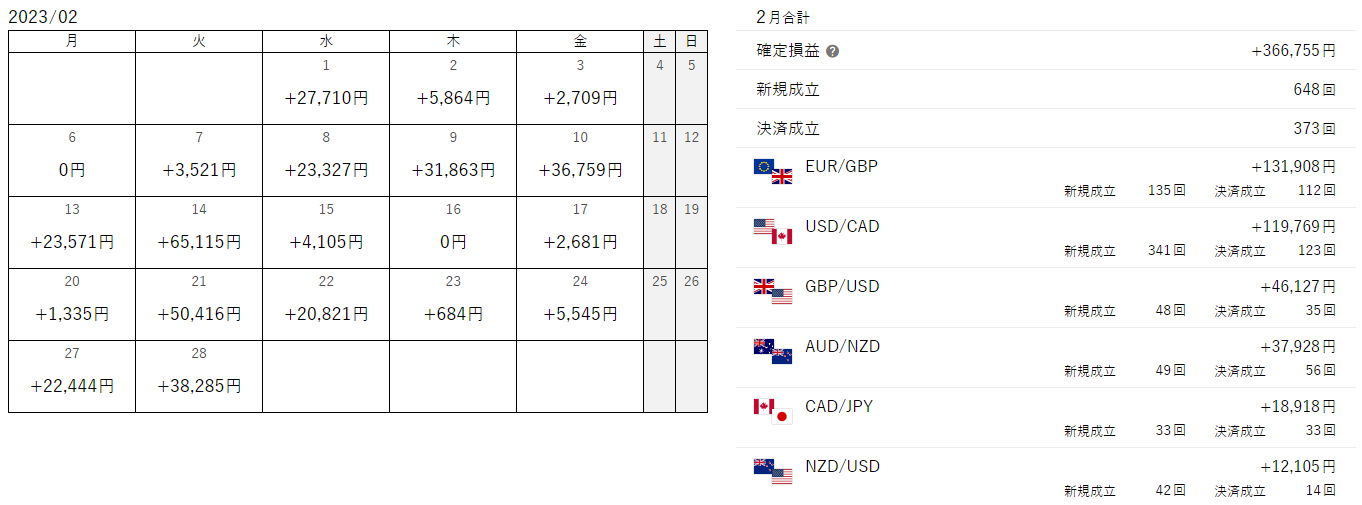

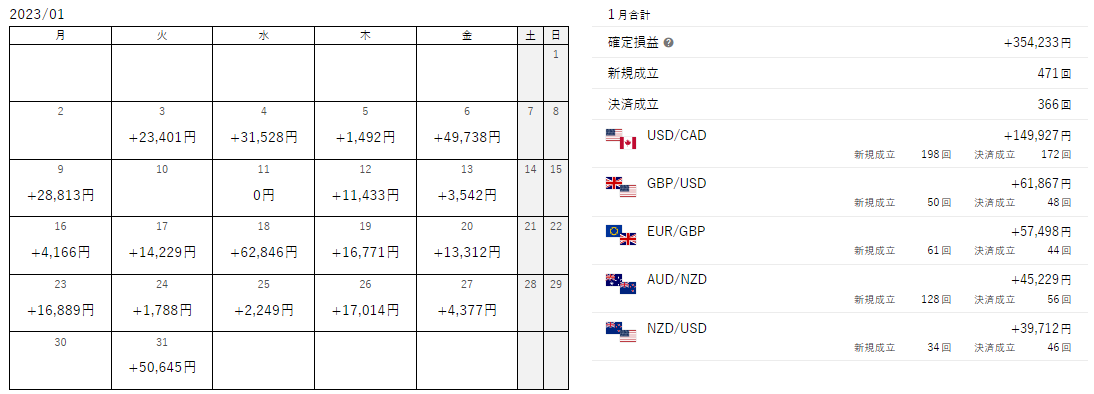

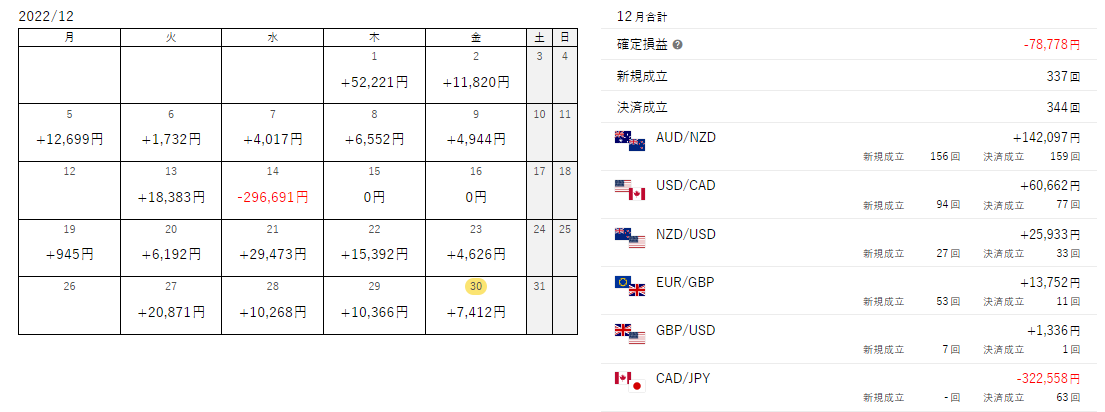

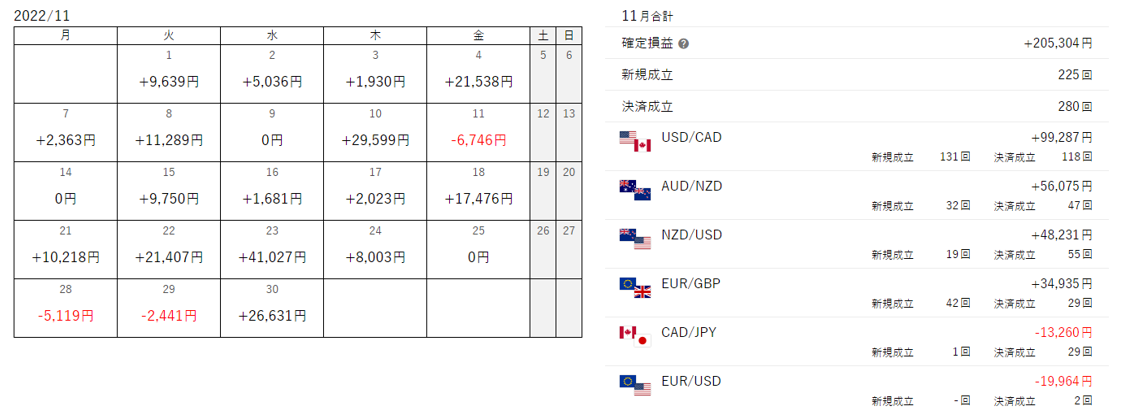

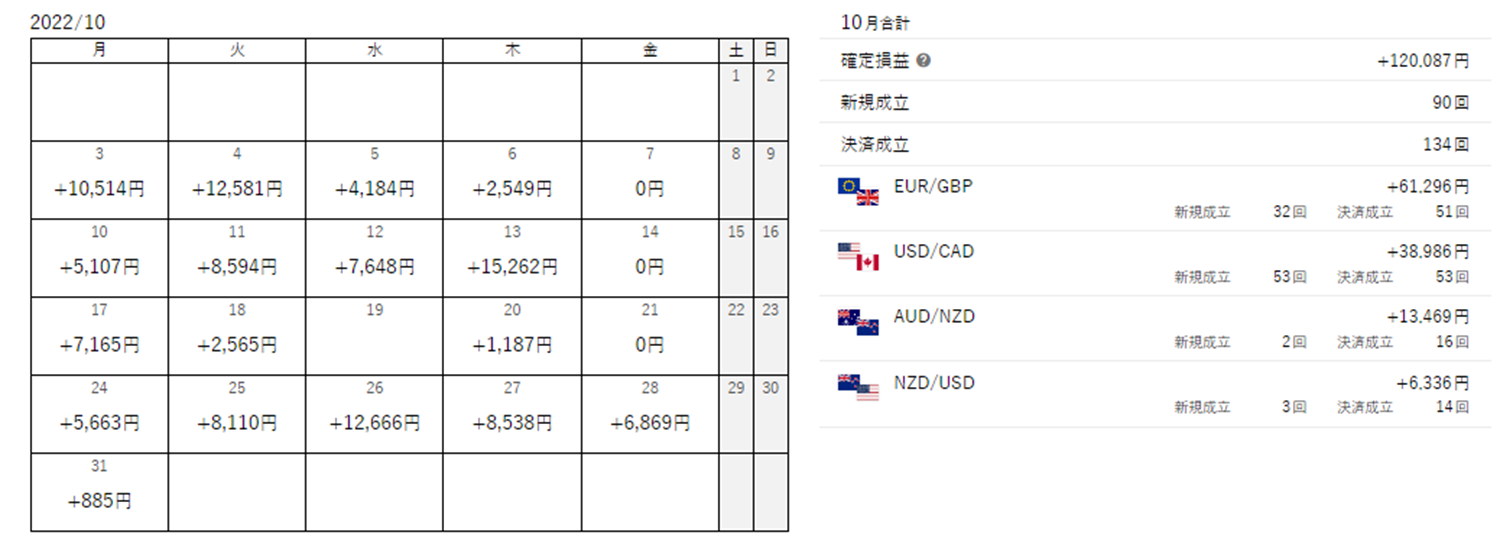

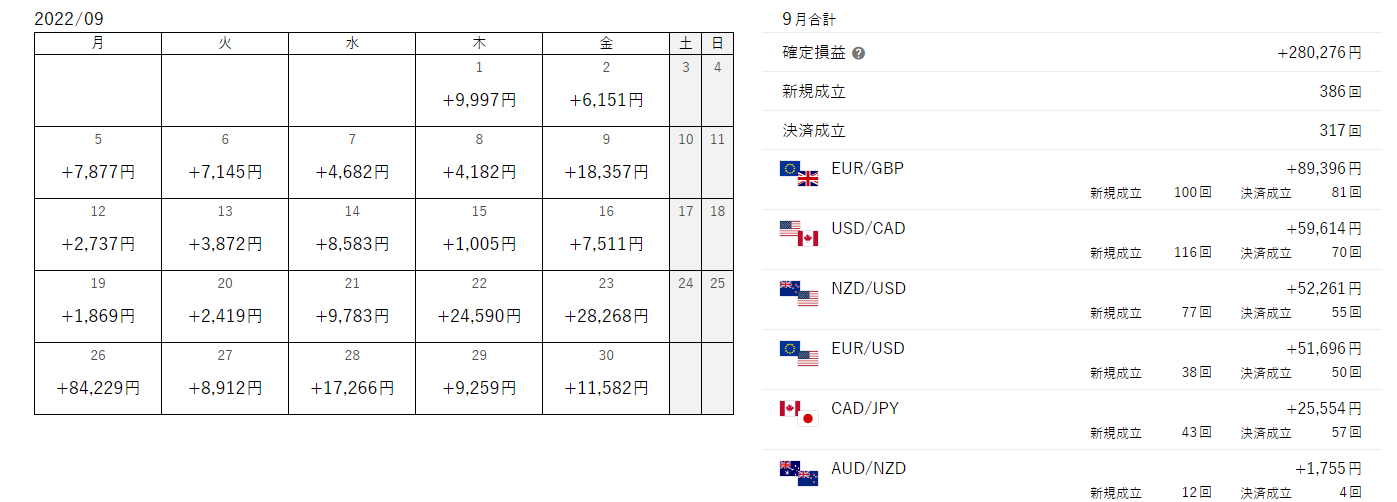

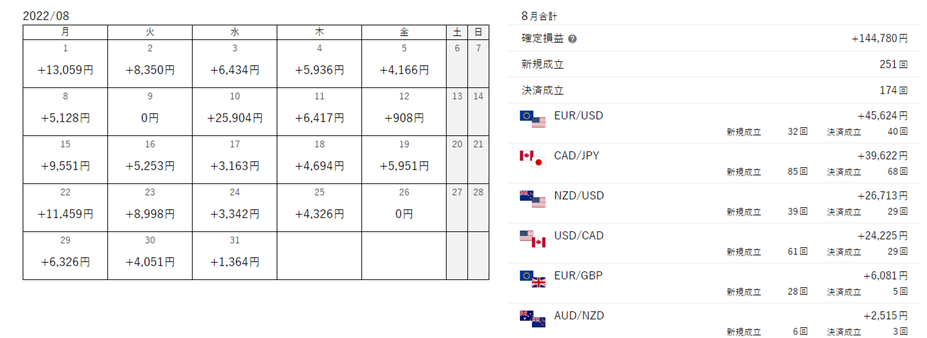

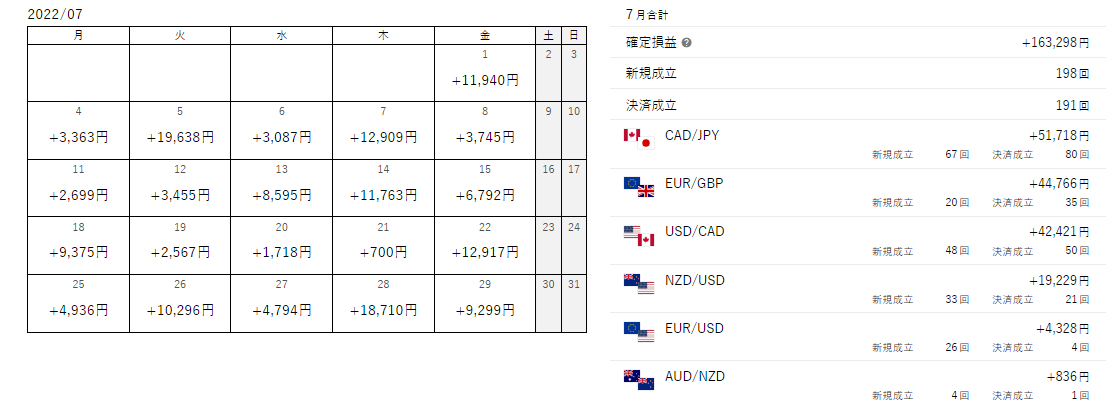

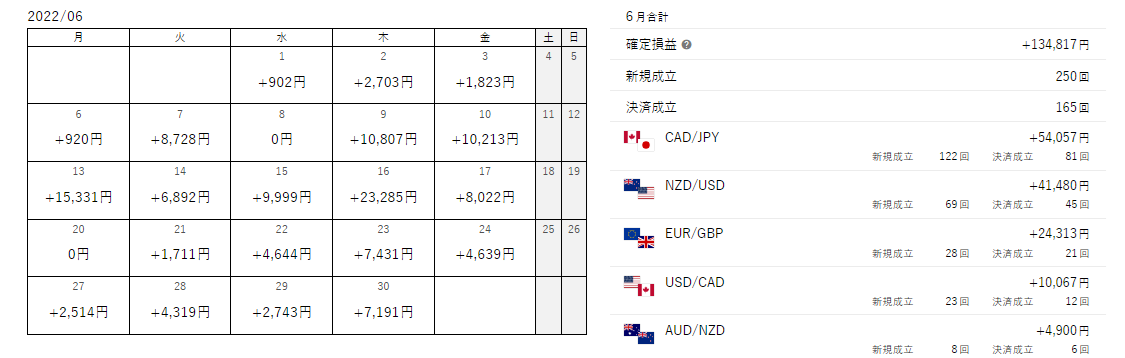

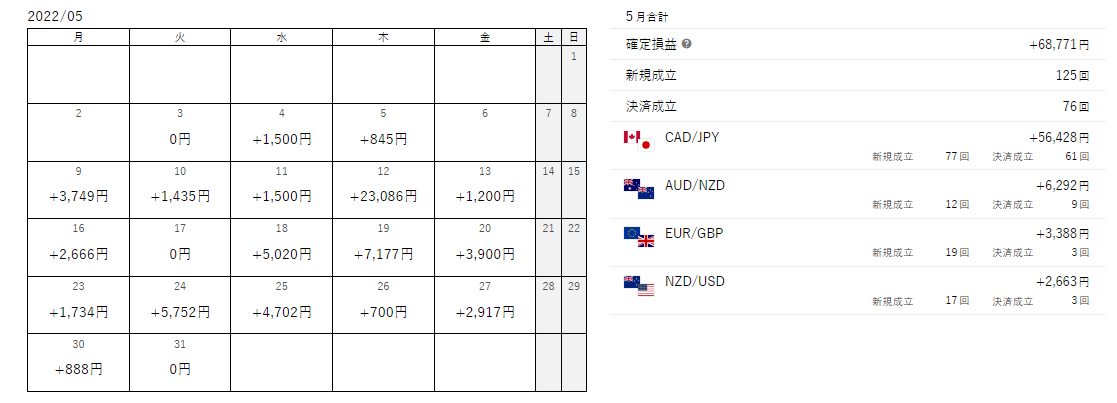

Establishment calendar of Traripi

Latest Settings

I am summarizing the settings of active currency pairs for my own reference.

In addition, I am learning every day by looking at the settings of many people who publish information on the Internet (regardless of the amount of investments). Therefore, I am also sharing my settings.

(I would like to give back to everyone who disclose their information.)

However, I cannot guarantee the performance with my settings. So please invest at your own risk.

I deleted all the setting descriptions as there are many temporary changes and I wiil made more changes going forward. (You can check the past logs if you are interested in my old settings.)

Updates of The Week

- Here is the sammary of the changes done on Nov 5th, 2024.

- USD/CAD Sell

- Thined out some traps again. This measure was taken in response to concerns about the rise in the USD prior to the presidential election.

- USD/CAD Sell

