Contents

Status of This Week

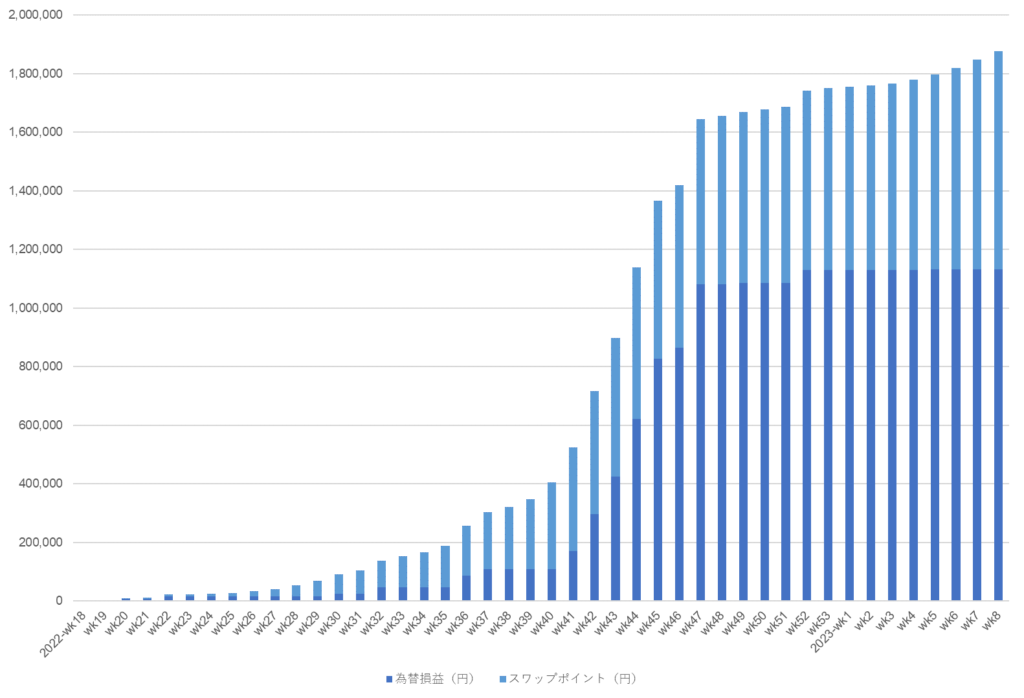

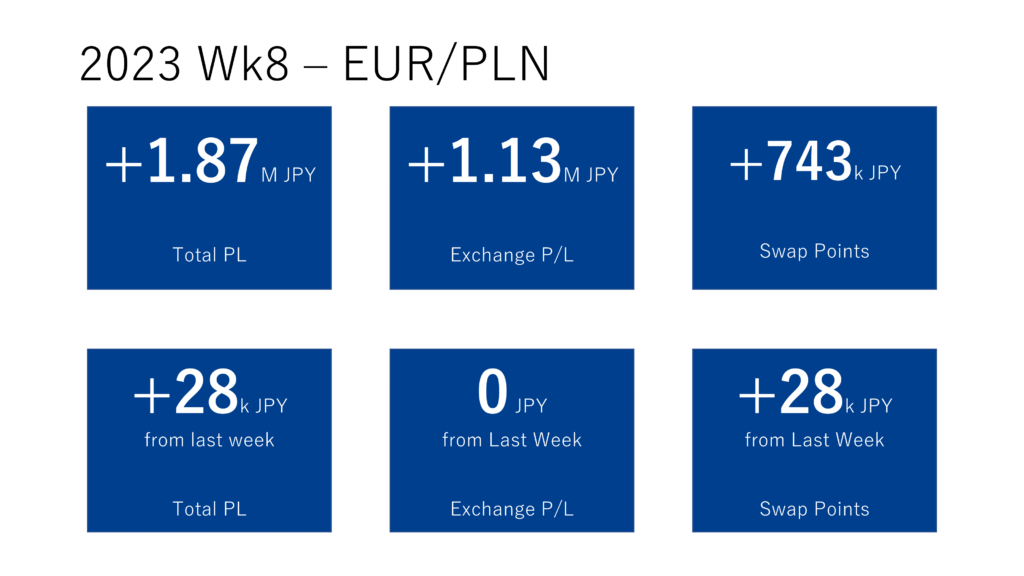

The combined results of IG and LIGHT FX are shown.

As the price went up slightly, the number of positions were increased this week.

Unfortunately, the rate is dropping, and the unrealized loss is getting small.

I still miss 100K JPY/day late last year. Though the swap points are going down, I want to have more positions!

Cost of Holding Positions with IG

IG now charges cost for holding positions, "Daily Admin Fee" independently. They say the cost was previously included in the swap points and automatically deducted, but now it is shown separately.

In addition, IG starts to charge daily based "Daily Admin Fee" for weekend as well. Previously IG charged "Daily Admin Fee" only for one day even in weekends regardless of # of days, but now IG takes care of # of days in weekends.

It is a small deterioration....

List of Current Positions

The positions with IG as of the weekend. No change from 5 lots for a while.

The positions in LIGHT FX has been increased to 21.3 lots.

As the price went up this week, the IFD orders I had set worked and the positions increased a little.

Rates have fallen this week and the unrealized profit is looking good. I am resisting the urge to settle the positions.