There are no cross-yen currency pairs currently.

Operational Policy

- Avoid settings that make me nervous and unable to sleep. NOT to be ejected from the Forex market.

- Avoid loss cutting even in the worst case simulation

- When adding traps or making changes, iterate simulation always.

- Avoid extremely high negative swap points

- Given the risk of holding positions for a long period of time, I am avoiding extremely high negative swap points.

- I am trading currency pairs with some negative swaps, but it is desirable to have a little positive swap points overall.

Settings under Consideration

CAD/JPY - Withdrawn temporarily

CAD/JPY has become the biggest loss cut in my history.

I suffered from negative swaps for a long time, but when it fell below 100 yen in mid Dec, 2022, I did a loss cut.

I think the next entry point will be when the JPY becomes stronger and it is easy to buy it.

EUR/USD - Withdrawn temporarily

I would like to set selling to avoid negative swaps, but it is not the time and I have temporary withdrawn from this currency pair.

I think the entry by selling should exceed 1.1. Ideally, above 1.2.

I will continue to check the chart and hope to resume when I have a good entry point. At that time, I would like to inform you here.

EUR/AUD

This pair is not for Traripi but for Triauto.

To avoid negative swaps with buying, I am waiting for the timing when I can enter from selling.

I see the border between selling and buying at about 1.55. I am thinking the entry with selling will be made after exceeding 1.6.

(Currently, the rate exceeds 1.6, but I am still monitoring the situation. The EUR interest rate is approaching it of the AUD, and if holding a short position for a long time, I am not sure if the positive swap will be maintained depending on the future interest rate situation.)

AUD/USD

When introducing NZD/USD, I also compared it with AUD/USD as they have close correlation. As AUD/USD has relatively high negative swap points for buying, the entry with selling was preferred, but it was not the timing.

Even if the correlation with NZD/USD is close, the countries are different from Australia and New Zealand, and it will diversify the risk somewhat.

Extra: GBP/AUD

As GBP/AUD is not handled by Traripi or Triauto, it is easily traded with automated trading. However, swap points are relatively low for both buying and selling as both currencies have similar interest, it is easy to trade this currency pair. To enter from selling with positive swap points, I am watching if it falls more. If the price is below 1.7, I will start to buy this pair.

I am thinking to use DMM or OANDA for this trade.

Extra: USD/CHF

Please see the latest USD?CHF post in this category for the latest status. As a profit has been made, I prepared a separate page.

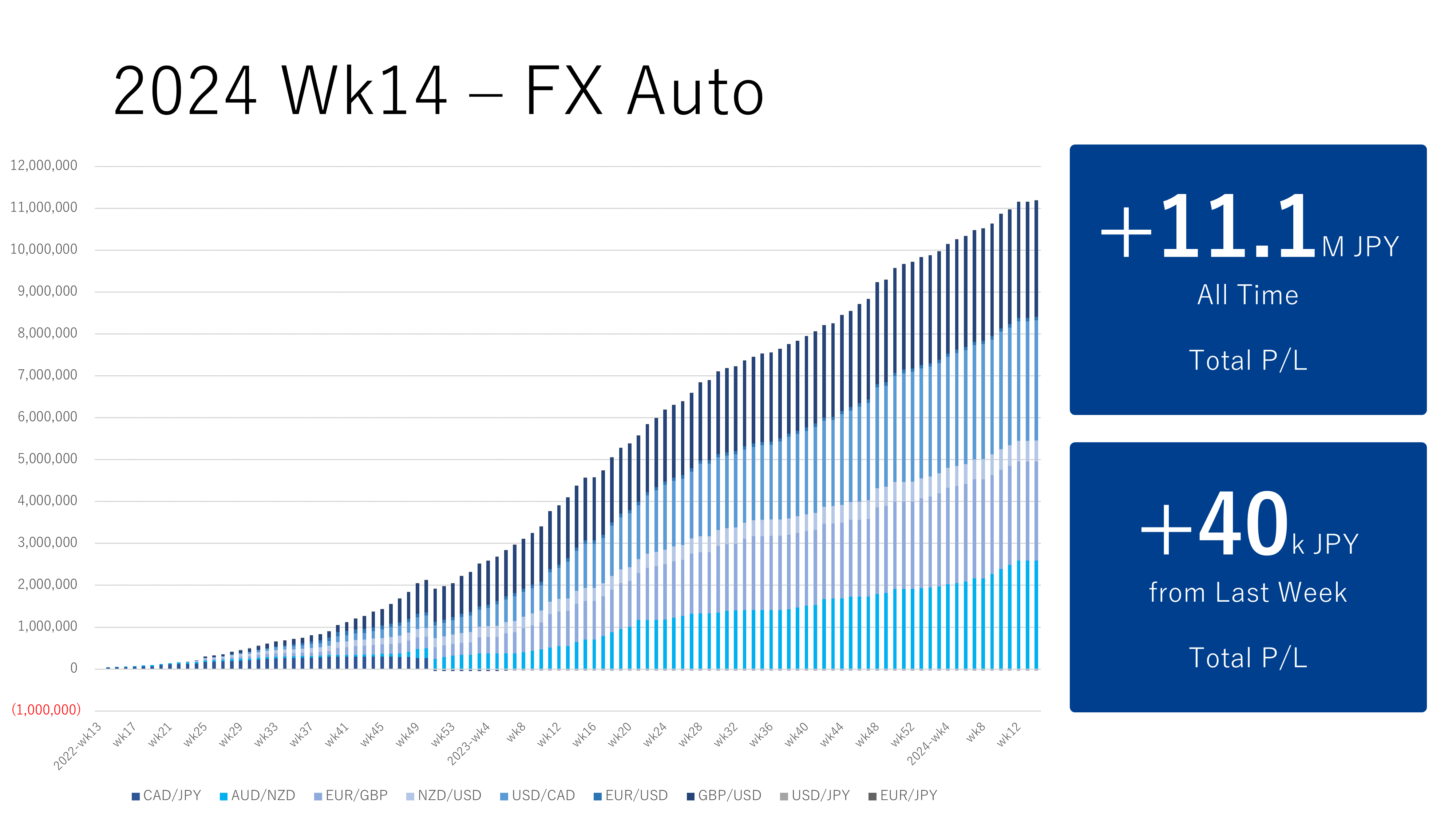

Milestones

JPY 10k

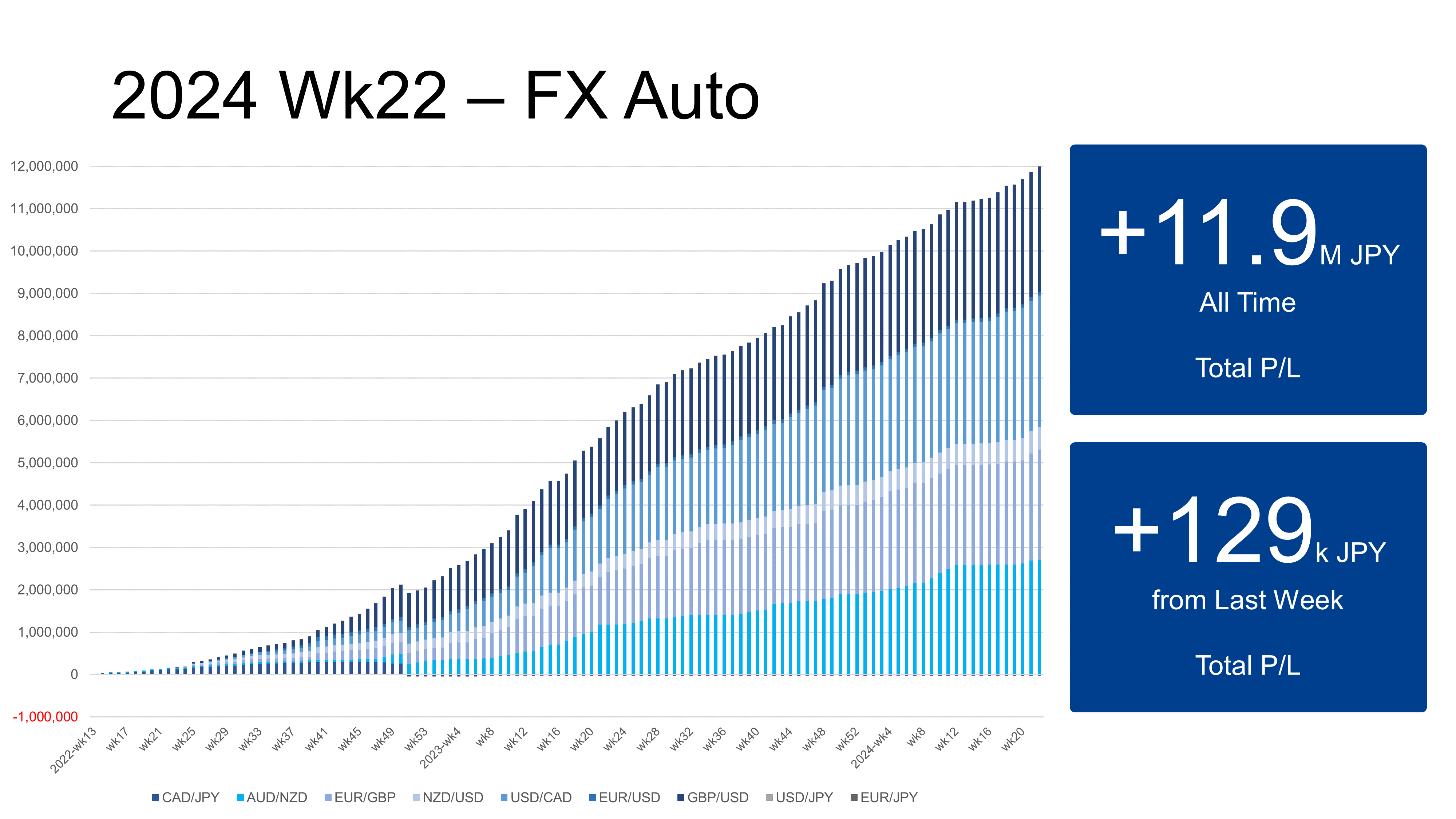

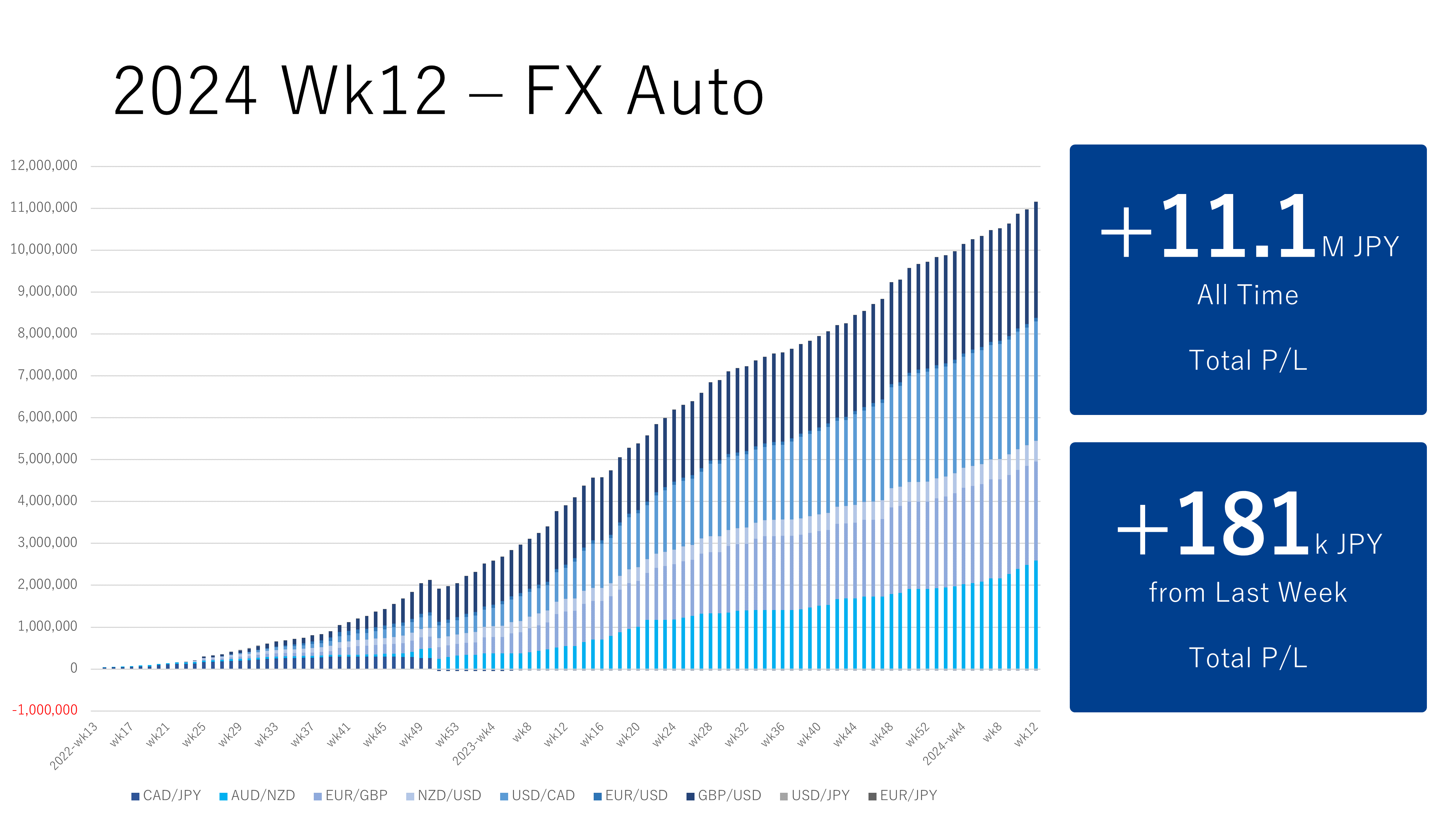

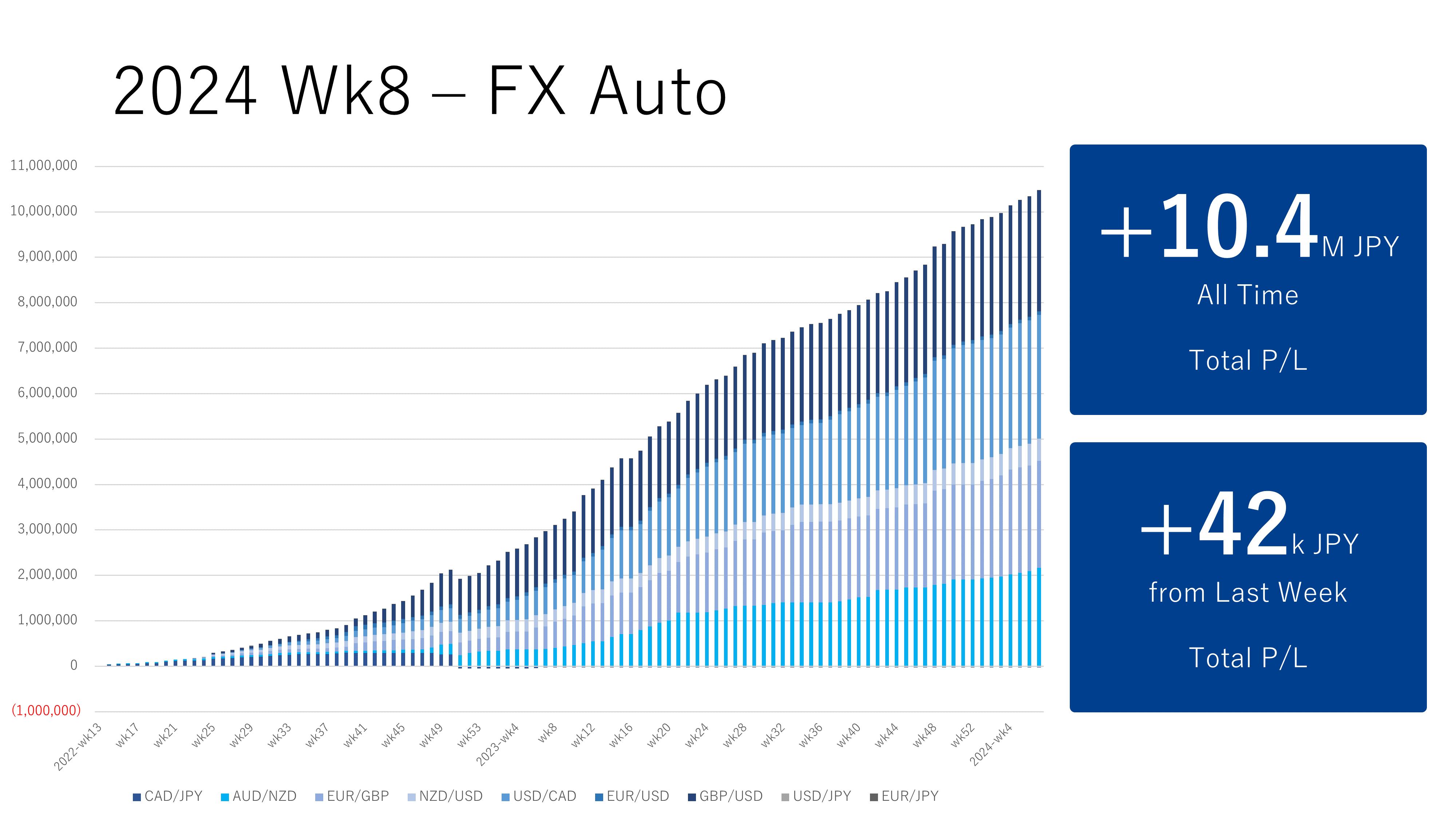