Current Trade Settings - EUR/PLN (Selling)

The settings are basically same for both IG and LIGHT FX. However, you can order from 0.1 lot (1k currency units). There is also a range where I ordered 0.1 lot with the 1/10 interval, but I stopped ordering everything with 0.1 lot. Unlike Toraripi or Triauto, it is tiring to order in the unit of 0.1 lot due to manual order.

Please click here for the ordering procedures with IG.

EUR/PLN (Traripi-style Descriptions)

Here is the descriptions of the current settings in Toraripi style.

| Range (Upper) | 5.0 |

| Range (Lower) | 4.7 |

| Order volume (10K) | 1 |

| # of traps | 61 |

| Trap interval | 0.005 |

| Profit price width | 0.07 |

| Profit (PLN) | 700 |

EUR/PLN (Triauto-style Descriptions)

For those who are familiar with Triauto, the same settings in a Triauto-style are shown below.

| Range width (pips) | 3,000 |

| # of traps | 61 |

| Order volume (10K) | 1 |

| Starting price | 4.7 |

| Profit price width (pips) | 700 |

| Counter value (pips) | 700 |

| Fixed Counter | Fixed |

As you can see in the current positions, I haven't been able to order as cleanly as the settings above, but I'm trying to follow this.

The current profit price width (700 PLN for 10,000 currencies) was determined while adjusting EUR/PLN trading in the second half of 2022.

The reason is that historically there are not many situations where it exceeds 4.7, and analyzing the past price movements are not helpful.

Also, it's not fun if I hardly earn profits, so I set a slightly narrower profit price width than when I started trading EUR/PLN.

Although it is not reflected in the table above, I am trying to widen the profit price range more in 2023.

There is a possibility that the lower limit of the expected range will raise, so I may manually settle the positions while watching the situation.

I will continue to show the details as much as possible on this page.

Ordering Procedures for IG

- On the ordering board, select "売 (Sell)", and "IFD (If Done)".

- Enter "ロット数 (# of lots)"

- In this example, the minimum lot of 1 lot (10,000 currency) is entered.

- Enter "注文レート (Order Rate)"

- In this example, the order is at 5 (5.0). It is the upper limit of my assumed range.

- Enter "指値 (Settlement rate)"

- For IFD orders, specify the settlement rate in advance. IG requires input in pips, which is different from the other Japanese brokers, you man need to be careful a little.

- In this example, entering 2,500, which means the settlement at 4.75 when it falls 2,500 pips from 5.0 of the sell order.

- After entering it, the settlement rate of 4.75 and the profit of PLN 2,500 will be displayed below. So check if they are intended numbers. (If PLN/JPY = 30, the profit is JPY 75,000.)

- Confirm the entered numbers and finally click "指値注文発注 (Place Limit Order)" to complete the order.

Notes: Interest Rate, etc.

ECB Governing Council Meeting March 16, 2023 (Thu)

NBP Monetary Policy Council Meeting March 7-8, 2023 (Wed)

At its February 2, 2023 meeting, the ECB raised the interest rates of the main reference operations by 0.5 points to 3.0%.

The National Bank of Poland also announced after its February 8 meeting that the reference rate will remain unchanged at 6.75%, which is the 5th time in a row.

According to Reuters interview with a MPC member of the NBP, he seems to recognize that the current interest rate policy is having some effect. If the situation does not change, it can be read that the current interest rate will not be raised for the time being and will be maintained. However, this is a temporary paused, and he did not deny the possibility of raising interest rate again.

Considering that the ECB is raising interest rates further and the swap points will drop, I think the risk to invest a large amount of money is a little high.

Looking at the long-term chart, it is also worrisome that the is raising continuously.

I am also monitoring PLN/JPY as BOJ does not raise the interest rates. I am also looking at other high-swap currency pairs for a good entry point. After the yen has fallen a little bit, it will be easier to enter MXN/JPY and ZAR/JPY. I wish I could start investment before the current depreciation of the yen progresses.

Please let me know if you have any recommendations for entries from now on.

It's really a memorandum for myself, but I'm attaching the pages of the meeting schedule for the ECB (European Central Bank) and NBP (National Bank of Poland).

Settings under Consideration

EUR/CZK - Selling

I am checking EUR/CZK for an entry point for a long time along with EUR/PLN, but in 2022 when I began to consider entry, CZK was getting strong, which makes difficult to enter. (In the case of EUR/PLN, PLN was getting weaker against the euro, which makes easy to enter.)

I was going to invest when the rate exceeds 25.5, but it getting lower and lower.💦

Moreover, since the beginning of 2023, swap points have fallen largely like EUR/PLN. The difficult situation for entry continues for me.

PLN/JPY - Buying

While the swap points for selling EUR/PLN is dropping sharply, I am also considering PLN/JPY again.

While ECB is likely to raise interest rates continuously, it seems BOJ will not raise its interest rate aggressively at least until the Governor of BOJ, Kuroda is replaced (on Apr 8th, 2023). (In December 2022, there was a small surprise when the allowable fluctuation range for long-term interest rate manipulation was raised from +/-0.25% to +/-0.5%.) While there is a certain gap in the interest rates between NBP and BOJ, it is good to study investment.

I am thinking the ideal entry point is JPY 28, but it is just ideal. If the rate goes below 29, then I will start to consider for entry.

MXN/JPY - Buying

When I expanded my investment coincided with the yen depreciation in 2022, MXN/JPY was soaring and it was difficult to enter.

Since it is an entry for buying, the ideal entry point is 5.5, but I will think about it when the rate falls below 6.0.

I will continue to check the status and will inform you here when the situation allows entry.