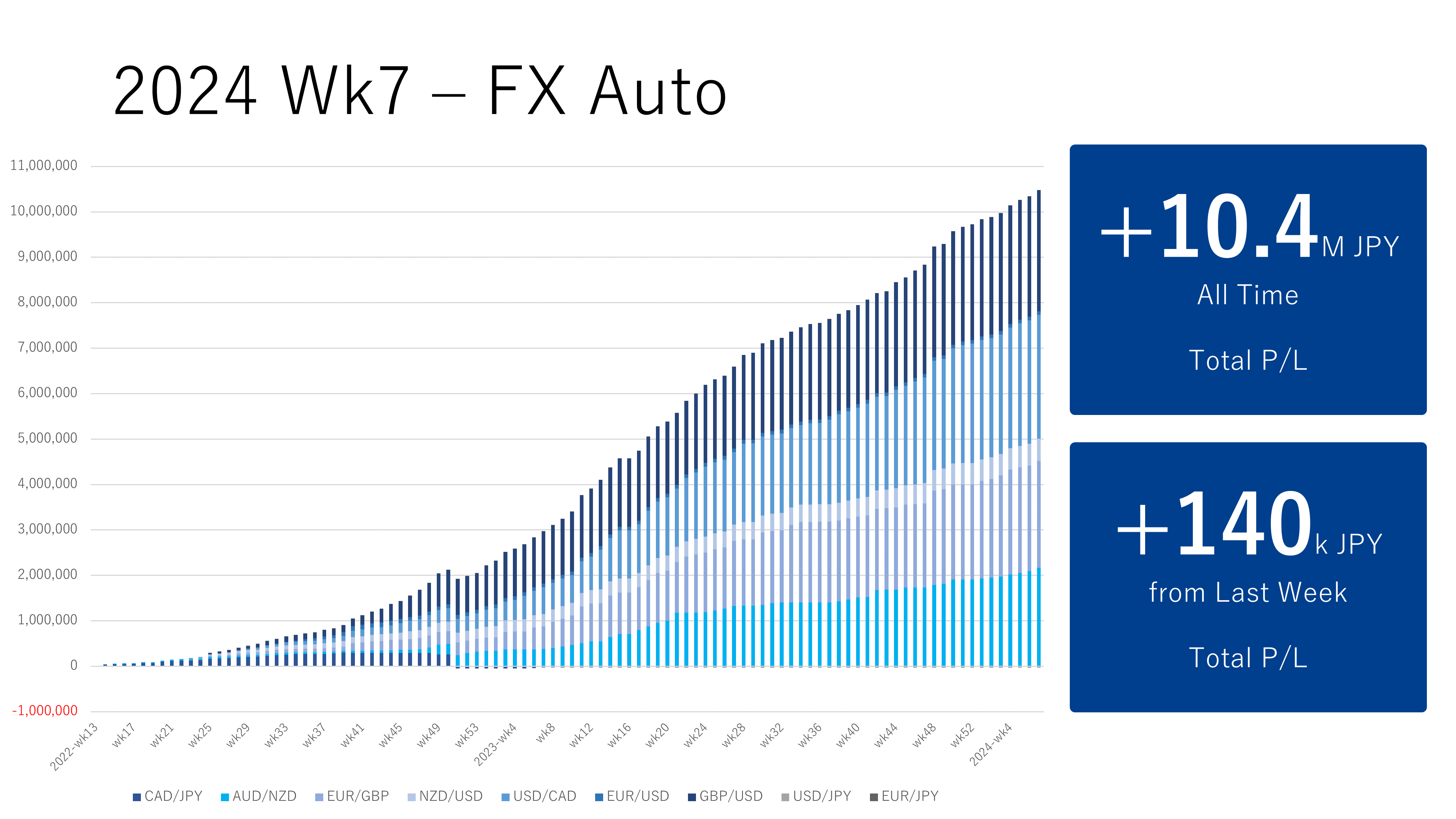

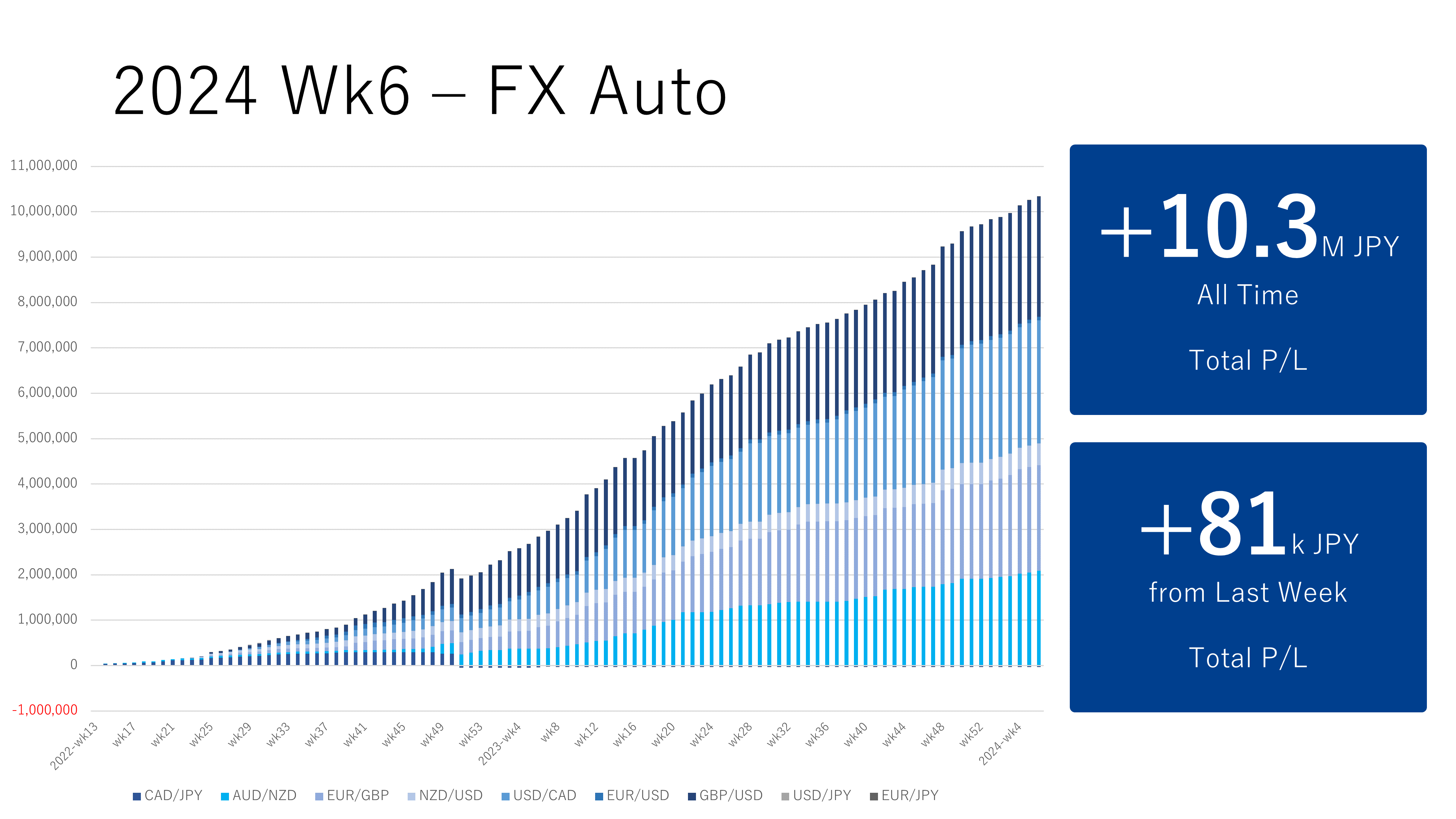

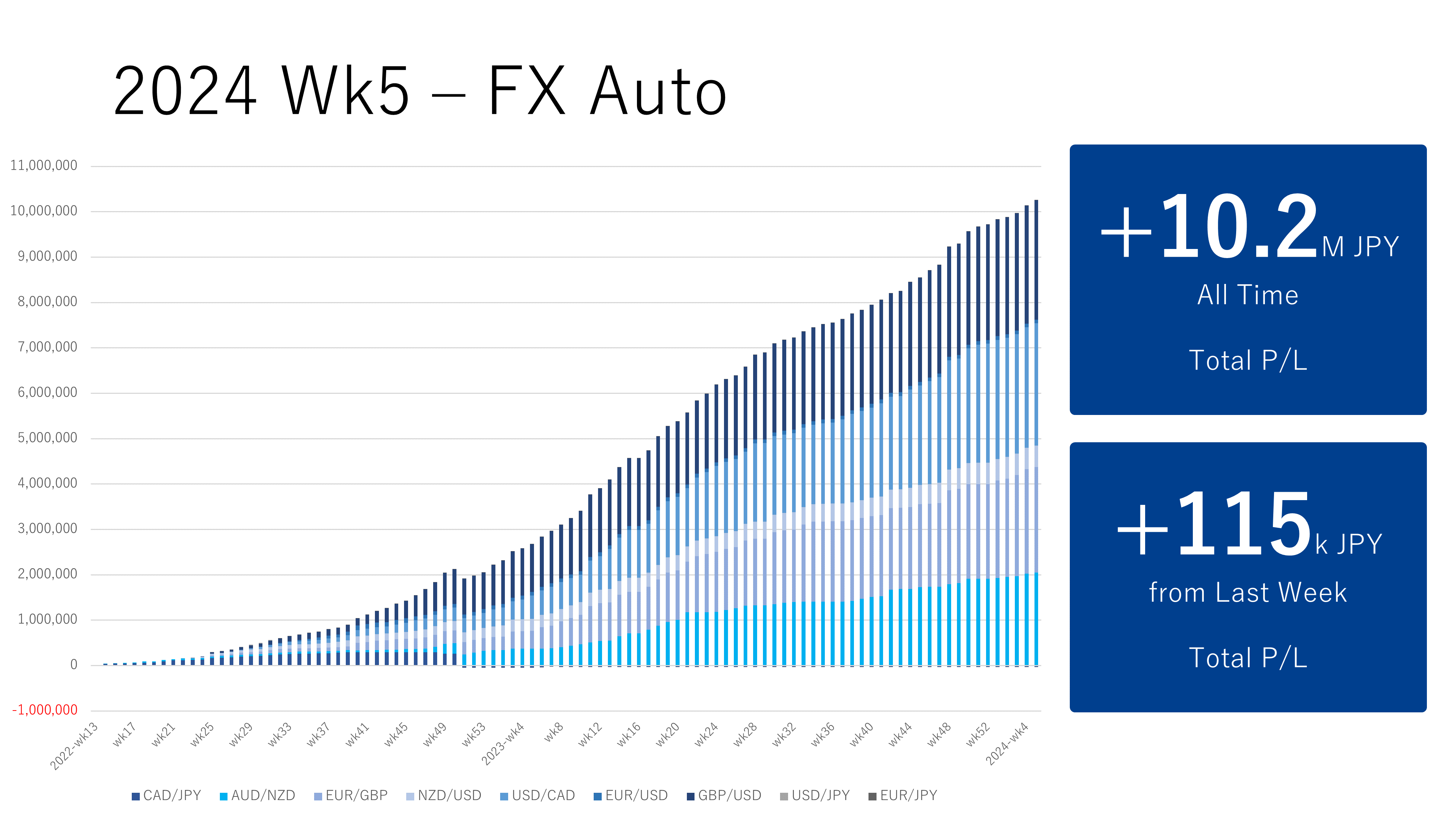

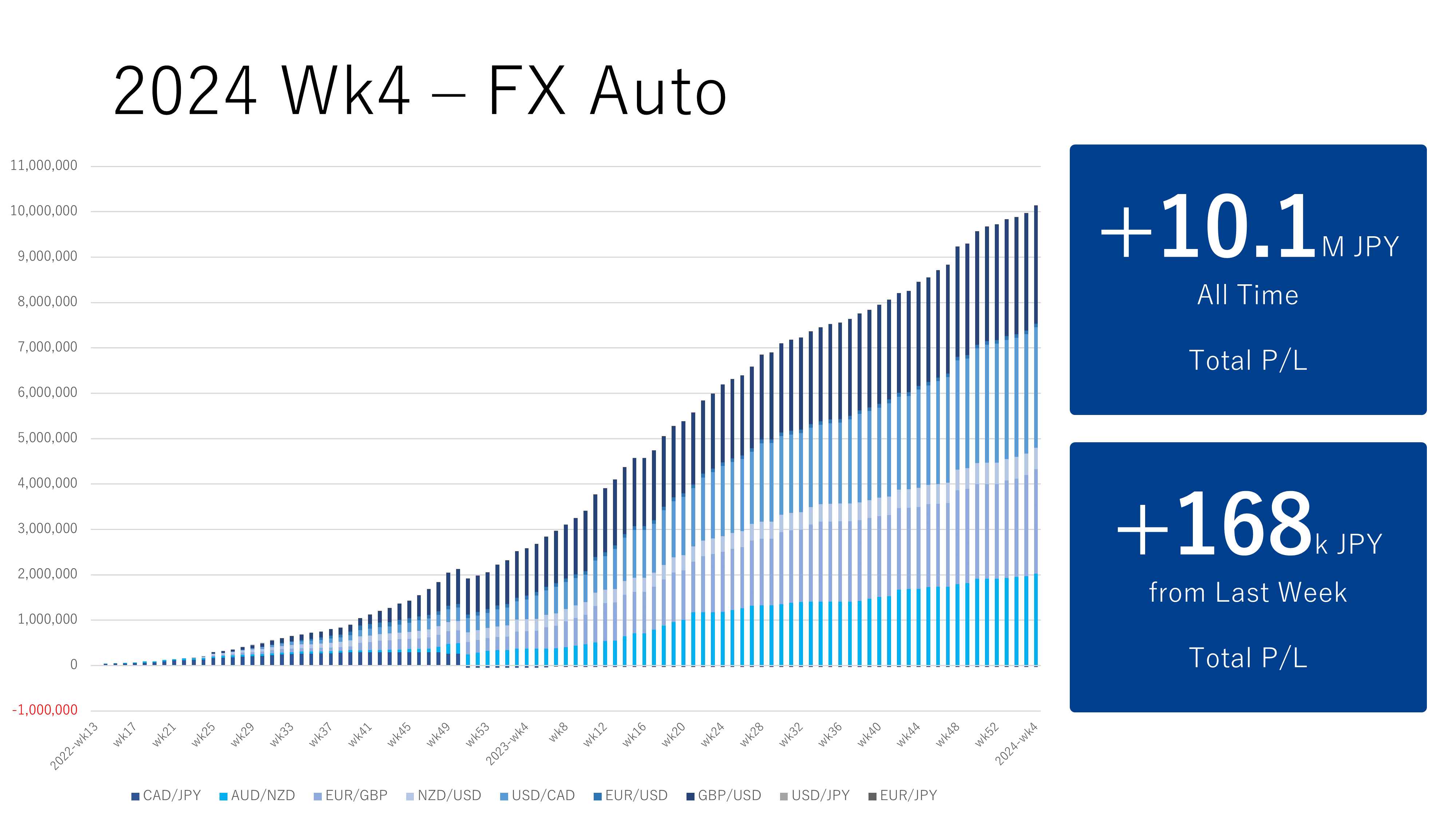

The profit amount of Automated trading (excl. discretionary trading) reached JPY 10k! 🎉

(The total profit incl. discretionary trading is JPY 13.3k now.)

Almost 1 year and 10 months passed since I started Automated Forex trading with Toraripi in the end of March, 2022.

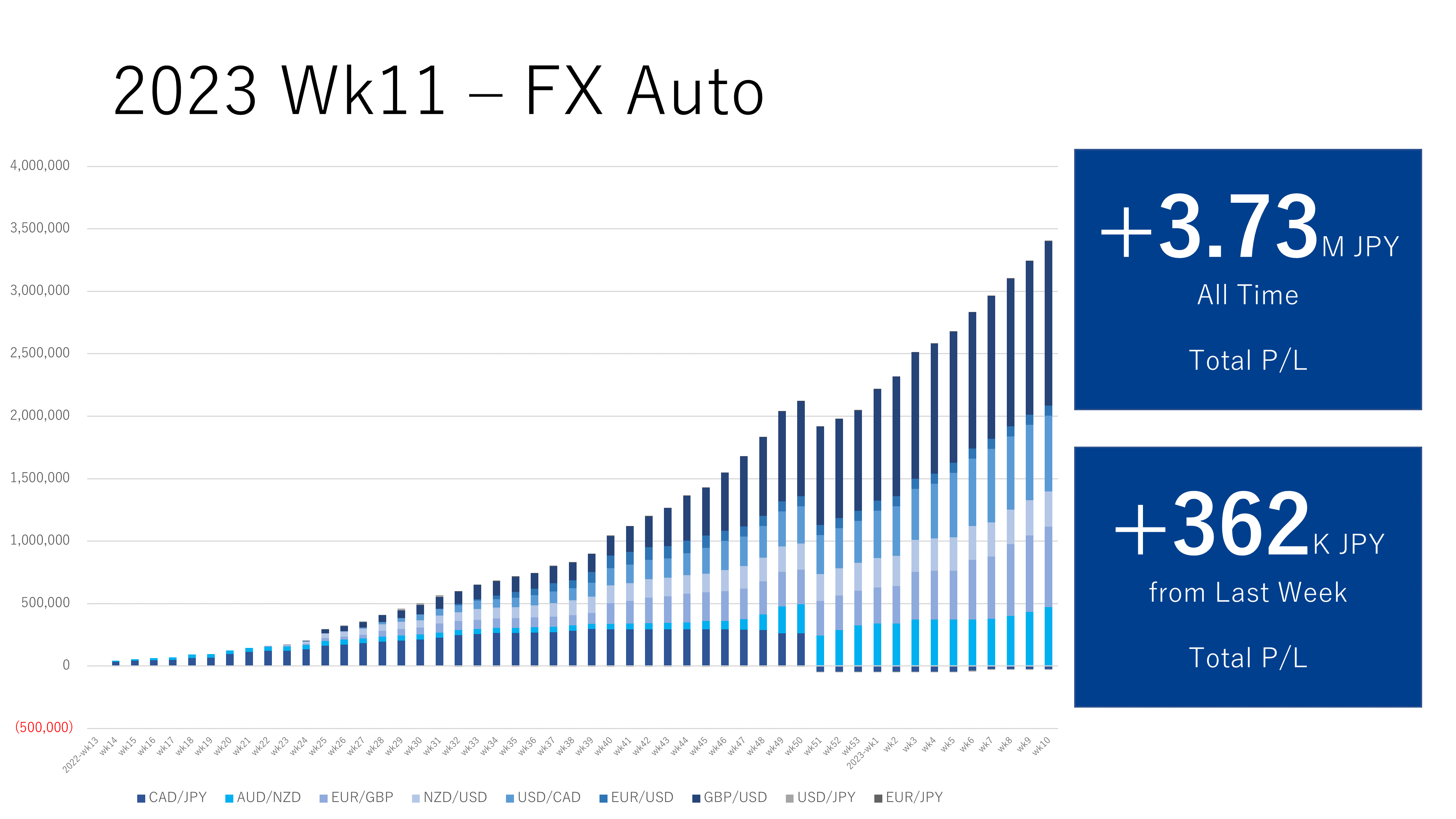

As I did some trial and error in 2022, the most part of profit was made in 2023. However, as the earning pace is getting calming down, I will think about the setting more.